The Next Black Swans

To download your reports immediately, jump here.

Or, read on for the transcript …

Dear Investor,

America is in grave danger, extremely vulnerable to black swan events that strike out of the blue, that throw the world into turmoil, and that raise the specter of even darker black swans still to come.

Like the Russian invasion of Ukraine, decimating an independent democracy larger than Germany and the UK combined, reducing its cities to rubble, sending shock waves through the global economy.

Or a massive future air attack on the independent democracy of Taiwan, igniting a new war in the South China Sea, spreading to the entire Pacific region, plunging East-West trade into turmoil.

How much damage could just one of these black swans cause?

For an answer, let’s not forget the black swans that have struck our nation since the beginning of the new millennium:

The black swan that attacked the very heart of our nation on 9-11 with great loss of life and treasure, setting off a chain reaction of events that have continued to ricochet through time:

The U.S. invasion of Iraq, the fall of Saddam Hussein, the rise of Al Qaeda, the global spread of the Islamic state, and then ...

Billions of dollars in new money printing by the U.S. Federal Reserve.

Or the black swan that attacked the very heart of our economy.

It wasn’t September 11th, 2001.

It was September 15th, 2008 — the Lehman Brothers failure, again, setting off a chain reaction of events that have continued to ricochet through time:

America’s deepest recession since the 1930s.

America’s largest bank failures and bailouts of all time. And then ...

A massive wave of central bank money printing that was many times larger than anything we’d ever seen before.

If you missed any part of this video or want to see it again, click here.

Or like the black swan virus that suddenly burst onto the scene, spread rapidly around the globe and mutated into even more contagious strains, transforming our cities into ghost towns, plunging financial markets into a tailspin, prompting governments to lurch from inaction to reaction, and then ...

Driving the Fed to unleash a tsunami of money printing that makes all prior money-printing binges look tiny by comparison.

I am not here to frighten you.

God knows, there’s enough fear in the world today. I’m here to give you the facts about the threats to your wealth so you find safety in an unsafe world.

Now, maybe you’re thinking that, once the world calms down and global conflicts recede, the inflation and economic turmoil will end, too.

If I were you, I wouldn’t bet on that either.

Long before the latest black swan events, we already had all the ingredients of a serious financial crisis here in America.

In fact, seeds for this crisis were planted a long time ago with …

More than two decades of Federal Reserve money printing …

Years of bad advice from Wall Street …

Dishonest ratings — and lies — that lured millions of people into debt …

That spurred millions of investors to throw caution to the wind …

That drove nearly everyone to take unprecedented risks with their hard-earned money.

If you find that hard to believe, I’ll give you the evidence here. I’ll show why we believe thousands of companies and even many banks are unprepared for the next black swans.

I’ll tell how many we identified were already in deep trouble before this latest phase of the crisis began.

And, before you and I part today I will give you access to my family’s — and my company’s — most precious crisis-investing guidance.

Because right now, the black swan events — along with the government’s reactions to the black swans — are creating three threats to investors.

Threat #1 is the destruction of any

decent interest you could possibly

earn on your savings.

Just look at what the Federal Reserve has already done:

The Fed has printed so much money, it has repeatedly wiped out any decent yield investors can earn without taking crazy risks. Now, adding insult to injury, the resulting inflation is decimating their principal as well. For our solution, go here.

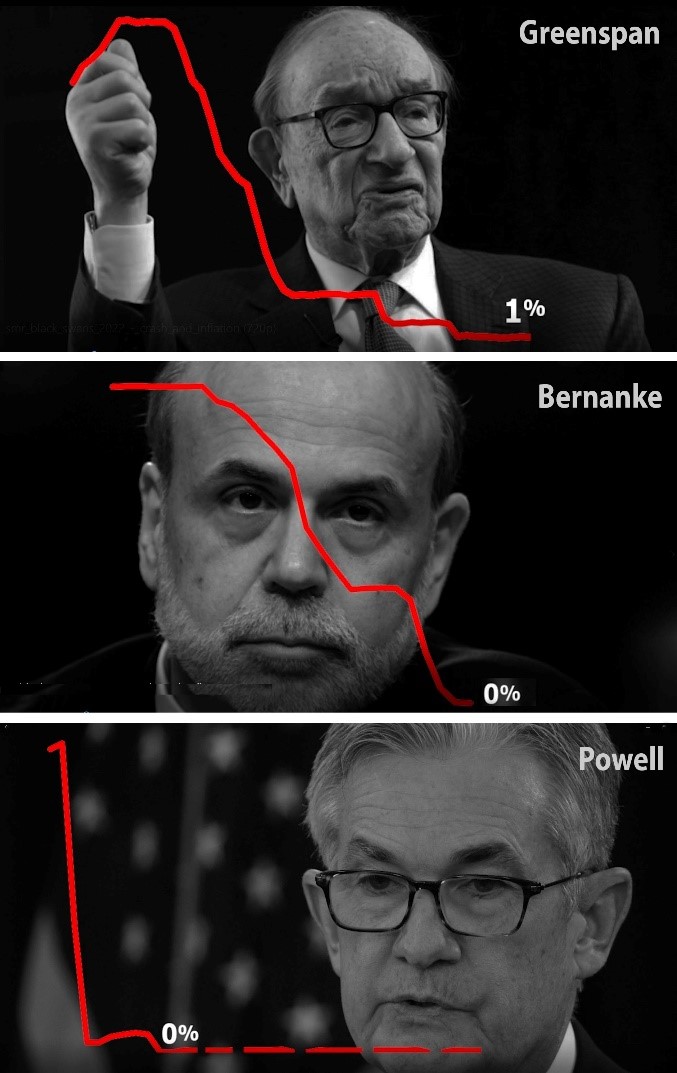

In response to the first black swan of the millennium, the 9-11 attacks, Federal Reserve Chairman Greenspan drove the Fed’s key interest rates down to 1%, gutting the yield of income investors.

In response to the second black swan, the Lehman Brothers failure, the next Fed Chairman, Ben Bernanke, drove rates down to zero, wiping out the yield of income investors. And...

In response to the third black swan, Covid-19, Fed Chairman Powell not only slammed interest rates down to zero, he kept them near zero for two full years, nearly obliterating people’s income today and for years to come.

What’s the solution?

In this session today, I’ll show you how virtually anyone can reliably earn 15% or more per year — not on stocks or bonds, but on cash-equivalent deposits. They’re liquid. And they CANNOT be manipulated by the Federal Reserve in any way.

Threat #2 is the rapid erosion of

your PRINCIPAL by out-of-control inflation.

This is no longer just a prediction. Inflation is already surging.

And the rising tide of conflict in the world today can only make it worse.

Not just wars in one country, not just wars in one region, but also trade wars, cyberwars and massive supply-chain disruptions all over the world.

I know. The inflation we’re seeing now is shocking. But what’s even more shocking to me is that most people are still so complacent about the truly dangerous inflation that’s rearing its ugly head today.

They didn’t live through the 1970s, when folks waited in gas lines for long hours just to top off their tanks … when the value of supposedly ultrasafe Treasury bonds plunged by more than half and … when the price of gold surged 2,324%.

To avoid the dangers and start reaping the great rewards, click this link.

They didn’t live through the inflation that gutted the economy of Brazil in the 1970s and Argentina in the 1980 … destroying the savings of millions of middle-class citizens … bankrupting their governments … prompting their leaders to confiscate their bank accounts … unleashing mass protests against inflation, and …tearing apart the fabric of society.

Nor does anyone dare think about the hyperinflation that wreaked havoc on the entire world …

Starting in Germany after World War I …

Creating the greatest avalanche of worthless paper money ever seen, and …

Giving rise to the most murderous dictator in the history of Western Civilization.

Hundreds of millions of Americans going about their daily business in America today are oblivious to the torrid past of inflation.

Fewer still believe anything vaguely similar might be possible today.

They have not yet learned the lessons of history.

And they don’t yet see the handwriting on the wall:

The consequence of complacency is catastrophe.

The solution is investments that have historically demonstrated a consistent pattern of surging when inflation rises and skyrocketing when inflation surges.

I’ll offer you specific insights on our selection of some the best in just a moment.

Threat #3 is the hidden

stock market crash.

I’m talking about a crash in stocks that, not long ago, were the biggest, flashiest, winners that investors piled into blindly.

But whether hidden or not, the next great crash is the ultimate threat to your wealth.

I know. Because my family and I have lived through market crashes and even predicted them ahead of time.

The story begins with my father, Irving Weiss, who first went to work on Wall Street in the late 1920s as a Customer’s Man, which nowadays they’d call a stockbroker.

The stock market of the 1920s would be eerily familiar to anyone who has lived through the current crisis. It was enjoying a roaring bull market that was unusually long, just like it has been doing in recent years.

And the market was unusually out of sync with the tough times that most working American families were experiencing, also much like recent years.

So, when the Dow Jones Industrials kept going up in the first ten months of 1929, my father didn’t trust it.

He didn’t trust the disconnect between the great times on Wall Street and the tough times in the neighborhood where he lived.

He didn’t have many clients yet — just friends and family. But he told them to get the heck out of the market.

In his office, the veteran stockbrokers laughed at him. “Weiss is just a kid,” they said. “What does he know?”

And then came Black Monday, October 28th, 1929. The market plunged the equivalent of about 4,500 points in the Dow Jones of today.

On the next day, it plunged the equivalent of another 4,000 points.

It was like an 8,500-point crash in just 48 hours.

Suddenly, Irving was a hero, and suddenly the word got around that he was the only one who saw it coming.

That’s when he decided to do more, much more.

He collected data on as many companies as he could. He put the numbers down on the large, green sheets that bookkeepers used, spreadsheets actually. And he created a series of formulas that would later become the foundation my company’s own computer models of today.

Using his formulas, he identified the companies that he thought were the riskiest. He called them “Dogs of the Dow,” stocks to avoid at all costs.

In the early 1930s, Dad also used his formulas to identify the strongest companies in the market, like gold mining companies, for example.

Years later, he wrote …

“In those days, very few people were buying the gold, which was ironic because you could buy it so easily. All my clients and I had to do was go to our bank, walk up to the teller window and ask for $20 gold coins. And that’s what we did.”

Among all the companies on his spreadsheet, guess which ones got the best grades! It was the mining shares. So, he figured he couldn’t go wrong if he concentrated on the companies with his highest grades, like Homestake Mining Company and Dome Mines Limited.

Most investors today have no idea how large the profits were in gold shares in the 1930s.

Homestake rose from $65 per share to $130 and change in 1931. Then it doubled and doubled again to more than $540 a share in 1936.

In the meantime, Homestake’s dividends also doubled and redoubled, reaching $56 per share in 1935.

Think about that:

The dividends earned in one year

alone almost paid back the entire

purchase price of the stock.

Dome, another great gold producer, did even better. You could have bought Dome for as little as $6 a share and sold them for $61 a share.

A person who put $10,000 into Dome could have walked away with more than $100,000, excluding dividends.

Is it possible that history will repeat itself? Everything I see happening today tells me the answer is yes. And it all comes back to one of the last predictions my father made before he passed away.

He warned that, someday, inflation will again rear its ugly head, and ultimately the stock market will crash again. He didn’t say exactly when it might happen, but he did tell me how it would happen.

“Inflation will run amuck, and the crisis will be so severe, all the government’s money printing will still not be enough to put things back together again.

“The entire monetary system will be in danger. Eventually, the country will recover, but it will take years, many years for that to happen.”

Now that crisis has begun. And now, we can see clearly how all the threats could soon converge in one time and place.

The utter destruction of any interest you could safely earn on your money.

The rapid erosion of your principal with raging inflation.

And the growing risk that your stock portfolio could also be gutted.

Not to mention wars and the threat of new wars.

This is a very solemn moment in history — a time for prayer, but also a time for action. And a few minutes from now, I will give you our roadmap for seven steps to take starting immediately. But first let me tell you the rest of my family’s story.

One half century ago, I founded my own company, Weiss Ratings, to help Americans of all walks of life keep their money safe — in good times and in bad times as well.

We transformed my father’s spreadsheets and formulas into a massive database on more than 56,000 companies and investments — stocks, ETFs, mutual funds, banks, insurance companies, even thousands of digital assets.

And today, that entire database has been modernized by a team of analysts, mathematicians and data scientists, using our advanced computer models to identify the weakest and the strongest every day of the year.

That’s how we warned in advance about the Dot-Com bust of the early 2000s and the great Debt Crisis of 2008. But …

We don’t just issue warnings.

We also issue RATINGS,

the Weiss ratings!

We provide a letter grade from A to E on nearly every stock, every ETF, every mutual fund and every financial institution in America.

With those ratings, we NAME the stocks that are likely to fall the most.

We NAME the banks that are most likely to go bankrupt.

Before the Debt Crisis of 2008, for example, we warned about nearly every major institution that failed and we did so months in advance.

We named Lehman Brothers as a candidate for failure 182 days before it went bankrupt.

We named Fannie Mae over one year in advance, Citibank, Wachovia Bank, and Washington Mutual Bank 51 days in advance … General Motors five months in advance, and many more. Among the 465 banks that failed during and after the debt crisis, we warned consumers about 464.

Yeah, we missed one, but that was only because the bank had committed fraud — it fraudulently kept hidden from everyone.

These kinds of on-target warnings prompted Worth magazine to say that our “record is so good compared with that of our competitors ... consumers need look no further.”

And The New York Times to say we were “the first to see the dangers and say so unambiguously.”

Barron’s wrote, Weiss is “the leader in identifying vulnerable companies.”

Chris Ruddy, founder of Newsmax and a close friend of former President Trump, said our “prediction of the current economic crisis is uncanny.”

And Louis Rukeyser of Wall Street Week wrote that we provide “a tougher service.”

And, I want to tell you that the service he was referring to includes a very important list of companies that, based on our ratings, are at the gravest danger. We call it the ENDANGERED LIST.

But I must warn you. Our endangered list is very long, and that’s the best evidence I can give you that the threat to your wealth could be deep and long-lasting.

Even before this phase of the crisis began, our endangered list included:

* Over 7,000 stocks, ETFs and mutual funds.

* More than 1,000 banks and credit unions with insufficient capital to withstand an ordinary recession.

* Plus another 3,000 that were unprepared for the next black swans.

And now, I’m sad to say, our endangered list is getting even longer.

So, the probability is high — and getting higher — that, if you’re an average investor, many of your stocks and mutual funds and even your bank could be on the endangered list.

Not all companies are in bad financial shape, mind you. There are still strong ones, and I’ll tell you about those in a moment.

But whether good or bad, you just need to know. And you need to know NOW, before the next black swans strike America.

Plus, there’s one more thing I want you to know.

Until now, we charged a fee for folks to access our ratings. You see, we’re not like Standard & Poor’s, Moody’s, and Fitch.

Because when they issue a rating on a company, they get paid by that company for the rating. Their ratings are bought and paid for by the rated companies.

Many smart people think that’s a serious conflict of interest, and I agree. Plus, it’s also one of the reasons why millions of people who followed their ratings lost so much money in the Great Debt Crisis of 2008. We never do business that way.

We have never taken a dime and never will take a dime from the companies we rate.

Our only source of revenue is the end user of our information, average people who want to get safe and make some money, too. But because of this crisis …

I don’t want any barriers between our ratings and your safety.

So, for the duration of the crisis, I propose to give you access to all of our ratings lists for free.

Look, I know that the vast majority of Americans will fail to heed my warnings and fail to get ready for the next black swans.

But I sincerely hope — for you and your family’s sake — that you’re not one of them.

The precautions required to protect yourself from the next black swans are not difficult. Even if the storm they create turns out to be less severe than we fear, the worst that will happen is that you’ll sleep better at night.

And potentially make some good money, too.

Because there IS some good news: You have some time to prepare.

But not much time.

Here are the seven steps I recommend you begin taking immediately to protect yourself and your loved ones from the storm I see coming ...

STEP 1

Avoid the Endangered Stocks

If you hold stocks or stock mutual funds — in your regular brokerage account, in your 401(k) or in your IRA — start selling the ones we’ve identified as the most vulnerable to the next black swans.

In the market decline during the Great Debt Crisis, for example, investors could have used our ratings to avoid 385 stocks that fell 90% or more in value. And on average, the stocks that were on our endangered list when the crisis began lost more than two-thirds of their value.

To download this report now, click here for all the details.

This time around, the most vulnerable are different names in different sectors. But you can find out exactly which ones they are simply by checking our special bonus report, The Weiss Ratings Endangered List.

In it, I give you a complete list of all the stocks, ETFs, and mutual funds with our lowest ratings — investments I wouldn’t touch with a ten-foot pole.

STEP 2

Learn How to Earn $1,000 in Income Per Week.

By income, I mean cash flow into your brokerage account.

Imagine an investment strategy that has generated about $1,000 in extra cash flow almost every Friday.

That could add up to $50,000 per year.

And with double the investment, could add up to $100,000 per year.

Imagine a success rate of 98% on your trades.

To download this report now, click here for all the details.

And imagine a yield equivalent of up 9% or more.

Well, you don’t have to just imagine anymore. Because we feel it’s an appropriate solution to overcome the terrible low yields that continue to plague the financial world.

Our Safe Money Report editor, Mike Larson explains exactly how in his special report, Instant Income Revealed.

STEP 3

Own Mankind’s Most

Traditional Crisis Hedge: Gold.

Own Mankind’s Monst

Traditional Crisis Hedge: Gold.

Since my family began recommending $20 gold coins in the early 1930s, the price of gold has risen 9,595%.

Better yet, if some of my father’s clients bought one of my father’s favorite gold coins at the time, the St. Gaudens $20 gold coin, and their family kept in good condition until today, they could have seen it appreciate to an estimated $42,000. From $20 to $42,000.

That’s a gain of 206,288%.

Now, I’m not saying you can make that much money in gold this time around. Nor am I expecting you to wait 90 years for that to happen.

But in more recent years, since Weiss Ratings began recommending gold bullion coins and bars in our monthly newsletter, gold has risen by 459%. An initial investment of $10,000 is worth $55,000 today.

To download this report now, click here for all the details.

We show all the ins and outs of precious metals investing in our third bonus report we've prepared for you — The Weiss Guide to Prudent Gold & Silver Investing.

STEP 4

Diversify Your Inflation

Protection With Digital Hedges

You might think I’m talking about Bitcoin, but I’m not.

I’m talking about newer digital assets that our specialists say could someday be used as a new kind of currency all over the world.

Remember my father’s prediction that the entire monetary system will be in danger? Well, that day is no longer decades away. I believe it’s nearer than most people think, and the threat is growing by the day.

So let me first tell you something about our experience with Bitcoin. Then I’ll tell you about the newer digital assets that have even better potential.

One of our analysts first started buying Bitcoin in 2012, when it was selling for $11 per coin. And he held them to this day, giving him a gain of 420,991%.

Think about that. In less than one decade, he has seen twice the gains holding Bitcoin than my Dad’s clients in the 1930s could have seen in nine decades holding one of the rarest $20 gold coins.

That’s double the results in less than one-ninth the time.

Today, we predict that three newer digital assets could be an even better solution to the global monetary crisis we see ahead.

When our lead expert first recommended one of these newer digital assets, it was selling for 6 cents. It then surged to $1.31, a gain of 2,083% in less than three years. And at current price levels, we think it’s just getting started. I predict it could go to $10, $100, even $1,000 in the future.

Not every digital asset he recommended has gone up that much. To give you some context, among the trades he recommended closing in 2021 — or holding through the end of 2021 — three were losers with an average loss of 30%. And 19 were winners with an average gain of 689%. But that was still far better than Bitcoin, which in turn rose more than almost any other asset class.

How do we identify the best digital assets? Well, in addition to our team of analysts who produce our stock ratings, we also have a separate team of analysts producing our digital asset ratings.

The data and formulas are very different. But, as with stocks, we also issue grades from A to E. And we cover nearly every active digital asset in the world today.

In today’s world of massive money printing, out-of-control inflation and wars, using our scientific data-driven approach to selecting the best of the best is absolutely essential.

To download this report now, click here for all the details.

And I give you all the details in our special bonus report: The Three Best Digital Assets for the Next Monetary Crisis.

In this report, I name three unique digital assets that we believe have the best chance of being among THE top leaders of the monetary system of the future.

Plus, I share with you my own personal investment plan on how to allocate funds between gold bullion and digital assets.

It’s not a fixed portfolio. It varies from time to time depending on a key indicator I also tell you about in The Three Best Digital Assets for the Next Monetary Crisis.

STEP 5

Own companies that have historically

done very well in times of high inflation.

I’m referring to companies that mine the natural resources, that mine Bitcoin … or that build their business around some of the most powerful inflation hedges of this era.

To download this report now, click here for all the details.

We name them in our special report The World’s Leading Resource Companies.

STEP 6

Invest in The Weiss Ratings Top Ten

These are not just the top ten among 100 stocks, not even the top ten among 1,000. They are the ten stocks that our ratings have identified as THE best among the 10,000 different stocks we rate and review every day. In other words, they’re in the top 0.1 percent.

So, let me repeat what I said before: Our ratings are not only designed to help you avoid the big losers, they’re also designed to help you identify the biggest winners.

We select these stocks not only because they are strong today but also because we believe they will be strong in the face of future black swans. Among them are companies that can do the most to help people in inflationary times, and to even benefit directly from inflation.

We name them in our special report, The Weiss Ratings’ Top Ten: The Cream of the Crop Among the 10,000 Stocks We Rate.

No one can guarantee the future performance of any list of stocks, and that’s also true for our top ten stocks today.

But I CAN tell you how stocks meeting the same criteria have performed in the past.

Go back to the first trading day of 2012, for example. If investors bought our January 2012 list of top ten stocks at that time, and simply held them until we issued a “sell” rating on the stock, they would have seen a total return of:

- 112% on NewMarket Corp.

- 135% on Intel Corp.

- 144% on Magellan Midstream Partners

- 334% on Cantel Medical Corp.

- 446% on Humana, Inc.

- 833% on MarketAxess Holdings, and

- 886% on Mastercard, Inc.

Not all ten were triple-digit winners. One made 81% and two returned only 25% and 18%, respectively.

But I’m proud to say that, on average, the Weiss Ratings top Ten Stocks returned 413%. That’s enough to grow an initial $100,000 into $513,000.

And I’m even prouder to say that NONE of the stocks on the list were losers.

To download this report now, click here for all the details.

Today, the world has changed a lot and, naturally, the list has also changed. It has different stocks in different sectors.

We name them in Weiss Ratings’ Top Ten: The Cream of the Crop Among the 10,000 Stocks We Rate.

We give you their ticker symbols. We explain why we’ve picked them. And we provide instructions on our strategy for buying them.

STEP 7

Stay up to Date With

Our 56,000 Different Ratings.

One of the free services we’re providing in this crisis is premium access to all our ratings. One half century ago, I founded my own company, Weiss Ratings, to help Americans of all walks of life keep their money safe — in good times and in bad times as well.

- 10,000 common stocks

- 2,400 Exchange-Traded Funds (ETFs)

- 26,000 mutual funds and

- 1,600 cryptocurrencies.

Plus, you not only get full access to all of our investment ratings, but you also get full access to all of our safety ratings on …

- 4,800 banks

- 5,000 credit unions, and

- 3,600 insurance companies.

That gives you the power to select, at will and at any time, the ones to avoid and the ones to favor for the best combination of relative safety and profit potential.

Both when the market soars and when the market sinks!

At a time like this, a powerful offense is your best defense. Building up substantial profits that you can convert into cash reserves is the best way to ensure your family’s safety and comfort.

You don’t need to have a lot of experience as an investor.

And you don’t even need to use exotic investment vehicles.

In a moment, I’ll show you how to download and access the bonus reports instantly — so you can start using them just a few minutes from now!

The Weiss Ratings Endangered Lists

Instant Income Revealed

The Weiss Guide to Prudent Gold & Silver Investing

The Three Best Digital Assets for the Next Monetary Crisis

The World’s Leading Resource Companies

The Weiss Ratings Top Ten: The Cream of the Crop Among the 10,000 Stocks We Rate, plus …

Not to mention premium access to the 56,000 Weiss ratings!

You get all of this right now. All I ask is that you apply for a one-year subscription to our flagship investment letter, Safe Money Report for just a few cents per day.

You can cancel and receive a full refund at any time during your 12 months with us, including up to the last day of your subscription. And even if you decide to cancel, you can keep all of the guides, reports and ratings information you download today or that you download at any time during the course of the year.

Fortunately, a small minority of investors WILL escape the dangers and even use this crisis to build substantial wealth. And if you act promptly on the simple steps I’ve given you today, you could be one of them.

You cannot rely on the government or anyone else to come to the rescue. Only you can protect yourself and your family. Only you can take your destiny into your own hands to create a better world for yourself.

I trust this time we’ve spent together has already given you some of the information you need to make that possible.

And I look forward to welcoming you on board to guide you the rest of the way. Click here for all the details.

Good luck and God bless!

Martin D. Weiss, PhD

Weiss Ratings Founder