Dear Reader,

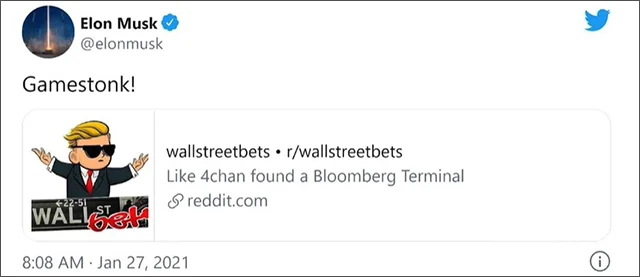

Elon Musk has a history of making bold statements on Twitter.

Even before he owned the company.

Whether it’s politics, pop culture, technology – or challenging Meta CEO Mark Zuckerberg to a cage match, Musk consistently grabs attention.

But his tweets about the stock market have had the biggest impact.

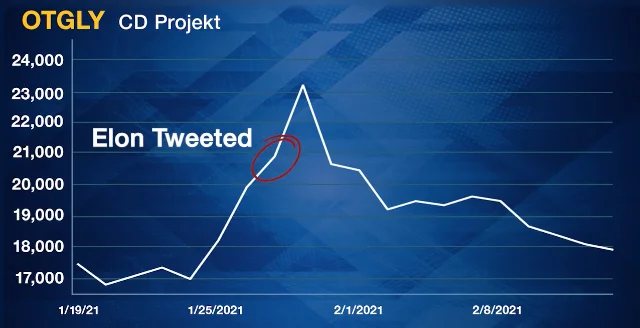

Like the time he complimented little-known video game maker CD Projekt.

The stock jumped 19% in a matter of hours.

The next day, he added a simple #bitcoin to his Twitter profile.

And the coin surged 20% the same day.

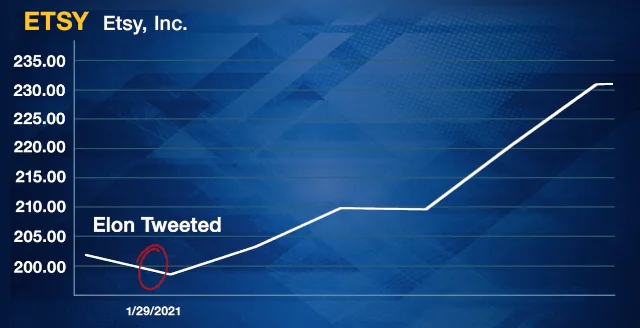

When Musk tweeted that he “kinda loves Etsy,” the stock climbed 8% during market open.

And eventually hit an all-time high just a week later.

After his public missive about meme stock GameStop, the company spiked 62% in one day.

He was even sued by the Securities and Exchange Commission for insider trading because of his tweets about Tesla’s stock.

But that hasn’t slowed him down.

And that’s why I rushed this urgent video to you today.

Look, it doesn’t matter what you think about Musk’s politics or his volatile personality …

I certainly don’t agree with him about everything.

But his tweets have been known to move share prices, quickly.

And I believe one of Musk’s next tweets could have a major effect on the stock market.

Specifically, I think a small handful of chipmaking stocks could gain attention as Musk presses send.

Musk often tweets frequently, in bursts, day and night.

He could start tweeting at midnight tonight … 9:30 a.m. tomorrow … or some random time a few days from now.

He might even tweet about two under-the-radar chipmakers.

So I’ll get right to the facts of the situation.

But first, I will admit, I’m not in Musk’s head.

And I don’t have any official connection to Tesla.

I’m just following my research to its logical conclusion.

And it tells me these chipmakers will be very important to Musk, Tesla and the entire electric vehicle market in the next few years.

Whether Musk tweets about them or not, these companies are likely to get attention thanks to the exponentially growing market around EV charging.

How Elon Musk Became the King of EVs

Hello, my name is Sean Brodrick.

I’ve spent the past decade-plus at the forefront of the electric vehicle adoption curve.

As an investor, I was touting this explosive growth market long before it was cool.

In fact, I have a history of spotting trends well before the mainstream media does.

Including EVs.

Just a few short years ago, Toyota’s CEO went on record stating that he felt EVs were overhyped.

And he wasn’t the only one who felt that electric vehicles would be a fad.

But I was pounding the table, saying we were about to see a “massive shift” to EVs.

Sure enough, electric vehicles are now mainstream.

Nearly a million EVs were sold worldwide last year … with sales leaping by two-thirds from the previous year …

Even while the rest of the automobile market was contracting.

By 2030, The Wall Street Journal expects over 50% of all new cars purchased in the U.S. will be EVs.

China and Europe are expected to hit the mark even sooner than that.

Tesla has gone from being an interesting story with a flamboyant owner to one of the three most valuable companies in the world.

And depending on the day, founder Elon Musk is the world’s richest man.

How did he do it?

Charging power.

You see, polls show over and over again …

The #1 thing holding electric vehicle sales back is what’s called “range anxiety.”

People are convinced the EVs will run out of juice before they can find a charger on the road.

On top of that, the time it takes to charge an electric car is still far too long for most potential customers.

The average charging time takes over an hour just to fill up to 80% — a 200-mile range.

That’s just not acceptable to folks who are used to a 10-minute fill up at the gas station.

That’s where Elon Musk comes in …

As a visionary, especially when it comes to electric vehicles, Musk figured out long ago that having a robust and powerful EV charging network was the key to overcoming customer objections.

So while the rest of the market players like Ford, GM, Toyota — even the U.S. government — were building inferior chargers that take an hour to do the job …

Musk went his own way.

And he built the most powerful chargers on the market, Tesla Superchargers.

Superchargers are refueling the battery in full in just 30 minutes – more than twice as fast as the other chargers.

Car and Driver magazine called Tesla’s network of Superchargers the “gold standard.”

Business Insider said the Supercharger network is already the most robust fast-charging network globally.

Not only that, but Tesla’s network of Superchargers is far larger than those built by the U.S. government, Ford, etc.

Tesla drivers have an app that helps them plan a trip via Superchargers – to limit range anxiety.

This commitment to fast charging is what made Tesla the dominant force in electric vehicles.

The now Texas-based company sold 1.3 million vehicles worldwide in 2022.

Now, the rest of the industry has given up.

They’ve conceded defeat to Tesla.

Every EV in the World Now Needs This Device

Just a couple months ago, Musk announced Tesla was making its one-of-a-kind Superchargers available to all other EV car companies.

They didn’t take long to take up his offer.

Access to Tesla’s “Holy Grail” of charging would be a huge boost for their customers and future sales.

Ford, GM, Mercedes Benz, Volkswagen, Nissan and Honda are already signed on.

Polestar, Rivian, Jeep, Dodge and Chrysler, are all expected to sign on soon. (Or they may have joined up by the time you read this.)

The Biden administration is handing out $7.5 billion in subsidies to build even more chargers using Tesla’s top-of-the-market technology.

Starting in 2025, it’s projected that every EV sold in America will be able to access Tesla’s Superchargers.

Plus, China’s much larger EV market is also adopting Tesla’s charging standard.

As is Europe.

That means over 120 million EVs a year … and rising.

All connected to Tesla’s charging network.

But there’s just one problem …

And it’s what I expect Musk to tweet about in the coming weeks.

Tesla’s EVs have a special device inside that allows them to get the full power of the Superchargers.

Without it, the Superchargers would be useless. And charging time would still be onerously long.

Starting next year, nearly every single EV built worldwide will need this device …

Or else they will not be able to get full use of Tesla’s Superchargers.

That means a surge in demand is coming for these devices.

And only a small handful of advanced chipmakers is capable of making them.

Tesla’s Secret Ingredient to Success …

You see, Musk and Tesla have a secret behind their success.

A technological wonder they developed before anyone else.

It’s this secret ingredient that allows every vehicle Tesla produces to have more power and range than most of its competitors.

And it’s what allows Tesla’s Superchargers to refuel the battery so quickly.

In fact, Kung-Yen Lee, a PhD at Purdue University, said this device, “is what propelled Tesla to fame.”

This device can withstand higher temperatures and operate at much higher voltages than anything else invented.

It’s incorporated into the inverters, or power source, inside every Tesla vehicle.

And it’s the key piece that allows Tesla’s Superchargers to connect directly to the battery.

That’s why Teslas can charge up to 200 miles of range in just 15 minutes.

And it’s what gives Tesla’s Model S Plaid the power to accelerate from 0 to 60 m.p.h. in 2.1 seconds.

No other charging station or vehicle can come close to matching the power of Tesla.

It’s why it is at the top of both electric vehicle sales AND charging capabilities.

And it’s largely due to this mysterious device.

It’s already inside almost every Tesla.

But now that nearly every EV built worldwide will have access to Tesla’s Superchargers …

They will all need this device to properly harness the power of Tesla’s charging network.

Otherwise, the Superchargers won’t work to their maximum capacity.

And fill-ups will still take an hour or more …

The MASS adoption of this device in EVERY electric vehicle and EVERY EV charging station is the key to the future of the industry.

Now that GM and Ford, as well as BMW, Mercedes, Nissan and many others, realize the power of this device … they are scrambling to get their vehicles equipped with it.

You can imagine the surge in demand.

Especially since only a small handful of chipmakers has the capability of making these unique, advanced semiconductors.

Investor Business Daily said the demand for this device is, “the Next Gold Rush.”

Rajvindra Gill, a leading analyst who’s appeared on CNBC, Fox Business and in the Wall Street Journal, said:

“The market for [these devices] is accelerating at breakneck speed … regardless of a pending economic downturn.”

In fact, this market is expected to grow by 40% annually over the next four years.

Gill believes revenue for these devices could grow by 1,200%.

The reason is simple:

Every electric vehicle will need this technology in order to access Tesla’s Superchargers.

I expect Musk to announce this publicly very soon.

When he does, he may even point to the specific chipmakers behind this breakthrough device.

And that will likely get investors talking.

It could arrive via tweet tomorrow at 6:25 a.m. … like when Musk tweeted that he loved Etsy … and the stock hit an all-time high in the next week.

Or anytime in the coming days or weeks … no one truly knows for sure.

He has over 158 million followers, and his tweets are often fodder for major media outlets.

So, when Musk starts moving his mouth, people hear it.

That means if he starts talking about chipmakers fueling the shift to EVs, there’s bound to be chatter among investors and industry experts.

But what we do know is whether Musk sends out this tweet or not, demand for this device is projected to rise rapidly.

Chips are at the heart of every great technology, and electric vehicles are no different.

When demand spikes for a specialized type of chip, the stock market gains can be astronomical.

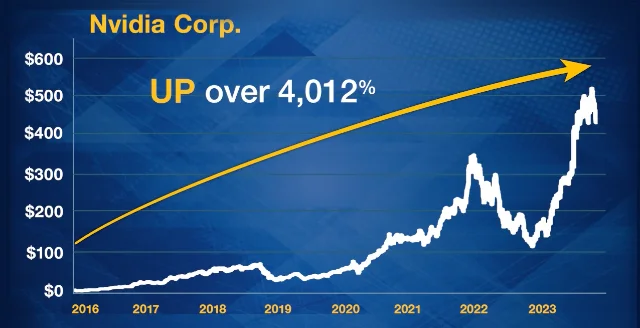

Take a look at some of the most exceptional examples over the past few years. Most chipmakers don’t see gains like this, and plenty go belly up, but things can go very well when a company is able to meet a critical market demand.

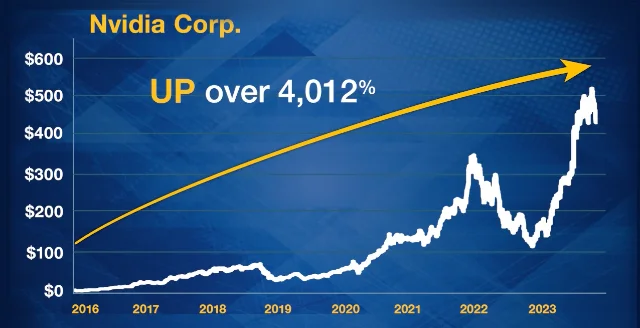

Chipmaker Nvidia is up over 4,000% since May 2016 … and became just the seventh company to join the $1 trillion club.

All thanks to a special gaming chip it made — which is now in high demand for AI.

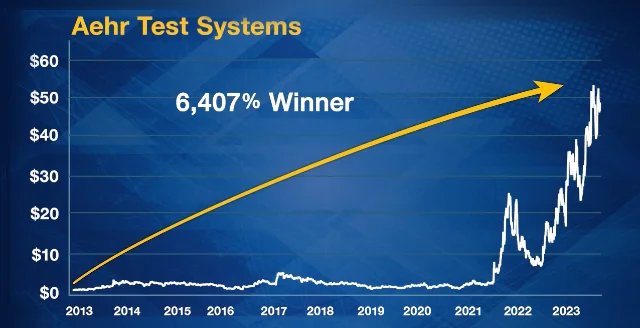

And it’s not just the biggest in the business that see their profits skyrocket.

Aehr Test Systems, a small company that tests the capabilities of specially designed chips, has seen its stock rise 6,407% since going public in November 2012.

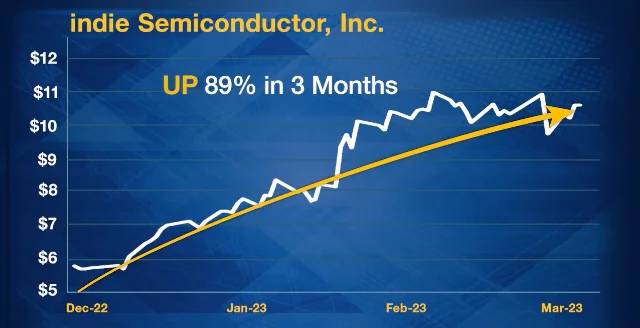

And indie Semiconductor makes specialized chips for sensors, in-cabin display chips as well as charging hardware inside of the car.

Its stock nearly doubled in the first three months of this year.

ASML is one of the world’s leading manufacturers of precision chip-making equipment.

Its stock has nearly doubled in the past nine months.

You see, the device I’ve been telling you about … the one inside every Tesla.

The one that carmakers will need to add to their new models in order to get the full power of Tesla’s Superchargers … is a very special type of microchip.

Made with a material few people have ever dared to use.

But it’s the key to high-powered fast charging – and the end of range anxiety.

10x Better Than Silicon …

What I’m talking about is a special kind of microchip made out of a much stronger material than silicon.

It’s called silicon carbide. And it’s the third-hardest substance on Earth.

These silicon carbide chips are 10 times more efficient than the current silicon chips used in most other EVs.

They’re smaller, lighter weight and conduct far higher rates of electricity.

All while losing far less energy …

That’s what allows the EVs to charge so fast when using the higher voltage of Tesla’s Superchargers.

First used in Tesla’s Model 3’s back in 2017, these silicon carbide chips were the beginning of the electric revolution.

Edoardo Merli, the executive of STMicroelectronics, who was Tesla’s chip supplier at the time, said:

“We wouldn’t have had such a boom in electric vehicles without silicon carbide.”

Silicon carbide is essential to every EV built worldwide going forward.

Without silicon carbide, fast charging wouldn’t be possible.

And without fast charging, mainstream adoption for EVs is unlikely to happen.

That’s why governments and automakers around the world are scrambling to get their hands on it.

China has specifically mentioned it in its five-year strategic plan.

The United States has called for more investment in its creation … calling itself “a global leader in the deployment of silicon carbide.”

It’s even being used in national security applications.

That’s the power of this tiny chip.

This is the critical missing piece to EV charging. There truly is nothing else like it right now.

And it’s the key to the future of electric vehicles worldwide.

Currently, this device is the ONLY one capable of providing the power to charge electric vehicles at faster speeds …

Now here's the problem …

Silicon carbide chips are extremely difficult to make. They require a very specific skill set.

For instance, these chips must be baked at a temperature equal to the outer layer of the sun.

And they have to be handled like delicate glass.

There’s only a small handful of companies in the world with the skill to make silicon carbide chips, en masse.

And the demand is projected to rise 10x over the next few years.

If you’re properly positioned in these chipmakers at the forefront of the silicon carbide boom – you could reap the benefits.

As EV sales increase, so should these companies.

But you don’t want to wait too long.

Silicon carbide is a bit of an industry insider’s secret right now.

If Musk were to tweet about these chips, or any of the major auto companies like Ford, GM or Toyota announced a large order of chips …

The small handful of silicon carbide companies in existence could gain a lot of attention from the market.

So if you’re interested in finding the best way to get in on the ground level of the EV boom – this could be it.

That’s why I put together a full report on silicon carbide, chipmakers and EV charging.

It’s called “The Silicon Carbide Boom: Two Chipmakers Leading the Charge.”

Inside, I share details on two silicon carbide chipmakers that I think will be critical to fulfilling a surge in demand for these chips.

Like I mentioned, I’ve been ahead of the curve in the EV market since I recommended Tesla over five years ago.

And I believe that silicon carbide is the next step in the advancement of electric vehicles.

Without it, EVs could become a big flop.

Over the next two years, almost every EV built worldwide will need silicon carbide chips in order to increase the speed and range of charging.

In my special report, I’ll give you the name and ticker symbol of two stocks that I believe are going to play a lead role in this surge in silicon carbide demand.

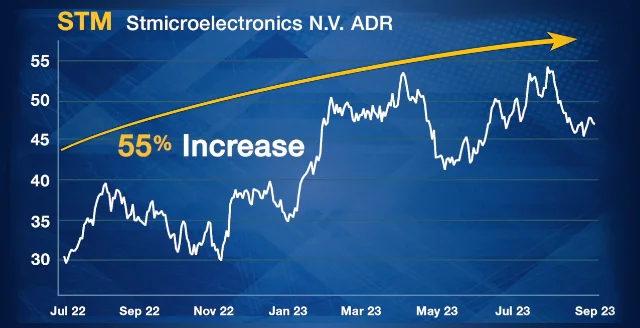

Already this year, our research shows a few select silicon carbide-related stocks have surged …

Like On Semiconductor, whose shares have rallied nearly 112% between July 2022 and September 2023.

Or STMicro, which has seen a 55% jump in its value in the same time frame.

Not every silicon carbide stock has, or will, achieve these gains. But after carefully researching the industry, I believe the two companies in my special report have a chance to benefit from a surge in silicon carbide demand.

Once auto manufacturers adopt Tesla Superchargers for their EV business, they will need these chips to optimize their technology and ensure consumers get the fast-charging vehicle they desire.

And one of these companies I’m talking to you about today recently put the finishing touches on a brand-new, cutting-edge process.

This new manufacturing method will allow it to drastically increase production of chips.

The ability to get the job done and produce more chips is a reason why its client list includes some big-time names like Apple, Google, Amazon, Nvidia, AMD … and Musk’s own company, Tesla.

Even Intel, the third-largest chip manufacturer in the world, outsources a good chunk of its production to this lesser-known chipmaker.

Another one of these silicon carbide giants just invested over $880 million to expand its silicon carbide production capacity.

One of the titans in the SiC industry, it is responsible for making nearly everything involved in the electric vehicle process.

From the chips that manage the powertrain and the advanced driver assistance systems like lane change warnings and parallel parking assist …

To the display screens that provide navigation and entertainment … all the way to the charging stations that power it all up again.

This leader in the industry has reported far higher revenues this year than last … smashing market expectations thanks to the rapidly increasing demand.

That’s because its chips are used in far more industries than just electric vehicles.

That includes aerospace and defense, data centers and computing, the Internet of Things … the list goes on.

No wonder it counts over 140 companies as partners … including Amazon and Intel.

With demand for silicon carbide chips only beginning, the way I see it, these two companies are on the verge of explosive growth.

Don’t forget … the silicon carbide industry is expected to quadruple in the next few years.

The two companies in my special report, “The Silicon Carbide Boom,” are well positioned to handle the increased demand compared to all the other chipmakers.

Investors who have the moxie to get on board now could see their profits rise as they ride the crest of this wave.

Time magazine called one of these stars, "The world’s most important company that you've probably never heard of."

But not because of its involvement with silicon carbide chips or electric vehicles …

It's because it's at the forefront of another massive tech trend:

Artificial intelligence.

The Most Complex Piece of Technology

Ever Created …

You’ve surely heard of artificial intelligence by now.

Just last year, companies invested roughly $92 billion in AI.

This windfall has created serious opportunities for investors in the know.

Perhaps none better than chip-maker Nvidia.

It is a company I’ve been gushing about through most of this presentation … and it is the leader in AI chip development.

The chipmaker’s association with artificial intelligence has driven its stock up over 4,000% from May 2016 through September 2023.

It recently became just the seventh trillion-dollar company in history.

And yet, despite this huge rise, it continues to crush expectations.

Just weeks ago, it rose to record highs when it reported quarterly earnings of almost $14 billion … a 101% increase from the previous year.

That’s because AI would not exist without the advanced chips made by companies like Nvidia, and the two I’ll highlight in my special report.

Artificial intelligence is exploding at breakneck speed.

It’s projected to add up to $15.7 trillion to the global economy — that’s as much as Japan, Germany, the United Kingdom and France’s GDP combined.

The technology powering artificial intelligence is growing rapidly …

And behind the whole push are these chipmaking companies …

Forbes says, “Modern artificial intelligence would simply not be possible without these highly specialized chips.”

Perhaps you’ve heard of ChatGPT.

It was the fastest app to reach 100 million users - which it did in five days.

That’s 6,000 times faster than Facebook …

And 1,500 times faster than Instagram …

Netflix took more than three years to reach 100 million users.

ChatGPT exploded onto the scene because of its amazing capabilities.

It can help you craft a customized resume … or explain a complex topic … even solve complicated math problems.

And that is because ChatGPT uses the most advanced form of artificial intelligence … generative AI.

Generative AI has been around for a long time … but recently it’s taken off in its abilities.

Recent advancements in generative AI are because it uses something called machine learning.

Simply put, machine learning is when computer systems can learn and adapt on their own.

Rather than relying on human interaction to continue to upgrade its programs, it can take huge spools of data and use them to create the foundation models like ChatGPT, Dall-E … even Google’s newest AI tool, Bard.

While these capabilities are a phenomenal advancement, they require the most powerful and complex chips ever made to complete these tasks.

It’s no surprise then that the shares of companies that make AI chips have been off the charts this year.

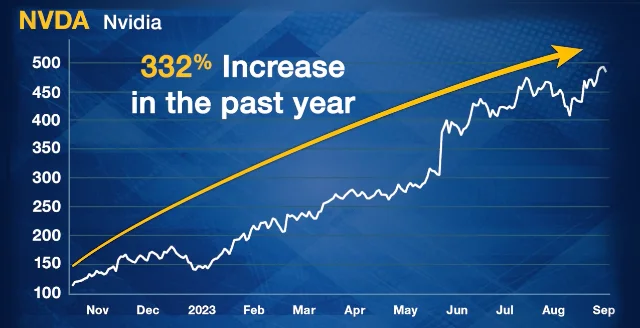

I’ve already told you about Nvidia’s growth since it got into the AI chip-making business.

Its stock is up 332% in the past year.

But Nvidia isn’t the only AI stock to pop in 2023.

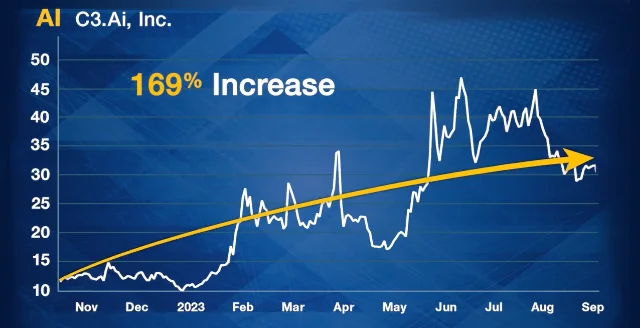

C3.ai is up 169% …

Opera … 271%

Duos Technology Group … 206%

BigBear.ai’s stock is up 175%.

Has every AI stock seen these gains? Of course not.

Some of them have experienced losses.

Remember, these stocks can be volatile, so it’s important to stay on top of any investment decisions.

That being said, five tech stocks with connections to AI have singlehandedly kept the S&P 500 in bull market territory: Alphabet (Google), Microsoft, Nvidia, Apple and Meta.

Those same five stocks propelled the Nasdaq to the best first half in its 52-year history.

With eyepopping gains like that, you might think the AI stock boom is behind us.

But I think we are just getting started.

AI is expected to be one-fifth of the United States’ GDP by 2030.

And it’s all due to the companies behind these chips.

You see, even though these chips are powering the growth in artificial intelligence and electric vehicles … they are not easy to produce.

Creating these chips for generative AI takes a combination of extremely difficult factors.

Forbes said, “They are the most complex object that humanity knows how to mass produce.”

To create them requires the world’s purest metals … the world’s most expensive machinery … legions of highly specialized engineers and extreme precision.

There are very few companies in the world that can put all these processes together.

No other facet of the economy is so dependent on so few firms.

That’s why I’m so excited about the two chip makers in my report, “The Silicon Carbide Boom.”

These two companies could be at the forefront of two enormous megatrends …

Electric vehicles and artificial intelligence.

But it’s not just these chip makers that I think could benefit in the AI Boom.

There are several other AI companies I think are worth investigating as we move toward the next wave of AI.

That’s why I’ve created another report that I want to share with you called “My Top 5 AI Stocks.”

In this report, I’ll reveal the name and ticker symbol of a handful of companies that could be poised to take advantage of the demand for artificial intelligence-related technology.

I mentioned Nvidia earlier.

I believe it is a stock that any investor should have in their portfolio for the foreseeable future.

Despite their meteoric rise this year, it is showing no signs of slowing down.

In my special report, “My Top 5 AI Stocks,” I’ll explain in further detail how Nvidia is working to maintain its position at the forefront of the AI megatrend.

However, I do think the stock price has gone a little too high too quick.

In this report, I’ll explain why I think a slight dip is coming for Nvidia and why that may give investors a chance to buy in a bit lower.

The other four stocks I’m excited about may not be as well known … but they are just as important to artificial intelligence.

One of them is partnering with Nvidia to develop the first hyperscale cloud system for AI.

It’s a huge boost for both the company and the world of artificial intelligence … which desperately needs a serious uplift in its cloud services.

Most companies say that cloud computing is the way to go when it comes to large language AI models … but the infrastructure is just not ready.

Dell’s Global Chief Technology Officer John Roese said the current cloud infrastructure “wasn’t really optimized for the kind of demand and activity level that we’re going to see as people move into these AI systems.”

The Wall Street Journal recently reported that, “The AI boom is here. The cloud may not be ready.”

Meanwhile, a Deloitte study revealed nearly three out of four companies get their AI from the cloud.

The need for a jolt in cloud computing for AI is why I’m so excited about one of the companies in my report, “My Top 5 AI Stocks.”

They are the kingpin of the cloud software market.

But its their newest technologies centered around machine learning that has me the most excited.

It just released a new product with groundbreaking Generative AI technology.

It is going to radically disrupt the world of online content, as well as advertising and marketing.

These new technologies have already driven its sales up to more than 30 million paid subscribers … double where it was five years ago.

One of the other AI companies I’ll tell you about is using AI to radically alter the world of computer automated design.

Computer automated design, or CAD for short, is used in nearly every industry from bridge construction and movie automation to office building design … you name it.

The company I’m excited about today is integrating both CAD and AI to create something called generative design.

Generative design is helping improve efficiency, enhance performance and reduce the overall time it takes to create a design.

This breakthrough has led this company to partner with some big-time names … including Microsoft, Dell and Hewlett Packard, among others.

And the final company I’ll reveal to you in this report has been involved in artificial intelligence since way back in 2015.

But as the AI revolution has sped up … this tech wizard has poured its resources into AI … investing upwards of $200 billion.

Already a tech darling, this powerhouse has embedded AI into 25 of its products … with that list only set to grow in the near future.

All these companies are playing a HUGE role in the rapid growth of artificial intelligence.

And you can learn all about them in my special report, “My Top 5 AI Stocks.”

I’m ready to rush you a copy of both “The Silicon Carbide Boom” and and “My Top 5 AI Stocks” at no additional charge.

All I ask is that you try a subscription to my newsletter, Wealth Megatrends.

The BEST Way to Find the Market’s Biggest Trends

Now before I get into how you can access both of these reports, as well as my cutting-edge financial newsletter, I’d like to tell you a little more about myself.

I’ve spent the last 25 years traveling around the globe …

To unearth the next great megatrends.

I’ve found over the course of my three decades-plus as an investment analyst that the best way to find the next big plays is by getting your hands dirty.

You can’t discover the next Nvidia just by staring at charts from an office …

You can’t tell anything real about a company just by talking to its CEO over the phone …

You need to go out there and meet with them.

Get your boots on the ground and see these companies in person.

That’s what I’ve been doing for over 25 years …

Oftentimes at some of the world’s most remote locations.

I’ve been to the largest undeveloped gold mine in the mountains of Chile … and panned for gold while avoiding bears in the Revelation Mountains in Alaska …

I’ve searched for big gains as far north as Nunavut, Canada … and traveled so far south identifying new growth opportunities that I had penguins running around me …

I’ve inspected uranium projects in Newfoundland …

Climbed on oil rigs in the Gulf of Mexico …

And visited the mummies of Guanajuato, a UNESCO World Heritage Site.

I’ve even sat in an Aztec bowl used for sacrifices during the conquistador days …

I did all this because I’m not looking to uncover the same old dry investments everyone else recommends.

The safe boardroom kinds of stocks …

If you want to find the world’s next big megatrends …

You don’t do it just by crunching numbers and having flashy lunch meetings in the city.

You need to get your hands dirty … get your passport stamped a lot … and get out in the field.

There are companies out there literally inventing the tech needed to make them billions …

These guys are cutting edge … and you don’t truly find out what they are creating until you go out and see for yourself.

It’s been a huge commitment to stay ahead of these trends for sure.

But it’s paid off countless times …

I have a long track record of spotting megatrends that other “experts” failed to see.

Like 5G … many news outlets were becoming skeptical of 5G …

But I knew this new tech disruption could benefit investors, and I told a group of my readers that 5G “will become the new global standard.”

Now, the global 5G market is already worth $2 trillion.

Or electric vehicles …

I predicted we’d see a “massive shift to EVs,” and that NOW was the time to bet on this emerging megatrend.

Since then, Tesla has become one of the most valuable companies in the world.

My team and I were ahead of the solar energy megatrend, too.

As recently as two years ago, critics were still dismissing the new energy source.

And today?

Solar power spending will surpass $1 billion a day this year.

Now, I believe we are at the start of a brand-new tech boom …

In Wealth Megatrends, I’ll track this boom every step of the way.

And every month, I’ll bring you a fresh recommendation … the stocks that I think are the best way to play this tech boom.

Not only that, but I’ll alert you any time something changes with our recommendations, day or night.

I won’t just give you a ticker symbol and leave you hanging.

We’ll monitor these stocks closely and let you know when we think it’s a good time for investors to make a move.

You’ll also have access to our full archive of stock analysis, special reports and video updates from me.

Even better, all my picks are backed up by a unique ratings system with a history of spotting winners – and danger – before the crowd.

The Average Gain Is 220% — Including the Losers

It’s not just my research in the field that’s telling me we are at the forefront of a new megatrend.

You see, I’m proud to use a tried-and-true stock rating system called Weiss ratings.

Each stock pick I send out is backed by thousands of data points and professional analysis …

Thanks to our proprietary Weiss stock ratings.

We incorporate the Weiss ratings system into our research.

It’s the only completely unbiased, independent ratings system …

For over 50,000 stocks, ETFs, mutual funds, bonds and banks.

For more than 50 years, Dr. Martin Weiss and his team have used their proprietary Weiss ratings system to help investors navigate any crisis and position themselves appropriately.

With this system, the Weiss team can scientifically evaluate risk against reward and assign a clear “Buy,” “Hold” or “Sell” rating for any stock.

For decades, this is what allowed us to spot amazing stocks at the very best prices … and avoid pitfalls that trapped many other investors.

In 2000, at the height of the Dot Com Mania, 98% of ratings issued by Wall Street firms were “Buys.”

But our ratings model said just the opposite. We declared nearly every Nasdaq stock a “Sell.”

Sure enough, three years later, the Nasdaq was down 75% and dozens of Wall Street’s former favorites had collapsed in price or even filed for bankruptcy.

By this point, many of those same firms had downgraded nearly every stock to a “Sell.”

Once again, our ratings model said the opposite.

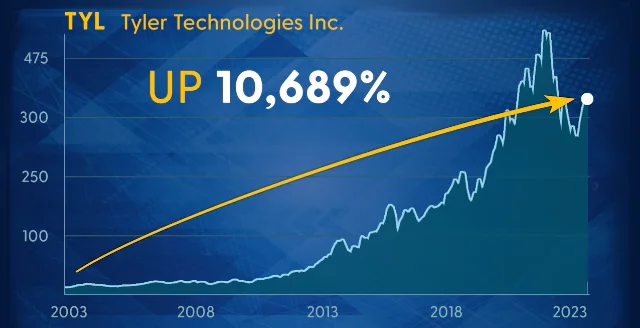

We upgraded Tyler Technologies to a “Buy.” Since then, it has soared 10,689%.

We said Ansys was a “Buy” before it exploded 5,466%.

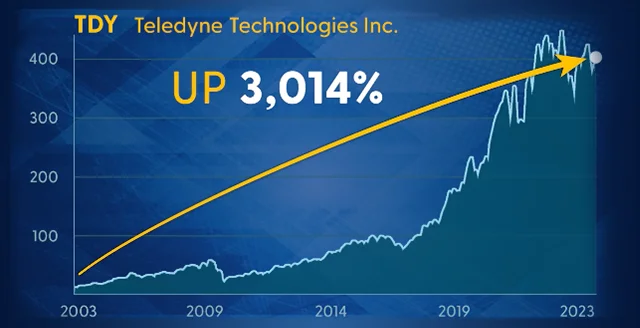

We upgraded Teledyne Technologies to a “Buy” before it climbed 3,014%...

We even declared a little company called Apple a “Buy” back in 2004, when most “experts” had written the company off.

Since then, Apple has gone up 32,571%.

Nvidia has had a tremendous run, with gains of more than 323% this year.

But it’s done even better with our proprietary system.

Ever since we issued a “Buy” back in 2011, the stock has gone up 9,624%.

And yes, these were some of the biggest and most exceptional picks we’ve ever made in our history.

And we can’t control when investors choose to invest their money or when to exit.

That’s a decision left to their discretion.

It’s not realistic to expect those kinds of results from every investment.

But look at this …

On 1,306 possible trades based on the Weiss tech stock ratings since inception, the average gain is a whopping 220% — and that includes the losers.

That could have tripled an investor's money … per trade.

I think most investors would agree these ratings are a powerful tool.

It’s why I trust the Weiss Ratings Model to back every Wealth Megatrends pick I send out, including these five AI stocks … as well as the two chip makers powering the EV’s industry shift to silicon carbide.

On the fourth Friday of every month, you will receive your latest issue with a new recommendation on the latest stock market megatrends.

But you get so much more than stock picks …

The markets move fast, so investors need to be prepared for quick changes.

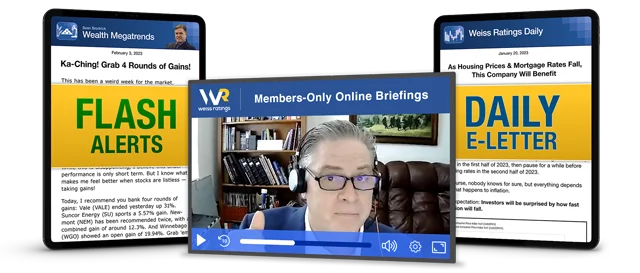

That’s why every Wealth Megatrends Member also receives my “Flash Alert” emails covering the latest risks and opportunities.

For really important events, members will also receive an invitation to my confidential online briefings where I’ll answer general questions live on the air and share my predictions for what the next quarter holds for investors.

You’ll also receive my free Weiss Ratings Daily e-letter.

It’s the most detailed and timely way to stay on top of new developments in the market, and it’s included at no additional cost.

But that’s scratching the surface of the value you’ll receive as a Wealth Megatrends Member.

When you sign up today, you’ll receive the following.

- Report #1: “The Silicon Carbide Boom: Two Chipmakers Leading the Charge.” By 2025, nearly every EV made in America, China and Europe will need silicon carbide chips – or else they will not be able to get the full power of Tesla’s Supercharger network. I expect Elon Musk to tweet about this any day. He may even name these two companies. Either way, my research shows that demand for silicon carbide is expected to jump 10x in the next few years. And these two companies will be critical to meeting that demand. Not only that, but these chipmakers are vital to the AI boom.

- Report #2: “My Top 5 AI Stocks”. Artificial intelligence is impacting almost everything we do … and growing at lightning speed. It’s all hands on deck to keep pace … and my research tells me it’s an amazing opportunity for five specific stocks. I believe each of these companies will play a major role in the ongoing shift toward AI. Get in now if you’re interested, before AI takes off even more.

- My Weiss Ratings Daily e-letter, sent to your inbox five times weekly. My daily e-letter covers all the day’s headlines from an alternative investing perspective, not just regurgitating the mainstream media’s hot takes. We’ll also host special guest analysts who will tell us about everything from AI to crypto to the best ways to buy gold.

- My “Flash Alerts” for critical, time-sensitive opportunities and warnings. My analysts and I will keep you in the loop on all the market news, including critically time-sensitive opportunities or dangers in the market. When something happens with one of our picks, we’ll alert our members as soon as possible so they can stay ahead of the market.

- An exclusive invitation to my confidential online briefings. Occasionally, a story will be too big for just an email or monthly issue. Instead, you’ll get an urgent video alert where I outline all the details of what you need to do to be prepared.

- And a full 12 months of access to Wealth Megatrends

On the fourth Friday of every month, you’ll get a new issue of Wealth Megatrends with a brand-new recommendation.

I’ll show investors how to get in on the biggest trends hitting the market, like 5G, EVs, artificial intelligence and the downfall of China. And we only select blue-chip, dividend-paying stocks.

If, at any point during the next year, you find yourself unsatisfied with your subscription, simply call our American-based customer service team for a full refund.

So how much does all this cost?

Less than you’d imagine given the incredible information I’m going to share with you inside.

And that’s not all, either.

There’s one more set of AI stocks I’m very excited about.

Because I believe AI’s biggest impact hasn’t been felt yet.

The next industry I see it disrupting is perhaps the largest and most important business in the world.

Without it, our daily lives would shut down.

Most businesses would be rendered useless. We’d be marooned in our homes, unable to go anywhere.

And those homes would be a heck of a lot less comfortable, as air conditioning, heat and even electricity would not be available without this industry.

Our food supplies would quickly run out. Amazon shipments would screech to a halt.

Basically, the world as we know it would cease to exist without this critical industry.

If you didn’t guess already, I’m talking about the oil and gas industry …

Three of the world’s six largest companies are oil companies.

The oil and gas sector alone accounts for roughly 10% of the world’s GDP.

And the International Energy Agency says AI could help oil companies add $1 trillion to its bottom line by 2025 when it comes to discovery and production.

You see, finding new sources of oil has become expensive – and frustrating – for most oil companies.

The oil and gas sector has been notoriously slow to adopt innovative technologies … and that includes AI.

Especially once these companies see how AI could make it much easier to find new sources of oil.

Already AI’s ability to mine reams of data in a short period of time is making a major impact on oil discovery.

It’s helping offshore rigs drill with far more efficiency.

One company has added $200 million in extra revenue – per year.

And that’s just on one of its two rigs.

AI is boosting the efficiency of refineries, which will eventually mean oil is converted to gas much quicker. Ideally, that means lower prices at the pump for you and me.

Like I mentioned, AI could add another $1 trillion to the bottom lines of oil and gas companies.

And I’ve identified four specific companies that are at the forefront of this integration.

I’ve put them all together in a special bonus report called “How AI Will Transform the $7 Trillion Oil Industry.”

In this report, I’ll share the names, ticker symbols and all the crucial information investors need to know.

All as a courtesy and a special thanks to you for taking a chance on my cutting-edge newsletter, Wealth Megatrends.

Just to recap … when you sign up today, here’s what you’ll receive.

- Report #1: The Silicon Carbide Boom: Two Chipmakers Leading the Charge

- Report #2: My Top 5 AI Stocks

- Report #3: How AI Will Transform the $7 Trillion Oil Industry

- My Weiss Ratings Daily e-letter, sent to your inbox 5 times weekly

- My “Flash Alerts” for critical, time-sensitive opportunities and warnings

- Exclusive invitations to my confidential online briefings

- And a full 12 months of access to Wealth Megatrends

Typically, Wealth Megatrends retails for $99.

And we think that’s still an amazing deal considering the wealth of information you’ll receive.

But that’s not anywhere near what you are going to pay today.

Not even close.

I'll give you access to everything I’ve covered today … for just $49 a year.

That’s HALF off the regular price.

And a mere 13 cents a day.

Even then, if you aren’t satisfied for any reason during your first 12 months …

Just call my team, and we'll provide a full refund with no hassles.

That means you get a full year to try out and enjoy my service – at no risk.

Right now, I believe we are 0n the front line of two explosive new megatrends:

Electric vehicles and AI.

Behind both of these trillion-dollar industries is a growing demand for the most advanced microchips available.

I've found two companies that I think will lead the charge of advanced chips for both AI and EVs.

In the past, when Elon Musk tweets, the market moves.

Just look at what he did to the price of Etsy … or GameStop … or Bitcoin.

His influence is second to none.

Soon Musk could deliver another bombshell.

And I believe it could be related to the two chip-making stocks I’ve talked about today.

We don’t know when … or how … but when he does a scramble is likely to ensue.

Two key chip makers could see interest in their stock increase drastically.

But you don’t need to wait for Musk to send a random tweet in the middle of the night.

I’m prepared to share the best way to play this emerging megatrend with you.

Before Musk pushes send … and the mainstream media latches onto these companies.

Click the link below to review my offer. Then fill out our simple order form to subscribe to Wealth Megatrends.

We’ll immediately rush these three valuable special reports to your inbox in minutes.

Sincerely,

Sean Brodrick