- Seven Urgent Steps for protecting your assets and making rapid-fire profits starting today.

- The biggest landmine stocks. If you own one, look out!

- How to build a protective firewall around any asset you own, while using investments that have produced gains of as much as 416%, 525% or even 1,700% in a single crash day. (Average, including all trades reviewed: 120%.)

If you want to learn how to start profiting immediately, jump here.

Chapter 1

The Stark Reality of Our Times Has a Profitable Silver Lining

As I write these words today, double-digit inflation is already in the cards and the Collapse of 2023 has barely begun.

But most investors continue to ignore the dangers.

They think the only time they can make money is in good times.

They don’t realize that some of the biggest profits can be made in the worst of times.

So, they grasp at any good news they possibly can.

They hear news about the economy recovering from the last vestiges of the pandemic.

They hear news that the government plans to fight inflation and prevent a recession.

And they rush to buy stocks.

This helps bring about what I call “sucker rallies” in the market, luring investors deeper into a great trap.

And again, most investors fail to realize that, instead of getting sucked in …

They can use stock market rallies to buy special investments that could be extremely profitable in the big declines that will follow.

Why do I predict the market will fall again?

Because the Fed has no choice but to raise interest rates faster than investors expect. And because even after they raise interest rates, they will remain FAR behind the curve in tackling inflation.

The silver lining: If you follow the simple steps I recommend in this ebook, not only can you protect your wealth from the ravages of this crisis, but you can also make the best of this crisis to build wealth swiftly.

The strategy you’re about to discover can help you turn this crisis in your favor. In fact, it has already shown us waves of massive gains were possible. The list includes 416% on Intuitive Surgical, 525% on Bed Bath & Beyond, 1,700% on NIO Limited and many more. All in a single crash day. (Average, including all trades reviewed: 120%.)

Click here if you want to jump to my chapter dedicated to this topic.

All these events are unfolding with great speed. So, to adapt, we also need to act with great speed.

That’s why I’m hosting a special series of emergency sessions online, and why I have rushed this ebook to you in a fraction of the time it normally would take.

In it, I alert you to what I predict will be the some of the biggest dangers — and biggest profit opportunities — in a lifetime.

I will show you how you can learn about them well in advance.

I will name the specific investments investors can buy to go for profits in the next decline … and then go for profits again when a true recovery gets under way.

But let’s face the facts. You and I cannot count on the government to stop inflation from raging or prevent a stock market crash.

This is the time to take your destiny into your own hands, and in the chapters that follow, I show you how.

It starts by taking a few, simple but powerful steps to protect yourself, right now.

Almost everything people own could be in jeopardy, even things thought to be safe — not just money in stocks, but also money in bonds and banks; not just right now, but for many months to come.

Chapter 2

The Next Phase of the Collapse Revealed: What’s Coming Now and How To Prepare

Some people seem to think rampant inflation is not a real concern, or even that this crisis is nearing an end.

Some folks even claim that the bear market is already behind us, and they’re loading up for “the next 10-year rally.”

Don’t make that mistake.

Everything is telling us that the crisis is just starting, and the next shoe is about to fall: A worldwide recession, followed by a tsunami of defaults and bankruptcies.

Tens of millions of Americans will default on their mortgages, on their auto loans and on their credit card payments.

Businesses, whether big or small, will do the same thing.

It will create a chain reaction: Finance companies will default on their obligations to their creditors. And hundreds of banks, especially those on our endangered list, will go bankrupt.

Corporate dominoes in Europe and Japan will fall at around the same time. And in emerging markets, as supply-chain disruptions disrupt their economies, the bankruptcies will be even more widespread.

A lot of people and a lot of corporate executives are counting on the government to save them. But if I were you, I wouldn’t bet on it.

Sure, the government can bail out some companies and some banks some of the time. But can the government bail out everyone all of the time? I’ll answer that question in Chapter 4.

But here’s the big question: If the U.S. government spends too much money to bail out everyone else, who will bail out the U.S. government itself?

Already, one thing is abundantly clear: No matter what the government has done, or plans to do, the inflation we’ve seen so far is already the worst in more than 40 years. And the impact on the economy has barely begun.

When the dust settles, I predict the collapse of 2023 will ruin the American dream for millions. And for most American families, nothing will ever be the same again.

I don’t want that for you.

Now, maybe you’re thinking: Once inflation settles down, then the financial crisis will end, too.

I wouldn’t bet on that either.

The reason is important. So, I want to underscore here: Before this scorching inflation appeared, we already had all the ingredients of a serious financial crisis in America.

In fact, this crisis actually began a long time ago with years of government manipulations, bad advice, dishonest financial ratings and even outright lies.

But it’s the Federal Reserve’s actions over the last 12 years that have really put America in a great bind — over $8 trillion in newly printed paper money, the true cause of the inflation that’s now rearing its ugly head.

It was the Fed’s monster $8 trillion money printing that encouraged Main Street and Wall Street to take on so much debt. It was the Fed that spurred millions of investors to throw caution to the wind. It was the Fed that drove nearly everyone to take unprecedented risks with their hard-earned money.

And now, the United States of America has a massive $57 trillion debt mountain that is about to implode, threatening a far more damaging downturn than what we saw in the Great Debt Crisis of 2008, when the economy almost collapsed on itself.

If you find that hard to believe, I understand. I’ll give you the evidence in a moment. I’ll show you how most people, most companies, even most banks in America are unprepared for this crisis.

I’ll tell you exactly how many of them were already in deep trouble before the crisis began.

And I’ll explain why I predict many will not survive.

But fortunately, a small minority of investors will escape the dangers and even use this crisis to build substantial wealth. If you act promptly on the simple recommendations I provide in this ebook, you could be one of them.

How? It starts by understanding the danger that could be lurking inside your current portfolio.

Chapter 3

How You Can Learn about the

Dangers and Opportunities

Ahead of Time

Over 50 years ago, I started my own rating and research company, the successor of my father’s company, which he started decades before that.

Since then, we’ve built a massive database of more than 56,000 companies and investments: stocks, ETFs, mutual funds and financial institutions.

Today, that entire database has been modernized by a team of analysts, mathematicians and data scientists, using advanced computer models.

That’s how we warned in advance about the bank failures of the 1980s.

That’s how we warned in advance about the Dot-Com bust of the early 2000s and the great Debt Crisis of 2008.

How we began sounding the alarm about 2020 stock market crash in December of 2019, well before Covid-19 reached America.

And how we warned about the inflationary crisis now sweeping the globe.

But we don’t just issue warnings; we also issue ratings, the Weiss ratings. We provide a letter grade from “A” to “E” on nearly every stock, every ETF, every mutual fund and every financial institution in America.

With those ratings, we name the stocks that are likely to fall the most, and we name the banks that are most likely to go bankrupt.

In the last debt crisis, for example, we warned about nearly every major institution that failed and we did so months in advance.

- We named Lehman Brothers as a candidate for failure 182 days before it went bankrupt.

- We named Fannie Mae over one year in advance.

- We named Citibank, Wachovia Bank and Washington Mutual Bank 51 days in advance.

- We flagged General Motors five months in advance and many more.

These kinds of on-target warnings prompted Worth magazine to say, “Weiss’s record is so good compared to that of its competitors, consumers need look no further” and …

The New York Times to say, “Weiss was the first to see the dangers and say so unambiguously.”

Barron’s wrote, “Weiss is the leader in identifying vulnerable companies.”

Louis Rukeyser of Wall Street Week wrote that “Weiss provides a tougher service.”

Chris Ruddy, founder of Newsmax and a close friend of President Trump, said, “Weiss’s prediction of the current economic crisis is uncanny.”

I think these comments demonstrate pretty clearly that our roadmap for surviving and thriving through this crisis wasn’t thrown together after the crisis began.

It’s built on a foundation of crisis investing that goes back nearly a century, to the Crash of 1929 and the Great Depression of the 1930s.

For our complete Endangered Lists, click here.

And it’s also the foundation of our endangered lists — every investment and financial institution meriting a Weiss Rating of “D+” or lower.

As of the latest count, our endangered lists include:

- 9,078 common stocks

- 9,554 ETFs and mutual funds

- 1,381 banks and credit union with insufficient capital to withstand an ordinary recession, and

- 3,580 banks and credit unions unprepared for a depression

This isn’t based on guesswork. It’s based on our massive databases — verified, official data we extract from their balance sheets, their profit and loss statements and from market price trends.

And it’s the best evidence I can give you to support one of the most important points I am conveying to you in this ebook:

This is not a “transitory” problem. It’s a financial crisis that was ready to happen long before today’s inflation —the worst in over 40 years, appeared — supposedly “out of nowhere.”

I repeat: The inflation crisis is not the cause. It is merely the trigger event, the Black Swan that swoops down from the clouds and uncovers the big debts and the big financial risks everyone was already taking.

That’s why our endangered lists are so long. And I’m sad to say, as this crisis unfolds, that’s why they’re likely to to get a lot longer.

But here’s the big payoff: As you’ll see in Chapter 6, not only can investors use our endangered list to protect themselves from losses, but they can also use them to go for life-changing profits in a market decline.

First, however, let me dispel a major myth that’s luring millions of unwitting investors into one of the greatest investment traps of all time.

Chapter 4

WARNING: If You’re Waiting for Government Bailouts To Save Your Portfolio, Read This NOW

Now, it’s time to answer that big question I raised earlier and that’s probably on your mind right now, too:

Can the government bail out the economy? Can the government fight inflation AND a recession at the same time?

Sure, the government can bail out a select group of companies. But since the last debt crisis, America’s companies have been piling up debt like there’s no tomorrow and now have over $15 trillion in notes and bonds outstanding.

And the biggest surge has been in the riskiest kind of corporate debt.

So, there’s very little the government can do to make so many financially sick companies healthy again.

There’s nothing the government can do to prevent a plunge in corporate earnings as inflation and recession strike.

There’s also nothing the government can do to stop companies from laying off millions of workers, and that’s also what we can expect. Everywhere.

There’s nothing the government can do to stop companies from cancelling their stock dividends like they did during the pandemic. Huge companies like Ford Motor, Occidental Petroleum, Boeing, Delta and Freeport-McMoRan slashed their dividends or cancelled them entirely.

And in the end, there’s nothing the government can do to stop the stock market from falling.

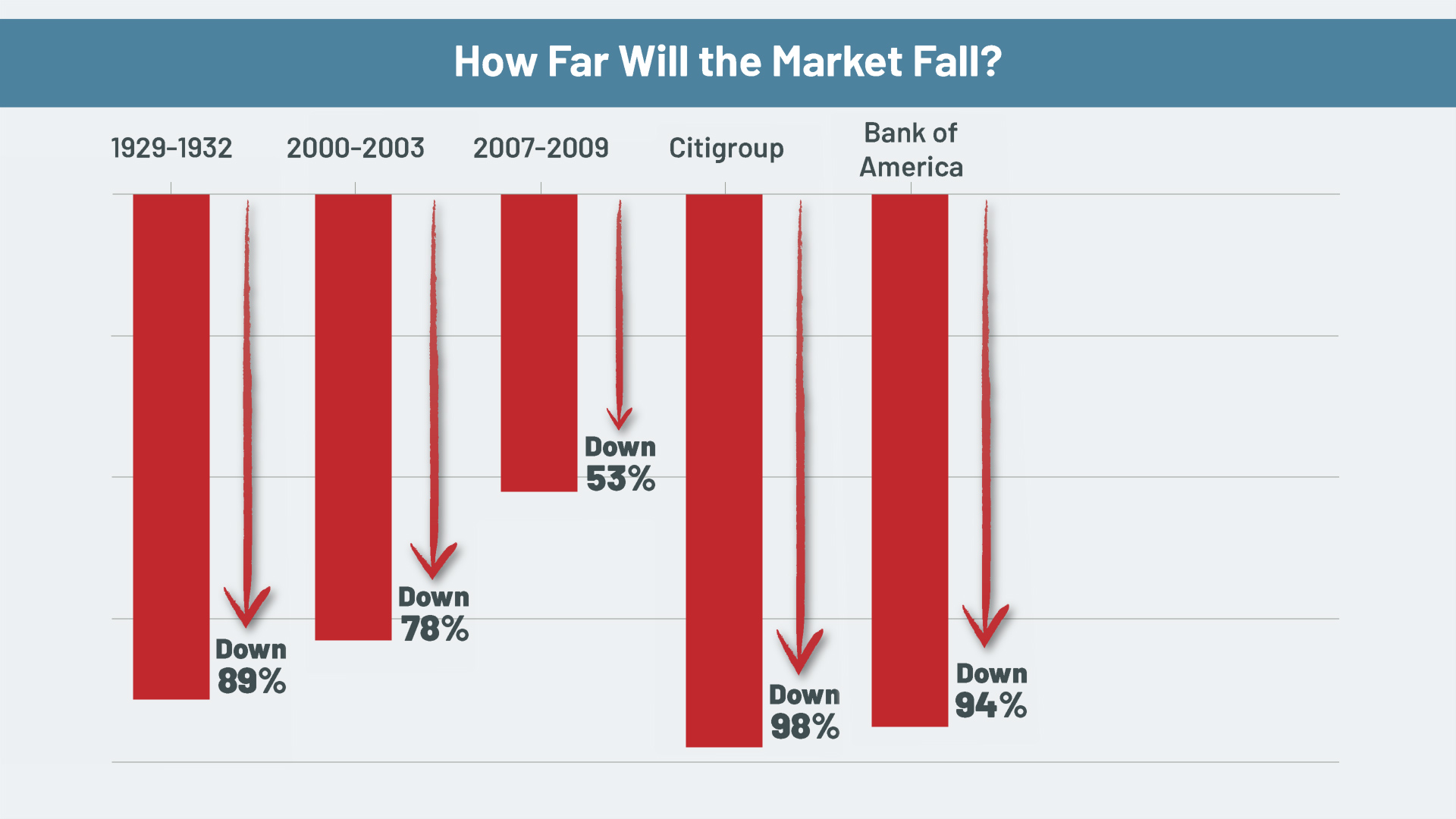

How far could the market fall? Well, here’s the history:

- In the Crash of 1929 and the big decline that followed, the average stock in the Dow Jones Industrials fell 89%.

- In the early 2000s, the average stock in the Nasdaq Composite Index fell by 78%.

- And in the 2008 Debt Crisis, the average stock in the S&P 500 fell 53%.

That’s bad enough. But notice I said “average” stock, and not all stocks are average.

- In the early 2000s, a lot of supposedly great internet stocks lost 99%, even 100% of their value.

- In the 2008 debt crisis, shares in the largest bank holding company in the United States, Citigroup, Inc fell by 98%.

- Shares in the second largest, Bank of America, fell 94%.

These giant banks and other banks were on our endangered list many months before they failed, and anyone heeding our warning would have saved a fortune back then, another reason it’s important for you to heed my warnings now.

And in the current market decline, last I checked, PayPal was down 59%, Zoom was down 60%, Roku had plunged 66%, Robinhood had crashed by 69%, Netflix had tanked 73% and Canadian Nexus was down nearly 100%.

So, if investors have stocks or ETFs, depending on which ones they own and how this crisis unfolds, history proves they could lose anywhere from half their money to almost all of their money.

Obviously, counting on the government to save your stock portfolio is not exactly a good strategy.

But here’s the biggest problem of all, the problem almost everyone on Wall Street and in Congress seems to be ignoring:

The Government Has

No Money in Reserve

The government has no savings whatsoever. Instead, it’s running a huge deficit and it’s deep in debt.

In the year 2021, even after the economy was temporarily recovering from the shock of the pandemic, the total deficit was nearly $2.8 trillion.

Even in the worst year of the Great Recession, the biggest yearly deficit was $1.4 trillion, which was then the biggest of all time.

So, last year’s deficit was TWICE as big!

Everyone should know this. But no one’s talking about it.

And no one seems to connect the dots. When the government runs such massive deficits, the only way to finance them is with funny money printed by the Federal Reserve.

And even when the Fed jacks up interest rates, that massive money printing of the recent past will fuel inflation like never before.

Of all the lessons learned from the past, this is probably the most important. Unfortunately, however, too many investors, including the so-called “pros” on Wall Street, have not yet figured it out.

That’s exactly why I’ve created this emergency ebook for you — to help you protect your assets from the storm ahead while taking steps to build wealth in the process.

In just a moment, I’ll reveal the powerful crisis-investing breakthrough my team has developed for doing just that.

But first, there’s one more major threat to your wealth, and it could be even more damaging to investor portfolios. So, I’ve dedicated the next chapter to nailing it down with no punches pulled.

Chapter 5

Sucker Rallies:

The Best Time To Sell and Make

a Fortune From the Next Decline

Starting on May 20, even as inflation continued to accelerate and the global economy continued to sink, Wall Street suddenly seemed to turn bullish. Stocks rallied, and investors breathed a sign of relief.

“This is not a bear market after all,” said the bulls. “The S&P is up, and it’s time to buy again.”

The market responded with a couple of big up days, and the mainstream media was quick to dub each one “a new bull market.”

That’s exactly what the bulls said in 1929, too.

After the initial crash in October 1929, President Hoover vigorously and repeatedly promised “the recovery is around the corner,” and investors wanted to believe him so badly, they started buying again.

So, from its low in November of 1929, the Dow rallied back to 294 on April 17, 1930. It regained 95 points or just about half of what it had lost in the crash.

But it was the next decline which turned out to be the big one. Starting in late April of 1930, the Dow plunged for nearly two full years, falling another 86%.

The bulls lost a lot of money in the crash of 1929 … and then lost a lot MORE money in the deep bear market of 1930-1932.

Meanwhile, short sellers used that second decline to make some of the greatest fortunes of the entire century, and the profits my father made are the single best example: He turned a meager $500 into more than $100,000, or about $2 million in today’s money.

Don’t be surprised if we see a similar pattern this time around.

As I showed in Chapter 3 already, even before the next phase of this crisis, we have 9,078 common stocks and 9,554 funds that are vulnerable.

Already, we have 1,381 banks and credit unions with insufficient capital to withstand an ordinary recession — not to mention 3,580 banks and credit unions unprepared for a depression.

Yes, the government can trigger big rallies in the market. But it cannot stop the stock market from falling any more than it did in the 1930s or in all the bear markets since.

And no matter what the government does, it cannot protect investors from declines in their bonds and other assets.

How to Protect Yourself From

Potentially Devastating Losses

Let’s say you own stocks that are vulnerable to a crash, especially stocks that are on our endangered list.

And suppose you’re unwilling or unable to sell them. Maybe you have a stake in the company you work for, and it’s not vested yet. Maybe the shares are in your pension plan or a family estate that you don’t control.

Plus, here’s another situation: a family business. For the most part, it would probably be very tough to sell your family business in the middle of this crisis.

So, what do you do?

This is where a hedge can be important — a firewall that investors build around their assets.

They have assets that are falling in value in this crisis. So they buy investments that are designed to go up precisely when their other assets are going down.

That’s what I mean by a hedge. And that’s what those super-profitable trades can do..

Let me give you some salient examples,

During the Great Debt Crisis, the S&P 500 fell by more than half and nearly all investors lost fortunes. But there was also a minority of investors who owned ETFs designed to profit from a market decline.

Among the 24 that existed at that time, 14 went up by 100% or more, giving investors gains of 103%, 110%, 124%, 134%, 147%, 150%, 157%, 163%, 168%, 174%, 195%, 198%, 243%, 293%.

In addition, seven of the ETFs went up by 70% or more, giving investors gains of 73%, 73%, 84%, 89%, 90%, 92% and 96%.

Now, in this crisis, I predict the profit opportunities could be even larger …

Chapter 6

How To Profit From

The Collapse of 2023

One of the most straightforward ways to make money in the Collapse of 2023 is with the simple purchase of options.

Like any other investment, the goal is to buy them low and sell them high.

The risk is absolutely limited to the small amounts invested, but the profit potential can be virtually unlimited.

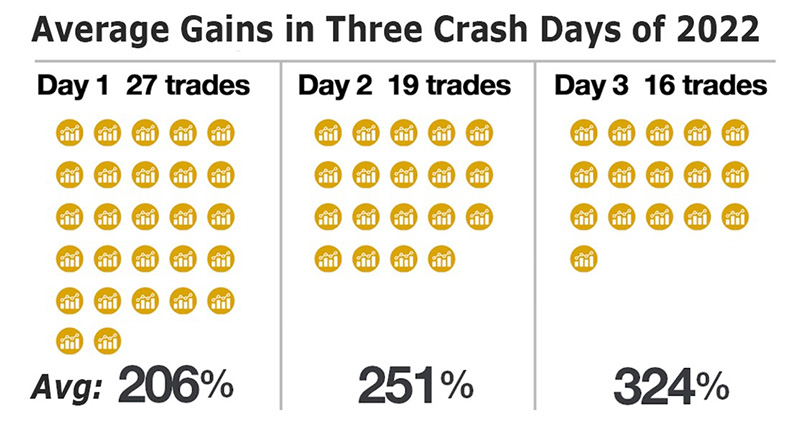

For example, in the stock market crash of 2022, we looked at three separate crash days and counted 62 distinct option trades selected by our Weiss Stock Ratings.

Each and every one could have given investors of at least 100%.

- On the first crash day, we identified 27 trades that returned gains ranging from 100% to 419%. The average gain among them was 206%.

- On the second crash day, the numbers were better: We saw 19 trades with gains ranging from 100% to 809%. Average gain: 251%.

- On the third crash day, it was even better than that: 16 trades ranging from 100% to 1,130%. Average gain: 324%.

Even if investors put up only $10,000, and even if they chose the least profitable of these trades, they could have made a profit of $10,000 on the first day, $10,000 on the second day, and another $10,000 on the third day. That's a total of $30,000 in gains in three days.

Or, if they invested those same $10,000 in just the average trades — not the best ones, mind you, just the average ones — they could have made $20,600 on day one, $25,100 on day two and $32,400 on day three. That's a total gain of $78,100.

All without reinvesting profits.

All in just three crash days.

We also saw trades that produced less than 100% gains. But even if you include all trades identified with our selection process in all three days, the average return was 110% on day one, 101% on day two and 149% on day three. That’s an overall average of 120% gains PER DAY.

Never forget: Options are volatile investments. So folks should only use funds that they can afford to lose. The great advantage is that the risk is strictly limited to the relatively small amounts to invest, and the profit potential can be virtually unlimited.

Our Breakthrough

Crisis-Investing Strategy

All of these trades meet the three strict requirements of our tried-and-tested all-weather strategy that can make money in almost any market environment:

- Requirement number one is strictly limited downside risk

- Requirement number two is liquidity. They have to be easy to buy and easy to sell.

- Requirement number three is high probability of success.

So exactly what is our strategy?

How can it protect you from stock market losses AND go for the opportunity to multiply your money?

First, in a declining market, we target the nation’s worst stocks, as determined by our Weiss Stock Ratings. These are the kinds of stocks that, based on 90 years of experience going back to 1929, we believe are likely to fall the most.

And never before have we seen so many: 9,078 common stocks and 1,021 ETFs on our endangered list.

Second, we narrow the list down further to stocks that are included in the S&P 500.

Third, on each stock, we select the most liquid, widely traded put options — investments designed to soar when stocks fall.

Fourth, we seek to buy the put options on a market rally, when they are cheaper.

Fifth, when the stocks fall and the puts skyrocket in value, we look to sell them for a not-so-small fortune.

Six, for assets that we believe will benefit directly from inflation, we follow a similar strategy with call options.

No complicated trades. The goal is to just buy low and sell high.

And if executed prudently, this strategy can be a godsend for investors, especially in crazy times like these.

Let’s say you hold stocks, ETFs or mutual funds in a regular stock portfolio which you are unable or unwilling to sell. Suppose you have stocks and corporate bonds in a 401(k), IRA or a variable annuity. Or perhaps you own a business that could suffer in the ongoing crisis.

If so, this strategy can go a long way toward protecting you against losses. Better yet, it has the potential to generate life-changing profits.

Here are just a few of the most recent examples of some of the larger winning trades (all on a single day) …

On Crash Day 1, April 26, 2022, we saw the following trades:

416% on Intuitive Surgical (rated C+), using a put with a strike price of $255, expiring May 13, 2022

513% on GrowGeneration (rated C-). Strike price of $6, expiring May 27

600% on SEMrush Holdings (rated D). Strike — $7.50. Expiration May 20.

1,160% on Rigel Pharmaceuticals (D-) put. Strike — $2, also expiring May 20.

Next, on Crash Day 2, April 28, the gains were even better:

483% on Editas Medicine, Inc. (rated D-) put. Strike — $11, expiring 5/6

700% on Veritone (D). Strike — $10, expiring May 20

1,000% on Accolade (D). Strike — $7.50, expiring May 20, and

1,800% on Orchid Island Capital (D). Strike — $2, also expiring May 20

Then, on Crash Day 3, May 5, investors could have made even more money with put options, including:

525% on Bed Bath & Beyond.

606% on Chewy, Inc.

1,700% on NIO Limited, and

2,200% on Blink Charging.

Among these, even with the least profitable example (Intuitive Surgical), investors could have started with $10,000 and ended it with over $50,000.

Even with the least profitable example (Intuitive Surgical), investors could have started with $10,000 and ended it with over $50,00.

With the fourth best trade (Rigel), investors could have turned $10,000 into $126,000. All in a single day.

And with the best trade (Orchid), investors could have turned that same $10,000 into $2,300,000. Also, in one day.

Bear in mind that starting with just $10,000 and making a net profit of more than $2 million like that in just a single day is NOT something folks should count on.

And I want to also remind you that we also saw trades that produced less than 100% gains. But even if you include all trades identified with our selection process in all three days, the average return was 110% on day one, 101% on day two and 149% on day three. That’s an overall average of 120% gains per day.

What makes this strategy have the potential to work especially well, however, is the strict discipline that our strategy requires.

Remember: All these trades come with downside risk that’s absolutely limited.

Chapter 7

What Should You Do Now?

With the ridiculously low interest rates we still have today, let’s start with income.

Imagine an investment strategy that has generated about $1,000 in extra cash flow almost every Friday.

That could add up to $50,000 per year.

To download this report now, click here for all the details.

And with double the investment, could add up to $100,000 per year.

Plus, imagine a success rate of 98% on your trades.

Well, you don’t have to just imagine anymore. Because we feel it’s an appropriate solution to overcome the terrible low yields that continue to plague the financial world.

Our Safe Money Report editor, Mike Larson, explains exactly how in his special report, Instant Income Revealed.

Second, Learn All the Ins and Outs of

Mankind’s Most Traditional Crisis Hedge: Gold

Since my family began recommending $20 gold coins in the early 1930s, the price of gold has risen 9,595%.

Better yet, if some of my father’s clients bought one of my father’s favorite gold coins at the time, the St. Gaudens $20 gold coin, and their family kept in good condition until today, they could have seen it appreciate to an estimated $42,000. From $20 to $42,000.

That’s a gain of 206,288%.

Now, I’m not saying you can make that much money in gold this time around. Nor am I expecting you to wait 90 years for that to happen.

To download this report now, click here for all the details.

But in more recent years, since we began recommending gold bullion coins and bars in our monthly Safe Money Report, gold has risen by 459%. An initial investment of $10,000 is worth $55,000 today.

We show all the ins and outs of precious metals investing in our third bonus report we've prepared for you — The Weiss Guide to Prudent Gold & Silver Investing.

Third, Learn How To Profit

Directly From Market Declines

We’ve talked about two instruments designed especially for protection and profit in down markets.

Put options which are ideal for crash days in the market, and inverse ETFs which I think are ideal for down markets overall.

If you hold almost any kind of vulnerable asset, you may need the kind of hedge that they can provide.

For example, suppose you own stocks, real estate or even a family business that could suffer a big decline. And suppose you don’t want to sell them … or you can’t sell them because they’re locked up in a trust … or because it’s hard to find buyers.

To download this report now, click here for all the details.

What do you do?

Well, that’s when you can use inverse ETFs or even put options as a hedge. While your vulnerable assets are going down, the idea is that at least these hedges will be going up.

And in a world that’s now more vulnerable than ever to black swan events, I think many investors may NEED that kind of protection.

Before you jump into them, I strongly recommend you read our guide: Crash Profits: How to Protect Your Portfolio in Down Markets.

Fourth, Own Companies That Have

Done Very Well in Times of High Inflation.

To download this report now, click here for all the details.

I’m referring to companies that mine natural resources or that build their business around some of the most powerful inflation hedges of this era.

We name them in our special report The World’s Leading Resource Companies.

Fifth, Stay up to Date With

Our 56,000 Different Ratings

One of the free services we’re providing in this crisis is premium access to all our ratings. One half century ago, I founded my own company, Weiss Ratings, to help Americans of all walks of life keep their money safe — in good times and in bad times as well.

- 10,000 common stocks

- 2,400 Exchange-Traded Funds (ETFs)

- 26,000 mutual funds and

- 1,600 cryptocurrencies.

Plus, you not only get full access to all of our investment ratings, but you also get full access to all of our safety ratings on …

- 4,800 banks

- 5,000 credit unions, and

- 3,600 insurance companies.

That gives you the power to select, at will and at any time, the ones to avoid and the ones to favor for the best combination of relative safety and profit potential.

Both when the market soars and when the market sinks!

At a time like this, a powerful offense is your best defense. Building up substantial profits that you can convert into cash reserves is the best way to ensure your family’s safety and comfort.

You don’t need to have a lot of experience as an investor.

And you don’t even need to use exotic investment vehicles.

In a moment, I’ll show you how to download and access the bonus reports instantly — so you can start using them just a few minutes from now!

- The Weiss Ratings Endangered Lists, which we’ve already talked about this week.

- Instant Income Revealed

- The Weiss Guide to Prudent Gold & Silver Investing

- Crash Profits: How to Protect Your Portfolio in Down Markets

- The World’s Leading Resource Companies

- Not to mention premium access to the 56,000 Weiss Ratings

You get all of this right now. All I ask is that you apply for a one-year subscription to our flagship investment letter, Safe Money Report for just a few cents per day.

You can cancel and receive a full refund at any time during your 12 months with us, including up to the last day of your subscription.

And even if you decide to cancel, you can keep all of the guides, reports and ratings information you download today or that you download at any time during the course of the year.

Fortunately, a small minority of investors WILL escape the dangers and even use this crisis to build substantial wealth. And if you act promptly on the simple steps I’ve given you today, you could be one of them.

You cannot rely on the government or anyone else to come to the rescue. Only you can protect yourself and your family. Only you can take your destiny into your own hands to create a better world for yourself.

I trust this time we’ve spent together has already given you some of the information you need to make that possible.

And I look forward to welcoming you on board to guide you the rest of the way.