Q: We were very intrigued when you talked about 809% total return and the idea of beating the Dow by seven to one since 2007. How consistent was that growth?

Q: We were very intrigued when you talked about 809% total return and the idea of beating the Dow by seven to one since 2007. How consistent was that growth?

Martin: Very consistent. In its worst year — in the depths of the most severe recession since the Great Depression — the Weiss model portfolio was down only 6.1%, compared to Dow, which was down 32.7% in that same year. Our average total return for the entire period, including the recession — was 68.8 percent per year. Our worst loss was five times smaller. Our average per year was seven times larger.

Martin: Very consistent. In its worst year — in the depths of the most severe recession since the Great Depression — the Weiss model portfolio was down only 6.1%, compared to Dow, which was down 32.7% in that same year. Our average total return for the entire period, including the recession — was 68.8 percent per year. Our worst loss was five times smaller. Our average per year was seven times larger.

Q: We’re planning for retirement and it seems the only solutions we’re offered are either ridiculously low yield or ridiculously high risk. Which do you choose, Dr. Weiss?

Q: We’re planning for retirement and it seems the only solutions we’re offered are either ridiculously low yield or ridiculously high risk. Which do you choose, Dr. Weiss?

Martin: Neither, of course! Both are obviously non-starters.

Martin: Neither, of course! Both are obviously non-starters.

The first so-called “solution” is just to plop your money into bank CDs or equivalent. But what good does that do you? Even if you have a nest egg of, say, $500,000, and even if you could find a bank that gives you 2% interest, all you wind up with is $10,000 per year. How do you pay the mortgage and buy food with only $10,000?

The second solution is even worse. You go for a high-risk bond or a high-risk speculation of some kind and then, suddenly, your principal is gutted. Speculation is OK for the money you can afford to play with. But not for your retirement nest egg.

The only true solution is something that gets you away from this Faustian choice between near-zero yield and high risk, something that takes you to a much higher plane. That’s my goal with the Weiss Ultimate Portfolio: Much faster growth without more risk, in fact, with much less risk overall.

Q: You’ve introduced us to other investment services before. But in this one, you seem to be more involved. Why is that?

Q: You’ve introduced us to other investment services before. But in this one, you seem to be more involved. Why is that?

Martin: Because our Ultimate Portfolio is the fulfillment of a lifelong ambition. To me it’s the ultimate reward at the end of a long journey.

Martin: Because our Ultimate Portfolio is the fulfillment of a lifelong ambition. To me it’s the ultimate reward at the end of a long journey.

You see, for many years, my father and I manually analyzed just a handful of companies quarterly. My dream was to do something that had never been done before — develop systems that could help us accurately review thousands of companies on a daily basis and then create a portfolio around it. So for several decades now, I’ve been leading multiple teams — each team with one analyst and one computer programmer. We’ve had one team for banks, one team for insurance companies, one team for stocks, and so on.

We built smart computer models that issue very accurate ratings. We started with the banks in the early 1980s, then insurance companies in the late 1980s, and then stock ratings in 2003. That was a decade and a half ago. So now we’ve been validating the accuracy of the stock ratings, in real time, for nearly a decade and a half. And now, based on that experience, and with 16 years of data to get it as close to 100% as we’re ever going to be, I’m confident now’s finally the right moment to open up our Ultimate Portfolio.

I personally oversee its implementation and am investing in it myself — with my own money. However, I have a very strict rule: I never buy or sell the investments we recommend until I have given members the opportunity to do so first.

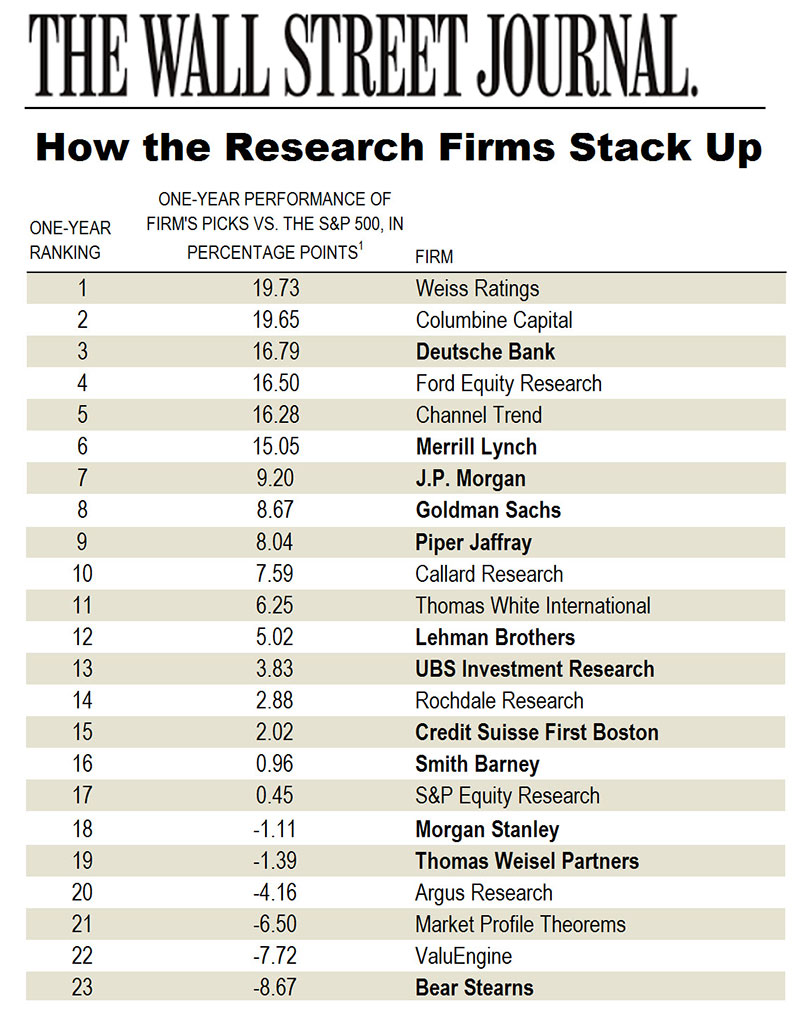

Q: I heard that The Wall Street Journal once reported that your Weiss Stock Ratings beat everyone else; that your ratings were number one in the world in performance. You even beat the research departments of Merrill Lynch, Goldman Sachs, plus every major Wall Street brokerage firm and bank in the study. How was that possible?

Q: I heard that The Wall Street Journal once reported that your Weiss Stock Ratings beat everyone else; that your ratings were number one in the world in performance. You even beat the research departments of Merrill Lynch, Goldman Sachs, plus every major Wall Street brokerage firm and bank in the study. How was that possible?

Martin: The main reason is that the Wall Street firms were riddled with conflicts of interest. They, in effect, got payola by making money off the companies they rated. And the more generous they were in giving out top ratings, the more generous their clients were in giving them business.

Martin: The main reason is that the Wall Street firms were riddled with conflicts of interest. They, in effect, got payola by making money off the companies they rated. And the more generous they were in giving out top ratings, the more generous their clients were in giving them business.

Some of those practices still continue today in various ways. But we have always refused to do business that way; we never accept a dime in compensation, whether hard dollars or “soft dollars,” from companies we cover. So outperforming them was easy. All we had to do was to make sure we always avoided conflicts and bias.

However, in the results of the study you mentioned, what was even more gratifying to me was this: We also beat the performance of all the independent research organizations. And I believe the main reason was because safety is such an important part of what we do. I feel they typically give too much weight to profits. We look very, VERY carefully at both safety and profits.

Q: I know all about your Weiss Ratings and I use them all the time. But with your Weiss Ultimate Portfolio, it seems you’re taking a step further. Is that true? And if so, how?

Q: I know all about your Weiss Ratings and I use them all the time. But with your Weiss Ultimate Portfolio, it seems you’re taking a step further. Is that true? And if so, how?

Martin: Yes, a giant step further! Our Ultimate Portfolio goes far beyond our published letter grades. That’s primarily because it ranks the stocks by an index we don’t publish — our performance index, based largely on how much money investors are making in the stock right now.

Martin: Yes, a giant step further! Our Ultimate Portfolio goes far beyond our published letter grades. That’s primarily because it ranks the stocks by an index we don’t publish — our performance index, based largely on how much money investors are making in the stock right now.

That way, we can buy strictly the current top, TOP TEN investments among the 12,000 or more that we rate. That means we’re so selective — so, so picky — we will consider buying about one-tenth of one percent of all the investments we cover. And then we adjust the portfolio as new stocks rise to the top ten.

Q: You publish your stock ratings. Why don’t you also publish the performance index you use for your Ultimate Portfolio?

Q: You publish your stock ratings. Why don’t you also publish the performance index you use for your Ultimate Portfolio?

Martin: Good question. Fundamentally, it boils down to the two goals I set forth when I first founded this company. First, to do everything I can to help protect the public from losses and help them find the most reliable stocks. That’s what our published ratings are so good at. But I also want to do provide very specific buy and sell recommendations. I want to do everything I can to help our closest friends and subscribers build their nest egg as efficiently as possible. And for that second goal, specific our performance ranking model is more powerful if it’s not published; if it’s not being used by a larger number of investors in the market.

Martin: Good question. Fundamentally, it boils down to the two goals I set forth when I first founded this company. First, to do everything I can to help protect the public from losses and help them find the most reliable stocks. That’s what our published ratings are so good at. But I also want to do provide very specific buy and sell recommendations. I want to do everything I can to help our closest friends and subscribers build their nest egg as efficiently as possible. And for that second goal, specific our performance ranking model is more powerful if it’s not published; if it’s not being used by a larger number of investors in the market.

Q: You talk lot about wars and the terrorism, and you say it’s going to get worse. So why are you investing in stocks to begin with? Shouldn’t you be just buying things like gold?

Q: You talk lot about wars and the terrorism, and you say it’s going to get worse. So why are you investing in stocks to begin with? Shouldn’t you be just buying things like gold?

Martin: We do that too. Whenever a mining stock appears in the top ten of our list, we look to buy it. Plus, several of the ETFs we use track precious metals. And, no matter what, ALL our stocks always have to pass ALL our tests for safety.

Martin: We do that too. Whenever a mining stock appears in the top ten of our list, we look to buy it. Plus, several of the ETFs we use track precious metals. And, no matter what, ALL our stocks always have to pass ALL our tests for safety.

Besides, most of the turmoil is overseas, not here in the United States. So it’s driving a flood of smart investors with a lot of money into the U.S. markets. And what are they buying? They’re looking to buy the highest quality, most liquid investments they can lay their hands on —the same kind of investments we select.

They include wealthy families in China, Japan, South Korea and other parts of East Asia. They include wealthy Russian oligarchs, many of them living mostly outside of Russia; West European industrialists and institutions fearing a new hotter cold war; Mid-East holders of large sums of petrodollars, and sovereign wealth funds all over the world.

They are not going to settle for just any investments. They’re demanding the best of the best. But we have a big advantage over them because we have such powerful, accurate selection tools.

Q: What is driving the stock market higher?

Q: What is driving the stock market higher?

Martin: Right now, whether right or wrong, good or bad, there are actually two powerful forces driving stocks higher: (1) The fear money pouring in from overseas and (2) the tremendous power of our best U.S. corporations to act as a magnet for that money. When and if that changes, our model will warn us and we’ll be ready.

Martin: Right now, whether right or wrong, good or bad, there are actually two powerful forces driving stocks higher: (1) The fear money pouring in from overseas and (2) the tremendous power of our best U.S. corporations to act as a magnet for that money. When and if that changes, our model will warn us and we’ll be ready.

Q: Can we use our IRA accounts to trade along with your Ultimate Portfolio?

Q: Can we use our IRA accounts to trade along with your Ultimate Portfolio?

Martin: Yes, you can. Our Ultimate Portfolio is designed to trade strictly stocks and ETFs that we feel are perfectly appropriate for an IRA. Moreover, this is not a high-risk strategy that goes for flashy one-up trades. Yes, it is designed to build wealth rapidly, but to do so steadily, over time. And it can do this especially well in a tax-protected account like an IRA.

Martin: Yes, you can. Our Ultimate Portfolio is designed to trade strictly stocks and ETFs that we feel are perfectly appropriate for an IRA. Moreover, this is not a high-risk strategy that goes for flashy one-up trades. Yes, it is designed to build wealth rapidly, but to do so steadily, over time. And it can do this especially well in a tax-protected account like an IRA.

Q: Your father is legendary for having made a killing in the crash of 1929. But making a killing in the next stock market crash, whenever that may be, doesn’t seem to be your goal. Why not?

Q: Your father is legendary for having made a killing in the crash of 1929. But making a killing in the next stock market crash, whenever that may be, doesn’t seem to be your goal. Why not?

Martin: Because you don’t have to. In bear markets, all you need to do is preserve your capital, and that alone puts you well ahead of everyone else in the market.

Martin: Because you don’t have to. In bear markets, all you need to do is preserve your capital, and that alone puts you well ahead of everyone else in the market.

Moreover, if you’re as picky as we are, and you buy just that one-tenth of a percent of stocks that are at the very pinnacle of our charts, that’s when you can truly jump far ahead of the averages. The numbers I’ve given you for my model portfolio prove both of those points.

But I need to correct something in your question. Dad didn’t make a killing in the crash of October 1929; he did it in the bear market that began in April 1930. My main point is that he did not specifically predict the crash. Rather, what he was able to do is recognize that the crash was the signal of a major, long-term bear market. At the time, most people thought the crash was just a fluke. He realized it was just the beginning.

Q: What’s a prudent strategy for a bear market?

Q: What’s a prudent strategy for a bear market?

Martin: Before you go there, you need a model that helps you do what Dad did — to accurately identify the beginning of the bear market as early as possible. And then to identify the end of the bear market as well. That way, you can pick up the bargains and get on-board for the recovery. That’s what we do with the disciplined study of long-term cycles. And to confirm the cycle forecasts, we use a tried-and-tested model, which includes a series of powerful indicators.

Martin: Before you go there, you need a model that helps you do what Dad did — to accurately identify the beginning of the bear market as early as possible. And then to identify the end of the bear market as well. That way, you can pick up the bargains and get on-board for the recovery. That’s what we do with the disciplined study of long-term cycles. And to confirm the cycle forecasts, we use a tried-and-tested model, which includes a series of powerful indicators.

Those bookends — marking the beginning and end of bear markets — are not going to be exact. But still, knowing them makes a huge difference. Then, your strategy is basic: You allocate a lot more to cash. You use solid hedges. And you’re going to preserve your capital or even make money.

Q: I want to do this on my own, without following your portfolio. Is that possible?

Q: I want to do this on my own, without following your portfolio. Is that possible?

Martin: Up to a point, yes. Use strictly our buy-rated stocks. Then, from that list, select the ones that are the most liquid. That means only our buy-rated stocks that enjoy average trading volume of at least 250,000 shares per day and have a total market capitalization of $50 million or more.

Martin: Up to a point, yes. Use strictly our buy-rated stocks. Then, from that list, select the ones that are the most liquid. That means only our buy-rated stocks that enjoy average trading volume of at least 250,000 shares per day and have a total market capitalization of $50 million or more.

But the next step could be a bit difficult to replicate on your own, because that’s where we rank the stocks with our unpublished performance index.

Q:You also buy ETFs. Why is that?

Q:You also buy ETFs. Why is that?

Martin: For maximum diversification across asset classes and countries.

Martin: For maximum diversification across asset classes and countries.

Q: I can’t afford to stay glued to my email all day every day waiting for the next trade.

Q: I can’t afford to stay glued to my email all day every day waiting for the next trade.

Martin: Good — because I can’t either. Just be sure to check your inbox each Monday after the market closes to see if I’m recommending a new trade or not.

Martin: Good — because I can’t either. Just be sure to check your inbox each Monday after the market closes to see if I’m recommending a new trade or not.

Q: What’s the minimum amount of money I need to follow your Ultimate Portfolio?

Q: What’s the minimum amount of money I need to follow your Ultimate Portfolio?

Martin: $25,000. That’s more than enough to diversify over all the investments we recommend, plus maintain a cash reserve for safety — and to make sure you’ll have money to take advantage of new recommendations.

Martin: $25,000. That’s more than enough to diversify over all the investments we recommend, plus maintain a cash reserve for safety — and to make sure you’ll have money to take advantage of new recommendations.

Q: I can’t tolerate any kind of risk at this point. None whatsoever.

Q: I can’t tolerate any kind of risk at this point. None whatsoever.

Martin: Then, in your case, I think it’s best to stay out of the market. In our Ultimate Portfolio a major goal IS to reduce risk. We avoid all the companies we rate as risky. We implement solid capital preservation tactics in major down markets. We use tremendous diversification. But we can’t reduce the risk down to zero. That’s impossible.

Martin: Then, in your case, I think it’s best to stay out of the market. In our Ultimate Portfolio a major goal IS to reduce risk. We avoid all the companies we rate as risky. We implement solid capital preservation tactics in major down markets. We use tremendous diversification. But we can’t reduce the risk down to zero. That’s impossible.

On the other hand, if what you’re looking for is a relatively cautious risk-averse strategy to grow your wealth pretty rapidly, then I think this strategy could be ideal for you.

Q: How long will you be in any position?

Q: How long will you be in any position?

Martin: It all depends on how long it stays at the top of our list. The key is we never try to tell the market what to do next. The stocks themselves tell us whether or not they’re worthy of our money!

Martin: It all depends on how long it stays at the top of our list. The key is we never try to tell the market what to do next. The stocks themselves tell us whether or not they’re worthy of our money!

Q: Beyond the “Buy” and “Sell” recommendations, what else do I get as a member?

Q: Beyond the “Buy” and “Sell” recommendations, what else do I get as a member?

Martin: All the benefits are listed on this website. Click here to review our “Member Benefits” page. Or, if you still have further questions, call our Customer Care department at 877-934-7778.

Martin: All the benefits are listed on this website. Click here to review our “Member Benefits” page. Or, if you still have further questions, call our Customer Care department at 877-934-7778.

Q: Do you offer a money-back guarantee?

Q: Do you offer a money-back guarantee?

Martin: Yes. Take as long as you want. If you don’t like my service for any reason, just let me know anytime and I’ll make sure you get a full refund on the balance of your subscription. That’s my way of saying that I trust you — and that you can trust me to make this work very well for you.

Martin: Yes. Take as long as you want. If you don’t like my service for any reason, just let me know anytime and I’ll make sure you get a full refund on the balance of your subscription. That’s my way of saying that I trust you — and that you can trust me to make this work very well for you.

Home Retirement Miracle Beat Nasdaq by 2 to 1 Track Record Benefits FAQs Reviews Editor Videos Join Now