How to Preserve Wealth and Go for Windfall Profits as Major Economic Cycles Converge to Form One of the Greatest Supercycles of All Time

by Martin D. Weiss with Sean Brodrick

In this ebook:

- Stunning predictions for 2023-2024 and beyond from Martin Weiss and Sean Brodrick — “The nightmare that keeps us up nights.”

- The great convergence of major economic cycles AND the war cycle, coming together within weeks: Why everything in your life is about to change.

- The four phases of this crisis and the opportunity to build four new fortunes.

- 14 Supercycle investments that could multiply investor funds; 969% total returns possible so far.

- Leveraged investments that have paid 50 times more than other investors make.

- Plus, much more.

Dear Fellow Investor,

Dr. Martin D. Weiss, founder of

Weiss Ratings

The future is not written in stone. People do have the power to alter their destiny, at least to some degree.

But this ebook lays what we believe to be THE MOST PROBABLE of future scenarios, based on our research …

Just weeks from today, the strongest historic cycles known to science will converge, forming a giant 5-year supercycle.

It will bring together four powerful financial cycles with the rising cycle of war. And we predict it will have enormous impact.

When cycles like these came together in the early 1930s, the world was plunged into a Great Depression that lasted more than a decade.

This time around, the cycles will trigger the end of one major epoch in human history … and the beginning of a terrifying (but enormously profitable) new one.

The age we have all known all our lives — an era in which governments and others amassed $226 trillion in debts — is about to end.

And a new era — the age in which all of us pay the price for our leaders’ reckless spending schemes, obscene debts and money printing — is about to begin.

We will witness the collapse of the societies, currencies and investment markets that have been built on those follies, and …

Everything about how we earn, spend, save, or invest our money — and live our life — will be altered forever.

Chapter 1

This Is The Moment of Truth

What investors do in the next few minutes, hours and days could determine their financial destiny for the rest of their life.

Our forecast is clear and unhedged: The Russian invasion and destruction of Ukraine is not a one-time event. Even if some semblance of peace is achieved in the near term, the war’s impact will continue to reverberate for years to come.

We will see a New Cold War pitting East versus West. New trade wars, currency wars, and cyberwars will erupt with staggering economic impacts. New regional wars, whether expected or unexpected, could be devastating to the global economy.

Inflation — already the inevitable outcome after a decade of fiscal and monetary abuse — will explode globally.

We are in for five years of chaos in the global economy, turmoil in world markets, and spreading global conflicts — all of which will impact our investments and personal lives.

As this supercycle courses through the world in the months ahead, the lenders and investors that governments count on for loans will snap their wallets shut.

Smart observers are already reading the handwriting on the wall: The clouds of war are turning darker. And governments are getting set to ramp up their defense spending like never before.

Bloated budget deficits will be bloated even more. Attempts to fight inflation will fall flat. The money printing presses will be run even faster.

But government debt is already simply too overwhelming. It can never be repaid.

Investors will recognize that it would be financial suicide to continue loaning their money to the European Union, Japan or to Washington; insane to throw good money after bad.

And so, major governments — including our own — will simply run out of lenders, and then … run out o money.

Among more than 39 million government employees and contractors of the most indebted governments of the world, many will find that their paychecks have been postponed or cancelled altogether.

Among the over 300 million more worldwide who depend on government retirement plans like Social Security and health programs like Obamacare, many will awaken to the same disturbing reality.

And tens of millions across the globe who count on welfare, food assistance and other government-sponsored assistance programs will find themselves unable to feed themselves or their families.

As the news reverberates, currencies, bonds and other investments will simply collapse. The wealth and retirement savings of generations will be vaporized in the twinkling of an eye.

Angry citizens will take to the streets. Local, state and even national law enforcement will be overwhelmed. In several countries, law and order will break down as riots erupt. No man’s life or property will be safe.

Before it’s all over, some governments, equally desperate to survive, will have no choice but to confiscate wealth from their own citizens, either directly or indirectly. Our world, and ultimately, our own nation will be changed forever.

Admittedly, This Is the Most Severe

Warning We Have Ever Issued

Make no mistake: I fully understand just how shocking this forecast is.

I realize that many people who read this ebook, especially those oblivious to the news now bursting onto the scene, will dismiss it as “too extreme.”

It’s what happened when we denounced Nixon’s devaluation of the dollar in 1971, and warned about its dangerous inflationary consequences.

It happened again when we warned that tech stocks were due to crash in 2000 …

It happened in 2007 when we told anyone who would listen that the U.S. real estate market was about to plummet, plunging the economy into one of the most severe recessions ever.

And it happened again, when we warned about a new explosion of inflation one year ago.

But please understand; this is no idle prediction. We have no interest in frightening anyone. We are simply following our research where it takes us.

And it is taking us to a terrifying place. Those who are unprepared for this great crisis risk losing everything: Their income, savings, investments, properties — plus personal and financial security — are all at risk.

We do not want that for anyone.

To warn investors of crises like these is the main reason I founded my research and ratings company in 1971, more than 50 years ago.

It’s why I hired renowned cycles experts Sean Brodrick, and his predecessor, Larry Edelson, more than two decades ago. It’s why Juan Villaverde, also an ardent student of cycles, joined us years ago.

And it’s why we’ve written this urgent report right now.

The plain truth is, the most powerful cycles forecasting tools we have ever used are virtually screaming that all hell is about to break loose in Europe, Japan and ultimately right here in the United States.

So, if you’re among those who disbelieve these forecasts, review the history. Then, just look at what’s happening in Washington, Brussels, Kiev, Moscow and any of the major seats of power in the world today.

Right now as we speak.

On the flip side, I also realize that many people reading this ebook may over-react and panic … or be paralyzed into inaction.

So, if you’re among them, let me reassure you in two ways:

First, all our research tell us that, in this 5-year supercycle, the chances of America jumping into a new shooting war are very small, and the chances of a nuclear war are practically zero.

Second, the great economic supercycle that’s driving these global events is also creating great opportunities to create generational wealth.

But before I give you the details, let me tell you more about our most powerful and accurate forecasting tool.

Chapter 2

The Proven Power of Cycles

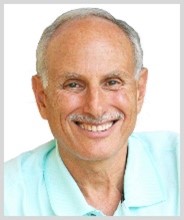

The same forecasting tools that accurately predicted the Great Depression — and every major economic event since — are now warning that the most severe financial crisis any of us has ever seen is about to begin.

It may help you to understand why I trust this research so completely. Or why I am changing everything in my own financial life to prepare for the events it predicts.

The forecasting tools we use … that have enabled us to accurately predict all the major events we just mentioned … and that are now warning of the most severe financial crisis any of us has ever seen … are not new.

Most were actually discovered by an American economist 90 years ago.

The year was 1932. That’s when U.S. President Herbert Hoover ordered one of his economists, Edward R. Dewey, to determine what caused the Great Depression.

What Dewey found was shocking: Very powerful economic cycles that govern the rise and fall of economies, currencies and investment markets.

It made perfect sense: All of creation moves in cycles — from the lifecycle of stars, the ebb and flow of the tides, changing of the seasons, human respiration and even to our beating hearts.

Just as cycles govern the physical universe and our physical bodies, they also govern the affairs of man. Such as the rise and fall of empires, nations, societies, economies, currencies and investment markets.

All of these things and many more are ruled by regular, PREDICTABLE financial cycles.

Dewey’s ultimate conclusion was a shocker: Anyone who studied the charts depicting these cycles could have known about the approaching Great Depression well in advance.

The Depression happened because it was TIME for it to happen.

Cycles Research Has Accurately Predicted

Nearly Every Major Financial Event In Our Lives

As the founder of Weiss Ratings and the man who has worked so closely with Sean and Larry for so many years, I know: Their knowledge of cycles is what allowed us to accurately warn of the stock market crash well in advance and nearly every major move in U.S. stocks since then.

In fact, Sean is the first person at Weiss Ratings who introduced us to The Great Supercycle. He has followed and predicted cycles with amazing accuracy. Plus, he and I worked very closely together to write this ebook.

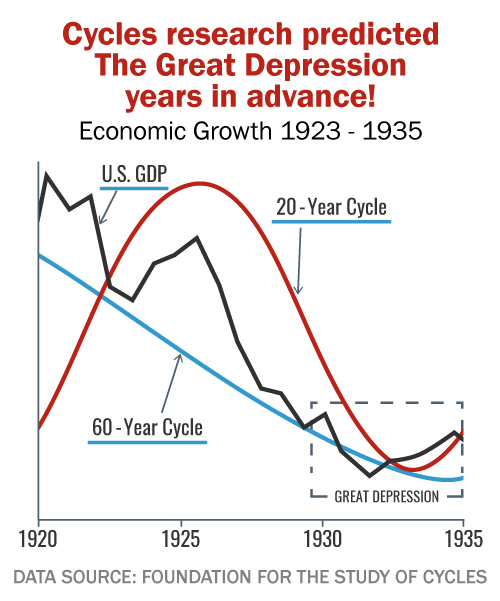

Take a look at the chart to the right, an example of our work. It is the product of our cycles research in 2006 and 2007 — work we did well before the U.S. real estate market cracked.

The red line is the cycle we were following — the cycle that helped us predict a major catastrophe ahead.

The black line is what actually happened.

As you can see, the cycle clearly predicted that the U.S. economy would peak in 2007, then suffer a deep crash.

RESULT: The Great Recession of 2008-2009 struck right on time, just as we predicted, and the S&P 500 crashed nearly 60%.

Anyone who bought the 3x inverse ETF of the S&P 500 on our forecast could have seen nearly a 180% gain.

And that’s only the beginning of the story. That same chart I just showed you also predicted that the bottom in the stock market would come in March of 2009. It forecast that, after that month, the economy and the stock market would begin a long-term recovery.

So, on March 16 of 2009 — while other analysts were still licking their wounds and terrified to even touch a stock — we announced that the worst was over; that stocks were about to catch fire again.

RESULT: Since that forecast, the S&P 500 is up a whopping 534%; enough to turn every $10,000 invested into $63,400.

And if investors had used our forecast to invest in the 3x S&P 500 ETF, they could be up as much as 1,602% — enough to turn every $10,000 invested into $190,163.

Plus, our cycles research has also helped us call nearly every major move in the gold market since 1999 …

Including the beginning of the bull market when gold was just $255 per ounce, giving investors the opportunity to turn $10,000 into $80,711 — not to mention the profit opportunities in other precious metals investments that were far greater.

Our study of these cycles also made it possible for us to accurately predict the collapse of the U.S. dollar that began in 2000 as well as the huge dollar rally we saw in 2014-2015.

Then, in 2015 we predicted the world would enter a new era of financial and political turmoil. It did.

That’s also when we first warned that the end of the European Union was in sight. Since then, the UK has abandoned Union … millions of migrants flowed into Europe, pushing social services to the breaking point … and now, the entire continent is under the dark cloud of Russia’s utter destruction of Ukraine.

All this is forcing governments to spend trillions of dollars that they don’t have, pushing them deeper and deeper into debt.

In 2015, we also warned about flight capital from Europe and Asia that would drive U.S. stocks to unimagined new levels.

As a result, we predicted that the Dow Jones Industrial Average would surge well past the 20,000 level and then the 30,000 mark. Since then, trillions of dollars have flowed into the United States, and the Dow has surged by more than 20,000 points, topping 36,000 in early 2022.

Chapter 3

Four Horsemen of the

Economic Apocalypse

Now, our cycles research is sending us a new message — a message that no wage-earner, retiree or investor can afford to ignore.

Four cyclical megatrends — Four Horsemen of the Economic Apocalypse — are converging in one place and time.

Each represents a powerful megatrend. Each has proven its disruptive capacity in supercycles of the past. And now, all four are coming together in the current, five-year time horizon.

The First Horseman

Biggest Debts Ever Known to Man

In all of history, no nation has ever prevailed by digging itself into a deep hole of debt.

And none has been able to dig itself out of the hole by piling on even more debt.

All have ultimately encountered their day of reckoning. All have faced Armageddon,

Members of the European Union thought they could trick history and fool Mother Nature. They could not. Each debt crisis is more severe than the previous.

Japan has tried to do the same. But instead of buying growth and prosperity, it has bought decades of stagnation, corroding all the strengths that once made it a stellar success.

Ultimately, the United States will suffer a similar fate.

The Second Horseman

Out-of-Control Inflation

Most Americans have never experienced anything like this in their lifetime.

They don’t remember the 1970s, when folks waited in their cars for hours in gas lines just to top off their tanks, or when millions had to pay 18% or more for a home mortgage.

They didn’t live through the inflation that gutted the economy of Argentina and Brazil in the 1980s, destroying the savings of millions of middle class citizens … bankrupting their governments … prompting their leaders to confiscate their bank accounts, and … tearing apart the fabric of their society.

Nor does anyone dare think about the hyperinflation that wrecked havoc on the entire world, starting in Germany after World War I … creating the greatest avalanche of worthless paper money ever seen … giving rise to the most murderous dictator in the history of Western Civilization … and plunging the entire planet into a great war that made all prior wars seem small by comparison.

Hundreds of millions of Americans going about their daily business in America today are oblivious to the torrid past of inflation. Fewer still believe anything vaguely similar might be possible today. They have not yet learned the lessons of history.

They’ve been told by Washington to look the other way, that it’s just “transitory” — merely a temporary blip.

They don’t read the handwriting on the wall: The consequence of complacency is catastrophe.

The Third Horseman

The Tsunami of Flight Capital

Throughout the history of mankind, human populations have been remarkably mobile.

When times are bad or violence erupts on to the scene, they move, they migrate in mass… and they shift their money to safer havens, better income, more profits.

That’s what happened in the wake of famines and pestilence in Europe, prompting wave after wave of immigration to America.

That’s what’s already happened twice in Europe just in the last decade — first from the Middle East, now from Ukraine.

And that’s what has driven a surging wave of flight capital to America’s shores. We call it “fear money.”

But our cycle research tells us that the waves you’ve seen so far pale in comparison to the tsunami of fear money that will come in the next phase of this 5-year supercycle.

The Fourth Horseman

The Rising Cycle of War

In the modern, era global war can take many forms:

Trade wars that multiply costs and disrupt supply chains.

Cyberwars that disrupt production and transportation on all levels.

Financial wars that cut off international transactions and capital flows.

And, sadly, regional wars that can cause even greater damage.

The Time of Maximum Risk and Opportunity:

When Multiple Cycles Converge

Even as you read these words, we are witnessing a major alignment of these cycles, including some of the most powerful known to man.

- The time-proven Kondratieff Wave, which is signaling an Armageddon for massively indebted economies …

- The rapidly rising cycle of debt …

- The unprecedented cycle of money printing by central banks …

- The cycle of raging inflation, and …

- The escalating cycle of war — the New Cold War, cyber wars, trade wars, currency wars, civil wars, regional wars and more. These conflicts turbocharge the inflation and debt cycles. And they drive an even greater flood of flight capital to safer havens.

Chapter 4

The Latest Events Are

Especially Disturbing

The facts coming to light right now are not only very disturbing, but they also confirm how each of these cycles is already having a major global impact on the daily lives of billions of people and millions of enterprises.

The Kondratieff Wave began to strike hard in 2008 when the global financial system came to the brink of a fatal meltdown.

The debt and money-printing craze began soon thereafter.

According to the Global Database of the International Monetary Fund, total debt is $226 trillion worldwide. That’s 256% of global GDP. And governments debts accounts for more than half, the largest share in more than 50 years.

The IMF reports that debts truly exploded in the wake of the Covid pandemic. And according to the Congressional Budget Office (CBO), it prompted the U.S. government to run up a budget deficit of $2.8 trillion in 2021.

As a result, the US National debt has eclipsed $30 trillion a full decade ahead of CBO projections.

And now, with defense spending ramping up, the deficits are expected to be even bigger.

Worse, in a desperate attempt to prevent those debts from driving interest rates skyward and cratering the world economy, central banks unleashed the greatest tsunami of money printing of all time.

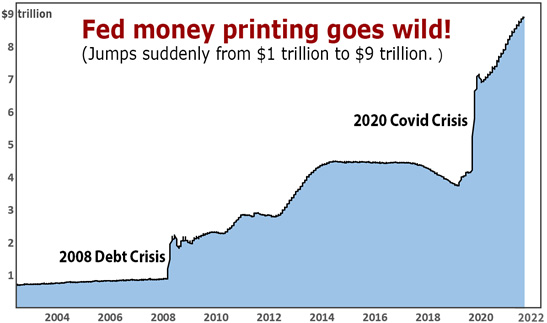

The U.S. Federal Reserve led the way: Between 2008 and 2022, the Fed alone printed $8 trillion in funny money.

That’s eight times more paper money than had been printed since the birth of the United States of America as a nation.

Anyone in Washington, London, Brussels or Tokyo who said that would not have explosive inflationary consequences was either dreaming or lying.

So, it should come as no surprise that the long-dormant inflation cycle is now again rearing its ugly head.

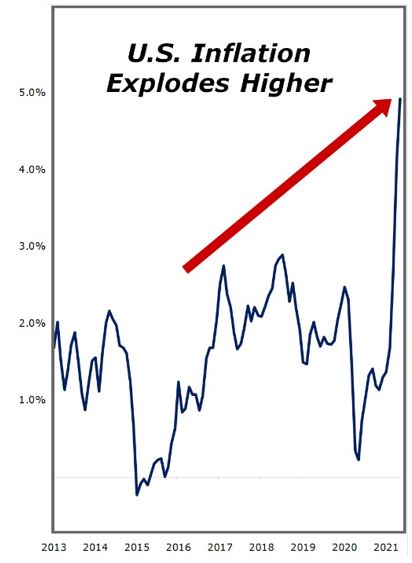

In February of 2021, the yearly inflation rate was 1.7%.

In February of 2022, it was 7.9%.

That’s four-fold surge in just 12 months, the fastest — and potentially most dangerous — inflationary explosion in U.S. history.

Moreover, it does not yet even include the far-reaching consequences of the war. That includes …

* The oil and energy embargo slapped on one of the world’s largest oil exporters (Russia), and …

* The disruption — and destruction — of one of the world’s largest grain producers (Ukraine).

* Plus, worse to come.

And STILL the Fed continues to pump money like crazy …

And STILL the government continues to run up the largest federal deficits of all time.

While Jerome Powell and the Federal Reserve have frequently promised to fight inflation, what they actually do is another story entirely.

At the Fed’s March 16 meeting, for example, they decided to raise rates by an inconsequential quarter of a point.

That’s like fighting a forest fire with a water balloon.

And it leaves Americans stuck paying sharply higher prices for gas, food, housing, heating plus virtually all goods or services under the sun.

We know what’s likely to happen next because we’ve seen the cycle of inflation ravage countries since man began recording history.

In my own 50 years studying inflation on the ground, I’ve personally seen it run amuck in many countries and in many different ways.

But I can tell you flatly: This is worse. It’s global. It’s beyond the power of any government to control. And it’s just getting started.

Chapter 5

New European Debt

Crisis on the Near Horizon

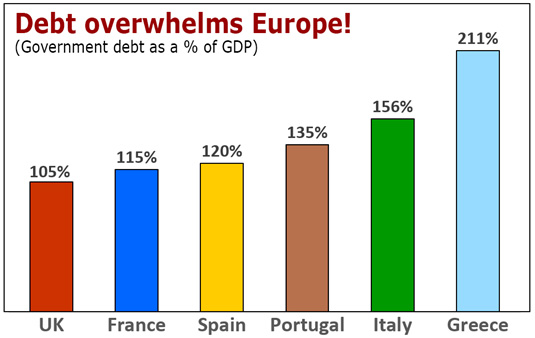

In Europe in the early 2010s, we saw the cycle of debt strike Greece. Then it hit Portugal, Spain , Italy and Greece again. But what you saw in Europe in the prior debt crisis is just a sneak preview of what's coming.

And again, the numbers support this forecast all the way. Throughout Europe, the government burden today is far worse than it was during the last major debt crisis.

In France, government debts are 115% of GDP. In Spain, they're 120%, in Portugal 135%, Italy 156%; Greece 211%.

Why are these levels so critical?

Back in the 20th Century, 50% of GDP was considered a dangerous line that no country should ever cross. Now, debt loads are as much as four times larger.

We're in uncharted territory, which begs the question: When will we collide with the tipping point?

The answer for Europe is 2022. And the trigger event is the war in Ukraine, setting off a scramble to boost defense spending, again financed by debt.

Italian banks could be among the first victims.

They now have more of their capital and reserves tied up in Italian government bonds than at any time in history — even more than they did in the depths of the last financial crisis.

For many investors, I know this is far away from home. So, let me explain the gravity of this from a historical perspective.

You see, in other countries, when banks have been in trouble, they counted on the government to bail them out. But in Italy, it's been the opposite. When the government is in trouble, it calls on the banks to bail out the government by buying its bonds.

This is a wild experiment that makes Frankenstein look tame. Any surge in inflation and interest rates could slash the value of the banks’ bond holdings and gut their capital.

All the news most people have seen out of Europe recently has been about Russia and Ukraine, and before that, the pandemic crisis and political crisis.

And it’s true that all of those factors are driving the European Union toward the brink. But in terms of their potential impact on the daily life of average people, nothing compares to the government debt crisis. It will severely impact the lives of 450 million citizens of the European Union.

And it will lead European governments to take desperate measures.

After the last debt crisis, the Spanish government began taxing bank deposits. People paid an income tax on their paycheck, then paid still another tax when they deposited it in their bank.

In France, police routinely searched travelers. They looked for large amounts of cash being smuggled out of the country to avoid taxation.

In Cyprus, the government literally robbed its own banks. Depositors with more than 100,000 euros watched helplessly as the government seized up to 40% of their money.

This time around, expect even more desperate measures.

And, as in nearly all such calamities, the United States will be the last safe haven.

OUR FORECAST: The European Union will not survive. It will disintegrate. This will be a big blow to Japan, one of Europe’s biggest trading partners. And these powerful economic cycles are already converging right now, forming the supercycle that will signal Europe’s future collapse. (For more details on how to better take advantage of this forecast, go here.)

Chapter 6

Japan’s Debt Load

Is Even More Extreme

I have lived on and off in Japan since 1979. My 40-year-old son has been living there for over a decade.

So, studying Japan’s history, economy and future has been a lifelong interest of mine.

And I can tell you flatly: Japan is at the center of not just one, but THREE overlapping conflicts.

- Prime Minister Fukuda has just decided to ship military equipment to Ukraine, one of its first such actions since World War II. In response, on March 22, Russia suspended ended peace negotiations with Japan over disputed islands that Russia annexed during World War II. This step puts it squarely into the war zone …

- Japan faces a fierce battle with China over the Senkaku Islands in the East China Sea, plus, at the same time …

- Japan is in the cross-hairs of North Korean dictator Kim Jong-un.

The chances that Russia, China or North Korea will invade Japan any time soon are still small. Fortunately!

But there’s no chance Japan can escape the economic impacts of those threats. Even as I write these words, Prime Minister Fumio Kishida is moving swiftly to reorganize security and defense spending, paving the way for major new expenditures.

And long before this latest crisis began, the Japanese government was already struggling with its overwhelming debts.

Just consider the terrible facts:

- Japan’s government is saddled with the largest debt in the world: More than 1.5 QUADRILLION YEN in debt. That’s a FIFTEEN digits. And it means that even if Japan had a yearly budget surplus of a trillion yen, it would still take 1,500 years for the country to pay off its debt.

- Tokyo’s debt is nearly two-and-one-half times the size of the entire Japanese economy and far larger than the debt load that pushed Greece, Ireland and Portugal to the brink of collapse.

- Japan’s debt is still skyrocketing. Social welfare spending in Japan, which is already one-third of its budget, is rising automatically by about one trillion yen every year.

This is an extremely dangerous situation.

OUR FORECAST: Japan’s already-bulging budget deficit will explode. Debt load will strangle the economy. The bond market will collapse. And the global crisis swirling outside of Japan will come crashing into its shores. Exports — still the lifeblood of the Japanese economy — will plunge. The economy will crater. Tax revenues will evaporate.

Chapter 7

Why the United States Is the World’s

Safest Safe Haven … for Now

Believe it or not, there is some good news in all of this — especially for investors in the United States.

The first bit of good news is that there’s still time — not much time, mind you, but some time — to prepare.

The second piece of good news is that the troubles in Europe, Asia and other hot spots around the world have prompted wealthy investors to seek safe havens. And at this juncture, the world’s safest safe haven is the United States of America.

(Go here for more info on how to benefit from this powerful reality of our times.)

That’s why savvy European and Japanese investors recently dumped trillions of euros and yen, driving those currencies lower …

Why they bought trillions of U.S. dollars, driving the greenback sharply higher. It’s also why they used those dollars to buy assets here: Stocks. Real estate. Even collectibles.

But if history and our cycles research proves anything, it’s that this wave of flight capital we’ve seen coming to our shores so far is just a sneak preview. It is about to become a giant tsunami.

It’s crucial that everyone who owns stocks … everyone with a retirement account … understands this.

Because at a time like this — with the world burning down around us — growing richer is the ONLY real defense.

Chapter 8

Four Distinct Phases;

Four Distinct Fortunes

Investors are delighted when they can make one fortune. But thanks to four entirely separate and clearly defined phases, this crisis has provided — and continues to provide — the opportunity to build four fortunes:

Phase 1 — Fortune #1. Governments spends money, borrows money, and prints money with impunity and no apparent consequences. This has given investors the opportunity to build a great fortune in stocks.

As I said, since our cycles research first called the bottom of the market in 2009, the S&P 500 Index has surged 534%, enough to turn every $10,000 invested into $63,400.

And those using our forecast to invest in the 3x S&P 500 ETF could have seen gains of up to 1,602% — enough to turn every $10,000 invested into $170,200. Investors buying our highest rated stocks could have made even more.

Phase 2 — Fortune #2. Inflation surges out of control. This phase, beginning as we speak, delivers the first big consequence of Phase 1 — roaring inflation in the United States and even greater inflation overseas. The fortunes made by investors in Phase 1 pale by comparison. But instead of technology stocks taking the lead, it’s the stocks that benefit from inflation that soar the most.

Phase 3 — Fortune #3. Europe and Japan implode. This is when the waves of flight capital rushing to safer havens becomes a giant tsunami, driving U.S. asset prices even higher, again especially in sectors that benefit the most from inflation.

Phase 4 — Fortune #4: When this crisis comes to America. This is when the United States pays the price for the largest orgy of debt and money printing in 5,000 years of human history.

Because with each passing year, America’s final reckoning is drawing nearer.

The Same Fate Suffered by Europe and Japan and Ultimately Awaits Us as Well

The bounce from the pandemic, the flood of government spending, and the nonstop Fed money printing have boosted the U.S. economy.

But no one can make America’s huge debt problem disappear.

And with the U.S. making greater and greater commitments to NATO, debts will explode even more — not to mention the cost to service those debts.

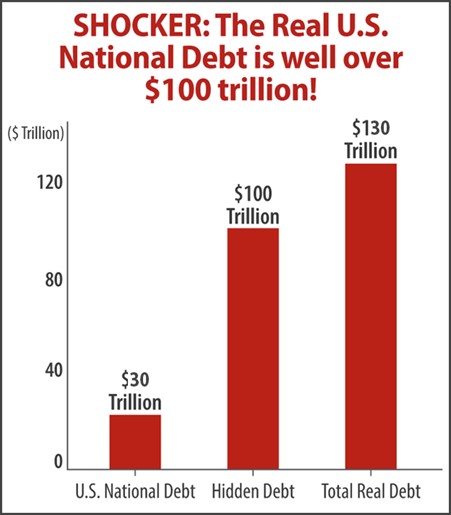

Washington’s debts are far larger than most people realize. Everyone worries about our $30 trillion national debt — that it equals more than the value of all the goods and services the U.S. produces.

But let me tell you: That’s a drop in the ocean.

In addition to that debt, according to the latest statistics from the U.S. Treasury Department, our government owes close to another $100 trillion that it never wants to talk about.

These are what officials euphemistically calls “unfunded liabilities” — the money it owes primarily to veterans and to seniors for pensions, Social Security and Medicare payments.

Altogether, Washington is on the hook for more than $130 trillion.

That’s not 130% of GDP. It’s 565% of GDP!

Sorry — but I have to ask,

Who are we kidding here?

Everyone knows Washington will never make a dent in that debt.

What most economists know, but don’t say, is that Washington won’t be able to even service that much debt for much longer. Any significant surge in defense spending or decline in the economy could ultimately push Washington into default of some kind.

It could be a default on the sly (via inflation), a default via an outright dollar devaluation or perhaps even an outright default forced by a government shutdown.

And long before that happens, U.S. government bonds will have collapsed in value.

The bottom line is that our government, our economy and our society are living on borrowed time. It will all come crashing down.

That’s why we believe that …

A Final Reckoning with Debt

Is as Certain as Death and Taxes

We’ve always known there was no way Washington could tax, print and spend forever. That kind of insanity is simply unsustainable.

We’ve always known that the day would come when it would all come crashing down. The only question has been “WHEN?”

Now, we have an answer.

Our study of cycles — the most powerful forces in the economic universe — has provided it.

The great global government debt collapse that will begin in Europe … and that will spread to Japan … will inevitably strike America as well.

When that happens, only those who are prepared will have a prayer of protecting their loved ones; let alone preserving their wealth or their quality of life.

And those who prepare will also have the opportunity to make a lot of money — with the handful of crisis investments that explode in value at times like this.

Chapter 9

We've Already Begun Preparations to

Shield Our Own Wealth and Profit

At this moment, we have our eye on four broad categories of investments for the years ahead:

Category A — Assets that cannot be confiscated.

Remember, the coming debt crisis will hit governments. And governments will seek every devious way they can in order to gain control over our wealth, even confiscating assets directly or indirectly.

Ironically, U.S. stocks are among the least likely to be confiscated.

It is extremely doubtful that the government will take away our shares in the bastions of capitalism — companies like Alcoa, Apple, ExxonMobile, or Proctor & Gamble.

And this is not the first time we’ve said so.

We began alerting thousands of investors to the importance of “fear money” on July 20, 2015. And since that time, flight capital has already driven many U.S. stocks dramatically higher.

So it should come as no surprise that anyone who bought our “buy” rated stocks on that date and held through yearend 2021 could have seen life-changing returns.

For example, some of the bigger winners include …

- 440% with Domino’s Pizza

- 445% with Netflix, Inc.

- 489% with Apple, Inc.

- 512% with Taiwan Semiconductors

- 699% with Old Dominion Freight Line

- 703% with Microsoft Corp

- 809% with Teradyne

- 835% with Cadence Design Systems

- 871% with Applied Materials

- 935% with Lam Research Corp.

- 969% with Monolithic Power Systems

But Monolithic Power Systems was NOT our best performer. In fact, among our buy-rated stocks, some surged even more during the same time frame.

One even produced a total return of 6,058%, or six times more than Monolithic.

And here’s the key: Since we never downgraded any of these stocks to a “sell,” I think it’s fair to say that investors faithfully following our ratings could have taken FULL advantage of these gains.

Of course, not all stocks in this group went up that far or that fast, and 1% of the stocks were losers with an average loss of 10.3%. But even if an investor bought equal amounts of ALL the Weiss Ratings buy-rated stocks, he could still have enjoyed an average return of 196%.

Looking ahead, we predict the waves of foreign capital that have helped bring about these gains will become a tsunami, and we believe the gains seen so far will pail in comparison to those ahead.

This is why our plan is to own our buy-rated stocks BEFORE foreign investors chase them.

But beware: They will probably NOT be the same names. Instead, our research tells us most of the biggest winners are likely to be stocks that benefit directly or indirectly from surging resources and other stocks that benefit from inflation.

Category B — Alternative assets that we consider excellent hedges against a government crisis — and to best capitalize even more directly on the flood of fear capital.

Gold and silver have served as mankind’s ultimate crisis hedges for 5,000 years. We see gold bullion prices soaring to $7,000 per ounce. That would be more than three times today’s levels.

And when bullion prices skyrocket, the shares of companies that produce them go even higher.

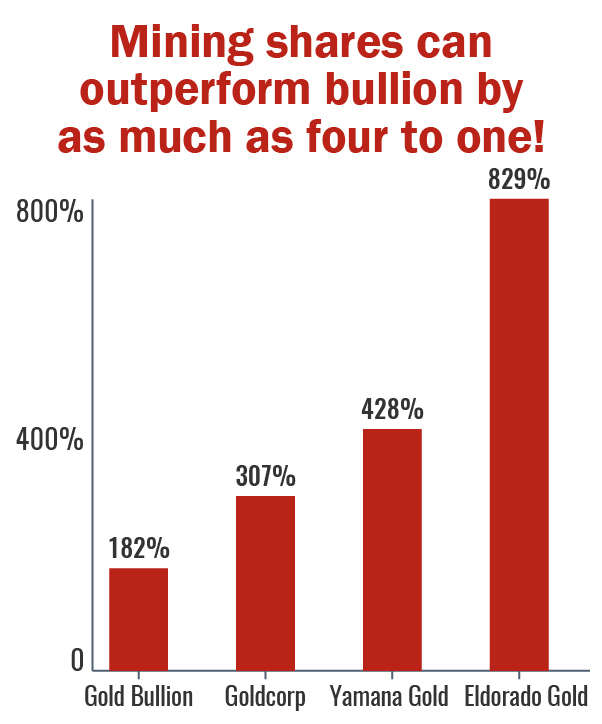

For example, from October 2008 to September 2011, gold bullion rose 182%. That means it almost tripled in price.

But if investors bought shares in a gold mining company like Goldcorp, they could have seen gains of 307%, or four times their money.

And in Yamana Gold, investors could have seen a gain of 428%, or more than five times their money.

In Eldorado Gold, the profits were even better — 829%, or more than nine times their money.

Moreover, those remarkable gains posted by the “big boys” of the mining world often pale in comparison to those of small-cap miners — Sean’s particular area of expertise.

Sean has personally visited small-cap miners in Mexico, the Arctic and all over the Americas. He prides himself on getting his boots dirty and investigates these investment opportunities on the ground.

He meets regularly with mining executives from all over the world. And the money those companies have made for investors is even greater than the profits I just told you about.

Small and Junior Mining Stocks to Go for

Gains of 974%, 1,481%, or Even More

History tells us that investing in small-cap miners and developers provides the benefit of leverage that’s just as powerful as the leverage of call options.

But investors can do it without any options at all, without risking more than a tiny fraction of their capital … without using debt or margin accounts … and without expiration dates.

In other words, no time limit on the opportunity!

Again, history provides the best example.

In the last global debt crisis, which was smaller than the one on the horizon today, gold bottomed at $700 on a pullback and proceeded to rocket to $1,900 over the next two years … an impressive 171% gain.

But in that same timeframe, the historic data shows that investors could have seen gains like …

- 324% on Premier Gold

- 455% on Richmont Mines

- 502% on Chesapeake Gold

- 723% on Oceana Gold Corp

- 937% on High River Gold

- 974% on China Gold

- 1,245% on Midway Gold

- 1,481% on Centerra Gold

- 2,295% on Allied Nevada, and

- A staggering 5,237% on Kaminak Gold

That last one was 30-times more money than simply holding gold … and enough to turn every $500 into $26,685 … every $1,000 into $53,370 … and every $25,000 invested into $1,309,250 — on just one stock!

Not all stocks performed that well, of course. But on average, mining shares rose very substantially during the same period.

For details on how to take fullest advantage of these trends, go here.

Companies That Produce These “White Metals”

Can Generate Gains Of 566%, 719%, 1,076% and More

There’s one sector in particular that practically nobody is paying attention to: Industrial metals.

But the convergence of cycles — and the global megatrends born as a result — are driving these metals through the roof.

Sean calls it the “Secret Rally” — and it is part and parcel of the supercycle coursing through the world economy.

Meanwhile, he’s famous for finding companies that produce these metals with the potential to give investors the opportunity for many times those returns.

Consider what happened in the last cycle, for example …

- Solitario Zinc surged 114%.

- Century Aluminum jumped 566% …

- Silver Bull Resources, which is a big supplier of silver and zinc, surged 719% …

- Starfield Resources, a developer of copper and nickel, skyrocketed 1,076%, and …

- Sarissa Resources, which develops copper and uranium, jumped as much as 1,214%.

It’s no coincidence that these companies could have made investors vast fortunes. It’s all part of the supercycle in commodities that Sean first wrote about many years ago. Plus, we believe …

Metals Used for Energy Have Even Greater Potential

A major opportunity we see today can be compared to similar opportunities around the turn of the last century.

That’s when we saw the world shift from horses to internal combustion vehicles. And now, a similar shift is occurring from internal combustion vehicles to electronic vehicles.

Two metals, lithium and cobalt, are integral components of the batteries that power electric vehicles. And now, flight capital from fearful investors — plus rising demand — is expected to drive the price of these metals through the roof.

What if the debt disaster ultimately drives the global economy into a Great Depression?

Well, just because there was a Great Depression in the 1930s, the world didn’t stop switching over from horses to the internal combustion engine. It’s the same thing today.

That’s why the shares in companies that benefit the most from this trend will continue to surge. And flight capital from overseas is turbocharging this trend:

Just between March of 2020 and June 2021, Standard Lithium surged 608%. American Manganese jumped 661%. Encore Energy soared 1,255%. And these were not even the biggest winners.

Category C — Leveraged Investments

If there ever was a time to use leverage, THIS IS IT!

The fact that these cycles have been so amazingly accurate over the past century gives us an enormous amount of confidence right now.

We’re not going to be content to settle for just ordinary investments.

Since we honestly believe this is the profit opportunity of a lifetime, in special cases, Sean will recommend using leverage to multiply their profit potential.

The goal: To go for profits of $2, $3 or even up to $50 for every $1 in profits an ordinary investment might generate.

And given the historical accuracy of these cycles, we recommend not just one, but THREE kinds of leverage:

The first kind of leverage is the relatively less risky leverage available through ETFs.

Many ETFs provide two and three times leverage. So, for every $1 in profit other investors make, it is possible to make $2 or $3. Investors could make up to triple the profits.

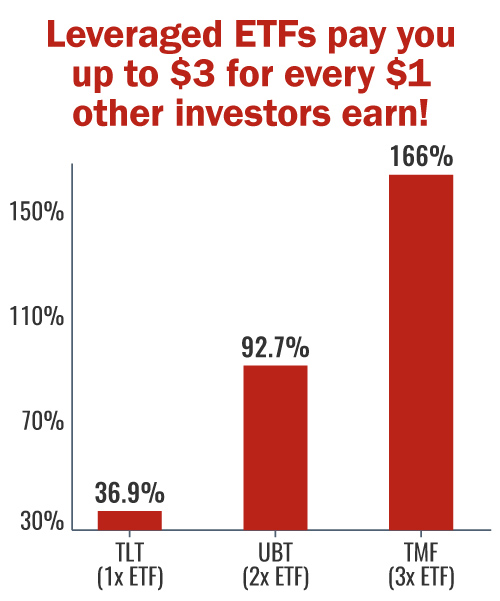

Example: Not long ago, in a just a 13-month period, the “Plain Jane” ETF that owns U.S. Treasuries — iShares 20+ Year Treasury Bond ETF (TLT) — posted a 36.9% gain.

Meanwhile …

The double-leveraged ProShares Ultra 20+ Year Treasury (UBT) produced a 92.7% gain … and the triple-leveraged Direxion Daily 20+ Yr Treasury Bull 3X Shares ETF (TMF) could have made you 166% richer.

The second kind of leveraged investment we recommend from time to time is somewhat more aggressive. These are options on stocks and ETFs.

I’m talking about buying call options on select U.S. stocks that we expect foreign investors will want to own, and also on ETFs that own those stocks.

This is important since, instead of paying “only” $2 or $3 for every $1 or profits possible in the underlying investment, options could pay you $10 … $25 … $50 or more.

Of course, all investments involve risk — and that includes options. As with any investment, investors should never risk more than they can afford to lose.

The good news: With the purchase of options, while your profit potential is virtually unlimited, your risk is strictly limited to the small amounts you invest.

The third kind of leverage Sean recommends is not really leverage at all — even though it does offer the potential to go for astronomical gains quickly: Small-cap mining shares.

You simply buy their stock, no different than buying a share of Facebook or Google. But these companies’ values are tied at the hip to the price of the metal they produce.

In fact, during the last major gold rally, mining shares in this category rose to $68 for every $1 move in bullion!

And if, as we expect, the convergence of cycles send the value of industrial, energy and precious metals through the roof, small companies that mine them could do exponentially better than the metals themselves.

Chapter 10

A Speculator’s Dream

We believe the next five are going to be a speculator’s dream — not just for veteran speculators but for nearly ANY investor with the knowledge.

And as fear money rushes to the United States, it will likely turbocharge megatrends that are already beginning to take the world by storm. Here are just a few on Sean’s radar screen:

Bigger-than-ever defense spending: Giant future spending on military hardware and operations is virtually unavoidable …

And the last time this happened not long ago, historical market data shows us that select leveraged investments in one of his favorite defense companies posted gains of 329% in 195 days … 463% in 200 days … and 670%, also in 200 days!

That’s enough to multiply the initial investment more than seven times over.

The global conversion to electric cars: With the right timing, select speculative investments in Tesla could have given investors gains of 388% in 91 days, 579% in six months and 881% in just seven months.

That was enough to turn every $10,000 into almost $991,000!

But our research proves that it’s not just the car companies that could make you rich. It’s also the companies that develop the materials that make these vehicles possible.

Not long ago, leveraged investments on LIT, the lithium ETF, could have made you 231% in 91 days and a whopping 4,100% in just 5 months!

That could have been enough to turn a $5,000 grubstake into a $205,000 fortune!

Shift to U.S. energy. In tandem with the shift of capital to the United States, we’ve seen a massive shift from Middle Eastern crude oil to U.S.-produced oil and natural gas. (And the recent ban on Russian energy imports can only accelerate this trend.)

By simply buying ordinary common stock in select companies like Marathon Oil, you could have seen gains of 45% in just 40 days.

But with judicious use of leverage, you could have seen gains of …

- 425% in 40 days …

- 1,422% in 42 days, and …

- 2,150% in 40 days — enough to turn a $10,000 investment into $225,000 in just over one month!

These were among the best winners, but by no means the biggest.

Of course, not all options can perform as well and, if investors choose the wrong ones or at the wrong time, they can also lose money.

But we feel these demonstrate the unusual power of leverage in today’s unusual times.

And here’s the BEST news:

All of our cycles research indicates that these megatrends are just beginning. The biggest profits will come during Phases Two, Three and Four of this crisis!

And because the timing of these megatrends is tied to predictable cycles, we have the confidence to use judicious leverage and go for the biggest reasonable gains possible.

We believe these investments are ideal for Phase Two of this crisis (now) and Phase Three. But in Phase Four, when this great crisis strikes Washington D.C., we will make a major change of strategy …

You see, until that time, America will still be considered the safest safe haven in the world. So torrents of fear money will flow to our shores.

But after that time, investors everywhere will awaken to the fact that America is also feeling the sting of the crisis — that it is no longer a safe haven …

That it is, in fact, among the victims of the debt crisis.

At that point, it will be time to close out our positions on most U.S. investments and use inverse ETFs as well as put options to go fourth and final fortune in this crisis.

These would include funds like the ProShares UltraShort S&P 500 ETF … ProShares UltraShort QQQ ETF … ProShares Short Dow 30 ETF … and the ProShares UltraShort Russell 2000 ETF.

And you can also use options on these ETFs to go for gains of 400% … 500% and more.

When my father, Irving Weiss, saw a major depression on the way in the early 1930s, he borrowed $500 from his mother to follow a similar strategy. By the time the market hit rock bottom, he had transformed that small grubstake into $100,000, the equivalent of $2 million in today’s dollars.

Two of his contemporaries, Jesse Livermore and Bernard Baruch, invested far larger sums and made the equivalent of billions of dollars.

In Phase Four of this crisis, we believe investors should be able to follow a similar path — all with limited risk and by investing just a small portion of their money.

14 Supercycle Investment Opportunities for 2023-2027

If everything plays out like our cycles are telling us …

In the next two phases of this crisis, investors could go for windfall profits as …

- Debt and war crisis drives trillions of dollars in flight capital into America’s most prosperous blue-chip companies.

- The crisis drives more money into companies that are leaders of sweeping megatrends — defense, electric cars and the U.S. energy boom.

- The euro and the Japanese yen fall …

- And as European and Japanese stocks follow.

Then, in Phase Four, we aim to grow even richer as …

- The U.S. dollar crashes …

- Many U.S. stocks collapse …

- And U.S. corporate bonds implode.

And throughout this crisis, we will go for still greater profits as this massive wave of flight capital drives precious metals and commodity prices higher …

- Gold (Target price: $7,000 per ounce)

- Silver (Target price: $150 per ounce)

- Platinum (Target price: $9,000 per ounce)

- Palladium (Target price: $4,000 per ounce)

- Oil and energy (Crude oil target: $250 per barrel)

- Energy metals, like nickel, cobalt, lithium and uranium

- Food, especially wheat

Plus, here are two ETFs that can get you started right away:

Invesco DB Commodity Index Tracking Fund, It’s very liquid fund with 5.7 million shares per day. It holds a basket of commodities with 56% of the portfolio in energy, 22% in agriculture, and the rest in metals.

Invesco DB Agriculture Fund, also very liquid, with a nice mix of corn, soybeans, wheat, sugar, cocoa, coffee, cotton, cattle and hogs.

Most important, to help you survive and profit, we want to empower you to go to the next level.

This Could Be THE Watershed Moment

of Our Financial Lives

Our entire life as an investor — and as a student of the economy and the investment markets — has led us to this moment.

We’ve always known that the obscene debts our leaders were amassing were unsustainable.

We always knew that sooner or later, the end of this great debt cycle would come one day — and that there would be hell to pay.

Now, the same cycles that accurately predicted the Great Depression — and every major economic or investment event since 1929 — are converging to form a powerful new supercycle …

A supercycle that marks the end of the era in which our leaders could amass mountains of debt without suffering the consequences …

And the beginning of a dangerous new era in which we all pay the price for that debt.

As we’ve seen, the facts on the ground have been completely in sync with this forecast. They confirm and validate every warning our cycles research is giving us.

The die is cast. The handwriting is on the wall.

These facts leave us with two choices — and ONLY two:

We can do nothing; knowing full well that as these events unfold, they will likely destroy everything we have worked for.

Or, we can take the needed precautions to protect our wealth — and better yet, harness the awesome power of these events to go for windfall profits with stocks, ETFs, leveraged ETFs, and some options.

Please remember what’s at stake: Over the past year or so — well before the worst of this crisis will begin — we showed you that many of these investments have posted actual, real-world profits of 719%, 1,076% and 1,214% (industrial metals) … 1,260%, 1,275%, and 1,536% (metals used for energy) … and 1,422%, 2,150%, and 4,100% (electric vehicles).

We’ve also showed you how the influx of foreign capital has already helped drive up our “buy” rated stocks by 699%, 703%, 809%, 835%, 871%, 935%, 969%, and much more!

But now, the convergence of cycles will threaten to wipe out millions of investors who fail to prepare … and send the investments we’ve named in this report into high gear, with the potential to make investors not just one fortune, but FOUR distinct fortunes.

We’ve made our choice. We are doing what’s necessary to protect our family’s wealth.

Good luck and God bless!

Martin D. Weiss, PhD

Founder, Weiss Ratings

with

Sean Brodrick

Senior Analyst and

Economic Cycles Specialist