We were among the first financial experts to predict Donald Trump would give Hillary Clinton the drubbing of her life. Now we predict that …

President Trump

will be impeached!

And the impact will shake Wall Street to the core.

Stocks and bonds will crash. America’s $120 trillion debt bubble will burst. Social Security, welfare and Medicare checks could lose 80% of their value.

Most Americans will see their retirement plans vanish. But a few savvy investors will emerge on the other side of the crash far richer than they were coming in.

Dear Investor,

America has not been this divided by this kind of political hatred and venom since the Civil War. And it’s in the upcoming midterm elections that you're going to see it all play out.

The Republicans are careening toward sweeping losses.

Already, 44 Republican House members have announced they won’t seek reelection. Among these, the Democrats need to pick up just 25 additional seats to gain a majority in the House and elect Nancy Pelosi Speaker of the House.

Not long after, I predict the Democrats will take one of the most radical steps in the 242-year history of the Republic. They’ll vote to impeach President Trump.

And there will be no one to stop them, whether he’s guilty or innocent.

The impeachment will unleash a financial panic that will roll across the economic landscape, leveling everything it its path. And it will happen at a time when the U.S. government debt load is the worst in history.

Foreign countries like China, Japan, Germany and others hold $6 trillion of U.S. bonds. When Trump is impeached, they will dump their holdings. Bond prices will plummet. Interest rates will surge. Stocks will get clobbered.

States like California and Illinois, which have borrowed to the hilt, will be pushed into or near bankruptcy.

Just like Detroit in 2013 and Puerto Rico in 2016.

Millions of American citizens have been left out of the so-called “recovery” of recent years. For them, the pain will become unbearable.

Many will cut off from their Social Security checks. Or worse, all the checks will be slashed in value. Medicare will cover just a fraction of your medical costs.

The crisis will crush the income, savings, investments and retirements of nearly the entire middle class.

It will plunge vast numbers of families into the nightmare of poverty. Only a minority of investors will survive intact.

But some will actually build their wealth in the process. Before I tell you how, let me introduce myself.

My name is Mike Larson, Senior Analyst at Weiss Ratings.

We were the among the first to predict that Trump would give Hillary Clinton the drubbing of her life, pull off the upset of the century, and sweep into the White House.

We were also the first rating agency in the word to tell the truth, the whole truth and nothing BUT the truth about the financial mess the United States government has gotten itself into.

Moody’s, Fitch and even S&P still give the U.S. a stellar rating despite its financial troubles. But we gave Uncle Sam a credit rating that places him where he really belongs. It's above nations that are already on the brink of bankruptcy. But not far above their level.

The Wall Street Journal and Barron’s widely reported the news about our rating. They wrote that the Weiss Rating on Uncle Sam is a mere two notches above “junk” — the category assigned to near-bankrupt nations.

And Forbes reported that Weiss beat Standard & Poor’s in giving the U.S. the rating it merits.

You may also know us because, in the 47 years since our company was founded, so many of our prior warnings made the news.

Months in advance, we warned about the S&L crisis of the 1980s, the giant insurance company failures of the 1990s, plus the great “Tech Wreck” of the early 2000s.

Then, just before 2008 debt crisis, ours was the only firm in the world to issue low ratings — and specifically name — nearly every major company that later collapsed.

We were the only ones who gave advance warnings about the failure or bail-outs of Bear Stearns, Lehman Brothers, General Motors, Fannie Mae, Wachovia, Citigroup, Bank of America, and many others.

These kinds of on-target warnings prompted Worth magazine to say, “Weiss’s record is so good compared with that of their competitors ... consumers need look no further.”

And the New York Times to say, “Weiss was the first to see the dangers and say so unambiguously.”

Barron’s wrote, “Weiss is the leader in identifying vulnerable companies.”

Or consider Chris Ruddy. He's a close friend of President Trump and the founder of NEWSMAX. He wrote: “Weiss’s prediction of the current economic crisis is uncanny.”

More importantly, our forecasts allowed investors to avoid big losses and even make money as the crisis unfolded.

I expect they could do even better in the months ahead. Because now, another global debt crisis is in the making, one that could make 2008 look like a walk in the park.

Your Financial Future is More Fragile than It Was

in 2007 When the Dow was About to Fall 53%

In 2008, defaults on mortgages brought down Lehman Brothers, Fannie Mae, Freddie Mac, AIG, and several major U.S. banks.

Hundreds of billions of dollars in bailouts were doled out. Yet the stock market lost more than half its value anyway!

Then to prevent a depression, the Federal Reserve under former President Obama slashed interest rates to zero percent. They printed $3 trillion of fresh money. And they pumped it all into the economy.

Never before have they created so much money out of thin air.

Never before had the Fed cut rates that low.

Never before in 2000 years of history were interest rates held there for so long.

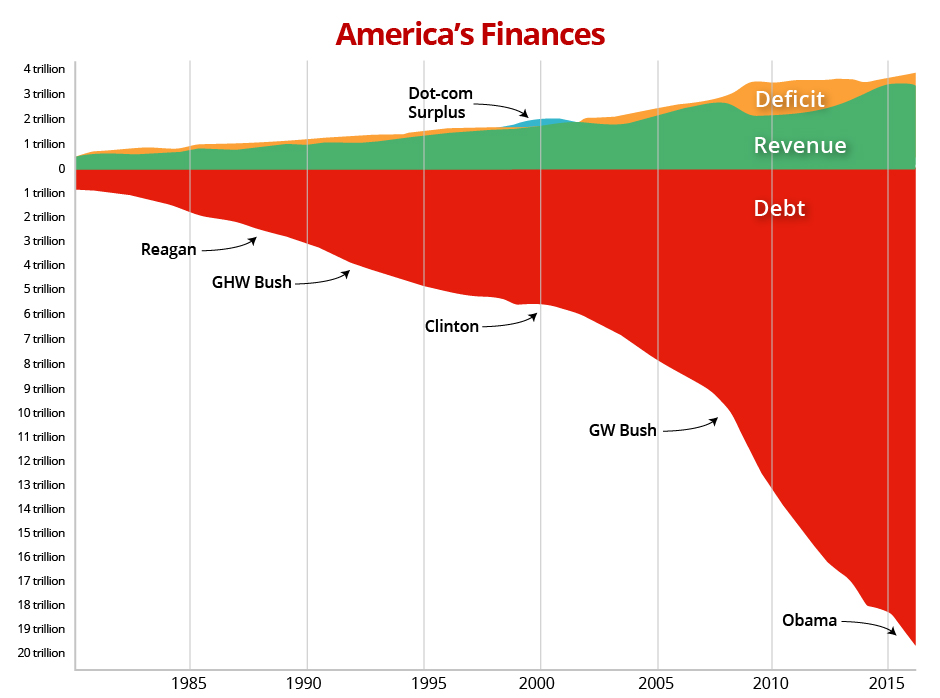

And never before has a government racked up more debt.

The economy remained weak. For most companies, earnings barely improved.

But despite all this, stocks rose!?

What makes sense about this?

Mark my words: The day of reckoning is coming: The Trump impeachment and the convulsions that follow will pop this bubble.

Already, it’s past the point of no return.

Washington borrows more money every second

than honest American workers make in a year

I know it sounds absurd, but it's true.

Look, our nation’s debt load is increasing by $5.4 billion per day. That’s $62,500 per SECOND. The average working American earns $52,000 — before taxes — per YEAR.

So there you have it: What Uncle Sam borrows in just one second is MORE than the average American earns in an ENTIRE YEAR!

Do you think this is sustainable?

There are now 120 million Americans in the workforce ... and $21 trillion of government debt. That’s $175,000 in debt per working citizen.

And that’s just the “official” debt.

If you include unfunded liabilities for things like Social Security, Medicare, and government pensions, you get a total debt of $132 trillion. That’s $1.1 million of government debt per working American.

Can anyone in their right mind believe that this debt is ever going to be repaid?

Average American workers are already having

trouble keeping their heads above water

The numbers already show that as a nation, we’re tapped out, stressed out, and living on the brink of bankruptcy!

And as usual, it will hit the average person first. The average household pays $1,292 in interest each year. And that’s just on credit cards.

Student loans are $1.33 trillion — mostly owed to the Federal Government. But there are 42 million borrowers. 11% of them are delinquent by at least 90 days. Another 15% are in default.

This is holding a sword over the real estate market. It's preventing young families from buying a first home.

Banks have spent the past decade giving out car loans to anyone with a pulse. You'd think bankers would have learned a lesson from the housing collapse of 2008 when they did exactly the same thing with home loans.

And now those car loans are going bad just like the home loans did in 2008. Delinquencies on subprime car loans have already doubled from 2.9% to 5.8%.

That’s worse than in the depths of the housing bust— at a time when we’re supposed to believe everything is just fine and dandy!

So Americans are under the strain of credit card and student loans payments.

Is it any wonder that they can’t save any money?

Would you be surprised if I told you the U.S. savings rate has plunged? It was a respectable 6.8% in 2008. Today it’s a miserably low 2.4%. As people have to make higher principal and interest payments on their debts, there’s just no money left to save.

The threat of a Trump impeachment alone could wipe out

more than half the wealth of America’s middle class

This unhedged warning will NOT make me any friends in Washington OR on Wall Street!

I’m well aware that these forecasts will be controversial even among my closest friends. But in our time together today, I’ll present powerful evidence of their accuracy.

Even if I’m wrong about how massive this crisis will be, you should still do very well.

And if I’m right, you could make more than enough money to get your loved ones through it all in safety and comfort.

Not long ago, this kind of crisis

also struck a very powerful European nation

The United States is no longer the country we knew so well. Its leaders have made too many mistakes for too many years.

But this isn’t the first time this kind of crisis has struck a large, powerful nation.

Not long ago, after its leaders made many of the same mistakes ours are making now, another country’s government was also torn apart.

Its bonds collapsed in value. Its interest rates exploded — to over 200%. In just six months, its stock market plunged 75%.

The common people suffered tremendously: A staggering 60% of the workforce was paid only partially — and received their paychecks months after they were due.

As the economy collapsed, millions of average citizens fell victim to crime and corruption. The police demanded bribes for traffic violations — both real and imagined.

A friend of ours said:

“No one knew how long our president could hold onto power. No one knew what would happen to their money. Many banks, including some of the largest in the country, shut down. Our savings were wiped out.

“All people could do about it was to go to their banks and hammer on locked doors.

“Other people demonstrated in the streets. They carried their devalued money in miniature coffins and marched past our central bank.”

All this happened in the 1990s — in Russia, one of the most powerful nations on the face of the Earth.

Of course, the U.S. is not Russia. We have far stronger democratic institutions. But when a nation’s leaders make the same mistakes as Russia has made, the consequences are likely to be similar.

The Russian people paid dearly for their leaders’ blunders. The American people are also likely going to pay a very big price.

Greece, Ireland, and Spain suffered through

this same kind of crisis just a few years ago!

For a sneak preview of the doomsday event that will strike the United States, just look at the catastrophe that took place in Western Europe not too long ago. In Greece, a friend of ours reported:

“Here in Athens, we’ve seen riots, the firebombing of banks and blood in the streets.

“Everywhere in Greece, home values are plunging. Unemployment is soaring. One in four Greeks, including over 450,000 children, live in poverty. Crime is exploding.

“Athens is beginning to look like a ghost town. Everywhere you look, shop windows are boarded up. Of those that are still open, most are running going-out-of-business sales.”

While Greece was sinking, the crisis also hit another country, Ireland. Ireland’s real estate values also crashed.

Mortgage defaults and bank foreclosures soared. Suddenly, Irish banks had lost billions of euros and were in danger of failure.

So, just as in the U.S., the Irish government stepped in and bailed out the banks. But then the government itself went bankrupt.

As a result, the Irish people were forced to live under crushing austerity measures.

Salaries were cut to the bone; pensions and health benefits were slashed.

Meanwhile, in Spain, similar stories were told in Madrid, Barcelona and 50 other cities across the country.

Tens of thousands of workers took to the streets to protest a problem they thought they’d NEVER see again in their lifetime:

Not just 10% official unemployment like we saw in America’s Great Recession, but 21% official unemployment!

A friend of ours in Madrid said:

“You wouldn’t believe what I’m seeing here on the streets. Beggars outnumber tourists and protesters outnumber beggars.

“In front of Parliament, riot police stand watch to protect lawmakers from angry mobs. All over the country, in Viscaya, Cataluña, Andalucía, we see the same thing.”

Worse, the crisis spread like wildfire — to bigger and bigger countries, such as Italy, France, and even the UK.

Now, you may be thinking, “But we’re different! Nothing like that could ever happen here.”

I assure you: The people of Russia, Greece, Ireland and Spain never dreamed it could happen there, either!

But the truth is, our own leaders have made political and financial blunders that are very similar to those made by their leaders.

As our Greek friend says:

“You can’t save a nation that’s drowning in debt by throwing more debt at it, any more than you could save a drowning man by throwing more water on him.”

Look, in every one of these countries, the pattern is clear:

First, the government spends everything it has.

Second, the government borrows all it can from its people.

Third, retirees lose almost all their interest income. Working people are trapped in low-paying jobs.

Fourth, the country is torn by political hatreds, including attempts to depose their leaders.

Finally, everything comes to a head. Foreign investors pull out. Interest rates rise. And the stock market crashes.

That’s when panicky political leaders take desperate steps. They start economic wars or even fighting wars. They turn on their own people. They confiscate their wealth and destroy their freedoms.

Yes, America is still the richest country in the world. But that fact has enabled our leaders to take the greatest and most dangerous RISKS in the world.

So, this brings us to the most frightening question of our era: When Greece, Ireland and Spain went bankrupt, Germany and the rest of the European Union came to the rescue. But …

Who’s going to bail

out the U.S. government?

No one. No person, company or country on earth is rich enough to bail out the government of the United States of America.

Moreover, in recent years, the U.S. government has borrowed most of the money from foreigners, especially China.

That’s more than six times what Washington owed foreigners when the U.S. plunged into recession in the early 2000s.

But it still hasn’t been enough. The White House and Congress under President Obama wanted to spend even more money than Americans and foreign investors would loan us — combined.

COMING NEXT:

Trump impeachment causes

all hell to break loose ...

When debts are unpayable and impeachment tears the country apart, there can be only one outcome: The government will no longer be able to borrow and will simply run out of money.

That’s the moment when all hell breaks loose.

I’m talking about a wholesale rejection of U.S. debt by the world’s investors — a creditors’ revolt. That’s when foreign lenders throw up their hands in despair and say: “How can I trust my money to a government that’s broke and impeaching its president?”

What would happen right now if foreigners are scared away by impeachment proceedings and Washington is no longer able to borrow money?

Remember: The government is borrowing more per second than the average working American earns in one year.

In fact, the government borrows nearly half of every dollar it spends today.

So, what will happen when global investors, spooked by a Trump impeachment, deny our application for yet another loan?

When Chinese, Japanese and European lenders simply say: “Sorry — but America’s line of credit is CANCELLED. Washington’s loan application is DENIED!”

This is not far off. The warning signs are already here ...

Warning sign #1: According to credit market analysts, just as soon as it’s evident that impeachment is likely, global investors will dump their holdings of U.S. bonds. This will drive Uncle Sam’s interest costs sharply higher and even shut him out of the bond market.

Warning sign #2: The market values of U.S. Treasury securities are already beginning to fall.

Warning sign #3 is the looming trade war. Most Democrats and Republicans agree about this. They said that the trade war will harm the global economy. But that’s not the biggest threat. What’s worse is that, in retaliation against the United States, China will pull the trigger on what I call the “nuclear option.”

No, I’m not talking about nuclear war. I’m talking about the $1.2 trillion in U.S. government bonds and securities that China is holding in its coffers. U.S. government bonds that they can dump at ANY time of their choosing.

That they can dump like hot potatoes.

Put simply, that fateful day — when Washington is no longer able to borrow the money it desperately needs — is speeding toward us like a runaway freight train.

This is why former Congressman Ron Paul issued this somber warning:

“The Chinese have backed off from what they’re loaning us, interest rates are starting to go up, inflation factors are coming up.

“Believe me, the next step is a currency crisis because there will be a rejection of U.S. investments. That rejection is a big, big event.”

Ten former heads of the Council of

Economic Advisors Warn: The next

debt crisis could “Dwarf 2008!”

Still finding all this hard to believe? Then consider these ten former heads of the Council of Economic Advisors.

They are the men and women who directly advised Presidents Reagan, Clinton and Bush. Even before Trump was on their radar, they wrote that the next debt crisis could “Dwarf 2008!”

And these ten former presidential advisers are not the only ones who have rung alarm bells.

Take the Director of National Intelligence, Dan Coats, for example. He's a Republican appointed by Trump. But look what he said to Congress in February 2008:

“The failure to address our long-term fiscal situation has increased the national debt to over $20 trillion and growing.

This situation is unsustainable. And as I think we all know, it represents a dire threat to our economic and national security.”

Republican Senator David Perdue of Georgia puts it this way: “This is out of control! Every dime that we’re talking about for disaster relief is borrowed. We have to go to China and borrow that money.”

Senator John Kennedy of Louisiana says: “We’re going to have to change the name of the Department of Treasury to the Department of Debt, because there’s not going to be any Treasury left.”

These government officials are merely following the facts to their logical conclusion. And that’s what I’ve done in this report. The warnings I’ve given you are based on nothing more — and nothing less — than political and economic facts.

My research team and I have simply crunched the numbers and let the chips fall where they may — just like we did when we issued “D” ratings on nearly every big bank and savings & loan that subsequently failed.

Just like we did when we gave a “C” rating to the United States.

We have no political axe to grind. We are not beholden to Republicans, Democrats, or any other political party. Nor do we owe allegiance to Wall Street or any of the thousands of companies and countries that we rate.

But to quote Harry Truman, “I never give them hell. I just tell the truth and they think it’s hell.”

Our loyalty is with the people — investors, savers, and everyday citizens — who rely on us to tell them the truth about what we see in the future, and about the investments they make with their hard-earned dollars.

Believe it or not,

today’s political turmoil is actually

the CALM before the storm!

If the crisis I’ve just described is hard for you to imagine, I certainly understand.

We’ve never seen anything like this happen before in America.

We always believed we were somehow insulated from these kinds of catastrophes.

It’s still hard for some people to imagine that such terrible things could happen to us — and that it could all happen so quickly.

But isn’t that always the case? Isn’t there always a calm before the storm? Aren’t people always caught by surprise when historic crises strike?

After all, nobody believed the Soviet Union would collapse virtually overnight. And when it did, it caught everybody by surprise. Even our own CIA failed to see that one coming!

And remember, for years, Islamic extremists made no secret of their determination to knock down the World Trade Center. They actually tried to do it in 1993.

AMAZINGLY ACCURATE!

“Integrity and dedication to his subscribers is outstanding and his accuracy in forecasting economic events and to build your wealth is superior.

“He calls it right, and early.”

— T.A., Petersburg, Virginia

But among the thousands who streamed into the twin towers on September 11, 2001, how many — if any — believed they had anything to worry about?

Many, including some of our own friends, just kept going to work as they always had — and thousands paid the ultimate price.

Even in my own two-decade career, I’ve seen complacency and denial exact a hefty price over and over again.

A few years ago, only a handful of people believed me when I repeatedly warned that the real estate bubble was about to burst.

Very few listened when we warned that Lehman Brothers would go belly up, that Washington Mutual Bank would fail, and that even the almighty Bank of America would come within an inch of failure.

Back in 2016, months before the election, we said Donald Trump would win. But major media like the New York Times said the odds against him were 95 to 5. So very few believed us.

And now, as we predict the president will be impeached, I suspect that the vast majority of Americans will fail to heed this warning. And they will fail to get ready for this crisis.

I sincerely hope — for your family’s sake — that you are not one of them.

Because the precautions required to weather the coming tempest are not difficult.

Even if the storm turns out to be less severe than I fear it may be, the worst that’ll happen is that you’ll sleep better at night — and you could make some money in the process.

Take these six steps immediately

to protect and potentially grow your wealth

So, WHEN should you expect to see the government run out of money? Soon. VERY soon.

The U.S. Treasury holds a 30-year bond auction about every two weeks — and it auctions shorter-term notes and bonds even more frequently. So, it could happen at any time.

Even before talk of impeachment is taken seriously in the financial markets, foreign investors are already pulling away from those auctions. The U.S. government already has to pay higher and higher yields just to get buyers to pony up.

Already, Uncle Sam’s cost to borrow for ten years is at its highest level since 2013. Its cost to borrow for five years is at its highest since 2009.

There is, however, some good news:

You still have some time — but not much — to prepare. If you take action right away, you can still use the defensive steps I’m about to recommend to protect your family.

And there are simple things you can buy that could not only protect you, but also give you the opportunity to build substantial wealth.

Here are the steps I recommend you begin taking immediately to protect yourself and your loved ones from the coming storm ...

STEP #1 is to prepare your defenses: If you count on the government for anything, then plan to live without it.

As we’ve seen, all levels of government — federal, state and local — will have no choice but to cut spending as this crisis unfolds.

That means you’ll need a plan for getting by on your own — without help from Social Security, Medicare, or other government programs.

If the government owes you money — tax refunds, for instance — be aware that the payments could be delayed.

It would also be a good idea to make preparations to personally ensure your family’s safety. Because police, fire, and emergency services will probably be harder to come by in many communities. Imagine dialing 911 and getting no answer!

If you live in a city, have a plan and a place to go if things become uncomfortable for you.

Those are the basics. But there’s so much more I need to tell you to help you through this crisis, I couldn’t begin to cover it all in this presentation.

That’s why I’ve just put the finishing touches on “Four Horsemen of the American Apocalypse: Protect Yourself and Profit.” It’s the ultimate survival guide for 2018 and 2019 — and I want you to have a copy free of charge.

In this free, but indispensable, emergency guide, I show you how an impeachment and massive debts are likely to cause this great Armageddon to unfold, and how it will impact you.

I give you very specific instructions on the steps you must take to get your financial house in order. And I show you what to do immediately to protect your savings, your investments, your real estate, and everything you own.

I'll show you how to shield your bank account, safeguard your insurance policies, and defend your 401(k)-retirement account. I'll give you a handy tool to insulate your stock portfolio and even show you how to protect the value of your home and other real estate — no matter how bad things get.

PLUS, I lay out the steps you need to begin taking right away to defend your family and to help ensure their physical safety even in a worst-case scenario.

STEP #2 is to make sure your investments are solid.

Here, there’s even more I can do to help. As I explained at the outset, our firm, Weiss Ratings, is the nation’s leading provider of independent ratings on your investments.

Every trading day of the year, we update our ratings and reports on 9,000 common stocks, 27,000 mutual funds and 1,800 ETFs.

And unlike most research firms on Wall Street, we never accept a dime or any form of compensation with the firms we rate.

Since 2007, if you had followed our stock ratings and our recommended strategy for using them, you could have made a total return of 722%.

You would have made enough to beat Warren Buffett’s Berkshire Hathaway by 4.8 to 1.

And you could have outperformed the S&P 500 by a whopping 5.8 to 1.

Equally important, you would have avoided the crash of 2008, when stocks fell by over 50%.

So, to help you try to maximize your profits AND get your portfolio through this crisis unscathed, I want you to have a complimentary copy of:

“The Weiss Ratings “X” List: America’s Weakest and Strongest Stocks.”

In this guide, I give you the complete list of the weakest, most vulnerable stocks and ETFs that you should avoid at all costs, and also a full list of the strongest that are best equipped to weather the coming political and financial storm.

STEP #3 is to build an impenetrable wall of privacy around your finances: Make no mistake — the United States government will NOT be your friend as this crisis unfolds. Neither will your state, county, or local governments.

If history proves anything, it’s that there’s virtually nothing as dangerous as a big government that’s being threatened with extinction.

In the worst-case scenario, if politicians and bureaucrats decide that your rights and property stand in the way of saving the government ... you can kiss your assets goodbye. They could crawl into every safe deposit box in the country to get at your money.

You’re also going to have to think about others who will be desperate enough to seize your wealth — especially if you live in a city or even the suburbs of a large metropolitan area.

Privacy — keeping a low profile for yourself and your assets — will be among your best defenses.

And in the third emergency guide I created for you — “The Invisible Man: Hide Your Assets from Prying Eyes” — I give you simple, legal ways to enhance your privacy and protect what you own — and more — including ...

-

What Washington snoops can already know about you: The four surprising ways Washington spies on you and how the information it collects could be used against you as this crisis unfolds.

-

Six outrageous assaults on your money and liberty: The shocking steps Washington could take to violate your rights as this crisis worsens.

-

The most important single way to protect your money and your life, plus five more: Quickly and easily get your money off of the government’s radar screen ... and more!

STEP #4 is to own mankind’s greatest crisis hedge — GOLD: Since we first began recommending them in 1999, gold bullion coins and bars have risen by 615%. An initial $10,000 investment is worth more than $71,500 today.

And just since 2008, gold bullion coins and bars have risen more than $600 in value.

So, I strongly recommend that you hold a reasonable portion of your ready money in physical bullion — mostly smaller denomination bullion coins.

Did you know that you can actually get some free gold simply by selecting the right bullion coins to buy?

It’s true! And the fourth report we’ve prepared for you — "The Weiss Guide to Prudent Gold & Silver Investment" — shows you how.

Plus, I give you ...

-

Our list of bullion dealers, including which ones to avoid ...

-

How to hold your gold bullion offshore for greater privacy ...

-

How to securely store your precious metals ...

-

Why keeping part of your holdings in smaller gold and silver coins could prove to be a godsend for you, and ...

-

Much more.

STEP #5 is to hedge against financial losses — With investments designed to spin off substantial profits when the economy implodes.

You don’t need a Ph.D. in economics to know that the crisis I’ve described in this presentation is NOT going to be good for most stocks.

So, your first priority as an investor is to make sure that you do not own the stocks that are most likely to plunge.

And one of the services my company provides is a powerful free tool you can use to help decide precisely which ones they are.

Your second priority is to harness the power of those declines — not merely with a special class of investments that rise in spite of them, but with things that soar because of them!

In your next free report — “Shield Your Wealth in Terrible Times” — I give you our comprehensive strategy for using these muscle-bound investments as portfolio insurance — to protect your other investments against loss.

In the last crisis, for example, the bank stocks we warned about plunged up to 98%.

Investors heeding our warnings could have avoided those losses entirely. Plus, you also could have used our warnings to go for gains of 51% ... 76% ... up to 99% and even more with simple investments that anyone can buy in a standard brokerage account. I show you how in this free emergency guide.

STEP #6 is to go for truly huge gains as this crisis unfolds: At a time like this, a powerful offense is your best defense.

Building up a substantial cash reserve is the best way to ensure your family’s safety and comfort.

Plus, when you see a trend that is this imminent, this clearly defined, and this powerful, you may want to take some risk and go for the greatest profit opportunities ever seen in modern history.

I’m talking about cryptocurrencies, the ultimate place to protect your money (and your privacy) during a debt crisis.

Weiss Ratings is the first and only company in the world to rate cryptocurrencies. Money Magazine, Forbes, Fox Business, CNBC and many others have applauded and quoted our scientific cryptocurrency ratings.

They’ve done so not only because our highest rated cryptocurrencies have enjoyed massive appreciation but also because our low rating of Bitcoin could have helped protect investors of the recent Bitcoin crash.

Plus, it’s because our cryptocurrency ratings are the only robust tool investors have to cut through the hype and invest in the ones with the most advanced technology that will truly revolutionize finance.

In your free copy of “Cryptocurrencies: How to Make Life-Changing Profits in The Ultimate Crisis Investment,” — we introduce you to the highest-ranked coins on our Weiss Ratings list.

In just three months last year, one of those cryptocurrencies surged by 3,343%, enough to turn $10,000 into $344,300.

Then, in April of 2018, soon after we issued an alert to buy it again, it skyrocketed by over 300% in just a few weeks, making new, all-time highs.

Another cryptocurrency near the top of our list did even better: It rose by $5,849%, enough to turn $10,000 into $594,960 in just two months. And now, after a major correction, it’s beginning to surge again.

In “Cryptocurrencies: How to Make Life-Changing Profits with the Ultimate Crisis Investment,” we show you exactly what to buy, when and how. Plus, we also warn you about the risks and how to reduce them.

You can download all six

of these reports instantly

and be reading them

just a few minutes from now!

I’ll invite you to do just that in a moment.

First, let me tell you why my company is going to such extreme lengths to get this indispensable information to you.

TURNED $352,000 INTO MORE THAN $2.1 MILLION!

“I started my subscription in 1998. Thanks to the sound financial advice of the Safe Money Report and some fortunate investment choices, my original $352,000 in my 401(k) is now worth $2,171,000.”

— J.D., Medina, Ohio

Frankly, we’ve never seen a political and financial crisis that even comes close to equaling the one we see ahead. And I’m deeply concerned that millions of other Americans could lose nearly everything.

That’s why I prepared these six emergency survival guides for you. They won’t cost you anything and you can download them right now.

All I ask is that you also take a look at my monthly newsletter, Safe Money Report.

Safe Money Report is our flagship publication here at Weiss Ratings. It has the distinction of having warned investors of every major financial threat of the past 42 years.

As its editor, I bring you everything you need to protect and grow your wealth in these troubling times.

You may have seen me on CNBC or on Fox Business News, or on one of the many other financial programs where I have regularly appeared.

You also may have read about me in the Washington Post, New York Times, Wall Street Journal, Dow Jones Newswire, Associated Press, Reuters, and many other news outlets.

The media is right to turn to us for our analysis: If you had been listening to us since 2005, you wouldn’t have had to lose a dime in the housing bust, debt crisis or market crash ...

You could have actually grown your wealth even while others were losing theirs!

And if you agree to check out Safe Money Report for yourself, I’ll give you instant access to all six of the emergency survival guides I just described:

- “Four Horsemen of the American Apocalypse: Protect Yourself and Profit”

- “The Weiss Ratings “X” LIST: America’s Weakest and Strongest Stocks”

- “The Invisible Man: Hide Your Assets from Prying Eyes”

- “The Weiss Guide to Prudent Gold and Silver Investment”

- “Shield Your Wealth in Terrible Times”

- “Cryptocurrencies: How to Make Life-Changing Profits with the Ultimate Crisis Investment”

Just agree to examine my Safe Money Report and I’ll send you a fresh new issue every month.

I will make sure you have all of our recommendations for the investments we’re counting on to grow your wealth as this crisis continues to intensify.

Plus, as an extra bonus, I will also give you a second subscription — to our 3-times-weekly e-mail alert, the Weiss Ratings Daily Briefing — to make sure you’re up to date on the most critical new developments, threats and opportunities.

SAVE $199 NOW

— SATISFACTION GUARANTEED

And I’m making it remarkably easy for you to grab your free reports and also to check out Safe Money Report for yourself.

“My portfolio has continued to increase in both safety and in value.

“I can’t thank you enough.”

— S.M., Louisville, Kentucky

Normally, a full year of Safe Money Report is $228. But right now, you can test-drive Safe Money Report for just $29. That’s 87% below our regular rate.

But you don’t even have to make your final decision now.

Just join me and get your six free reports now. Then, take all the time you like — up to a full year — to make your final decision. Even if you decide to cancel on the very last day of your membership, I owe you a full refund.

And I’ll insist that you keep all six free reports and every issue of Safe Money Report we’ve sent you in the meantime.

Plus, if you join me in Safe Money Report within the next ten minutes, I’ll also give you our very latest ratings on YOUR stocks, ETFs or mutual funds.

“I am retired and you have given my portfolio a very healthy boost! Thank you.”

— J.H., Longboat Key, Florida

Look. I wish I could tell you that our leaders will pull us back from the brink in the nick of time.

Sadly, though, they’re too busy fighting each other, even threatening impeachment. Even if they could make peace, it’s probably too late.

The mountain of debt that Washington has created — and the huge risks our Federal Reserve has taken — virtually guarantee that America will wind up facing many of the same disasters faced by other nations that made similar blunders.

The numbers don’t lie. Yes, it’s a crying shame that our great nation has come to this. It didn’t HAVE to happen.

Never before has a nation possessed the vast riches that America has amassed.

Never before have 326 million souls enjoyed such personal wealth, comfort and security.

And never before has so much been squandered so needlessly or in such a thoughtless manner.

“We started about eight years ago. Our money is growing and we sleep a lot easier knowing our investments are safer.”

— G.C., Savannah, Georgia

I am committed to getting you through this great crisis with your wealth intact and growing — and the six free emergency guides are a great place to begin your preparations.

When you click on the button below, it will take you to a secure order form where you can make your final decision.

Then, after you finish your purchase, check your inbox for an email containing all the information you need to download all of your free reports and access all your free ratings.

To get your free reports and ratings now, just click below.

Best wishes,

Mike Larson, Editor

Safe Money Report