The Collapse of 2023

How to Escape the Housing Bust • Landmine Stocks to Dump Now

Giant Profits in Sinking Markets • $1,000 in Extra Cash Flow Weekly

To download your reports immediately, jump

here.

Or, read on for the transcript …

Dear Investor,

The collapse of 2022 is already here, just as we warned. But the collapse of 2023 is bound to be a lot worse.

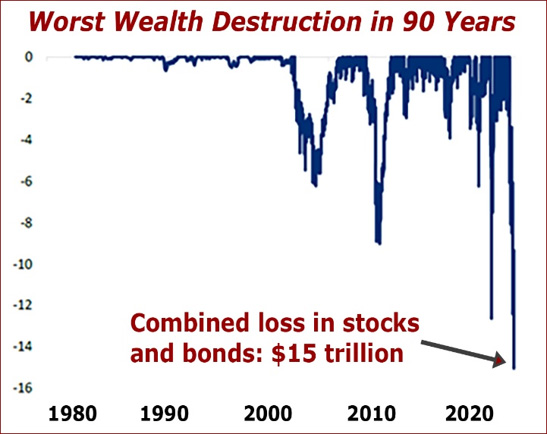

Already, markets have fallen so far and so fast, investors have lost $15 trillion in value — the worst destruction of wealth since the Great Depression.

Already, the housing market is shifting rapidly from boom to bust.

Already, many big-name stocks like Netflix and Meta have been cut down by half or more.

Clearly, this is no ordinary crisis.

Unlike in the housing bust of 2008 and the Great Recession that followed, the government is not coming to the rescue. The Fed is not cutting interest rates or pumping trillions in new paper money.

The Fed is doing precisely the opposite.

Unlike any other collapse, almost everything you own could be in jeopardy, even things that you thought would be safe. Not just money you have in stocks, but also money you have in bonds, real estate and even banks. Not just right now, but for many months to come.

I'm Martin Weiss, founder of Weiss Ratings, which I began more than half a century ago to help Americans of all walks of life keep their money safe in good times and bad.

I'm not here to frighten you. God knows we already have enough fear in America today!

I’m here today to …

- Give you six simple steps you can take immediately to find safety in an unsafe world …

- Name the landmine stocks to dump with urgency …

- Give you immediate guidance on what kind of assets to buy to protect your stock portfolio and protect your real estate portfolio …

- And I’m here to guide you to special kinds of trades that have a consistent track record of unusual success precisely when nearly everything else is crashing. I call them Crash Profit Trades, and, as you’ll see, there are many to choose from.

This crisis is unfolding with great speed. So, you need to respond with equal speed. If you don’t act swiftly, depending on which stocks or properties you own and how this crisis unfolds, history tells us you could lose anywhere from half your money to nearly all your money.

If you own a home or other real-estate properties that recently enjoyed a massive influx of big investors, you’re especially vulnerable to losses.

Even U.S. Treasury bonds, supposedly among the safest investments in the world, are crashing in value.

But investors who act promptly to implement the profit strategies I’m going to tell you about today could turn this unusual crisis into an equally unusual profit opportunity.

One type of Crash Profit Trade is ideal for bear markets overall. In the last bear market, for example, even as stocks plunged, they gave investors the opportunity to reap average gains of 126%. With no losers!

That’s right. Zero losers!

In 2022, we also have identified 62 Crash Profit Trades that are ideal for the crash days in the market. On one crash day, we saw average gains of 206%. On a second crash day, we saw average gains of 251%. And on a third crash day, the average gains were 324%.

Per day!

I’ll give you the details in a moment. But first, let’s be sure to face the facts: Our world today harbors almost certain dangers, and this isn't the first time I've said so.

Our Endangered Lists

consistently warned ahead of time.

For many months, I’ve published lists— our Endangered Lists — naming the stocks, ETFs, mutual funds and banks that were vulnerable to collapse.

As a result, investors who were paying attention could have avoided big losses, and they also could have made money from the declines.

In this session, I will give you immediate access to our Endangered Lists. I will show you how they could be used not only for protection and safety but also to build wealth swiftly in a crisis like this one.

Now, maybe you’re thinking that once the global conflicts and wars come to an end, the turmoil we’re facing in the economy will also end. If I were you, I wouldn’t bet on that.

Or maybe you see a bounce in the market and you think now the danger is over.

If I were you, I wouldn’t bet on that, either.

Long before the Collapse of 2022 began, we already had all the ingredients of a serious financial crisis here in America.

In fact, the seeds for this crisis were planted many years ago, going all the way back to the Great Debt Crisis of 2008.

Before that crisis began, we also issued warnings, much like the warnings I’m issuing today. We warned about nearly every major institution that failed and we did so months in advance.

We named Lehman Brothers as a candidate for failure 182 days before it went bankrupt.

We named Fannie Mae over one year in advance, Citibank, Wachovia Bank and Washington Mutual Bank 51 days in advance … General Motors five months in advance and many more.

Among the 465 banks that failed during and after the debt crisis, we warned consumers about 464.

Yeah, we missed one, but that was only because the bank had committed fraud — it fraudulently kept the truth about its bad financials hidden from everyone.

These kinds of on-target warnings help explain why …

Worth magazine wrote: “Weiss’ record is so good compared with that of our competitors … consumers need look no further.”

The New York Times wrote “Weiss was the first to see the dangers and say so unambiguously.”

The Wall Street Journal reported that the profit performance of our research beat the performance of every major firm on Wall Street and off Wall Street, including Bear Stearns, Goldman Sachs, Merrill Lynch, Standard & Poor’s and others.

Chris Ruddy, founder of Newsmax and a close friend of former President Trump, said “Weiss’ prediction of the current economic crisis is uncanny.”

Louis Rukeyser of Wall Street Week wrote that “Weiss provides a tougher service.”

And the service he was referring to includes our Endangered Lists.

You see, we don’t just issue warnings. We also issue RATINGS, the Weiss ratings: We provide a letter grade from “A” to “E” on nearly every stock, every ETF, every mutual fund and every bank in America.

With our ratings, we name the stocks that are likely to fall the most.

We name the banks that are most likely to go bankrupt.

But I must warn you: Our Endangered Lists are very long, and that’s the best evidence I can give you that the threat to your wealth could be deep and long-lasting.

For our complete Endangered Lists, click here.

Our Endangered Lists today includes:

- 9,078 common stocks …

- 1,021 ETFs and

- 8,533 mutual funds. Plus …

- 1,634 banks and other financial institutions that our research tells us are unprepared for the storm we see coming.

So, the probability is high — and getting higher — that many of your stocks, ETFs and mutual funds, even your bank, could be on our Endangered Lists.

Not all companies are in bad financial shape, mind you. There are still strong ones, and I’ll tell you about those too, in a moment.

But whether good or bad …

You just need to know. And you need to know NOW, before the collapse gets a lot worse.

Plus, there’s one more thing I want you to know …

We’re not like Standard & Poor’s, Moody’s and Fitch.

Because when they issue a rating on a company, they get paid by that company for the rating. Their ratings are bought and paid for by the rated companies.

Many smart people think that’s a serious conflict of interest, and I agree. Plus, it’s also one of the reasons why millions of people who followed their ratings lost so much money in the Great Debt Crisis of 2008.

We never do business that way.

We have never taken a dime — and never will take — a dime from the companies we rate.

Our only source of revenue is the end user of our information, average people who want to get safe and make some money, too. But because of this crisis, I don’t want any barriers between our ratings and your safety.

So, today I will offer you access to all of our ratings for free.

I’ve taken this unusual step because this crisis is already shaping up to be a lot worse than the Great Debt Crisis of 2008 or the COVID-19 Collapse of 2020.

In 2008 and again in 2020, the Federal Reserve came to the rescue by printing money with wild abandon.

Many smart people were shocked. But Wall Street loved it.

They loved it because the Fed drove interest rates down to zero. And because the Fed pumped up the stock market to unprecedented heights.

But along the way, the Fed also lured Americans into cheap debt and drove nearly everyone to buy some of the riskiest investments in the world.

- Before the Great Debt Crisis, American corporations had about $6 trillion in debt. Now they’re in far worse shape with $12 trillion in debt.

- Before the Debt Crisis, the U.S. government had debts of $10 trillion, and everyone thought that was a lot. Now it’s got more than $30 trillion in debt.

- According to the Congressional Budget Office, our national debt wasn’t expected to pass that number for another 10 years. And now it has already happened so much faster than anyone dreamed possible.

As long as the Fed kept interest rates near zero, no one seemed to care.

But Now the Party Has Ended

Now, the Fed is jacking up interest rates. And now, it looks like all hell is about to break loose.

The cheap, easy money that poured into stocks, into bonds, into real estate is starting to pour out, and everything has begun to collapse again.

Most people don’t realize how bad it already is.

Remember: Stocks and bonds have already lost $15 trillion in market value, the biggest and fastest destruction of wealth since the Great Depression.

And never forget: Instead of coming to the rescue like it did in 2008 and 2020, the Fed is doing precisely the opposite.

So, why isn’t the government coming to the rescue? Why did the Fed decide to start jacking up interest rates and crushing the financial markets?

Who or what is the new, uninvited guest that’s crashing the party? Well, it’s not really new, at least not to folks in my generation. In fact, it’s actually very old, very dangerous and very well-known.

Surging inflation!

Surging Inflation

Already out of Control

Surging inflation, which measured the way it used to be measured years ago, is already well into double digits.

That’s right. If you calculate the Consumer Price Index the same way the government did back in 1980, the inflation rate in the United States today is not 8%, 9% or even 11%. It’s over 16%.

No wonder the Fed has been forced to raise interest rates! And no wonder the Fed’s rate hikes have done nothing, absolutely nothing to stop inflation from surging!

How high could interest rates go? Well, the last time the Fed mismanaged money, inflation surged to 13% and the Fed had to raise its benchmark interest rate to 20%.

But this time around, the Fed’s mismanagement of money — or should I say the Fed’s sheer abuse of money — has been far more extreme. So, the resulting inflation is also likely to be far more extreme.

I think it’s safe to predict that inflation will surge to at least 18%, and the Fed will have to raise interest rates to at least 25%.

How far could average home prices in the U.S. fall? Well, during the last housing bust, homeowners and investors lost almost half their wealth.

In some markets it was far worse, and that’s despite the fact that the government came to the rescue in a big way.

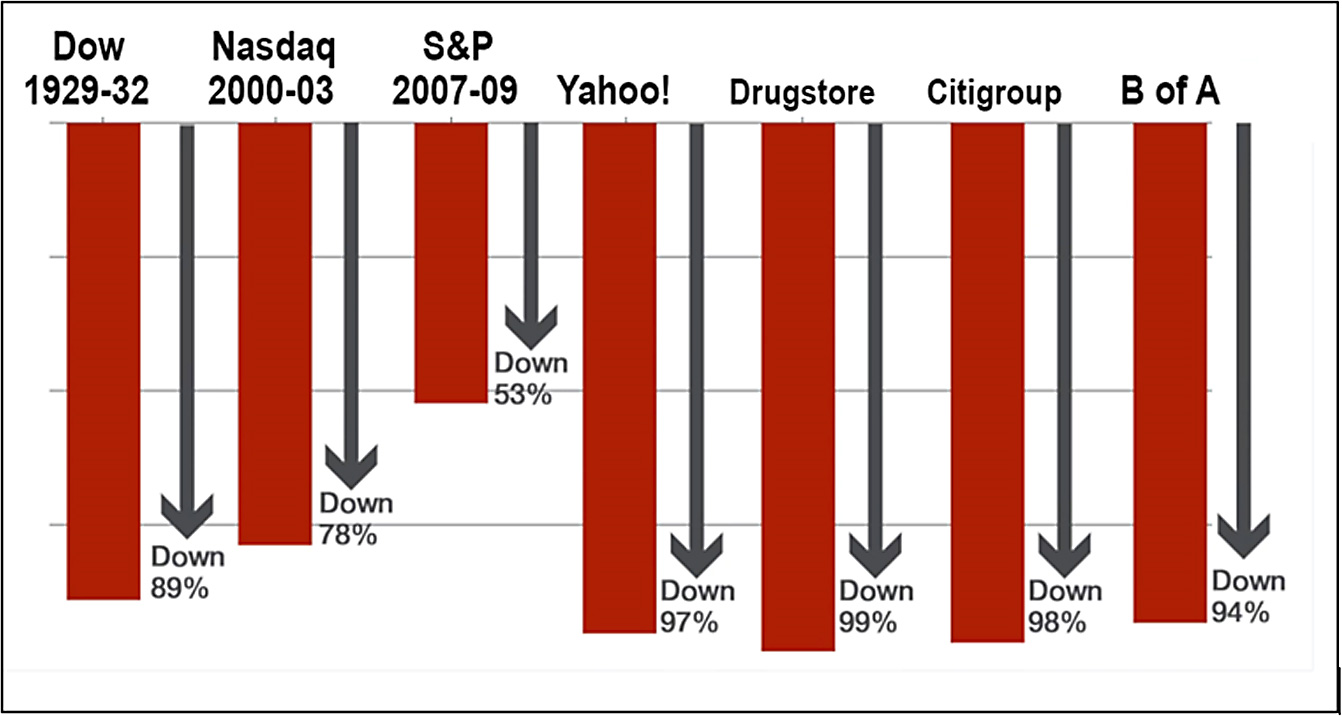

How far could the stock market fall?

Again, history gives us the answer.

HOW FAR THE MARKET HAS FALLEN IN THE PAST

- In the Crash of 1929 and the big decline that followed, the average stock in the Dow Jones Industrials fell 89%.

- In the early 2000s, the average stock in the Nasdaq Composite Index fell by 78%.

- And in the 2008 Debt Crisis, the average stock in the S&P 500 fell 53%.

That's bad enough, right? But notice I said the "average" stock, and not all stocks are average.

In the early 2000s, Yahoo fell by 97%. Drugstore.com fell 99%.

And a lot of supposedly great internet companies went bankrupt, losing 100% of their value. All of them and many more were on our Endangered Lists months before they crashed.

In the 2008 Debt Crisis, shares in the largest bank holding company in the United States, Citigroup Inc., fell by 98%. And shares in the second- largest, Bank of America, fell 94%.

These giant banks were also on our Endangered Lists many months before they failed. So, anyone heeding our warning would have saved a fortune back then … another reason it's important for you to heed my warnings today.

Of course, no one can know for sure what the future will bring. But here’s what we do know:

The Fed’s money printing and zero interest rates were the two big things that were keeping the economy alive, the two big things that were driving stocks and real estate higher, feeding investor frenzy, creating speculative bubbles everywhere.

And we also know that the Fed has now been forced to abandon its money printing and abandon zero-interest-rate policy.

It’s raising rates dramatically, and it’s still not nearly enough to kill the inflation monster, not even enough to wound the inflation monster.

That’s shocking enough, right? But what’s even more shocking to me is that most people are still so complacent about the truly dangerous inflation that’s rearing its ugly head today.

They didn’t live through the 1970s, when folks waited in gas lines for long hours just to top off their tanks … When the value of supposedly ultrasafe Treasury bonds plunged by more than half and …

When the price of gold surged 2,324%.

They didn’t live through the inflation that gutted the economy of Brazil in the 1970s and Argentina in the 1980s …

Destroying the savings of millions of middle-class citizens …

Bankrupting their governments …

Prompting their leaders to confiscate their bank accounts …

Top: Gas lines in the U.S. Middle: Confiscation of bank accounts in Argentina. Bottom: Destruction of money’s value in Germany. All due to rampant inflation the likes of which are creating grave dangers — and large profit opportunities — for investors today. To learn what to do, jump to this section.

Tearing apart the fabric of society.

Nor does anyone dare think about the hyperinflation that wreaked havoc on the entire world …

Starting in Germany after World War I …

Creating the greatest avalanche of worthless paper money ever seen and …

Giving rise to the most murderous dictator in the history of Western Civilization.

Hundreds of millions of Americans going about their daily business in America are oblivious to the torrid past of inflation.

Fewer still believe anything vaguely similar might be possible today.

They have not yet learned the lessons of history.

They underestimate how quickly inflation today is feeding on inflation, how the surging cost of living is driving up wages and how surging wages are driving up the cost of living.

They don’t realize that, once rampant inflation gets underway like today, the only thing that will stop it is shock therapy — a collapsing economy and crashing stock prices.

I have some personal experience with this. In fact, my family and I have lived through market crashes and even predicted them ahead of time.

Irving Weiss in the Crash of 1929:

“The Only One Who Saw It Coming”

The story begins with my father, Irving Weiss, who first went to work on Wall Street in the late 1920s as a customer’s man, which nowadays they’d call a stockbroker.

The stock market of the 1920s would be eerily familiar to anyone who has lived through the current crisis. It was enjoying a roaring bull market that was unusually long, just like it has been doing in recent years.

And the market was unusually out of sync with the tough times that most working American families were experiencing, also much like recent years.

So, when the Dow Jones Industrials kept going up in the first ten months of 1929, my father didn’t trust it.

He didn’t trust the disconnect between the great times on Wall Street and the tough times in the neighborhood where he lived.

He didn’t have many clients yet — just friends and family. But he told them to get the heck out of the market.

In his office, the veteran stockbrokers laughed at him. “Weiss is just a kid,” they said. “What does he know?”

And then came Black Monday, Oct. 28, 1929. The market plunged the equivalent of about 4,500 points in the Dow Jones of today.

On the next day, it plunged the equivalent of another 4,000 points.

It was like an 8,500-point crash in just 48 hours.

Suddenly, Irving was a hero, and suddenly the word got around that he was the only one who saw it coming.

That’s when he decided to do more, much more.

He decided to actually make money from the crash.

He collected data on as many companies as he could. He put the numbers down on the large, green sheets that bookkeepers used — spreadsheets, actually. And he created a series of formulas that would later become the foundation of my company’s own computer models of today.

Using his formulas, he identified the companies that he thought were the riskiest. He called them Dogs of the Dow.

200X GAIN IN THE GREAT BEAR MARKET OF 1930-1932

Martin Weiss’ father, Irving Weiss, used the great bear market of 1930-1932 to sell stocks short, transforming $500 into about $100,000, the equivalent of $2 million in today’s money. Today, investors can profit from market declines with less risk. For guidance on the best instruments, click here to download our bonus report, Crash Profits: How to Hedge and Make Money in Down Markets plus much more.

Then, in April 1930, after a big stock market rally, Irving borrowed $500 from his mother and he started selling short the Dogs of the Dow. When the market plunged, he took profits. Whenever it rallied, he shorted again.

By the time the Dow hit rock bottom in 1932, he had over $100,000, or nearly $2 million in today's money. That was about 200 times his money.

Not bad for a young man who was just a rookie on Wall Street, right?

Are there ways for investors to do something similar in today’s market? Absolutely!

It can be done with inexpensive, liquid investments anyone can buy in today’s modern markets. It can be done without going short, without a margin account and with a lot less risk than my father took in the 1930s.

I’ll give you the details in a moment.

But first, let express this deep concern. I fear that the vast majority of Americans will fail to heed my warnings and fail to get ready for the next phase of this collapse.

But I sincerely hope — for you and your family’s sake — that you’re not one of them.

Because the precautions required to protect yourself from the collapse are not difficult. Even if the storm they create turns out to be less severe than we fear, the worst that will happen is that you’ll sleep better at night.

And potentially make some good money, too.

Here are the six steps I recommend you begin taking immediately to protect yourself and your loved ones from the storm I see coming …

STEP 1

Avoid the Endangered Stocks

If you hold stocks or stock mutual funds — in your regular brokerage account, in your 401(k) or in your IRA — start selling the ones that are on our Endangered Lists.

Some the biggest names to sell are what I call the land-mine stocks. Airbnb, American Airlines, Boeing, Budweiser, Credit Suisse, Dell, DocuSign, Expedia, PayPal, Prudential, Roku, Royal Caribbean, Walt Disney, Twitter, Uber and United Airlines, plus the many others on your screen.

But what you see on your screen is just a small sampling of the 9,000-plus stocks on our endangered list today.

How much could they fall? Well, in the Great Debt Crisis, investors could have used our Endangered Lists to avoid 385 stocks that fell 90% or more in value. And on average, the stocks that were on our Endangered Lists when the crisis began lost more than two-thirds of their value.

To download this report now, click here for all the details

This time around, the most vulnerable are different names in different sectors. But you can find out exactly which ones they are simply by checking our special bonus report, The Weiss Ratings Endangered Lists.

In it, we give you a complete list not only of all the most vulnerable stocks, but also the most vulnerable ETFs, mutual funds and banks that. We explain why we believe they’re so weak, how and when to sell them and what to do right now to protect your portfolio in the most efficient way possible.

STEP 2

Use Our Endangered Lists

to Go for Large Crash Profits

Our Endangered Lists can not only help protect your from the crash, but also make money from with investments designed especially for crash profits — the Crash Profit Trades I told you about earlier.

The faster and deeper the market falls, the more profits investors stand to make.

Let me give you some salient examples using our strategy based on the Weiss Stock Ratings.

During the last bear market, the S&P 500 fell by more than half, and nearly all investors lost fortunes. But there was also a minority of investors who owned ETFs designed to profit from the crash.

Among the 24 that existed at that time, 14 went up by 100% or more, giving investors gains of 103%, 110%, 124%, 134%, 147%, 150%, 157%, 163%, 168%, 174%, 195%, 198%, 243% and 293%.

In addition, seven of the ETFs went up by 70% or more, giving investors gains of 73%, 73%, 84%, 89%, 90%, 92% and 96%.

On average, these ETFs went up 126%. And not a single one lost money during that period.

Plus, there are also specialized investments that are ideal for days when the stock market crashes.

For example, we looked at three separate crash days in 2022.

Then, among the S&P 500 stocks that did not get good Weiss Ratings, we identified 62 trades that could have produced gains of at least 100%.

- On the first crash day, we identified 27 trades that returned gains ranging from 100% to 419%. The average gain among them was 206%.

- On the second crash day, the numbers were better: We saw 19 trades with gains ranging from 100% to 809%. Average gain: 251%.

- On the third crash day, it was even better than that: 16 trades ranging from 100% to 1,130%. Average gain: 324%.

Even if folks had invested only $10,000, and even if they chose the least profitable of these trades, they could have made a profit of $10,000 on the first day, $10,000 on the second day and another $10,000 on the third day. That's a total of $30,000 in gains in three days.

Or, if they invested those same $10,000 in just the average trades — not the best ones, mind you, just the average ones — they could have made $20,600 on day one, $25,100 on day two and $32,400 on day three. That's a total gain of $78,100.

We also saw trades that produced less than 100% gains. But even if you include all trades in all three days, the average return was 110% on day one, 101% on day two and 149% on day three. That’s an overall average of 120% gains PER DAY.

All without reinvesting profits. All in just three trading days.

So, that gives you two kinds of Crash Profit Trades designed especially for protection and profit in down markets. One is ideal for crash days in the market, and the other is ideal for bear markets overall.

Now, I want to warn you, any kind of investing involves risk, and that's equally true if you bet on the market going up, or you bet on the market going down. But for the money you can afford to risk, you should consider it seriously for two reasons:

First, because of the tremendous profit potential I just told you about. It's mind-boggling. While most other investors were losing their shirts and panicking about their future, others could have been banking tens of thousands of dollars, giving them and their family the security they needed.

Second, because it's like buying crash insurance. Let's say you own stocks that are vulnerable to a crash, especially stocks that are on our Endangered Lists. And suppose you're unwilling or unable to sell them. Maybe you have a stake in the company you work for and it's not vested yet. Maybe the shares are in your pension plan or a family estate that you don't control.

So, what do you do?

Well, this is where a hedge can be important. It's like a firewall that you build around your assets. You have assets that are falling in value in this crisis, right? So, you buy investments that are designed to go up precisely when your other assets are going down. That's what’s meant by a hedge.

To download this report now, click here for all the details

And you’ve seen how powerful those kinds of super-profitable trades can be in times like these.

We name these investments, reveal our strategy and show you exactly how to use it in our special bonus report, Crash Profits: How to Hedge and Make Money in Down Markets.

STEP 3

Give Your Income a Nice, Big Boost

Imagine an investment strategy that has given investors an opportunity to generate about $1,000 in extra cash flow almost every Friday!

That could add up to $50,000 per year. And with double the investment, it could add up to $100,000 per year.

To download this report now, click here for all the details

Also imagine a success rate of 98% on the trades!

Well, you don’t have to just imagine anymore. Because this strategy is real, and I feel it’s an appropriate solution to overcome the terrible low yields that still plague the financial world.

Our Safe Money Report editor, Mike Larson explains exactly how in his special report, Instant Income Revealed.

STEP 4

Own Mankind’s Traditional Crisis Hedge: Gold

My father was the first to teach me about gold.

“Back in the 1930s,” he said, “very few people were buying gold, which was ironic because you could buy it so easily. All my clients and I had to do was go to our bank, walk up to the teller window and ask for $20 gold coins. And that’s what we did.”

That was very fortunate. Because since he began recommending $20 gold coins in the early 1930s, the price of gold has risen 9,595%.

Better yet, if some of my father’s clients bought one of my father’s favorite gold coins at the time, the St. Gaudens $20 gold coin, and their family kept in good condition until today, they could have seen it appreciate to an estimated $42,000. From $20 to $42,000.

That’s a gain of 206,288%.

Now, I’m not saying you can make that much money in gold this time around. Nor am I expecting you to wait 90 years for that to happen.

But in more recent years, since Weiss Ratings began recommending gold bullion coins and bars in our monthly newsletter, gold has risen by 459%. An initial investment of $10,000 is worth $55,000 today.

To download this report now, click here for all the details

Silver offers even greater profit potential.

We show all the ins and outs in our third bonus report we've prepared for you — The Weiss Guide to Prudent Gold & Silver Investing.

This is important. But I’ve left one of the most important steps for last.

STEP 5

Protect Your Real Estate

If you have a portfolio of investment properties, if you own a vacation home or rental units, or just your own home that you live in, you probably don’t want to sell in this market, right?

But there’s another way you can protect your real estate WITHOUT selling a single property.

It’s not rocket science. It does not require special investment savvy or fancy maneuvers. All you have to do is …

Add up the total value of your properties …

Use our simple formula …

And then buy a pair of specialized investments that are designed to go up when real estate markets go down.

To download this report now, click here for all the details

Even better, we show you how, when the time comes, you can spot the bottom in the market to pick up choice properties in choice locations for a fraction of their true value.

It’s all explained in our fifth bonus guide How to Escape the Coming Real Estate Bust Without Selling a Single Property.

STEP 6

Stay Up to Date With Our 56,000 Ratings

One of the free services we’re providing in this crisis is premium access to all our ratings.

- 10,000 common stocks

- 2,400 exchange-traded funds (ETFs) and

- 26,000 mutual funds.

Plus, you not only get full access to all of our investment ratings, but you also get full access to all of our safety ratings on …

- 4,800 banks

- 5,000 credit unions and

- 3,600 insurance companies.

That gives you the power to select, at will and at any time, the ones to avoid and the ones to favor for the best combination of relative safety and profit potential.

Both when the market soars and when the market sinks!

Substantial profits that you can convert into cash reserves is the best way to ensure your family’s safety and comfort.

You don’t need to have a lot of experience as an investor.

And you don’t even need to use exotic investment vehicles.

Click here, and I’ll show you how to download and access the bonus reports instantly — so you can start using them just a few minutes from now!

To download these reports now, click here for all the details.

- The Weiss Ratings Endangered Lists

- Crash Profits: How to Hedge and Make Money in Down Markets

- Instant Income Revealed

- The Weiss Guide to Prudent Gold & Silver Investing

- How to Escape the Coming Real Estate Bust Without Selling a Single Property, plus

- Premium Access to the 56,000 Weiss Ratings!

You get all of this right now. All I ask is that you apply for a one-year subscription to our flagship investment letter, Safe Money Report, for just a few cents per day.

You can cancel and receive a full refund at any time during your 12 months with us, including up to the last day of your subscription.

And even if you decide to cancel, you can keep all of the guides, reports and ratings information that you download today or that you download at any time during the course of the year.

Fortunately, a small minority of investors WILL escape the dangers and even use this crisis to build substantial wealth. And if you act promptly on the simple steps I’ve given you today, you could be one of them.

You cannot rely on the government or anyone else to come to the rescue. Only you can protect yourself and your family. Only you can take your destiny into your own hands to create a better world for yourself.

I trust this time we’ve spent together has already given you some of the information you need to make that possible.

And I look forward to welcoming you on board to guide you the rest of the way.

All the details are on this page.

Good luck and God bless!

Martin D. Weiss, PhD

Weiss Ratings Founder