The Financial

Pandemic of 2022

How to Protect Your Finances

and Build Wealth Swiftly

by Martin D. Weiss, PhD

This is a very solemn moment in history — a time for prayer, but also a time for action.

We believe the Delta variant of COVID-19 is about to create a new financial nightmare in America.

It’s unleashing a chain of devastating economic events that will change almost everything in your life.

This is urgent. Because what we see coming is no ordinary financial crisis. It’s far bigger than anything we’ve ever experienced in our lifetime, and it’s likely to strike with far greater SPEED. So, if you think what’s happened so far is shocking, brace yourself for what we see coming next.

My name is Martin Weiss, and I’m the founder of Weiss Ratings, a company I began 50 years ago to help Americans of all walks of life keep their money safe in good times … and in bad times as well.

I'm not here to frighten you. God knows, there's more than enough fear already in America. Rather, I’m here to give you the facts about how we see this crisis impacting your money and how you can find safety in an unsafe world.

Because, despite what you may hear from Washington or Wall Street, our financial world today is not safe, and this isn’t the first time I’ve said so.

Before every major crisis, we have published lists ... I call them ENDANGERED lists — naming thousands of stocks, exchange-traded funds (ETFs) and mutual funds that are vulnerable to a crash.

As a result, we have not only helped investors avoid the stock market crashes, but we’ve also helped them make money in the process.

Other research firms typically help you make money only when the market is going up. Their mantra is almost always “buy, buy, buy.” So you will almost definitely LOSE money when things turn down.

Our 50 years of history stand as proof that we help investors make money in both up markets AND down markets.

I’ll tell you more about that in a moment. Right now, I want to focus on a more urgent question: How do you protect yourself from the disaster that nearly everyone blindly assumes could never happen?

That complacency is, in and of itself, a warning sign. When investors are caught by surprise ... when everyone suddenly rushes for the exits all at once ...

Like we saw in the fall of Afghanistan. Like we saw in the Debt Crisis of 2008. Like my father experienced in the Crash of 1929.

And like we saw in every sudden crisis in history. Today, in this short time we have together, I’ll give you a clear roadmap about what’s likely to happen.

When the stock market was peaking, we issued a landmark trade alert, telling our subscribers to sell all their long ETF positions, including SPY (which tracks the S&P 500) and QQQ (which tracks the Nasdaq 100).

I’ll give you immediate free access to our lists of investments that are in gravest danger … and to our lists that will guide you to investments that we believe are most likely to survive — and even thrive — in the worst of times.

I’ll walk you through seven steps you can take right now. These simple steps are designed to help you protect everything you have — your stocks and mutual funds, your 401(k) and IRA, your real estate and your savings.

Plus, with these steps, you could also turn the next wave of this crisis into an opportunity to swiftly build your wealth.

As I said, this is not something we can ignore. It’s time to act because we believe this financial crisis will strike swiftly, catching so any investors completely off guard.

Not long ago, you got a sneak preview.

On March 12, 2020, the Dow Jones Industrials crashed 10%, almost as much as the second worst day in the Crash of ’29.

And two days later, the Dow crashed even more — plunging nearly 13%, more than the single worst day in the Crash of ‘29.

All this happened at a time when the economy was still strong … when there was virtually no consumer price inflation in America … when the Federal Reserve still had the power to come to the rescue … when the people still TRUSTED the federal government.

Soon after stocks crashed, the Fed printed more money than ever before in history. Congress embarked on the single largest spending spree of all time. And it SEEMED the crisis had ended.

But did it really? Well, fast-forward to today and take a closer look.

According to the U.S. Treasury department, the government has spent so much money so quickly that the federal budget deficit has suddenly ballooned to $3.1 trillion. That’s more than TRIPLE what the deficit was when the market crashed in 2020.

And according to the Federal Reserve, it has printed more new paper money SINCE the pandemic began than the TOTAL amount it printed in its entire 107-year history.

So, it should come as no surprise that Wall Street was delighted with all the free money coming its way. Free money from government spending. Free money from the Fed’s printing presses. Free money landing in the pockets of consumers. Free money driving stock prices higher. Free money everywhere.

They thought the crisis was over. They thought they had found nirvana. But they thought wrong.

And that’s even before the next pandemic crisis, which we see looming just ahead. Almost everything you own could be in jeopardy, even things that you thought would be safe. Not just money you have in stocks, but also in bonds and even banks. And not just right now, but for many months to come.

Even if the next panic does not turn out to be as bad as we fear, you could lose half your money, and in many situations, you could lose almost all your money.

I’ll explain why in a moment. But before we go there, I want to be perfectly clear about one thing: This will not be the end of America. Our country’s forefathers — and our own ancestors — were able to overcome threats that were even worse. We will ultimately overcome this threat too.

Trouble is, it could take quite a few years to get there.

I don’t want you to suffer through years … not even one month.

In fact, if you take the few simple steps

I will outline today, not only can you survive this

crisis with your money intact, you can actually come out far ahead of the game.

If you do that, you won’t be the only one who benefits. Everyone in your family will be better off, too.

And when the economy is finally ready for a true recovery, the country will need savers and investors like you — people who keep their money safe now, who wait for the right time and who reinvest in America.

Today, it’s far too soon to talk about a true recovery.

The way we see it, as the pandemic rages on in the U.S. and around the world, thousands of companies, big and small, will go bankrupt. Millions of people will be evicted from their homes. Millions more will be thrown out of work. Even the rich will take a big hit, and they have the most money to lose.

Yes, the government can bail out some companies and some of the people most of the time … But can the government bail out everyone all the time? Can the government stop the stock market from falling?

And here’s the big question: If the U.S. Government spends too much money to bail out everyone else, who will bail out the U.S. government itself?

For now, what I can say for sure is this: No matter what the government does, this phase of the pandemic will make the last phase —the pandemic panic of 2020 — pale by comparison.

When the dust settles, it will have destroyed the American dream for millions. And for most American families, nothing will ever be the same again.

I don’t want that for you.

Now, maybe you’re thinking that once the pandemic ends, then the financial crisis will end, too.

If I were you, I would not bet on that either.

Long before COVID-19 and long before the Delta variant appeared, we already had all the ingredients of a serious financial crisis here in America.

This crisis began a long time ago with years of government manipulations, years of bad advice, dishonest ratings — and lies — that lured millions of homeowners into debt, that spurred millions of investors to throw caution to the wind, that drove nearly everyone to take unprecedented risks with their hard-earned money.

If you find that hard to believe, I’ll give you all the facts here. I’ll show you how most companies, even most banks, are not prepared for this crisis. I’ll tell how MANY of them were ALREADY in deep trouble before the crisis began.

Fortunately, a small minority of Americans will escape the dangers and even use this crisis to build substantial wealth. If you act promptly on the simple recommendations I’m about to give you, you could be one of them.

You see, in 1971, I started my ratings and research company, the successor of my father’s company, which he started decades before that. Since then, we’ve built a massive database of more than 52,000 companies and investments — stocks, ETFs, mutual funds plus banks and insurance companies.

And today, that entire database has been modernized by a team of analysts, mathematicians and data scientists, using advanced computer models.

That’s how we warned about the bank failures of the 1980s. That’s how we warned about the Dot-Com bust of the early 2000s and the great Debt Crisis of 2008.

But we don’t just issue warnings. We also issue RATINGS, the Weiss Ratings. We provide a letter grade from A to E on nearly every stock, every ETF, every mutual fund and every financial institution in America.

With those ratings, we NAME the stocks that are likely to fall the most. And we NAME the banks that are most likely to go bankrupt.

Before the Debt Crisis of 2008, for example, we warned about nearly every major institution that failed … and we did so months in advance.

- We named Lehman Brothers as a candidate for failure 182 days before it went bankrupt.

- We named Fannie Mae over one year in advance …

- Citibank, Wachovia Bank and Washington Mutual Bank, 51 days in advance …

- General Motors five months in advance, and many more.

Among the 465 banks that failed during and after the debt crisis, we warned consumers about 464. Yeah, we missed one, but that was only because the bank had committed fraud — it fraudulently kept information hidden from everyone.

These kinds of on-target warnings prompted Worth magazine to say our “record is so good compared with that of our competitors ... consumers need look no further.”

And the New York Times said we were “the first to see the dangers and say so unambiguously.”

Barron’s wrote, Weiss is “the leader in identifying vulnerable companies.”

Chris Ruddy, Founder of Newsmax and a close friend of President Trump, said our “prediction of the current economic crisis is uncanny.”

And Louis Rukeyser of Wall Street Week wrote that we provide a tougher service.

You see, our roadmap for surviving and thriving through a crisis wasn’t thrown together after the crash hit.

It’s built on a foundation of prudent investing that goes back nearly a century — to the Crash of 1929 and the Great Depression of the 1930s.

Martin Weiss’s father, Irving Weiss, borrowed $500 from his mother and turned it into about $100,000 in the great bear market of the early 1930s. You could do something similar today with much less risk.

That’s when my father and mentor, Irving Weiss, discovered the foundational secrets behind our business today, and that’s what led him to make a final prediction before he passed away.

That prediction is literally coming true in real time — right now. So let me roll back the clock to show you how he knew.

Irving Weiss first went to work on Wall Street in the late 1920s as a Customer’s Man, which nowadays they’d call … a stockbroker.

The stock market of the 1920s would be eerily familiar to anyone who has lived through the current crisis.

It was enjoying a roaring bull market that was unusually long, just like it had been doing in recent years. And the market was unusually out of sync with the tough times that most working American families were experiencing ... also much like recent years.

So when the Dow Jones Industrials kept going up in the first 10 months of 1929, my father didn’t trust it. He didn’t trust the DISCONNECT between the great times on Wall Street and the TOUGH times in the neighborhood where he lived.

In 1929, Wall Street veterans laughed at Weiss’s warnings of a crash. “He’s just a kid,” they said. “What does he know?” As it turned out, he not only knew to get his clients out of the market before the crash, he also learned to turn the decline into an opportunity to build substantial wealth.

He didn’t have many clients yet. Just friends and family. But he told them to get the heck out of the market. In his office, the VETERAN stockbrokers laughed at him. “Weiss is just a kid,” they said. “What does he know?”

And then came Black Monday, October 28, 1929. The market plunged the equivalent of about 4,500 points in the Dow Jones of today. Then, on the next day, it plunged the equivalent of ANOTHER 4,000 points. It was like an 8,500-point crash in just 48 hours.

Suddenly, Irving was a hero, and the word got around that he was the only one who saw it coming. That’s when he decided to do more, MUCH more. He decided to actually MAKE money from the crash.

He had learned accounting in school. So he knew the numbers really well. He collected data on as many companies as he could. He put the numbers down on the large, green sheets that bookkeepers used, spreadsheets actually. And he created a series of formulas that would later become the foundation for our computer models.

Using his formulas, he identified the companies that he thought were the riskiest. He called them “Dogs of the Dow.”

Then, in April of 1930, after a six-month stock market rally, Irving borrowed $500 from his mother, my grandmother. And he started selling short the Dogs.

When the market plunged, he took profits. Whenever it rallied, he shorted again.

And by the time the Dow hit rock bottom in 1932, he had over $100,000, or nearly $2 million in today’s money.

He made about 200 times his money.

Not bad for a young man who was just a rookie on Wall Street, right?

So you’re probably wondering: When our lowest-rated stocks crash, could YOU do something similar — both to protect your wealth from downside AND build your wealth swiftly as this crisis unfolds?

The answer is yes.

And it all comes back to one of the last predictions Dad made before he passed away.

One of the last predictions my father

made before he passed away …

He warned that, someday, inflation would rear its ugly head, the stock market would crash again, and America would suffer a second great depression. He didn’t say exactly WHEN it would happen. But he did tell me HOW it would happen.

“This crisis will be so severe,” he predicted, “all the government’s money printing and all the government’s spending will still not be enough to put things back together again. Inflation will go through the roof. The U.S. dollar will collapse. And people’s savings will be practically worthless. Eventually, the country will recover. But it will take years, many years for that to happen.”

Now, we believe that crisis is nearly upon us, and it’s so new, it still has no name. I call it the financial pandemic. But whatever you name it, the dire reality is staring us the face:

According to the U.S. Labor Department, after the first wave of the pandemic, more people were thrown out of work more quickly than during the Great Recession of 2008-2009 … and even more than during the Great Depression of the 1930s.

And according to a Bloomberg report, more businesses failed more quickly than at any time in history.

But if you think that’s bad, consider this:

Over 11 million American families are behind on their rent or mortgage payments. Homeowners alone are estimated to owe almost $90 billion in missed payments. And among them, all face eviction and are at risk of losing housing, according to the U.S. government.

The Wall Street Journal reports that 600,000 small- and medium-sized businesses have closed their doors forever.

And based on our Weiss Ratings, we know that thousands of larger companies are also in danger.

There’s simply no way the government can save them all!

So, before you and I part today I’ll give you access to my family’s — and my company’s — most precious crisis-investing guidance. That includes our current ENDANGERED STOCK LISTS and our lists of the strongest companies, too.

But I must warn you … our endangered lists are very long, and that’s the best evidence I can give you … that this is not just a health crisis. It’s also a financial crisis that has been building up for years.

Even before this phase of the crisis began, our endangered lists included over 7,000 stocks, ETFs and mutual funds.

More than 1,000 banks and credit unions have insufficient capital to withstand an ordinary recession. Another 3,000 are unprepared for a depression.

And now, I’m sad to say, as the Delta wave hits and inflation surges, our endangered lists are getting even longer.

So, the probability is high — and getting higher — that most of your stocks and mutual funds and even your bank could be ON the endangered list.

Not all companies are in bad financial shape, mind you. There are still strong ones, and I’ll give you those lists, too.

But whether good or bad, you just need to know. And you need to know now, before the financial pandemic returns in full force.

Plus, there’s one more thing I want you to know …

Until now, we charged a small fee for folks to access our ratings.

You see, we’re not like Standard & Poor’s, Moody’s or Fitch. Because when THEY issue a rating to a company, they get paid by that company FOR the rating.

Their ratings are bought and paid for by the rated companies.

Many smart people think that’s a serious conflict of interest, and I agree. Plus, it’s also one of the reasons why millions of people who followed their ratings lost so much money in the last debt crisis.

We never do business that way. We have never taken a dime and never WILL take a DIME from the companies we rate. Our only source of revenues has been the end user of our information, average people who want to be safe and make some money, too.

But because of this crisis, I don’t want any barriers between our ratings and your safety. So, for the duration of the crisis, I’ve opened up access to all of our ratings lists for free. And I’ll show you how to get them before we’re done here today.

First though, I want to answer the big question I raised earlier … that’s probably on your mind right now:

Will the government be able to print and spend enough money to make a lasting difference for you and your family?

Sure, the government can bail out some companies some of the time.

But since the last debt crisis, America’s companies have been piling up debt like there’s no tomorrow. Nearly $7 trillion dollars’ worth. And the biggest surge has been in the riskiest kind of corporate debt.

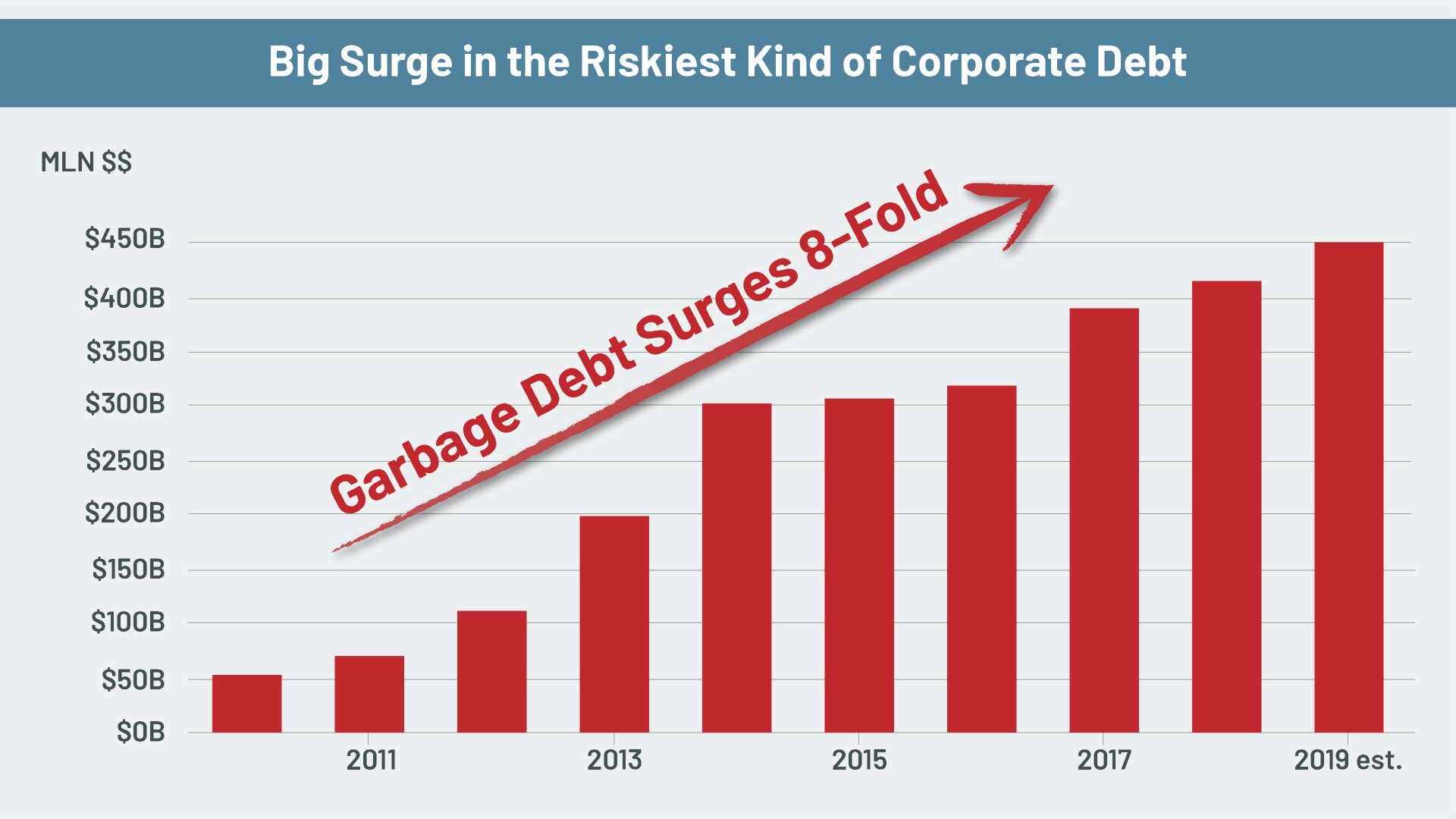

These types of debt are called “Covenant-Lite Loans.” They are the riskiest of all because they don’t include strict rules on how much debt borrowers can take on or how much cash they need to keep on hand. Our senior analyst, Mike Larson, calls it “garbage debt.” And this garbage debt has surged roughly eight times over since 2010 to an all-time record of more than $400 billion.

In fact, the garbage debt now represents a whopping 75% of all leveraged loans — far and away the highest market share of all time.

There’s very little the government can do to make those financially sick companies healthy again.

And there’s NOTHING the government can do to prevent a plunge in the earnings of companies vulnerable to the next phase of this crisis.

They can’t stop companies from losing money! And that’s exactly what we saw in the first phase of this crisis. All kinds of companies — giant oil companies, auto manufactures, airlines, hotel chains, restaurants, small family business — all of them lost money. Hand over fist.

Looking ahead, there’s nothing the government can do to stop companies from laying off millions of workers … that’s what they did in the first phase of this crisis, and that’s what they’ll do in the next phase.

There’s nothing the government can do to stop companies from cancelling their stock dividends. Again, that’s what they did in the first phase, and that’s what they’ll do again.

Huge companies like Ford Motor, Occidental Petroleum, Boeing, Delta and Freeport-McMoRan are just a few of the many that slashed their dividends or canceled them entirely.

And obviously, as we’ve seen time and time again over the years, ultimately, there’s nothing the government can do to stop the stock market from falling.

How far will the market fall?

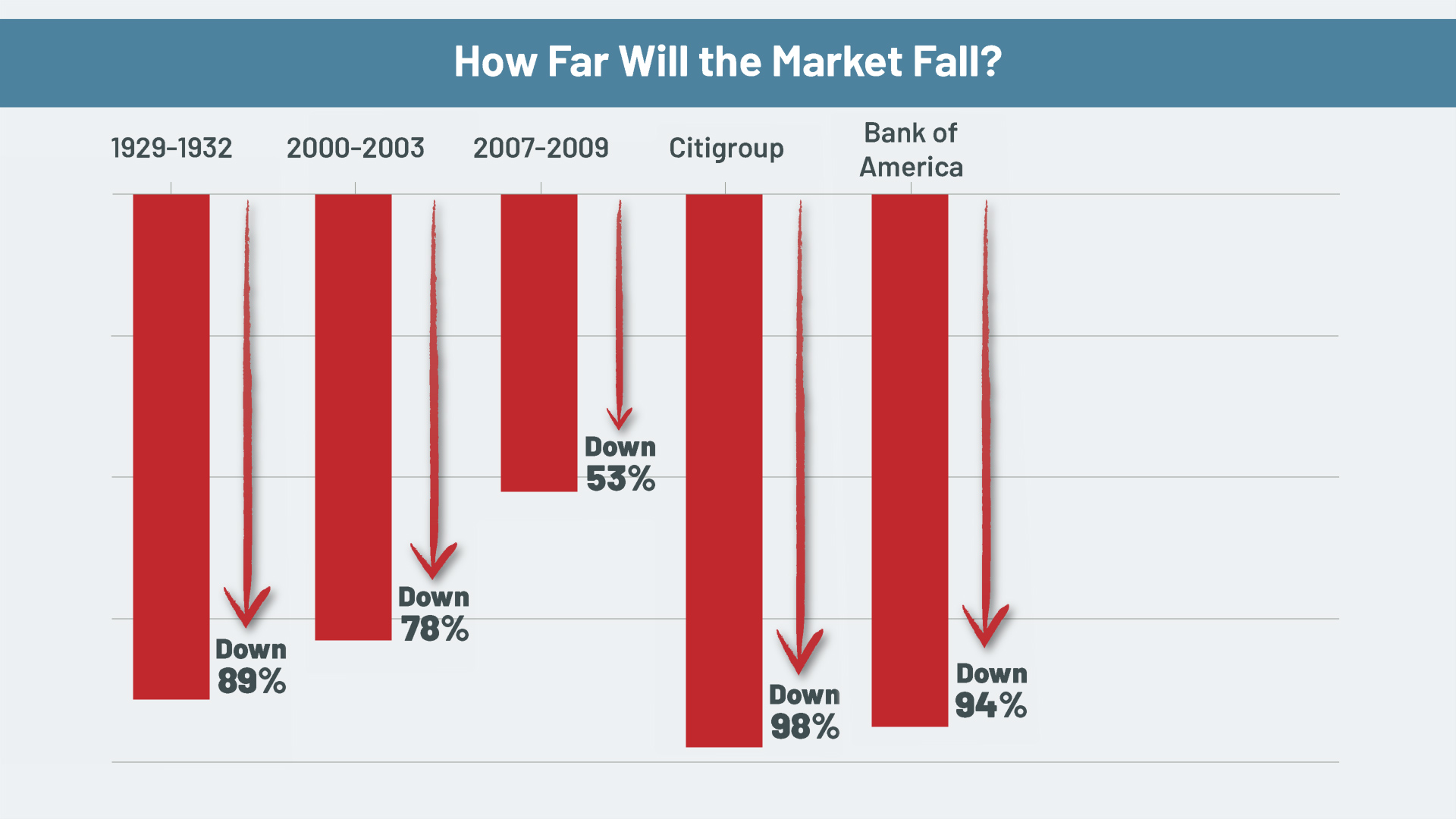

Well, in the Crash of 1929 and the big decline that followed, the average stock in the Dow Jones Industrials fell 89%.

In the early 2000s, the average stock in Nasdaq Composite Index fell by 78%.

And in the Debt Crisis, the average stock in the S&P 500 fell 53%.

So that gives you some parameters of how much the average stock can go down in a crash — anywhere from about half to as much as about nine-tenths.

That’s bad enough, right? But notice I said the “average” stock … and

Not ALL stocks are average.

- In the early 2000s, for example, a lot of supposedly “great” internet stocks lost 99%, even 100% of their value..

- In the Debt Crisis of 2008, shares in the largest bank in the United States, Citigroup, fell by 98%.

- Shares in the second largest, Bank of America, fell 94%.

And these giant banks and others were on our endangered lists many months before they failed. So, anyone heeding our warnings would have saved a fortune back then … another reason it’s important for you to heed my warnings today.

Right now, if you have stocks or mutual funds, depending on which stocks you own and how this crisis unfolds, it’s fair to assume you could lose anywhere from half your money to almost all of your money.

And the more the market rallies despite this crisis swirling all around us, the greater the danger.

Most people on Wall Street and around the country are still counting on the government to do all the heavy lifting — to dish out money to the public, to bail out companies that fail.

But there’s a simple reality they seem to be ignoring:

The government has no money in

reserve, no savings whatsoever.

Instead, it’s running a huge deficit and it’s deep in debt.

Like I said — the federal budget deficit is over $3 trillion. And even in its rosiest scenario, the U.S. Congressional Budget Office projects trillion-dollar deficits for years to come.

So, who’s going to finance that debt? And if this crisis gets a lot worse, who in the world would be able to bail out the United States Government?

Don’t get me wrong. I’m not predicting that the U.S. government is going default outright. I’m just stating a fact of life that you must always bear in mind: There is a limit to how much the government can do!

The government cannot bail out every small business and every big corporation in America.

It cannot bail out every city and state in trouble. It cannot bail out all the people who go broke.

So, you cannot — you MUST not — rely on the government to bail YOU out either! Only YOU can truly protect your finances. You’re the only one who can take your destiny in your own hands to save yourself and your family from financial disaster.

Even better, you can use our ratings to avoid

stocks that plunge and own stocks that surge.

In the last crisis for example, you could have used our ratings to avoid bank stocks that plunged as much as 99% while owning stocks that surged 102% ... 103% ... 115% ... up to 121%.

And since 2007, if you had followed our stock ratings and our strategy for using them, you could have made a total return of 1,669%, including the period when the market was down.

That means you could have beaten Warren Buffett’s Berkshire Hathaway by six-to-one. And you could have outperformed the S&P 500 by five-to-one.

This is important … So, let me repeat what I said before: Our ratings not only can help you avoid big losses, they can also help you make money with investments that surge.

Let’s say, for example, that in the last crisis, you heeded our forecast of banking collapses and bought a special kind of ETF that goes up when bank stocks go down.

- Between September 19 and November 21 of 2008, you could have made a gain of 144%. A $10,000 investment would have turned into $24,400.

- And during that same period, another investment designed to profit from the real estate decline posted a 354.9% gain — enough to more than quadruple your money. Your $10,000 would have grown to $45,490.

Now, in THIS crisis, the profit

the opportunities could be even larger.

For example, you can buy special investments to profit directly from a stock market crash. The faster and deeper the market falls, the more money you could make.

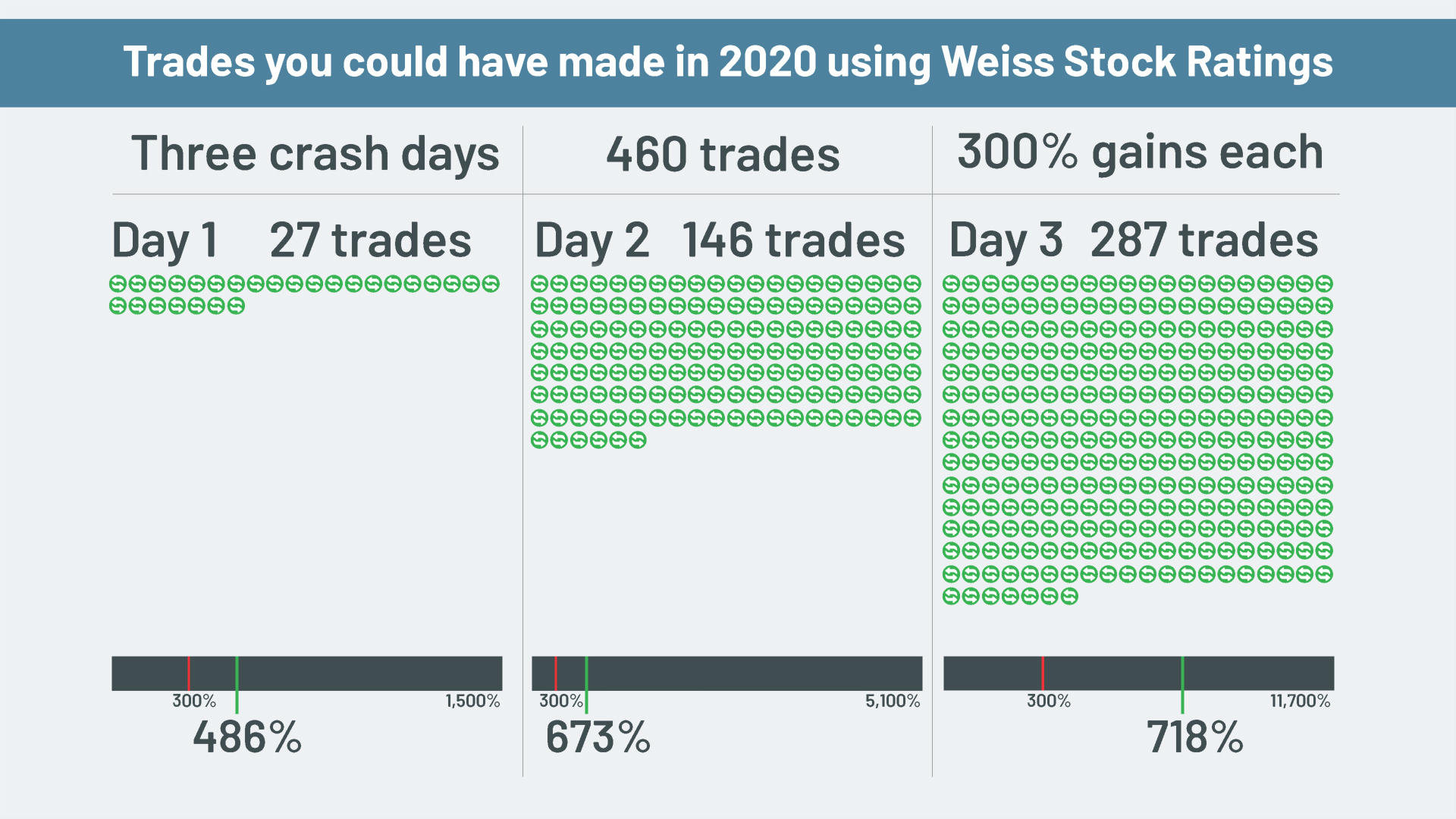

In the Crash of 2020, for example, I looked at three separate days ... and we counted 460 distinct trades selected by our Weiss stock ratings that could have made you AT LEAST 300% gains.

- On the first crash day, we saw 27 trades that returned gains ranging from 300% to 1,500%. The AVERAGE gain was 486%.

- On the second crash day, the numbers went parabolic. We saw 146 Weiss Ratings winners, ranging from 300% to 5,100%. Average gain: 673%.

- On the third crash day, it was even better: 287 winners, ranging from 300% to 11,700%. Average gain: 718%.

Even if you invested only $10,000, and even if you chose the least profitable of these trades, you could have made about $30,000 on the first day, over $30,000 on the second day and another $30,000-plus on the third day. That’s a total of more than $90,000 in gains.

Or, if you invested those same $10,000 in just the average trades — not the best ones mind you, just the average ones — you could have made $48,600 on day one, $67,300 on day two, and $71,800 on day three. That’s a total of $187,700!

Now I want to warn you, any kind of investing involves risk, and that’s equally true if you bet on the market going up, or you bet on the market going down.

But for money you can afford to risk, you should consider it seriously for two reasons …

First, because of the tremendous profit potential I just told you about. It’s mindboggling. While most other investors are losing their shirts and panicking about their future, you could be banking tens of thousands of dollars, giving you and your family the security they need.

Second, because it’s like buying crash insurance.

Let’s say you own stocks that are vulnerable to a crash, especially stocks that are on our endangered list. And suppose you’re unwilling or unable to sell them.

Maybe you have a stake in the company you work for and it’s not vested yet.

Maybe the shares are in your pension plan or a family estate that you don’t control. Plus, here’s another situation: A family business.

There are exceptions, of course, but for the most part, even if you wanted to, it would probably be very tough to sell your family business in the middle of a major crisis.

What do you do?

Well, this is where a hedge can be important. It’s like a firewall that you build around your assets. You have assets that fall in value in this kind of crisis, right?

You buy investments that are designed to go UP precisely when those assets are going down. That’s what I mean by a hedge. And that’s what those super-profitable trades can do for you.

You need these of kinds of strategies. Not next year. Not tomorrow. But today!

Plus, you also need a solid plan designed to profit from rising markets in a recovery. I’m not talking about quick, in-and-out stock trading. I’m talking about finding the truly best stocks in the market, buying them at bargain prices and sticking with them for years.

This is where our ratings on the strongest stocks truly shine.

These are the companies that have the best potential to save America. If you had bought just one of them when we first gave it a “buy” rating, you’d be looking at a gain of 2,108% — enough to turn every $10,000 invested into $220,000.

Now, you’re probably thinking that was some small-cap start-up that no one ever heard of.

But it was actually Thermo Fisher Scientific, one of the largest healthcare companies in the world and a leader in COVID-19 testing.

Or maybe you’re thinking that I cherry-picked our biggest winner.

Not even close!

Investors who acted on our “buy” signal for our biggest winner, could have a gain of 25,543% today. That’s enough to turn $10,000 into more than $2.5 million! All in a single trade! You’d also have …

- 1,228% on Global Payments, a major player behind the boom in online shopping.

- 1,839% on Amphenol, which makes the hardware that keeps the entire internet connected.

- 2,295% on Manhattan Associates 3,537% on Ansys. That’s 36 times your money, enough to turn $10,000 into more than $363,000.

- 4,758% on Tyler Technologies or 48 times your money. Your $10,000 would be worth more than $485,000 today.

- 6,047% on Deckers Outdoor Corporation, or over 60 times your money, turning every $10,000 invested into an even $614,000.

I could go on and on …

In fact, we issued 39 “buy” signals that could have made you a minimum of 10 times your money.

And here’s our biggest winner of all — the one I said I’d name for you now … Its Apple, which has given us a whopping gain of 25,543%.

You heard that right. Apple, Inc.

Just with our single “buy” signal on Apple, you could have made over 256 times your money, enough to turn every $10,000 into over $2.5 million today.

Of course these gains didn’t happen overnight. They occurred over the course of several years.

Should you rush out and buy all these stocks right now? No, as I said, the key is to buy them when a true recovery is about to begin — not in an artificial recovery manufactured by a bankrupt government.

Look, I know that the vast majority of Americans will fail to heed these warnings I’ve issued today and fail to get ready for the next phase of this crisis.

But I sincerely hope — for you and your family’s sake — that you are not one of them.

The precautions required to weather this storm are not difficult.

And even if the storm turns out to be less severe than we fear, the worst that’ll happen is that you’ll sleep better at night. And potentially make some money in the process.

Because there is some good news ...

You have some time to prepare. But not much time.

Here are seven steps I recommend you begin taking immediately to protect yourself and your loved ones from the coming storm ...

STEP 1. If you hold stocks or stock mutual funds — in your regular brokerage account, in your 401(k) or in your IRA — sell the most vulnerable.

Which are they? You can find out by simply checking the endangered list I send you.

STEP 2. Buy hedges. There are many good ones to choose from, some more conservative, some more speculative. Unless you’re a very experienced investor, I don’t recommend you buy the speculative ones on your own. But here’s one that can help get you started. It’s DOG, D-O-G. For every 10% decline in the Dow Jones Industrial Average, this ETF is designed to go UP 10%.

STEP 3. Identify the winners. A major side effect of the financial pandemic is a massive shift of capital from old-tech, brick-and-mortar industries that are dying to high-tech, online companies that are surging.

How do you know which ones they are? Just check our latest list of the Highest-rated companies on the market today.

STEP 4. is all about cash. Even if it pays practically zero interest, don’t underestimate the power of cash in a crisis like this. You will need some cash for safety, for emergencies, and later, to pick up some amazing bargains on very valuable assets.

So, those are the basics … But there’s so much more I need to tell you to help you through this crisis, I couldn’t begin to cover it all in this presentation.

Go to download page.

That’s why we’ve just put the finishing touches on "Second Wave of the Financial Pandemic: Your Guide to Financial Safety.

In this indispensable emergency guide — based on nearly a century of experience in the markets going all the way back to the 1920s — we show you what to do immediately to protect your savings, to protect your investments, real estate and everything else you own.

We give you specific instructions on how to insulate your portfolio, how to insulate the value of your home and other real estate assets — no matter how bad things get.

PLUS, you’ll learn how you could actually make money with investments that are designed to soar as this crisis unfolds.

STEP 5. is our INSTANT INCOME strategy.

You know, a second, very unfortunate side effect of this crisis is the ridiculously LOW yield you can make today. On a one-year bank CD, for example, the average interest rate is less than 0.2%. So, if you plop down $10,000, all you get at the end of the year is a meager $20. And that’s BEFORE taxes and before all the money you lose to inflation!

Go to download page.

But I have a solution — a strategy that could help you generate unusually high cash flow almost every week of the year. We call it “instant income,” and we have just published a special report, entitled "Instant Income Revealed", which gives you a step-by-step guide.

Even without a very large account, this guide shows you how you could generate $1,000 or more in extra cash nearly every week.

STEP 6. Own mankind’s greatest crisis hedge: gold. Since we first began recommending them in 1999, gold bullion coins and bars have risen by 450%.

An initial investment of $10,000 is worth $55,000 today.

So, we strongly recommend that you hold a modest portion of your ready money in physical bullion — mostly smaller denomination bullion coins.

Go to download page.

Did you know that you can actually get some free gold by simply selecting the right bullion coins to buy? It’s true! And we’ll show you in the third report I've prepared for you — “The Weiss Guide to Prudent Gold & Silver Investment.”

STEP 7. Stay up to date with our lists of the weakest and strongest stocks.

One of the free services we are providing in this crisis is premium access to a powerful tool you can use to help see precisely which ones they are. And at a time like this, a powerful offense is your best defense.

Building up substantial profits that you can convert into cash reserves is the best way to ensure your family’s safety and comfort. Same art as prior version.

Go to download page.

Plus, in your copy of “America’s Weakest and Strongest Stocks & ETFs” — we introduce you to an entirely NEW way to invest: A way to keep your money growing no matter how rocky the political, social or financial situation becomes.

The data shows, that if you had used this strategy, you could have beaten the S&P 500 by five-to-one since 2007, with an overall return of 1,669%. And that period includes 2008, when stocks crashed!

That’s enough to turn a $25,000 portfolio into more than $442,000 or a $250,000 portfolio into $4.4 million!

You don’t need a lot of money. You don’t need to have a lot of experience as an investor. And you don’t even need to use exotic investment vehicles. In a moment, I’ll show you how to download all four of my gifts instantly, so you can start using them just a few minutes from now!

Download all 4 free reports here.

- Gift #1. Second Wave of the Financial Pandemic: Your Guide to Financial Safety

- Gift #2. Instant Income Revealed

- Gift #3. “The Weiss Guide to Prudent Gold & Silver Investment” and…

- Gift #4. America’s Weakest and Strongest Stocks & ETFs

All I ask is that you apply for a one-year subscription to our flagship investment letter, Safe Money Report, for just a few cents per day.

You can cancel and receive a full refund at any time during your 12 months with us, including up to the last day of your subscription.

And even if you decide to cancel, you can keep all four of the free guides you download today.

I trust this time we’ve spent together has given you a lot of information you can use immediately. And I look forward to welcoming you on board!

All the details are on the page I’ll take you to now.

Good luck and God bless!

Martin D. Weiss, Founder

Weiss Ratings