Join for only a few cents per day and

DOWNLOAD YOUR 5 EMERGENCY

GUIDES JUST MINUTES FROM NOW

Dear Investor,

America is in grave danger, extremely vulnerable to black swan events that strike out of the blue, that throw the world into turmoil and that raise the specter of even darker black swans still to come.

These unprecedented events — plus the government’s reactions to them — are wiping out any interest you can earn on your money … eroding your principal with raging inflation … and threatening to gut the vulnerable stocks in portfolio with market declines.

It’s a time for prayer … but also a time for action!

Here are the 10 wealth-building benefits you’ll get when you begin your premium membership — all for just 19 cents per day:

Benefit #1. One full year of Safe Money Report (normally $129).

By Mike Larson, Weiss Ratings’ lead expert on safe investing. You get 12 monthly issues in your inbox, giving you specific “buy” and “sell” recommendations, plus instructions on …

- How to find the highest-yielding, low-risk investments in the world.

- Which stocks are most vulnerable to the next black swans.

- Which stocks are most likely to soar despite the crisis, or even BECAUSE of the crisis.

- ETFs designed to go up whenever the market goes down.

- Plus, much, much more.

Benefit #2. One full year of Safe Money Print Edition

You not only get your issues electronically, but you also get the hard copy editions delivered to your home or office via first class mail each month.

This benefit alone is worth an extra $39.

Benefit #3. The Weiss Ratings Endangered Stocks List ($79 value).

If you hold stocks or stock mutual funds — in your regular brokerage account, in your 401(k) or in your IRA — start selling the ones we’ve identified as the most vulnerable to the next black swans.

In the market decline during the Great Debt Crisis, for example, investors could have used our ratings to avoid 385 stocks that fell 90% or more in value. And on average, the stocks that were on our endangered list when the crisis began lost more than two thirds of their value.

This time around, the most vulnerable are different names in different sectors. But you can find out exactly which ones they are simply by checking our special bonus report, The Weiss Ratings Endangered List.

In it, Safe Money editor Mike Larson gives you a complete list of all the stocks, ETFs and mutual funds with our lowest ratings — investments I wouldn’t touch with a ten-foot pole.

Benefit #4. Instant Income Revealed ($79 value).

Imagine an investment strategy that has generated about $1,000 in extra cash flow almost every Friday.

That could add up to $50,000 per year ...

And imagine a success rate of 98% on your trades.

Well, you don’t have to just imagine anymore. Because we feel it’s an appropriate solution to overcome the terrible low yields that continue to plague the financial world.

Our Safe Money Report editor, Mike Larson explains exactly how in his special report, Instant Income Revealed.

Benefit #5. The Weiss Guide to Prudent Gold & Silver Investing ($79 value).

Since my family began recommending $20 gold coins in the early 1930s, the price of gold has risen 9,595%.

Better yet, if some of my father’s clients had bought one of my father’s favorite gold coins at the time — the St. Gaudens $20 gold coin — and their family had kept it in good condition until today, they could have seen it appreciate to an estimated $42,000. That’s a gain of 206,288%.

Plus, in more recent years, since Safe Money Report first began recommending gold bullion coins and bars in our monthly newsletter, gold has risen by 459%. An initial investment of $10,000 is worth $55,000 today.

Plus, did you know that, by using only dealers that give you the lowest markup on bullion bars and coins, you can effectively get some extra “free” gold and silver.

We show all the ins and outs of precious metals investing in this guide.

Benefit #6. The 3 Best Digital Assets for the Next Monetary Crisis ($79 value).

You might think I’m talking about Bitcoin, but I’m not.

I’m talking about newer digital assets that our specialists say could someday be used as a new kind of currency all over the world.

One of our analysts first started buying Bitcoin in 2012, when it was selling for $11 per coin. And he held them to this day, giving him a gain of 420,991%.

Don’t expect to make that much money today. But we predict that three newer digital assets could be an even better solution to the global monetary crisis we see ahead.

How do we identify the best of the best? In addition to our team of analysts who produce our stock ratings, we also have a separate team of analysts producing our digital asset ratings. The data and formulas are very different. But, as with stocks, we also issue grades from A to E. And we cover nearly every active digital asset in the world today.

In today’s world of massive money printing, out-of-control inflation and wars — using our scientific data-driven approach to selecting the best of the best is absolutely essential. We give you all the details in this special bonus report.

In this report, I name three unique digital assets that we believe have the best chance of being among THE top leaders of the monetary system of the future.

Plus, I share with you my own personal investment plan on how to allocate funds between gold bullion and digital assets.

It’s not a fixed portfolio. It varies from time to time depending on a key indicator I also tell you about in The Three Best Digital Assets for the Next Monetary Crisis.

Benefit #7. The World’s Leading Resource Companies ($79 value).

Historically, these are the kinds of investments that have repeatedly soared when inflation rises and skyrocketed when inflation surges.

So, we have every reason to believe that in today’s world of surging inflation, they could do the same.

In this report, we name what we believe to be THE five best in the world.

Benefit #8. Weiss Ratings Top Ten: The Cream of the Crop Among the 10,000 Stocks We Rate ($79 value).

No one can guarantee the future performance of any list of stocks, and that’s also true for our top ten stocks today. But I CAN tell you how stocks meeting the same criteria have performed in the past.

Go back to the first trading day of 2010, for example. If investors bought our list of top ten stocks at that time and simply held them until we issued a “sell” rating on the stock, they would have seen a total return of:

- 112% on NewMarket Corp.

- 135% on Intel Corp.

- 144% on Magellan Midstream Partners, L.P.

- 334% on Cantel Medical Corp.

- 446% on Humana, Inc.

- 833% on MarketAxess Holdings, and

- 866% on Mastercard, Inc.

Not all ten were triple-digit winners. One made 81% and two returned only 25% and 18%, respectively.

But I’m proud to say that, on average, the Weiss Ratings top Ten Stocks returned 413%. That’s enough to grow an initial $100,000 into $513,000.

And I’m even prouder to say that NONE of the stocks on the list were losers.

Today, the world has changed a lot and, naturally, the list has also changed. It has different stocks in different sectors.

We name them in this report.

We give you their ticker symbols. We explain why we’ve picked them. And we provide instructions on our strategy for buying them.

Benefit #9. One year membership (365 issues) to Weiss Ratings Daily e-letter (priceless).

Delivered to your inbox every day of the year, this priceless email alert brings you our analysis of the latest news … warnings of likely black swan events on the horizon … and guidance on not only how to avoid them, but also how to turn them into profit opportunities.

The Weiss Ratings Daily also gives you access to timely video interviews with the Weiss experts, in-depth webinars and virtually everything you’d want to become a more successful investor in these trying times.

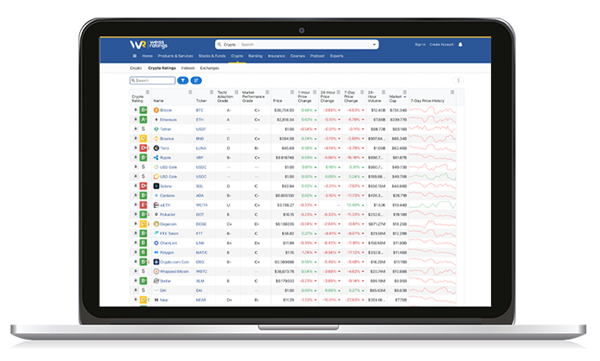

Benefit #10. Premium Access to 56,000 Weiss Ratings ($228 value).

With your premium membership, you get around-the-clock access to our very latest Weiss Investment Ratings (update daily) on …

- 10,000 common stocks

- 2,400 ETFs

- 26,000 mutual funds, and

- 1,600 cryptocurrencies

You get 24/7 access to our most recent Weiss Safety Ratings (updated quarterly) on …

- 4,800 banks

- 5,000 credit unions, and

- 3,600 insurance companies

You get upgrade and downgrade alerts to your inbox on your choice of any of the 56,000 companies or investments.

And you get power tools to create your own “buy” lists, “sell” lists and watchlists.

All told, for only $68, you get a total value of $861. YOU SAVE $793!

Plus, when you join now, you also get two extra benefits …

Extra Benefit #1. GUARANTEED LOWEST RENEWAL RATE.

When your subscription is up for renewal, we will notify you ahead of time, give you ample opportunity to cancel, and unless you tell us not to, we will renew your subscription. This way, you are assured no interruption in your service, and you always get the lowest regular renewal rate available. (You can opt out of this benefit whenever you wish.)

Extra Benefit #2. 100% MONEY-BACK GUARANTEE.

Plus, if you are not satisfied for any reason, you may cancel and receive a full, 100% refund at any time in your first year, including up to the very last day of your membership. (Just email us at [email protected] or call toll-free at 1-877-934-7778).

And you may keep all your special reports and all the Safe Money issues you’ve received — my “thank-you” for giving our Safe Money Report a try.

All told, for only $68, you get a total value of $861. YOU SAVE $793! To join now, simply click here.

Good luck and God bless!

Martin D. Weiss, PhD

Weiss Ratings Founder