THE $2 TRILLION CHINA EXODUS

Money, jobs and whole companies are flooding

out of China. But where are they headed?

The answer could mean a fortune for a handful of well-placed stocks.

Dear Reader,

Check out this building …

Just one year ago, a building like this housed thousands of Chinese factory workers.

But there’s been no activity for months.

No one has come or gone. The building is empty. The machines, silent.

And the latest intelligence out of China shows the same thing happening in megacities up and down the giant country.

Factories have gone dark. Workers have disappeared.

What exactly is happening?

Of course, the Chinese government hasn’t commented on the shuttered factories.

They want everyone to think it’s business as usual. Their power rests on the idea that China is an economic superpower, capable of dominating the rest of the world.

But the real story on the ground tells a far different tale.

China is in deep trouble.

Its whole empire was built on being the world’s factory floor. If the factories are closing, then something has gone very wrong.

And when I dug deeper, I found out that’s exactly what’s happening.

Over $100 billion dollars in business investment money has fled China in the last year alone. And billions more are to come.

Not just that, but this money is mostly flowing to one surprising place. A place I think could house some of the best investments of the next decade.

And if you hop onto this big trend now, you could ride this surge of money rushing out of China.

My name is Sean Brodrick.

I’ve been featured on networks as different as CNBC and Fox News because of my long track record for predicting global events – and showing investors the best ways to take advantage of them.

My team and I called the 2008 financial crisis ahead of time.

We called the start of the roaring bull market that followed as well.

We predicted the election of Donald Trump a year ahead of time, while most experts were still pooh-poohing his chances.

And I predicted the recent Russian invasion of Ukraine ... And its effect on the stock market.

Now, I believe we’re going to see a mass exodus of foreign businesses from China.

In fact, 90% of global corporate executives say they are in the process of moving production out of China or have plans to do so.

Apple, Amazon, Volvo, Samsung. Google. Microsoft.

These are just a few of the big names who are disappearing from China.

And now Wall Street, which was China’s biggest cheerleader in the West for years, is souring on the country.

JP Morgan & Chase even called Chinese stocks “uninvestable,” before they backpedaled and labelled them merely “unattractive”.

So where are all of these jobs and money going?

Well, you might have heard some talk about India. Or Vietnam and Malaysia.

And yes, a fraction of these jobs have found their way to cheaper third-world countries.

But when I really dug in and chased the money … I found that most of it was going to a surprising place.

It’s not a third world country.

And it’s not in Southeast Asia.

It has a stable government and a huge supply of skilled workers.

And in the last 12 months, over $200 billion of manufacturing investment has flooded into this country.

Soon, it will grow by ten times, to over $2 trillion.

Obviously, this type of monetary shift can change the fortune of whole countries, let alone individual investors savvy enough to spot this massive shift ahead of time.

So what country is it?

I’m not talking about anywhere in Europe. And it’s not Canada or Australia or anywhere like that.

Give up?

Believe it or not, I’m talking about right here in the U S of A.

That’s right … Trillions of dollars, hundreds of factories and thousands of jobs are coming back to America.

A new industrial boom is beginning in America – and at China’s expense no less.

Not only that, this manufacturing return to America – what some are calling re-shoring – could enrich a few companies, as I’ll explain in a moment.

But first, I want to give credit where it’s due.

We have Donald Trump to thank for this windfall in investment and jobs.

He was the first president in my lifetime to really call a spade a spade and point out China’s unfair trade practices.

Free trade only works when everyone plays by the same rules. China was breaking those rules for years and, to be very blunt, greedy, short-sighted people in America allowed them to get away with it.

Trump imposed tariffs and export controls of sensitive technology to China.

All the elitists in Washington and the media accused him of starting a trade war … when in reality he was just responding to the economic war that China had been waging — and winning — against America for decades.

And this process has continued. For all the criticism from Trump’s opponents, Joe Biden kept all of Trump’s tariffs and other China policies in place.

It’s because he KNEW it was long overdue, even if politically, he couldn’t admit it.

The supply chain shocks and empty store shelves we saw in 2020 added even more incentive to bring manufacturing back to the States …

And what began as slow trickle of reinvestment in America … has grown into a raging current, especially in the past 12 months.

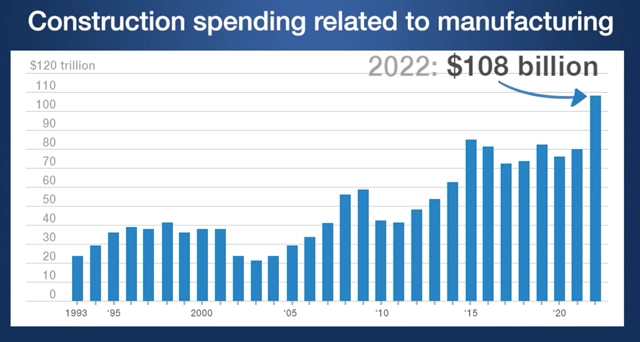

Manufacturing construction in America reached $108 billion last year, the highest annual amount on record.

And US Manufacturing orders from China were nearly cut in half last year … A drastic 12-month change.

It’s why the Wall Street Journal announced that “America is Back in the Factory Business”.

There are new advanced battery factories in places like Lansing, Michigan, built by General Motors and LG …

Huge semiconductor and solar panel plants are sprouting up in Arizona, Ohio and New York State.

And Apple just signed a multi-billion-dollar deal with chipmaker Broadcom to begin making 5G equipment right here in America:

This tidal wave of investment is why Volkswagen CEO Scott Keogh recently told Bloomberg: “There’s never been a better time to build a factory in America.”

He went even further, saying it’s a “little bit like the Gold Rush.”

And it’s not all just expensive, high-tech goods.

Danish toy giant LEGO broke ground on a new plant near Richmond, Virginia.

Eyeglass companies like Zenni now make their glasses in Ohio after making everything in China for years.

Their new factory produces thousands of glasses for only $3 more per pair than it would cost them in China. And with a shorter supply chain, they can deliver to customers faster than ever.

Bicycle maker Kent International made all their bikes in China for decades … But after their biggest customer — a little store called “Walmart” — told them they wanted US-made bikes, they opened new a factory in South Carolina.

Supplement company Vireo Systems sourced everything from China for years. After being hit by supply-chain problems during the pandemic, they built their first plant in Nebraska.

And this is just scratching the surface.

But look, I’m not telling investors to run out and buy these company’s stocks.

I’m not even going to tell folks to invest in the construction firms that I believe are most likely to benefit from this factory building boom.

Instead — I’ve found three undiscovered companies that could explode from this unfolding megatrend, whether or not this reinvestment in the US is a success.

In a few minutes, I’ll share more of what I know about these stocks, which are on the rise as we speak.

But at this point, you may be wondering …

Why is this all happening NOW? Why, after decades of outsourcing, is capital flying out of China and back to the US?

For a couple of big reasons, actually.

Security is one of them.

A lot of companies just don’t want to deal with the hassle of doing business in China anymore.

As tensions with the US increase, the paranoid Communist Party passed a “national security” law that is so hostile to foreign companies that it’s scaring a lot of them away.

They’ve used this law to threaten and intimidate foreign companies, and American ones in particular.

The Shanghai office of Bain, a major US consulting firm, was raided by government thugs.

The same thing happened to American due diligence firm Mintz Group. Police shut down their office in Beijing, and even detained five of their employees!

These are not isolated incidents. American and global companies are subject to constant harassment over there.

It’s gotten so bad that the US Chamber of Commerce issued a warning about the risks of doing business in China.

But an even bigger reason is cost.

You see, China became the world’s factory floor back when it was still a developing, borderline third-world country.

People who had nothing were more than happy to work long hours in factories for low pay.

But China has evolved over the last couple of decades. It’s a middle-class country now.

And far fewer people are signing up to work 14 hours a day for $2 an hour.

The same thing happened in the British and American industrial revolutions.

Eventually, as workers accumulate more money, they rebel. And wages rise, productivity declines and businesses are forced to adapt.

In the case of China, for American companies, it’s a simple question?

Why would I move my whole business across the world to a hostile country like China if it doesn’t actually save money?

It’s both cost and security that are accelerating this Chinese capital exodus and boosting the return of industry to America.

And I have good reason to believe this will REALLY kick into high gear in the next 18 months …

Why?

It’s because of this island right here:

This is Taiwan. It’s a democratic, self-governing island that China claims as its own.

But Taiwan also has a promise from the United States of protection from China.

Over the years, China has increased threats to invade the island and take it by force.

Look, I know geopolitics doesn’t interest everybody. It’s not my favorite subject either.

But every single person out there who has a 401(k), an IRA or a pension needs to pay attention to this, because it WILL affect you.

If China invades — and all signs indicate that’s exactly what they’re planning, I’ll get to that in moment — if they invade, transpacific trade will shut down.

Period.

No shipments of countless brands of t-shirts, toys, laptops, smartphones or tablets.

No shipments of all the other things that were outsourced.

Nothing.

It ALL grinds to a halt.

This will be catastrophically disruptive to companies that are still sourcing everything from China, or even from other countries in Asia.

Their items will quickly run out on American shelves and will not be refilled.

A scary picture, for sure. But there’s reason for hope.

The companies that survive that crisis and dominate the competition are the ones that have a presence HERE in the US.

They will be isolated from the breakdown in supply chains because they have factories here.

Simply put: the shorter your supply chain is, the stronger and safer it will be. And there’s nowhere in the world better to build a strong, secure supply chain than right here in the US.

Now, I know some of you may be skeptical.

You may be thinking, “sure this guy may have predicted the Ukraine War. But how does he know that China’s going to invade Taiwan? And how does he know that we could get sucked in that war?”

Look, nobody has a crystal ball to predict the future with 100% certainty. But I’ll tell you what we do know for sure.

In the past year China has dramatically increased their air and naval patrols around the island of Taiwan.

Some analysts think this is a rehearsal for a naval blockade, followed by an invasion.

According to CIA Director William Burns, Chinese president Xi Jinping has instructed his country’s military to “be ready by 2027” to seize Taiwan.

But I think it could happen much sooner.

All my research indicates they could make a move in the next 18 months.

And I’m not alone in making this prediction.

4-Star Air Force General Mike Minihan recently sent a memo to over 50,000 service members urging them to get their legal affairs in order and prepare for conflict by 2025. Here’s a quote:

“I hope I am wrong. My gut tells me we will fight in 2025 … Taiwan’s presidential elections are in 2024 and will offer Xi a reason. United States presidential elections are in 2024 and will offer Xi a distracted America. Xi’s team, reason, and opportunity are all aligned for 2025.”

- Gen. Mike Minihan, USAF

That’s what higher-ups in the Pentagon are saying.

Me? I’m not saying that the US will 100% get in a conflict with China.

But whether or not the US chooses gets involved in a fight between Taiwan and China … all the signs indicate China will invade in the next 18 months.

And that means transpacific trade WOULD shut down.

If this happens it will have a massive impact on the stock market.

There are still many companies that have exposure to China, and their stocks are likely to be crushed.

But companies that had the foresight to relocate at least some of their manufacturing back to the US?

That’s where the smart money is flowing now and will continue to flow in the future.

But why America specifically, and not just some other Third World country where labor is even cheaper than China?

Well, it’s because of a tech breakthrough you may have heard about lately. And it makes America the most logical and profitable place for many companies to make things.

I’m talking about artificial intelligence – the ability of microchips to learn and improve performance is a massive asset to the machines and robotics that will fuel the modern American factory.

In fact, you could say artificial intelligence is the cornerstone of the new American factory.

The AI will enable massive advances in robotics and automating tasks on the factory floor. More automation means fewer workers and far lower costs.

With artificial intelligence advances in everything from assembly line efficiency to optimal shipping routes, they will not be able to build one factory that isn’t outfitted with the latest AI chips and programs.

Look at Stanley Black & Decker, the $13 billion power tool giant that makes a lot of the products you see in Home Depot.

Their CEO raved about the advantages of the modern factory. He said “You’ve gone from a situation where if you did a power tool assembly in China or Mexico, you might have 50 to 75 people on a line …

The automated solution that we’ve created in North Carolina … has about 10 to 12 people on that line … and the 2.0 version looks like it’s going to get down to two to three people on the line.”

You want to talk about increasing returns for investors?

Who’s going to have the advantage here? The company that’s still doing things the old way in China, or the companies who embrace artificial intelligence and robotics.

The “offshoring” trend is over because it just doesn’t matter anymore that labor costs in the US are higher than China or elsewhere.

And in fact, because of advances in AI, labor in the US may soon be cheaper than the rising costs of China.

Companies that are “re-shoring” production back to highly automated US factories will have a critical advantage in the months and years ahead.

And of course, this isn’t even taking into account the secondary benefits.

Lower costs for health insurance and other employee benefits.

The machines used in AI-powered manufacturing will depreciate over time, offering tax advantages to the companies that use them.

Pretty soon it will be irresponsible for any company selling in America to ignore the benefits of US-based, artificial intelligence manufacturing. And this presents a major opportunity for investors.

I’ve spotted three companies that are driving this new megatrend of AI-run factories.

I suspect you’ll be hearing quite a lot about these three stocks in the near future.

And I think you’ll soon hear analysts on TV … relatives at Thanksgiving dinner … even friends at work or the barbershop …

Soon, you’ll hear all of them saying “If I only I bought that stock before it blew up” …

Just like you hear people wishing they bought Apple or Amazon when they were trading for a few dollars a share in the 90s. Investors who did that made a fortune because those stocks drove the new eCommerce and smartphone revolutions.

These were megatrends that shook the world and changed our lives forever.

The way I see it, today, two megatrends are coming together at the same time.

The explosive growth of artificial intelligence combined with the massive shift in manufacturing, as trillions of dollars flow out of China and into the United States.

The modern factory will be beat on AI. And the companies I’ve found will be at the heart of the re-growth of American manufacturing.

The three stocks I’ll tell you about in a minute offer what I believe is the very best opportunity to tap into this revolution.

Now, I have no doubt there will be skeptics … those who say it’s impossible for US manufacturing to come back.

But that’s why I want to stress …

No matter what happens, all signs indicate that trillions of dollars will be spent on new American factories …

And I believe all of them will have some level of artificial intelligence driving operations.

I think by the time the pundits start handing out grades for the US manufacturing renaissance, these three stocks will have already soared to new highs.

What makes me so sure?

Well, I have a long track record of spotting megatrends that other “experts” failed to see.

Like electric vehicles, for instance.

At a time when business leaders like former Toyota CEO Akio Toyoda were calling EVs “overhyped”, I took the opposite path.

I predicted we’d see a “massive shift to EVs”, and that NOW was the time to bet on this emerging megatrend.

I did the same thing with 5G … Many news outlets were becoming skeptical of 5G, even calling it, and I quote, “mindless marketing bullsh*t” …

But I knew this new tech disruption could benefit investors, and I told a group of my readers that 5G “will become the new global standard”.

My team and I were ahead of the solar energy megatrend too.

As recently as two years ago, critics were still dismissing solar as not a viable energy solution.

But I went on the record saying, “Solar’s future is so bright, I gotta wear shades”!

And today? Solar investment just surpassed oil investment for the first time in history.

And while those megatrends benefitted the investors who got ahead of them … I think the artificial intelligence megatrend – when combined with the return of American manufacturing – could surpass them all.

Artificial intelligence is currently pushing the stock market into bullish territory. And it’s going to play a massive role in the rebirth of industry in America. Especially when combined with robotics.

Robotic systems don’t get sick. They don’t need time off. They can work 24/7 and they help US manufacturing stay competitive on a cost basis with low wages in developing countries.

In some cases, they are already proving to be MORE cost efficient and productive, as the case with Stanley Black & Decker proves.

Using AI and robotics to make more products with fewer people, at lower cost and closer to your customers is more than a no-brainer …

It will be a REQUIREMENT to remain competitive in the future.

It’s also the most fundamental disruption to manufacturing since the modern assembly line over a century ago.

Venture capitalist Duncan Davidson even told CNBC that this technology is fueling a new “industrial revolution”.

Make no mistake: investors who get ahead of these two megatrends could be sitting pretty in a few years.

After many months studying the situation, I’ve narrowed it down to three key stocks I think are too important to ignore:

Pick #1 is a major player in semiconductor chips — one of the core technologies that power AI. In all the factories driving American industry, and in all the factories being built now and in the future … the machines will likely depend on this company’s chips in them.

In fact, beyond just helping to power the modern American factory, this company works closely with Google and OpenAI, the companies behind hit app ChatGPT.

Pick #2 is an important player in the field of industrial robotics. They make machinery used in nearly every heavy industry you can think of, from power grids to EV charging stations, mining, automotives, and more.

I believe almost any company that’s serious about automation will likely turn to them at some point.

Pick #3 has a 100-year track record of success. They played a big role in almost every high-tech breakthrough in the last century, and this ongoing artificial intelligence boom is no exception.

I believe this company could be to US manufacturing what Microsoft was to PCs. They could help hundreds of other companies make a fortune here in America. And if that wasn't enough, they’ve often paid investors a nice fat dividend as well.

I’ve prepared a detailed investor report titled, AI and the Return of the American Factory: How to Profit from Two Merging Megatrends. Inside you’ll find the names and tickers of the top three companies driving this trend in America.

I’m making this report available today. I’ll explain how to get your hands in on it in just a minute.

Folks, I really cannot emphasize enough why no investor should be sitting on the sidelines during this period of sweeping changes.

As I’ve said, all my research indicates this will come to a head in the next 18 months.

Rarely do we get a chance to catch one megatrend in time … now we have two cresting to a wave together:

Artificial intelligence. And the massive manufacturing shift from China and the third world back to America.

I’m confident that a lot of that investment will flow into the three stocks that are featured in my, special report: AI and the Return of the American Factory: How to Profit from Two Merging Megatrends.

But those are not the only opportunities.

There are 3 additional companies leading the charge in US re-shoring.

These are companies that are well positioned for growth even if China doesn’t invade in the next 18 months … and should the worst happen, I predict they will not only survive, but explode in value while their competitors go belly up overnight.

I believe this new reawakening of American industrial might is going to be the biggest megatrend of the coming decade – and possibly beyond.

But it’s not limited to one industry, or even just high-tech industries in general.

This transformation includes non-tech industries as well.

There’s a major apparel maker that has the potential to benefit in a big way from the shift to Stateside manufacturing. This Midwest-based company owns some of the world’s most well-known footwear brands.

They are also a dominant player in apparel aimed at the construction industry. With more factory construction and infrastructure investment in the past year than there has been in decades, I’m very confident this company is going to benefit in a big way.

And we’re not done.

Because I have another hot EV opportunity that’s currently under the radar … but it’s very different than the last one.

You see, there’s one big inconvenient fact for all EV companies, even Tesla.

America’s aging power grid just simply can’t handle the charging needs of millions of new electric cars. And the massive reindustrialization of the US will stress the grid even further.

Some parts of the grid are over 100 years old and estimates to fully upgrade it run as high as $7 trillion!

So, this 2nd stock came up with an ingenious solution to this problem. They’ve developed a cost-effective way to build “micro-grids” that generate, store, and distribute power locally, without putting strain on the old grid system.

In theory, I think this technology could also keep America safe in the event that China, Russia, or anyone else tries to hack into the nationwide grid, which the head of US Cyber Command has warned about.

That could cause trillions in economic damage. I think a company that could help defend America against this danger has amazing potential.

Finally, finally my next pick is a really interesting one. This company is a real estate investment trust or “REIT” that owns the land and warehouses used by some of America’s biggest companies. Multi-billion-dollar names like Amazon, FedEx and more all pay rent to them, and business is booming.

Warehouse construction is up 1,400% in the past decade, and the recent surge of industrial construction is only going to get bigger as companies continue to re-shore operations from China.

All signs indicate this company could explode in value.

I’ve put everything investors need to know in a second report titled 3 More Red-Hot Stocks for the Reindustrialization of America.

And I’m making this report available today as well.

So, how can you get your hands on them?

Well, the publisher I work with said we could justify selling these reports for $99 each.

That would mean $198 for two reports on six stocks at the forefront of the biggest economic disruption in decades.

To be perfectly frank, $198 for all that is a steal compared to what I think it’s worth.

But I want to spread the word about this opportunity to as many people as possible while there is still time.

So, for those who watched this presentation, you can get both of these bonus reports, with a risk-free trial membership to my investment research service, Wealth Megatrends.

It’s an incredible resource that helps investors understand HOW and WHEN to capitalize on this historic shift back to US industry and innovation.

While many investors will be caught unawares by these big changes, the people who take advantage of this offer are getting early access to all my projections, and early exposure to the great rebirth of American Industry.

That’s why I called the service Wealth Megatrends. And indeed, from where I sit there is no greater trend happening in the market today or in the next few years than the great exodus of industry out of China, and back to the US.

Our Secret Weapon for Zeroing in on the Very Best Stock Picks

Look, I should point out here that all investing comes with risk. Investors need to understand that while many investments come with a great upside, they can also go down as well. The smartest and most well-prepared investors do not play with money they cannot afford to lose.

And if you choose to invest, neither should you.

With all this in mind, I believe that Wealth Megatrends is the very best resource for anyone looking to seize this historic opportunity in front of us today.

What makes Wealth Megatrends different than other investor research services is that we don’t just throw stock picks at you every month and hope for the best.

My team and I keep our fingers on the pulse of all economic, geopolitical, technological, social, and cultural megatrends that shape the markets, for better or worse.

With this kind of intelligence on your side, backed by years of experience, you can unlock the door to some of the most exciting investment opportunities available today.

What do we mean by “experience?” Well, each investment recommendation I send out is backed by thousands of data points and professional analysis, by incorporating the Weiss Ratings system into our research.

Weiss Ratings is the only completely unbiased, independent ratings system for 50,000 stocks, ETFs, mutual funds, bonds and banks.

For over 50 years, Dr. Martin Weiss and his team have used their proprietary Weiss Ratings system to help investors navigate any crisis and boost returns.

With their proprietary model, the Weiss team can scientifically evaluate risk against reward and assign a clear “Buy,” “Hold,” or “Sell” recommendation for any stock.

For decades this is what allowed us to spot amazing stocks at the very best prices … and avoid pitfalls that trapped most other investments.

In 2000 at the height of the Dot Com Mania, 98% of ratings issued by Wall Street firms were “Buys”.

But our Ratings model said just the opposite. We declared nearly every Nasdaq stock a “Sell”.

Sure enough, three years later, the Nasdaq was down 75%, and dozens of Wall Street’s former favorites had collapsed in price or filed for bankruptcy.

By this point, many of those same firms had downgraded nearly every stock to a “Sell”.

Once again, our Ratings Model said the opposite.

We upgraded Tyler Technologies to a “Buy”. Since then, it has soared.

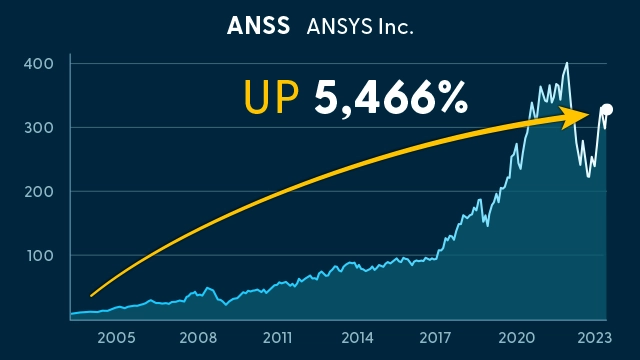

We said Ansys was a “Buy” before it exploded 5,466%.

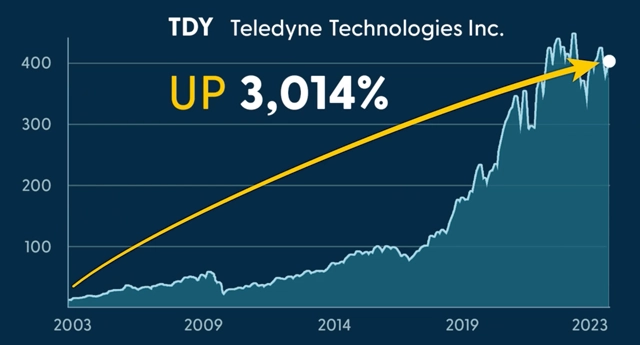

We upgraded Teledyne Technologies to a “Buy” before it climbed 3,014% …

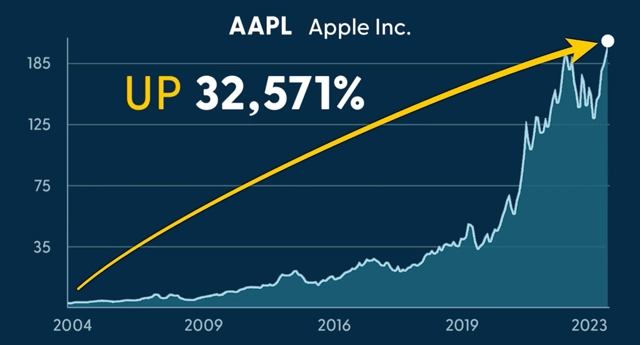

We even declared a little company called “Apple” a “Buy” back in 2004 when most “experts” had written the company off.

Apple – Up 32,571%

Since then, Apple has gone up 32,571%.

These were some of the biggest wins. Of course, it’s not realistic to expect those kinds of results from every investment. So, let’s look at the totals.

Among all the stocks we’ve upgraded to a “Buy” and never downgraded, 445 in total, there have been 428 winners with an average gain of 827% from the date we upgraded each to the present …

… and between the date we upgraded each to the present, just 17 losers with an average loss of 25%.

That comes to an average gain of 794% overall …

I think you’ll agree these Ratings are a powerful tool to have on your side.

And unlike other Ratings agencies like Moody’s or Standard & Poor’s, Weiss Ratings never has and never will accept one dime of compensation from a company we rate.

We have no conflicts of interest.

This transparency and integrity … and this stunning track record of success, is why I am so proud to work with Weiss Ratings.

And it’s why I trust their Ratings model to back every Wealth Megatrends recommendation I send out, including these top stocks for the rebirth of American industry.

But we’re not done.

The markets move fast, so investors need to be prepared for quick changes. That’s why every Wealth Megatrends member also receives my “Flash Alert” emails covering the latest risks and opportunities.

For really important events, members will receive an invitation to my confidential online briefings where I’ll answer questions live on the air and share my predictions for what the next quarter holds for investors.

You’ll also receive my free Weiss Ratings Daily E-Letter.

It’s the most detailed and timely way to stay on top of new developments in the market, and it’s included at no additional cost.

But just in case you’re still on the fence, let me throw in one last thing to make this decision a little simpler for you.

There are a few more rising stocks related to the return of industry to America that investors absolutely must know about.

I think these are the best “picks and shovels” stocks for the next decade.

Because much like the Gold Rush of the 19th Century, those who made the most money didn’t dig for gold — they sold the essential materials — the literal picks and shovels — to all the speculators who came for gold.

In a similar way, these final three companies are likely to play a key role in helping other enterprises seeking to build their fortune in this new era.

And just like the picks and shovels vendors of old, these three companies could soar in the near future, whether or not their customers succeed.

I’ve prepared one last investor report on these three final stocks, titled The Key “Picks & Shovels” Stocks for the Rebirth of U.S. Industry.

Inside you’ll find details on:

- The metalworking, maintenance and repair firm that I believe will benefit the most from industry coming back to America (this one has also typically paid a nice fat dividend!)

- A little-known company that provides critical back-end services that the energy and manufacturing sectors cannot function without. This is one of those “sleeping giant” stocks that I predict investors will be happy about if they get in early!

- And finally, a firm that could become a dominant player in the lithium sector. So many technologies, from EVs to smartphones to medical equipment … they ALL depend on this one key metal … and this overlooked company is sitting on two of the largest lithium deposits in the Western Hemisphere!

You’ll find the names, tickers and everything else you need to know about these companies in this third and final report. Now, I know we covered a lot of ground here so let’s quickly summarize again what this all includes:

Today, as part of a risk-free trial membership with Wealth Megatrends, you’re getting:

- Report #1: AI and the Return of the American Factory: How to Profit from Two Merging Megatrends

- Report #2: 3 More Red-Hot Stocks for the Reindustrialization of America.

- Report #3 The Key “Picks & Shovels” Stocks for the Rebirth of U.S. Industry

- My Weiss Ratings Daily E-Letter, sent to your inbox 3x Weekly

- My “Flash Alerts” for Critical, Time-Sensitive Dangers and Opportunities

- Exclusive Invitation to my Confidential Online Briefings

- And a full 12 months of access to Wealth Megatrends

So how much does Wealth Megatrends cost?

Normally access to this service retails for $129. But today anyone watching can get a full year of access to everything we’ve covered here for just $49.

That comes to just 14 cents per day.

A dime and four pennies per day. I think you’ll agree that is more than fair, especially given the kind of under-the-radar stock ideas I’ll send out on a regular basis.

And again, if you’re not satisfied for any reason during your first twelve months, just call my team and we’ll provide a full refund with no hassles.

Plus, I’ll give you a full year to enjoy my service. If you’re not satisfied for any reason, we’ll refund 100% of your money.

You can sign up for Wealth Megatrends by clicking the button below. Your card will not be charged when you click. You’ll simply be taken to a secure order page where you can review everything again before completing your order.

Whatever you decide today, we’ll respect your choice.

But just understand that this opportunity will not remain online forever.

And investors who choose not to jump on this $2 trillion flow of cash out of China, and into American industry of the future? I think they’ll be kicking themselves later on.

So, get in on the ground floor of this return to American manufacturing greatness. I hope you’ll join me and the hundreds of other Wealth Megatrends members who are planning to seize this moment.

Click the button below now, and I’ll see you inside.