“AI is the new electricity … It’s about to revolutionize everything.”

— BANK OF AMERICA ANALYSTS

Dear Reader,

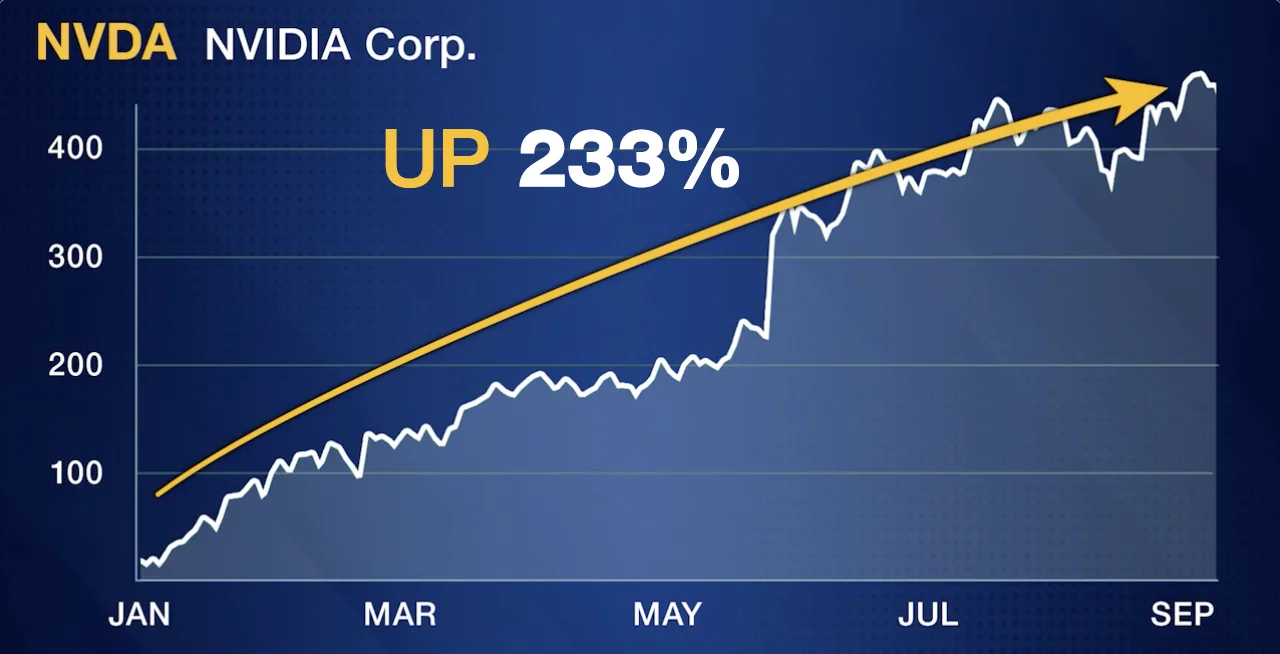

Artificial intelligence stocks have popped this year.

Look at some of this year’s most exceptional gainers.

Chipmaker Nvidia just became the seventh trillion-dollar company in history. The stock is up 233%.

But that’s just one high-profile example …

C3.ai is up 352% this year.

Opera … 374%.

Duos Technology Group … 278%.

BigBear.ai’s stock rose 846% in less than two months.

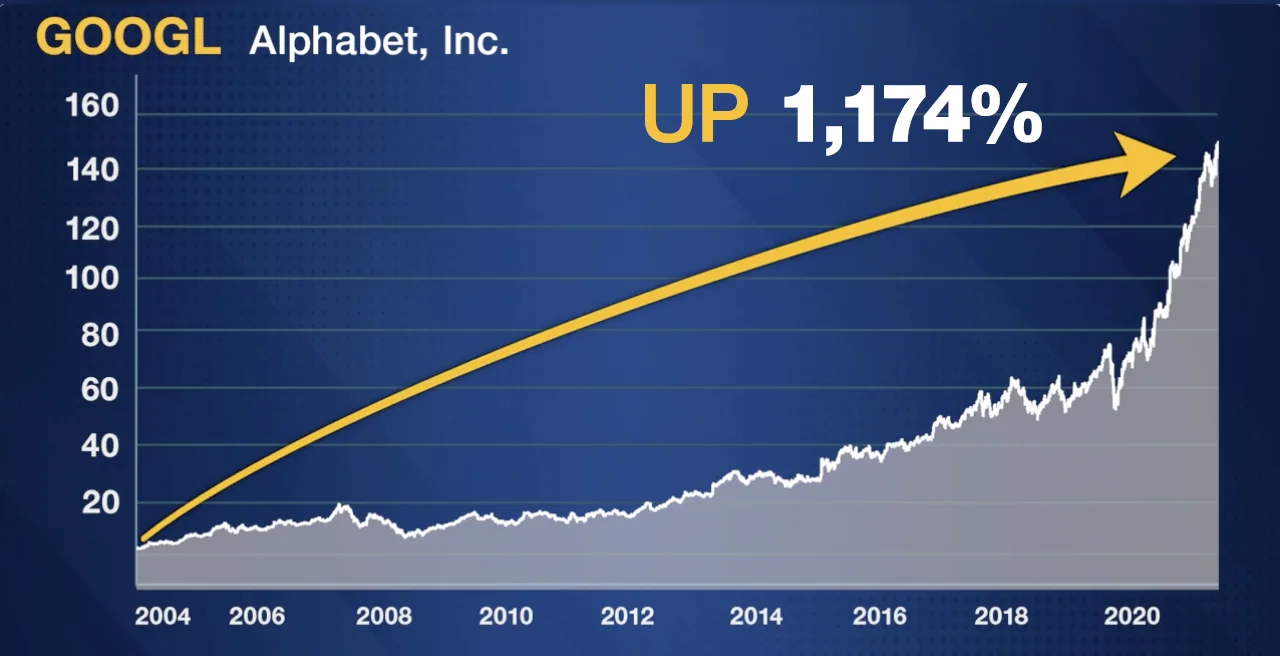

In fact, five tech stocks with connections to AI have singlehandedly kept the S&P 500 in bull market territory: Alphabet (Google), Microsoft, Nvidia, Apple and Meta.

Those same five stocks propelled the Nasdaq to the best first half in its 52-year history.

With eye-popping gains like that, you might think the AI stock boom is behind us.

But we think it’s just getting started.

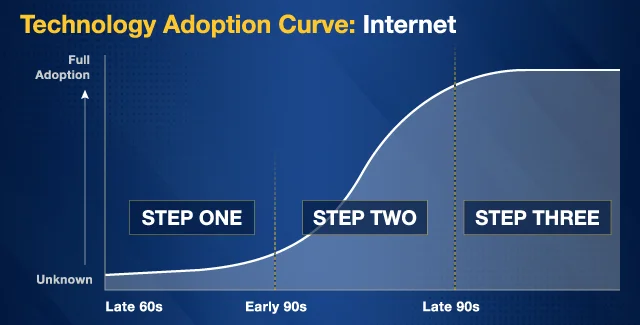

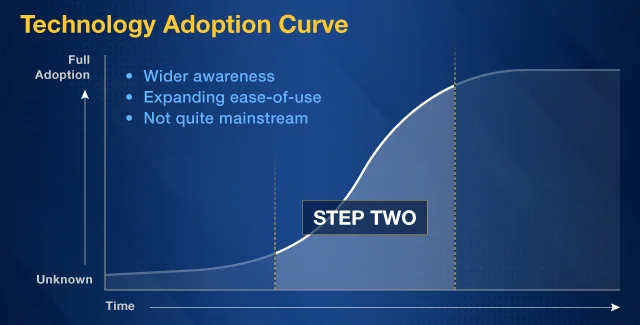

In fact, there is a simple three-step pattern to every single technology boom in history — from the automobile to the internet.

And artificial intelligence is following this script to a T.

AI just moved from Step One to Step Two.

And that’s what is really exciting.

Because it’s the next step — when tech stocks move from Step Two to Step Three — where things start to get very interesting.

Nvidia was just the beginning.

I believe this last step could usher in the Next Wave of AI stocks.

And although we can’t guarantee anything like Nvidia or the other early AI winners, we believe some of these AI stocks have potential.

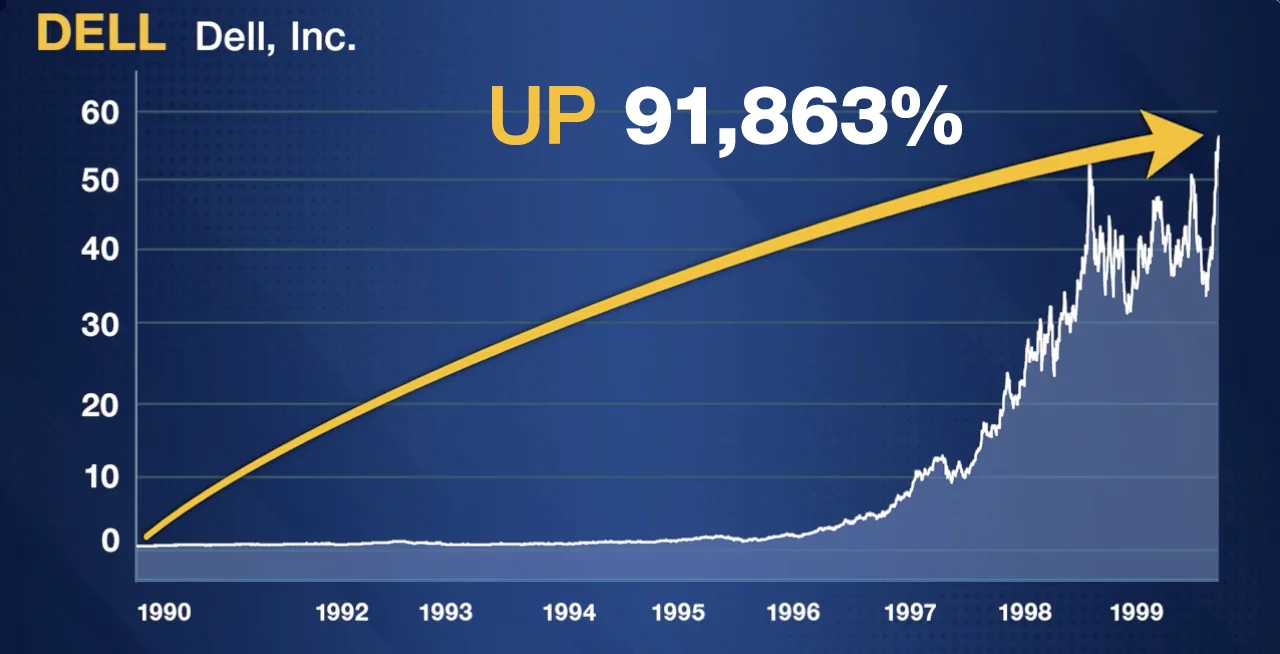

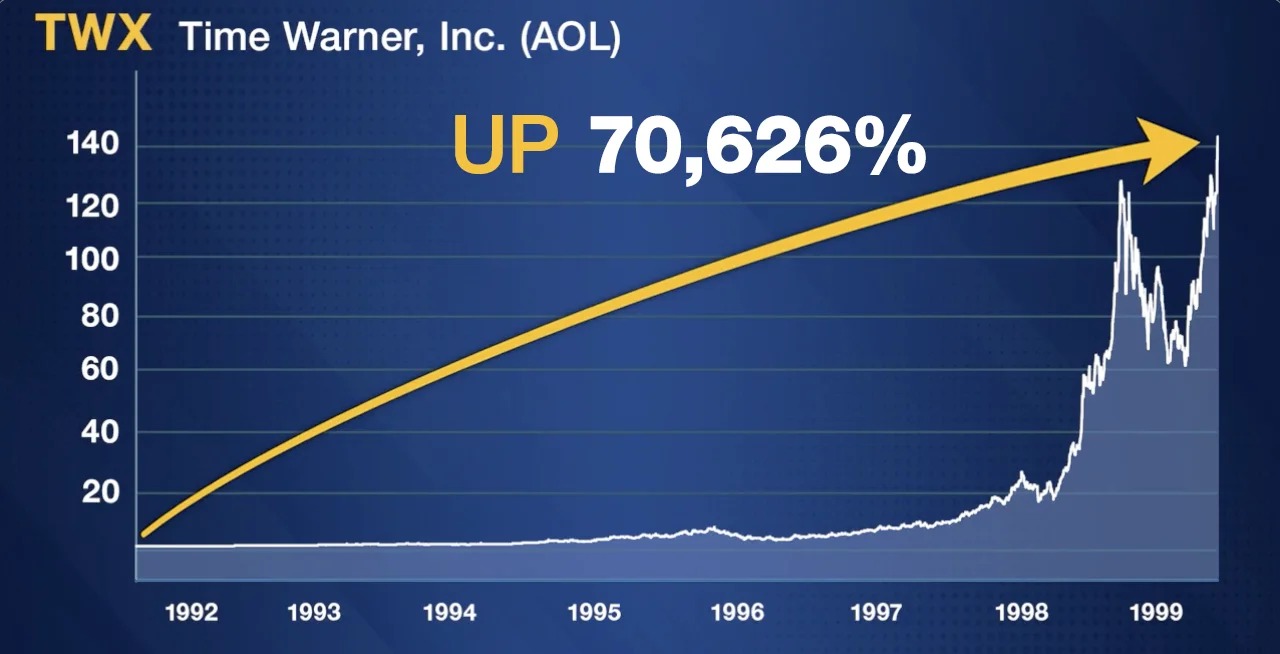

Check out some extraordinary examples of what has happened when a market starts moving from Step Two to Step Three …

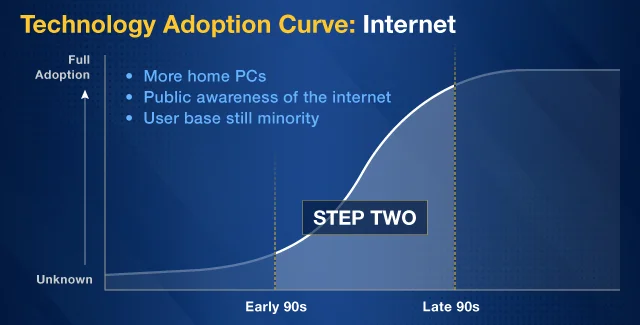

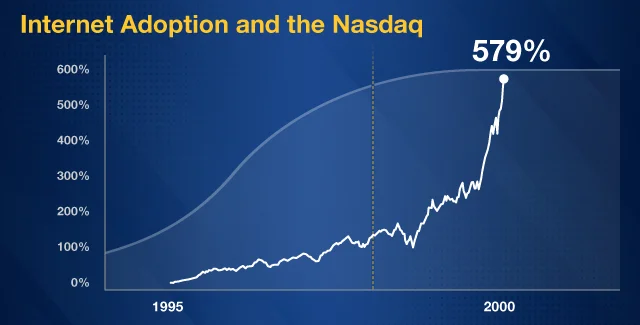

Take the internet, for instance.

It stayed in Step One from about 1968 until the early ‘90s.

Then, by the mid-‘90s, it had moved to Step Two. That is usually the shortest step.

By 1997, the internet had moved quickly into Step Three.

That’s when owning personal computers progressed from a luxury to a necessity …

More than 35% of U.S. households now had one …

And that’s when stocks took off.

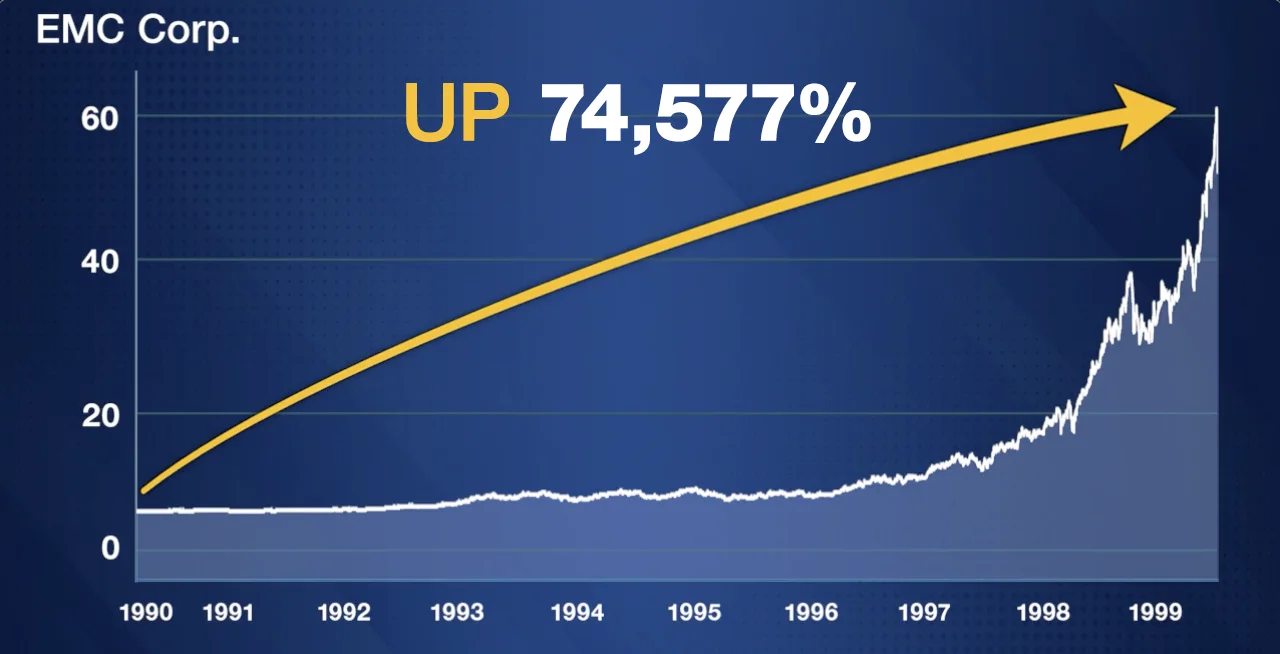

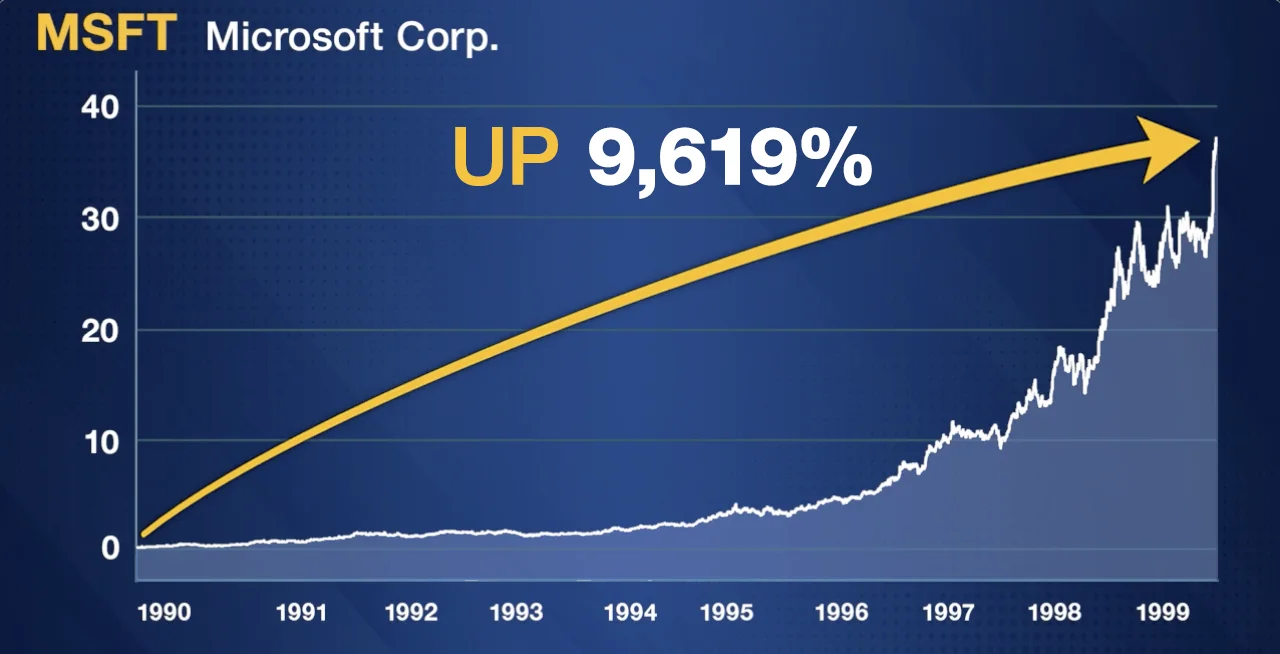

Check out some of the biggest gainers from the internet boom of the ‘90s:

Dell Computer soared 91,863% that decade …

America Online jumped 70,626% …

EMC Corp. shot up 74,577% …

And Microsoft jumped 9,619%.

Obviously not every tech stock in the ‘90s saw gains like these blue chips. Plenty of them went belly-up. So, it’s important to do your research before investing in a new market opportunity.

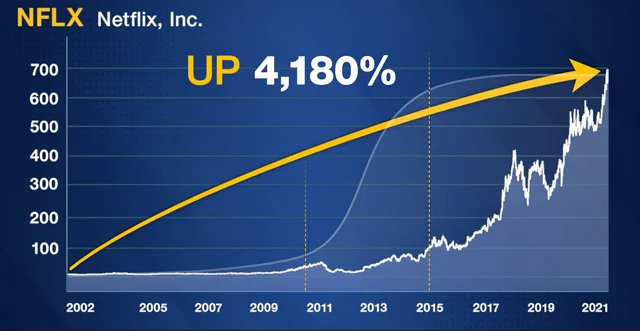

Streaming video services followed a similar pattern.

Step 1 lasted nearly a decade … and stocks barely budged, as you can see from Netflix’s chart for this period.

But by 2011, video streaming had jumped to Step Two.

And it didn’t stay there long.

The transition from Step Two to Step Three was even shorter than the internet. And Netflix stock soared.

It rose 4,180% …

Netflix’s success led a parade of companies into the streaming sector.

Many of which launched to great success.

Like Roku, which went up 623% less than three years after it went public in 2017.

Alphabet, Google’s parent company, has shot up 1,174% since it got involved with streaming …

And Amazon soared 1,968%.

Smartphones are another great example.

Their three-step transition happened around the same time as Netflix.

It launched the beginning of a boom in tech stocks in general.

But smartphone-focused companies saw some of the biggest wins, as the technology moved into Step Three.

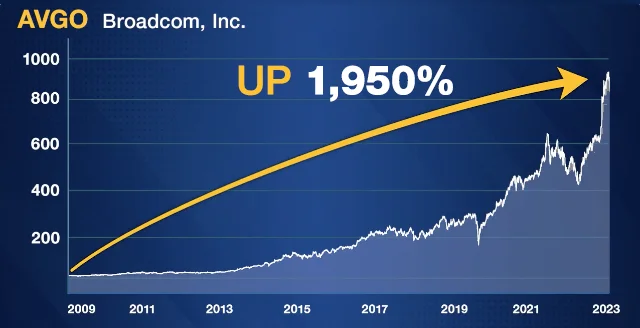

Broadcom’s stock jumped as much as 1,950% …

The iPhone launch sent Apple’s stock on a 1,735% ride …

Towers had to be constructed to expand the networks, and American Tower’s shares gained 239%.

A competitor, Crown Castle, saw its own shares jump 216%.

Nokia, one of the worldwide leaders in wireless devices, saw its shares spike 436%.

And Infinera, another device maker, returned investors 367%.

All once the technology jumped from Step Two to Step Three.

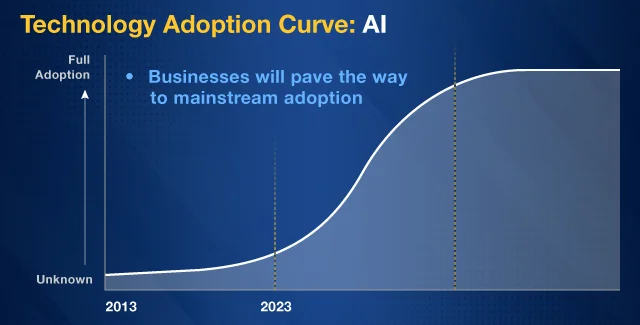

Right now, artificial intelligence has reached Step Two.

And that’s why I recorded this message.

Because advances in technology are moving even faster today.

Streaming and smartphones moved from Step Two to Step Three much quicker than the internet.

And the internet was much quicker than old tech like TVs or automobiles.

Our information suggests AI’s move from Step Two to Step Three could be even more rapid.

If you missed out on the early rise in AI stocks like Nvidia, don’t worry.

We believe there’s still a chance for you to get into AI before it moves to Step Three.

As you’re about to see, AI is moving faster than anything else before it.

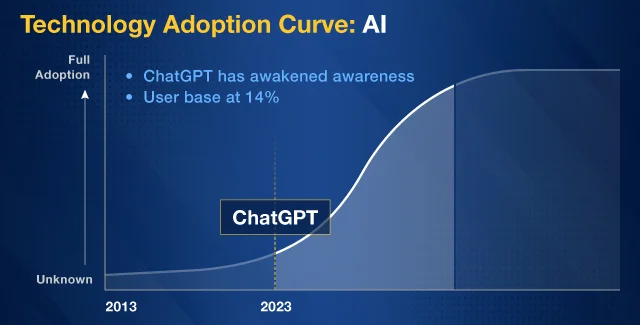

Have You Heard of ChatGPT?

ChatGPT is an app you can use to interact with what’s called generative AI.

Generative AI is capable of processing massive chunks of data in a split second. And it can learn from its interactions.

ChatGPT had tech enthusiasts geeking out earlier this year.

You can ask it to research pretty much anything. It’s capable of writing reports, novels, poetry.

It even passed the bar and the medical exam for doctors.

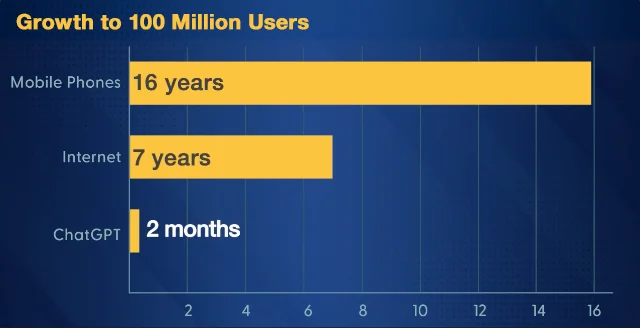

ChatGPT is so popular, it became the fastest app to reach 100 million downloads.

And it isn’t even close …

It took 16 years for mobile phones …

And seven years for the internet …

But ChatGPT added 100 million users in just two months.

48 times faster than the internet …

And 96 times faster than mobile phones …

But here’s where we see most investors making a huge mistake …

They’ve made ChatGPT out to be more than it is.

They’ve misread ChatGPT as a move into Step Three of the AI script.

That’s why a lot of people think they’ve missed the AI boom.

But we think ChatGPT was just Step One.

And despite what Nvidia has done this year, we believe the AI boom is just getting started.

After all, 100 million users may sound like a lot …

But there are more than 335 million people in the United States. And 8 billion people worldwide.

Currently, over 5 billion people use the internet. Over 1 billion smartphones were sold last year alone.

AI’s worldwide usage currently pales in comparison.

And while Microsoft paid $10 billion to acquire a stake in ChatGPT’s creator, OpenAI … ChatGPT is a mostly free tool and hardly brings in any revenue.

But that’s all about to change thanks to the speed at which AI learns and advances.

We could see a move into Step Three by the end of this year.

The 3-Step Script for Technology Investing

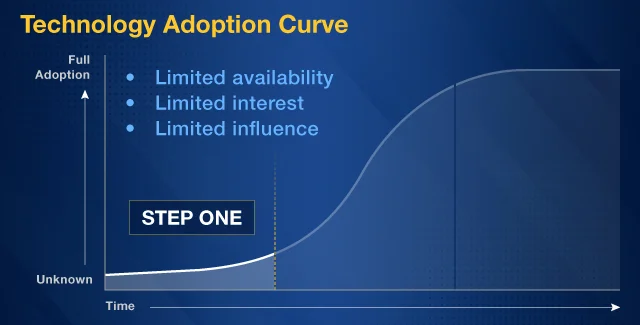

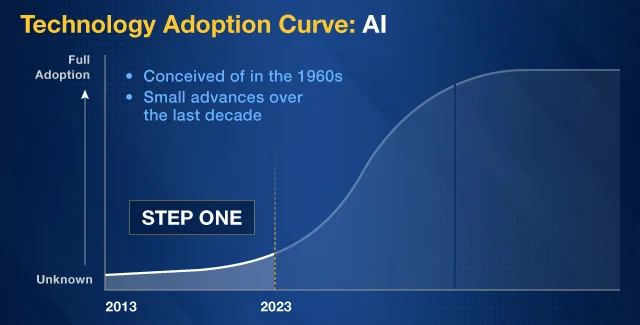

Step One is the early adoption phase …

Where the tech is available only to a limited number of enthusiasts.

It may get some interest in the news. And a couple speculative stocks may shoot up in anticipation.

But at this stage, the tech has limited uses — and limited influence on society.

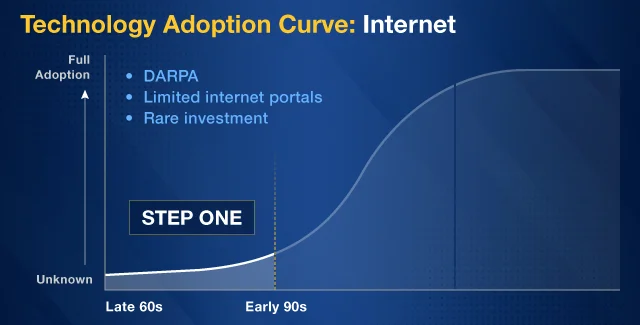

Let’s take the internet’s adoption curve, for example.

The internet was available as DARPA, for a few people as early as the late ‘60s.

But all the way through the early ‘90s, it was mostly theory — used by nerds and computer scientists lucky enough to gain access to one of the limited internet portals.

Investments were few and far between. The niche industry flew under the radar.

Most technologies stay mired in this period. They never reach the second step.

Step Two is when a technology has a spark or impetus that vaults it into public awareness, briefly.

It’s a moment where the number of people familiar with, and able to use, this technology has recently exploded.

But … the application of the technology is still not important or valuable enough for it to be truly mainstream.

With the internet, by the early to mid-‘90s, more people were buying home PCs and connecting to the world wide web.

The internet had gained general public awareness.

But the overall numbers were still small. Most Americans had still never used the internet.

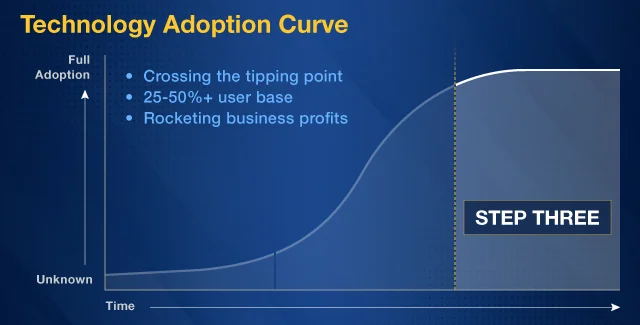

It’s only in Step Three, mainstream adoption, when things start to get truly exciting.

And that’s because you only reach Step Three when you cross a tipping point, numbers-wise.

History has shown that there’s a percentage of users, somewhere between 25%-50%, where that business’s profits start to grow exponentially.

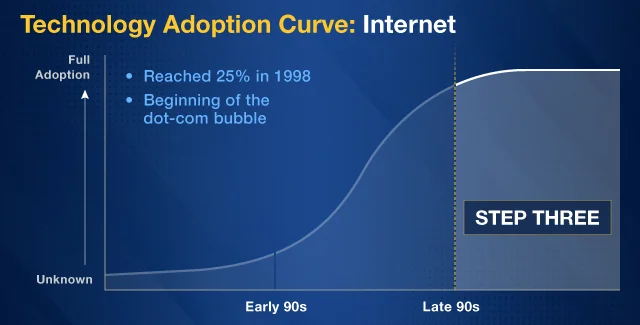

Internet-connected households reached 25% in 1998.

And that was the start of Step Three for the internet.

But most investors know it as the Dot-Com Bubble.

The Nasdaq soared 579% before the “bubble” eventually burst.

Only the wisest (or luckiest) investors who exited before the bubble burst were able to profit.

When it comes to AI, the concept has been around since the 1960s.

And small advances have happened over the past decade, barely noticeable to the public.

But the technology was still squarely in Step One.

Until ChatGPT came along.

Now, AI has moved into the general consciousness.

But only 14% of Americans have actually used it.

We think that is about to change in the next few months.

But instead of individual Americans leading the way, it will be businesses that vault AI to the last step.

And it’s already beginning …

AI Could Generate $4 Trillion EVERY Year

You see, while artificial intelligence will most certainly affect our daily lives … it’s going to have far more influence in the corporate world.

AI’s ability to sift through reams of data and understand it … is a gold mine for all sorts of industries.

When AI moves to Step Three, it won’t be because of one company or specific use.

Instead, unique use cases for generative AI are going to pop up in thousands of industries, creating massive disruption.

PricewaterhouseCoopers estimates that AI will generate $15.7 trillion by 2030.

That’s more than the combined economies of Japan, Germany, the U.K. and France.

But a McKinsey study found that generative AI could add $4 trillion per year to the bottom line of global businesses.

If industry experts like PricewaterhouseCoopers and McKinsey are correct, we predict a lift to the share prices of AI innovators and the companies that use AI to improve their bottom line.

As Bank of America strategists were quoted recently, “AI is the new electricity … it’s about to revolutionize everything.”

And it’s the AI companies that disrupt the biggest industries that will get the most attention.

This is the Next Wave of AI stocks I’ve been telling you about.

Generative AI’s introduction to the corporate world is happening as we speak.

Healthcare and drug discovery, the military, manufacturing, retail, banking, financial services, transportation …

AI is transforming all.

Let me show you what I mean …

Saving Millions of Lives in 1/10 the Time

For example, generative AI is expected to drastically impact the healthcare industry …

To the tune of at least $360 billion.

And it will mean the difference between life and death for millions of people.

You see, the process of drug discovery and development for just one successful new medicine can take more than a decade.

And it costs nearly $4 billion on average.

But there’s no guarantees. Far from it, in fact.

Nine out of 10 new drugs fail Phase II clinical trials.

That means a lot of time and money are spent on colossal medical failures …

While life-threatening diseases continue to ravage patients and their families.

But with AI, all of that is changing.

AI has dramatically accelerated the research and development timeline. Making drug development cheaper and faster.

Recently, news broke that a new drug to treat patients with obsessive-compulsive disorder (OCD) was created.

But the biggest news is that AI entirely invented the compound.

It was able to generate and sift through tens of millions of possible molecules to determine the best drug candidates.

And here’s the kicker …

The drug development took just 12 months to get to trial.

And that was topped by an early stage biotech company called AbCellera.

Just as the pandemic was beginning to terrify the world, in early 2020 …

AbCellera received a blood sample from a patient who had already recovered from Covid-19.

The company’s mission was to screen the blood sample for antibodies that helped the patient fight the virus.

Knowing which antibodies are effective against a virus is invaluable.

And it helped researchers create what could be an effective therapy against Covid-19.

Typically, this process would have taken years.

But AbCellera screened more than 5 million immune cells … and identified 530 antibodies that were effective against Covid-19 …

In just 11 days.

This pace of development is unlike anything I’ve seen before.

In the near future, critical medicines that treat more diseases are going to be created faster and cheaper.

And the companies that crack the code to AI could make millions and billions of dollars.

Feeding an Extra Billion? No Problem

Here’s another exciting example of AI’s potential impact:

The world’s population has doubled in the past 50 years … to more than 8 billion.

And another billion is expected to be tacked on in the next 15 years.

For farmers to meet that exponential demand, AI will need to play a vital role …

Artificial intelligence will allow farmers to utilize precision agriculture …

They can monitor crop moisture, soil composition and temperature in growing areas to increase their yields.

They will get more food from the same … or even smaller … farms.

It’s something most people don’t like to think about …

But half-filled supermarkets thanks to supply chain woes are not a distant memory.

This is why the global agriculture AI market is expected to triple in just a few years.

Some of the biggest companies in the world are playing a leading role, including Amazon, IBM and Microsoft.

Now, half-filled supermarkets everywhere would certainly be inconvenient …

But a half-filled military would be downright scary in today’s world.

AI pilots are already at the controls of modified F-16 fighter jets, Black Hawk helicopters and U2 spy planes.

Autonomous combat is the next front in modern warfare …

And the U.S. wants to lead that charge …

That’s why U.S. Secretary of Defense Lloyd Austin recently announced a $1.5 billion investment in AI research, in part, to keep pace with China.

But healthcare, agriculture and the military are just the tip of the AI iceberg.

Look at some of the other massive businesses that are beginning to incorporate AI.

- Banking — $8.2 trillion

- Legal Services — $950 billion

- Construction — $12.7 trillion

- Fast Food — $973 billion

- Real Estate — $3.9 trillion

- Retail — $4.9 trillion

But while all these uses of AI are exciting and could inject some value into these industries down the line …

There’s one particular industry we believe will see the biggest positive disruption from AI.

What industry am I talking about?

It generated $4 trillion in profits last year alone …

Three of the six largest companies in the world engage in this business.

It’s essential to the lives of nearly every single person on Earth.

And we think it’s about to get flipped on its head by the power of AI.

Companies that take advantage of this disruption could reap extraordinary benefits.

I’ll explain exactly how — and which publicly traded companies could be at the forefront in just a moment.

But first, let me introduce myself …

And explain why I believe we’re at the start of the biggest energy boom in decades — and why I think AI could be a major driving force.

The ONLY Way to Find the

Market’s Biggest Trends

My name is Sean Brodrick.

I’ve spent the past 25 years traveling around the globe …

To unearth the next great megatrends.

Because you can’t do this just by staring at charts from an office …

You can’t tell anything real about a company just by talking to its CEO over the phone …

You have to go out there and meet with them. See these companies in person.

You need to get boots on the ground.

Often times at some of the world’s most remote locations.

I’ve been to the largest undeveloped gold mine in the mountains of Chile … and panned for gold while avoiding bears in the Revelation Mountains in Alaska …

I’ve searched for big gains as far north as Nunavut, Canada … and traveled so far south identifying new growth opportunities that I had penguins running around me …

I’ve inspected uranium projects in Newfoundland …

Climbed on oil rigs in the Gulf of Mexico …

Sat in an Aztec bowl used for sacrifices during the conquistador days …

And visited the mummies of Guanajuato.

I did all this because I’m not looking to uncover the same old dry investments everyone else recommends.

The safe boardroom kinds of stocks …

If you want to find the world’s next big megatrends …

You don’t do it just by staring at charts and having lunch meetings in the city.

You need to get your hands dirty … get your passport stamped a lot … and get out in the field.

There are companies out there literally inventing the tech needed to make them billions …

These guys are cutting-edge … and you don’t truly find out what they are creating until you go out and see for yourself.

It’s been a huge commitment to stay ahead of these trends, for sure.

But it’s paid off countless times …

I have a long track record of spotting megatrends that other “experts” failed to see.

Like 5G … many news outlets were becoming skeptical of 5G …

But I knew this new tech disruption could be huge, and I told a group of my readers that 5G “will become the new global standard.”

Now, the global 5G market is already worth $2 trillion.

Or electric vehicles …

I predicted we’d see a “massive shift to EVs,” and that NOW was the time to bet on this emerging megatrend.

Since then, Tesla has become one of the most valuable companies in the world.

My team and I were ahead of the solar energy megatrend, too.

As recently as two years ago, critics were still dismissing this new energy source.

And today?

Solar power spending will surpass $1 billion a day this year …

Now, I believe we may be at the start of a brand-new tech boom …

Built on the shoulders of artificial intelligence.

We are at the beginning of an innovation cycle …

AI can reshape society and the economy.

AI is already disrupting industries from accounting to fast food to our military.

But I believe AI’s biggest impact hasn’t been felt yet.

Because the next industry I see it disrupting is perhaps the largest and most important business in the world.

Without it, our daily lives would shut down.

Most businesses would be rendered useless. We’d be marooned in our homes, unable to go anywhere.

And those homes would be a heck of a lot less comfortable, as air conditioning, heat and even electricity would not be available without this industry.

Our food supplies would quickly run out. Amazon shipments would screech to a halt.

Basically, the world as we know it would cease to exist without this critical industry.

If you didn’t guess already, I’m talking about the oil and gas industry …

Three of the world’s six largest companies are oil companies.

Yet, despite all the celebration over global profits, the future of oil production is in doubt …

Russia’s invasion of Ukraine skyrocketed energy prices.

And now Russia is cutting oil supply to international markets.

OPEC is extending production cuts into at least next year.

And this is all while demand from China and India continues to rise dramatically.

Meanwhile, in the United States, which still produces more oil than any other country in the world.

Strategic oil inventories are the lowest they’ve been in nearly 40 years.

Drilling activity is sliding … there are one-third fewer oil rigs available than just four years ago.

Refineries in states like Texas, Tennessee and Louisiana are nowhere close to producing at capacity.

And that means worries about domestic supply, which also means the potential for rapidly rising prices at the gas pump.

You’re seeing them right now.

So, what do I see as the solution for a world starved for energy resources?

Artificial intelligence.

Why the $7 Trillion Oil &

Gas Industry Needs AI NOW

The oil and gas sector alone accounts for roughly 10% of the world’s GDP.

Energy is constantly in high demand.

But finding new sources of oil has become expensive — and frustrating — for most oil companies.

The oil and gas sector has been notoriously slow to adopt innovative technologies …

And that includes AI.

But this anti-tech bias is changing quickly.

Especially once these companies see how AI could make it much easier to find new sources of oil.

In the exploration and production stage, the vast amount of data that is generated can be overwhelming.

There are substantial amounts of geological data …

Seismic readings … satellite imagery …

And this information is difficult to analyze manually.

However, since AI can absorb data at rates never before seen …

It can quickly process and analyze this data to identify patterns and make predictions.

This allows companies to find new drilling sites.

As well as collect data from existing wells to determine the best areas and environments to drill future ones nearby.

And that means more oil on the market.

In fact, AI could help oil and gas companies cut the exploration timeline from nine months …

To as little as nine days.

This is critical …

Because, for all the booming profits oil and gas companies already have …

And all the millions of barrels of oil being produced daily.

Oil and gas companies still aren’t close to reaching their full potential.

One report showed how offshore platforms are running at just 77% of their maximum production potential.

That means a shortfall of 10 million barrels … a day.

That’s $200 billion in annual revenue lost.

The International Energy Agency says AI could help oil companies add $1 trillion to their bottom line by 2025 when it comes to discovery and production.

One oil and gas superpower has already implemented AI and saved $200 million in drilling operations costs.

Another has already used AI to increase production by about $30 million per year …

On each of their offshore platforms.

These aren’t long-term forecasts … they’re dramatic near-future impacts.

Oil and gas giants are rushing to tap into AI right now.

And I’ve found four companies who, thanks to the impact of artificial intelligence on the oil and gas industry, could soar.

These four companies are at the forefront of AI’s Next Wave.

Again, while I cannot guarantee any particular outcome, I want to share these four stocks and tell you about how they have started to leverage AI to their benefit.

For instance, one company became the first to use autonomous drilling in deepwater.

That’s when a drilling system learns, adapts and evolves to consistently deliver wells at improved performance.

That means increased productivity in far less time.

I’ve got all the details on this company — as well as three other companies set to use AI to drastically disrupt the oil and gas industry.

I’ve included them in a special briefing I just prepared for you, called How AI Will Transform the $7 Trillion Oil Industry.

Inside you’ll find the names and tickers of the four companies at the forefront of AI’s Next Wave.

I’ll also explain how AI is transforming these other three companies:

- One company is using AI to significantly expedite well development by cutting the time needed for seismic interpretations in half and saving up to 40% in production costs as a result.

- Another company is using AI and has already seen revenues jump 52% year-over-year, with profits soaring fivefold.

- The fourth company is implementing AI in efforts to optimize production off the coast of Newfoundland, as well as other tricky cold-water locations in Canada.

I’m making this report available right away, and I’ll explain how to get your hands on it in just a minute.

As you know, AI has moved faster than any sector in history.

As a result, when AI moves into Step Three, stocks could spike quickly.

So, if you missed out on the earlier surge in AI stocks …

And if you’ve regretted staying on the sidelines during the initial AI boom.

Then now is the time to start educating yourself about this current window of opportunity.

As I’ve said, all my research indicates that this Next Wave of AI could be coming in the next few months.

In fact, it’s already begun.

Opportunities to capitalize on technology with this kind of life-changing impact rarely come along.

And now I am confident that, as AI surges to the final step of this technology cycle, so should the four stocks in my special report, How AI Will Transform the $7 Trillion Oil Industry.

But the oil and gas industry isn’t the only business primed to ride AI’s Next Wave.

Advanced Microchips: The Secret

Ingredient to the AI Megatrend

Because even though it impacts just about every facet of our daily lives …

The oil and gas industry isn’t the only business undergoing a dramatic transformation thanks to AI.

Without this next industry:

- 17 billion cell phones worldwide would be worthless …

- 2 billion computers couldn’t even turn on …

- The $3 trillion global automotive manufacturing industry would grind to a halt …

- Nearly 1.5 billion cars currently in operation would rust away in the garage … and

- We wouldn’t be able to get many critical services we need at hospitals.

I’m talking about advanced microchips and semiconductors.

Without them, we’d quickly fall into a technological dystopia.

This industry will soon be worth $1 trillion.

And it’s already set to climb another 50% in the near future.

With the rapid data-processing speeds of even simple AI apps like ChatGPT …

There is a dramatically increased demand for AI-related microchips and semiconductors.

Normal CPUs may not be able get the job done.

These advanced devices require chips with exponentially more powerful resources to work properly.

ChatGPT made great waves with its ability to generate content using AI …

That’s created an arms race to innovate in the AI space.

The most prized munitions of this ensuing arms race are processing power … chips.

They serve as the backbone for all AI.

And one company is positioned at the front lines of this next wave of the AI bull run.

It currently dominates the global chips market …

Producing more than 90% of the advanced chips available.

Existing clients have a combined market cap totaling more than $5 trillion.

In addition to producing chips critically needed for powering cars, healthcare devices, consumer electronics, military systems and renewable energy sources …

It’s now producing chips to expand AI’s capabilities.

Honestly, this chipmaker may be the most important company on the globe right now.

And that’s not all …

I found a second company that specializes in creating and producing integrated circuits for microcontrollers.

These are basically small computers available on a single chip.

They go into everything from airplanes to data centers to consumer appliances.

This company’s products are at the forefront of key megatrends such as 5G, electric vehicles and the Internet of Things.

When it comes to AI, this company makes components that are vital. These switches connect servers and individual chips to each other.

You see, the more AI comes into play, the more computing power the world will need.

That means both of these companies appear well-positioned as AI adds up to $4.4 trillion to the global economy annually.

I’ve put everything investors need to know in a second report titled The #1 Chip Stock of 2023.

And I’m making this report available today as well.

Inside, I’ll tell you more about the chipmaker I think may be the most important company in the world, including its ticker symbol and my full analysis of its prospects.

I’ll also give you a second bonus company, who I also think could ride the next wave of AI stocks.

But I am so excited about the chips’ massive importance to the future of AI, I’ve added a bonus third stock pick to this report.

Earlier, I mentioned how Nvidia just became the seventh trillion-dollar company in history.

The company took advantage of the earlier AI wave better than anyone else.

Its stock has gone up over 300% in the last nine months as a result.

Nvidia’s graphic processors are critical to AI devices.

Many companies out there are playing catch -up when it comes to AI …

But not Nvidia. It’s positioned itself as the flagbearer for the AI boom.

Their GPUs are the best-in-class due to their computing effectiveness and success running and training AI models.

OpenAI, which owns ChatGPT, uses Nvidia for the bulk of its GPU needs.

As the current market leader, Nvidia will continue to dominate as the competition ramps up.

But here’s the thing …

While I think Nvidia is a company you should own over the long term, I am not recommending you buy the stock.

Based on my research, the stock price has just gone too high right now.

However, I’ve spotted a prime opportunity in the near future …

I see a temporary dip coming, a prime inflection point that may prove fruitful.

So, for investors who sat out Nvidia’s earlier run-up … there be another opportunity down the line.

I’ll show you the next time to get in. And what buy price you should be targeting for Nvidia in the near future.

My latest information on Nvidia, plus details on the most important chipmaker in the world — and a bonus, second chip company — are all in my special report, The #1 Chip Stock of 2023.

This and my other report, How AI Will Transform the $7 Trillion Oil Industry, can be yours as soon as this video ends.

So, how can you get your hands on my research in these two reports?

My publisher told me we could easily justify selling each report for $79.

Including Nvidia, that would mean $158 for two reports featuring seven stocks that are at the front lines of a potential AI megatrend.

But I’ll send both information-packed reports to you today, no charge.

I only ask one favor.

Take a completely risk-free subscription to my monthly stock market newsletter, Wealth Megatrends.

It gives readers the information to evaluate HOW and WHEN to jump on some truly earth-shattering ideas.

My team and I find stocks that play into the biggest trends …

Like my early calls on the $2 trillion 5G industry …

The $500 billion EV industry …

And the $422 billion solar power industry.

Never before in our lifetime have we witnessed more powerful and sustainable megatrends with the potential to change our world for the better.

And that includes a broad array of new technologies, including AI, driverless vehicles, big data, the Internet of Things, cloud computing and blockchain …

They are all working with each other to produce an ongoing cycle of growth and opportunity.

That’s why I call this service Wealth Megatrends.

What Is Wealth Megatrends’ Secret Weapon (With Average Gains of 220%)?

Look, all investing comes with risk …

Investors need to understand that, while many investments come with great upside potential, they can also go down as well.

The smartest and most-prepared investors do not play with money they cannot afford to lose …

And if you choose to invest, neither should you.

With all that in mind, Wealth Megatrends is the absolute best resource for anyone looking to seize this historic opportunity in front of us.

We don’t just close our eyes and throw darts at stock picks on the wall.

My team and I keep our fingers on the pulse of all economic, geopolitical, social and cultural megatrends that shape the markets, for better or worse.

With this kind of intelligence, backed by years of experience, investors can unlock the door to some of the most exciting and unique opportunities available today.

We’re also not just looking to find some fad “meme” stock.

We only want the cream of the crop.

And I’ll only recommend stocks that pay a healthy dividend.

Each stock pick I send out is backed by thousands of data points and professional analysis …

Thanks to our proprietary Weiss Stock Ratings.

We incorporate the Weiss Ratings system into our research.

Weiss Ratings is the only completely unbiased, independent ratings system …

For over 50,000 stocks, ETFs, mutual funds, bonds and banks.

For more than 50 years, Dr. Martin Weiss and his team have used their proprietary Weiss Ratings system to help investors navigate any crisis and position themselves appropriately.

With this system, the Weiss team can scientifically evaluate risk against reward and assign a clear “Buy,” “Hold” or “Sell” rating for any stock.

For decades, this is what allowed us to spot amazing stocks at the very best prices … and avoid pitfalls that trapped many other investments.

In 2000, at the height of the dot-com mania, 98% of ratings issued by Wall Street firms were “Buys.”

But our Ratings model said just the opposite. We declared nearly every Nasdaq stock a “Sell.”

Sure enough, three years later, the Nasdaq was down 75%. And dozens of Wall Street’s former favorites had collapsed in price or even filed for bankruptcy.

By this point, many of those same firms had downgraded nearly every stock to a “Sell.”

Once again, our Ratings model said the opposite.

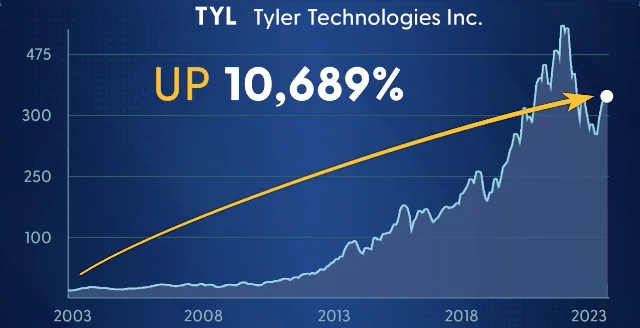

We upgraded Tyler Technologies to a “Buy.” Since then, it has soared 10,689%.

We said Ansys was a “Buy” before it exploded 5,466%.

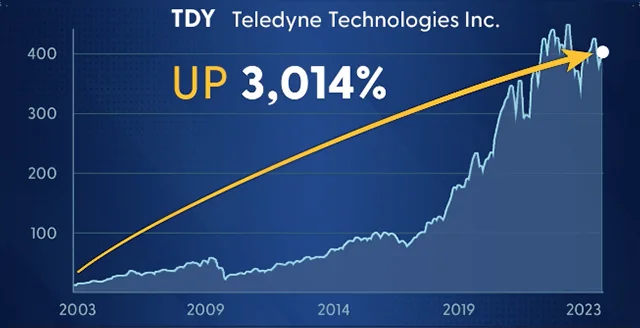

We upgraded Teledyne Technologies to a “Buy” before it climbed 3,014% …

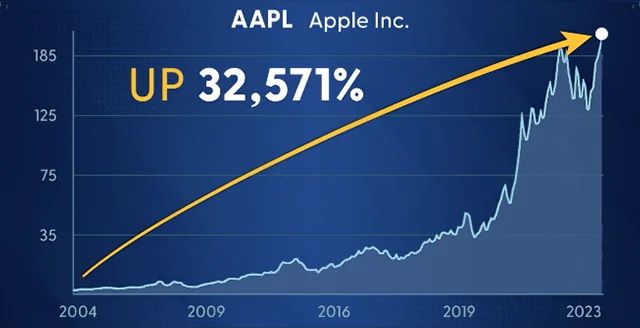

We even declared a little company called Apple a “Buy” back in 2004, when most “experts” had written the company off.

Since then, Apple has gone up 32,571%.

Nvidia has had a tremendous run, with gains of more than 300%.

But it’s done even better with our proprietary system.

Ever since we issued a “Buy” back in 2011, the stock has gone up 9,624%.

And yes, these were some of the biggest and most exceptional picks we’ve ever made in our history. And we can’t control when investors choose to invest their money or when to exit. That’s a decision left to their discretion.

It’s not realistic to expect those kinds of results from every investment.

But look at this …

On 1,306 possible trades based on the Weiss tech stock ratings since inception, the average gain is a whopping 220%.

That would be more than three times your money.

Per trade.

On 1,306 possible trades.

I think most investors would agree these Ratings are a powerful tool.

It’s why I trust the Weiss Ratings model to back every Wealth Megatrends pick I send out, including these seven AI stocks I believe will thrive if and when we enter Step Three of the AI boom.

On the fourth Friday of every month, you will receive your latest issue with a new recommendation on the latest stock market megatrends.

But you get so much more than stock picks …

The markets move fast, so investors need to be prepared for quick changes.

That’s why every Wealth Megatrends member also receives my “Flash Alert” emails covering the latest risks and opportunities.

For really important events, members will also receive an invitation to my confidential online briefings where I’ll answer questions live on the air and share my predictions for what the next quarter holds for investors.

You’ll also receive my free Weiss Ratings Daily e-letter.

It’s the most detailed and timely way to stay on top of new developments in the market, and it’s included at no additional cost.

But just in case you’re still on the fence, there is one more report I want to share with you …

I’ve already shown you oil and chip stocks that are well-positioned thanks to AI …

There are four more AI stocks I believe investors should own today.

That’s why I’ve prepared this third report titled My Top 4 AI Stocks.

These are the companies outside of the oil sector and beyond just chipmakers.

Like a promising company at the forefront of AI and cloud computing.

Or a company whose technology supports the design and production of microchips. It’s tapped into the profits of all the major chipmakers, but they don’t make chips.

A company whose ability to soup up computer power will allow AI to be used by more people and process data even faster.

And one of the best companies in the world. It’s already embedded AI into 25 of its products.

Inside, you’ll find out all the critical details you need to know about these companies — including their names and tickers — in this third and final report.

I know this is a lot …

So, let’s quickly summarize what this comprehensive AI Next Wave package includes:

Today, as part of your risk-free membership with Wealth Megatrends, you will receive:

- Report #1: How AI Will Transform the $7 Trillion Oil Industry

- Report #2: The #1 Chip Stock of 2023

- Report #3: My Top 4 AI Stocks

- My Weiss Ratings Daily e-letter, sent to your inbox 5X weekly

- My “Flash Alerts” for critical, time-sensitive opportunities and warnings

- Exclusive invitation to my confidential online briefings

- And a full 12 months of access to Wealth Megatrends.

With the 11 AI stocks I’ll share within these reports, you’ll have a real chance to capitalize on the Next Wave of the AI boom.

And I’ll keep you updated on important changes in the market, so investors can make more informed decisions.

So how much does Wealth Megatrends cost?

Less Than a Tank of Gas

A year’s subscription to Wealth Megatrends normally retails for $129.

But we don’t want you standing on the sidelines during AI’s potentially powerful move into Step Three.

So today, anyone watching can get a full year of access to everything we’ve covered here for just $49.

That’s less than the cost of one tank of gas.

I think you’ll agree that is more than fair, especially given the kind of megatrends we’ll be following.

Like with AI, I’ll show you what I believe to be the best stocks to invest in every step of the way.

And if you aren’t satisfied for any reason during your first 12 months …

Just call my team and we’ll provide a full refund with no hassles.

That means you get a full year to try out and enjoy my service.

So, if you missed out on the early pop in AI stocks, don’t worry.

The Next Wave of AI stocks is here right now.

And I believe that AI is moving into Step Three as we speak.

Act now to subscribe to Wealth Megatrends and get immediate access to my AI stock special reports.

Sincerely,

Sean Brodrick

November 2023