America’s Day of

Reckoning Has Begun

The fat-cat bankers at the U.S. Federal Reserve have just unleashed a chain of devastating events that will change everything in your life.

In this report:

What you must do immediately to protect and preserve your wealth …

What you can do now to grow up to 6 times richer when it all hits the fan …

Dear Investor,

An event that took place on December 19, 2018 has already begun to change everything in your life.

This is not a prediction. It is historical fact. And it means nothing will ever be the same again for you or for your family.

The fallout of this historic event will be horrific for the unprepared.

It will trigger all-out panic on Wall Street.

It will destroy the housing market ... sentence middle class Americans to a “dark age” of depression ... send gold and silver prices careening higher ... even push the U.S. government toward the brink of financial disaster.

The carnage could ultimately make the Great Recession of 2008 and 2009 pale by comparison.

When the dust settles, the American dream will have died for millions.

For most, this cataclysm will be a bolt out of the blue.

Years of economic manipulation, dishonest accounting and outright lies told by Washington and Wall Street have lulled millions of consumers, savers and investors to sleep.

But a select handful of Americans who read the handwriting on the wall will be able to escape the dangers and even use this crisis to build substantial wealth. If you act immediately on the simple recommendations I am about to give you, you could be one of them.

My name is Mike Larson, editor of Safe Money Report. I’m the analyst who accurately warned of the housing bust, debt crisis and Great Recession more than one year in advance ...

Now I want to warn you that America is facing a crisis that will be much worse.

Whether you prepare or not, the price for decades of economic sins must finally be paid. All things end in judgement.

That debt is NOW coming due.

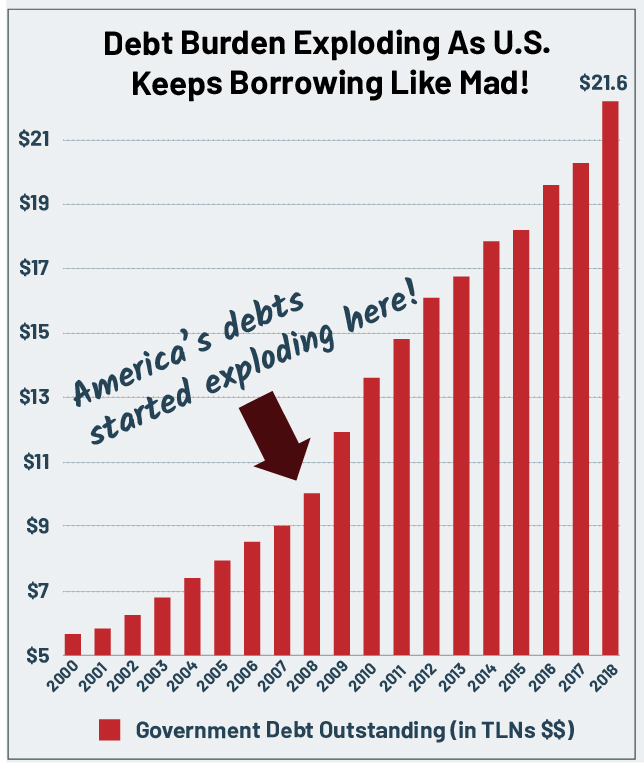

The federal government has racked up over $9 trillion in budget deficits trying to combat the effects of the last crisis.

And now, the U.S. budget deficit is suddenly ballooning to $1 trillion and beyond.

When you run gigantic budget deficits year in and year out, you have to finance them by issuing debt. Mountains of it.

That’s why America’s debt load has more than TRIPPLED since the start of the millennium, surging from $5.7 trillion to $20.2 trillion today.

And the lion’s share of that growth came in the wake of the Great Recession.

With this huge mountain of debt looming, bond markets here in the United States and around the world have already fallen sharply.

Global stock markets are already reeling.

The American housing market is already stumbling.

And now a small group of bureaucrats has already made a decision that's going to sabotage everything.

This will wipe out the ONE and ONLY force that kept the economy from collapsing during the Great Recession of 2008-2009.

In 2019, that force will no longer be able to keep us from the edge of the abyss. All hell is going break loose.

An extreme forecast? Perhaps. But over the past 42 years, my Safe Money Report has earned a reputation for unhedged warnings that have been proven amazingly accurate.

Hundreds of thousands rely on our ratings on stocks, ETFs, mutual funds, banks and insurance companies.

They count on us to help them avoid companies and investments that are destined to crash and burn ...

And they also come to us for reliable help in finding the cream-of-the-crop companies that they can invest in with confidence ... and with relative safety.

In fact, you could have used our ratings to avoid stocks that plunged by as much as 48.5% while owning stocks that surged 102% ... 103% ... 115% ... up to 121%.

And since 2007, if you had followed our stock ratings and our recommended strategy for using them, you could have made a total return of 809%.

You would have beaten Warren Buffett’s Berkshire Hathaway by four to 1.

You would have outperformed the S&P 500 by a whopping FIVE to 1.

And equally important, you could have avoided the Crash of 2008 when stocks fell by over 50%.

Millions have seen me and our team of financial experts on CNBC, CNN and NBC News or in The New York Times or Wall Street Journal.

The media turn to us because our forecasts are amazingly accurate.

Months in advance, we warned about the S&L crisis of the 1980s, the giant insurance company failures of the 1990s, plus the great Dot-Com Bust of the early 2000s.

Then, just before the 2008 mortgage crisis, we were the only ones in the world to issue low ratings — and specifically name — nearly every major company that subsequently collapsed.

For example, we warned of the failure or near-failure of Bear Stearns, Lehman Brothers, General Motors, Fannie Mae, Wachovia, Citigroup, Bank of America, and many others.

These kinds of on-target warnings prompted Worth magazine to say our “record is so good compared with that of competitors ... consumers need look no further.”

And the New York Times to say we were “the first to see the dangers and say so unambiguously.”

Barron’s wrote, we are “the leader in identifying vulnerable companies.”

And Chris Ruddy, founder of Newsmax and close friend of President Trump wrote our “prediction of the current economic crisis is uncanny.”

More importantly, our forecasts allowed investors the opportunity to avoid big losses and even make money as the crisis unfolded.

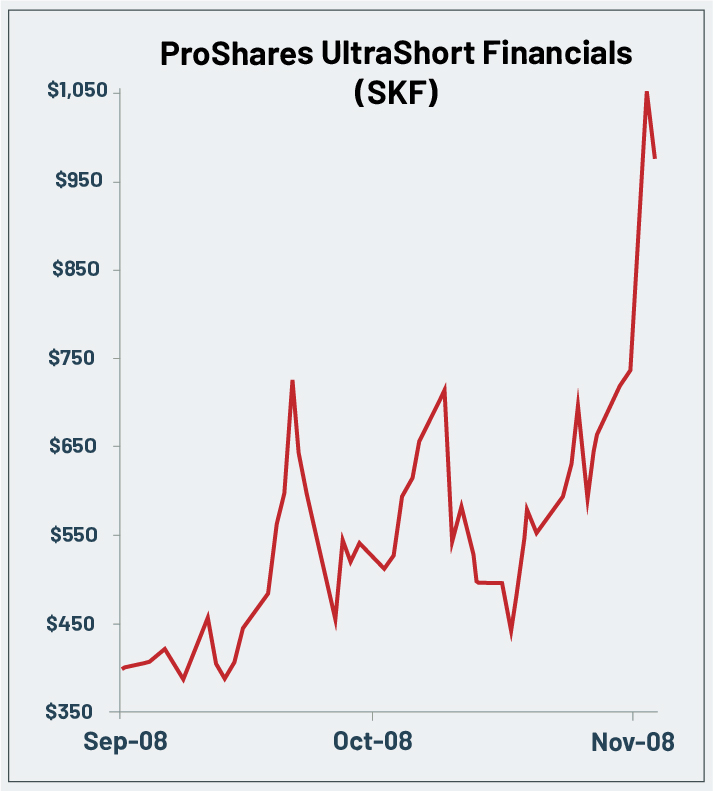

If you had heeded those forecasts, you could have multiplied your money with defensive investments that soared as busted mortgages caused the real estate sector to crash and burn.

Between September 19 and November 21 of 2008, for instance, the ETF that rises when financial stocks fall posted a 144.1% gain.

And during that same period, another investment designed to profit from the real estate decline posted a 354.9% gain — enough to more than quadruple your money.

Plus, as the crisis struck other industries, you could have used similar investments on other sectors to grab gains of 156% ... 176% ... 193% ... 289% ... up to 553%.

Now, another crisis is brewing.

My mission is to make sure YOU are

prepared to protect your wealth and keep it

growing even in the worst of times.

I know. I am well aware this forecast is going to be controversial even among my closest friends and followers.

But in our time together today, I’ll present powerful evidence of its accuracy.

I’ll explain why this crisis is inevitable, in fact, carved in stone. Why it has already begun and why it is about to trigger an economic implosion the likes of which none of us has ever seen.

I will describe what to expect when disaster strikes — how it’s likely to impact you, your family and your finances.

I will NAME giant companies and stocks that are most vulnerable.

And I will also name the investments most likely to survive, thrive and make investors richer ... not just “in spite of” the crisis, but BECAUSE of it.

If you take the simple steps I’ll recommend today, I can guarantee you’ll be a lot better off than folks who haven’t prepared.

Even if I’m wrong about how massive the coming economic disaster will be, you should still do very well.

And no matter what, you could make more than enough money to get your loved ones through in relative safety and comfort.

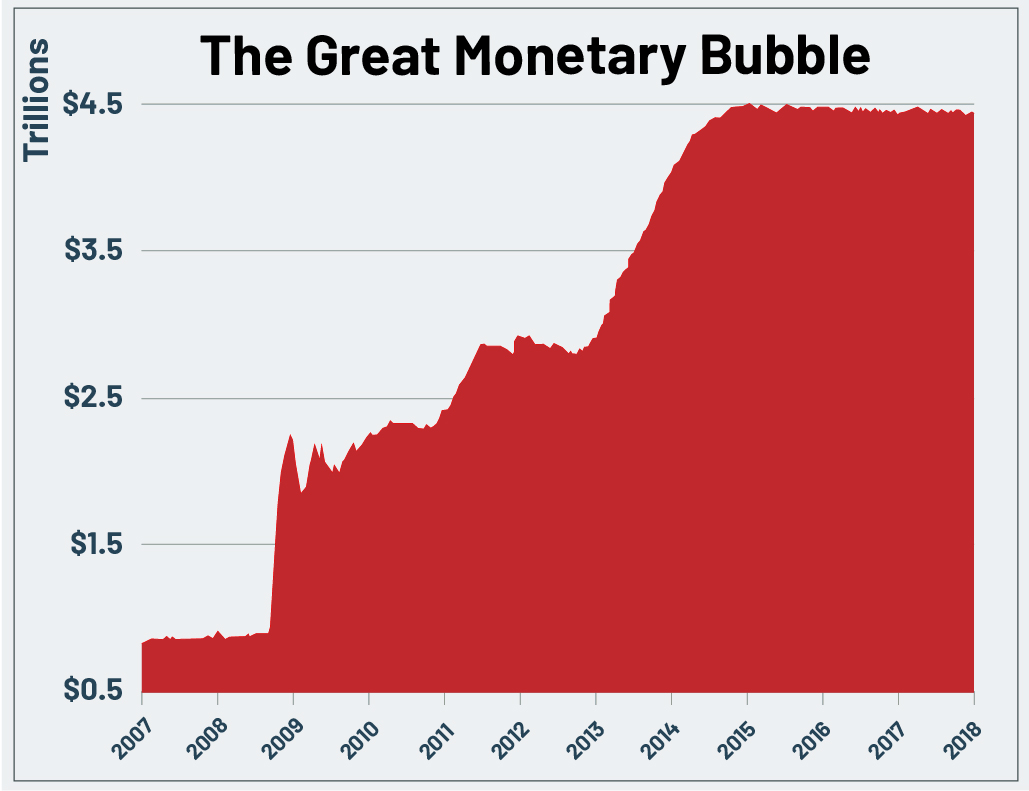

The Federal Reserve created the greatest bubble of all time — $4 trillion in printed money. And now the Fed has taken the first steps to PUNCTURE that bubble, with far-reaching consequences for investors.

That’s critical — because there is only one reason why The Great Recession and Debt Crisis did not become a full-fledged depression.

It’s because the U.S. Federal Reserve printed more than four trillion paper dollars, the biggest money printing of all time.

Why did they do it? Because they wanted to shove interest rates all the way down to zero, and then KEEP them there for the longest time ever in history!

So today, the entire U.S. economy is hanging on that one thin thread: Extremely low interest rates.

If it weren’t for these record low interest rates, The Great Recession and Debt Crisis of 2008-2009 would have turned into a full-scale Great Depression and Debt Panic.

If it weren’t for record low interest rates, the housing market would never have recovered, trillions in corporate profits would never have materialized and millions more would be unemployed today.

And if it weren’t for record-low interest rates, we wouldn’t have seen a new bubble in the bond market, the stock market and the entire economy.

The Great Trigger Event

that is bursting this bubble.

The trigger event that has lit the fuse on the greatest calamity of our lifetimes, which will vaporize massive amounts of wealth?

It should be obvious: It’s when interest rates suddenly begin to RISE.

On December 19th 2018, Fed Chairman Jerome Powell decided to hike interest rates with gusto … despite stern warnings from economists that it would sink the financial markets. Not long ago, interest rates were at 0.25%. Now they’re already TEN times higher.

Powell effectively signed the death warrant of the American economy … and sentencing millions of Americans to poverty for the rest of their lives.

At the same time, he unwittingly created a special situation with the power to multiply your money many times over … IF you make the right moves now.

But this is just the beginning.

Indeed, history shows us exactly what happens when the Fed pushes interest rates higher: When the Fed began raising rates in 1999, it triggered the Dot-Com Bust that wiped out a staggering $5 trillion in invested wealth.

When the Fed started raising rates in the mid-2000s, it triggered the most devastating housing bust, debt crisis and recession in modern American history.

Now, the Fed is raising interest rates again. And just as it did in the Great Recession and stock market crash of 2008-2009, this great final, debilitating blow to the U.S. economy will leave millions financially naked, alone and vulnerable.

The timing couldn’t be worse because of three hidden time bombs virtually no one is talking about.

Hidden Time Bomb #1:

Everywhere you look, banks and investors

have thrown caution to the wind.

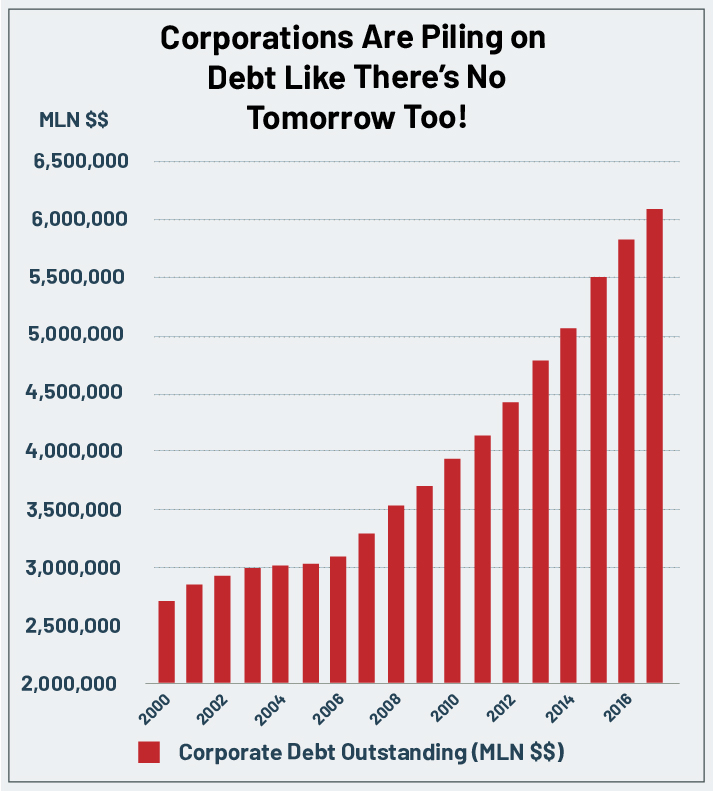

Banks are taking huge risks again by lending money for corporate takeovers at the fastest pace since late 2006-2007, right before everything collapsed. America’s corporations are also taking on huge risks again. We know because their debt has suddenly ballooned like crazy.

A decade ago, they had $3.3 trillion in debt. Now, they have $6.1 trillion, a stunning 84% surge!

Measured against the economy, corporate debt is off the charts. These corporations now have 45 cents in debt per $1 of Gross Domestic Product.

That’s a higher percentage of the U.S. economy than at any point in history, including at the peak of the Dot-Com Bubble!

Bond investors have taken huge risks again, piling into junk bonds like never before.

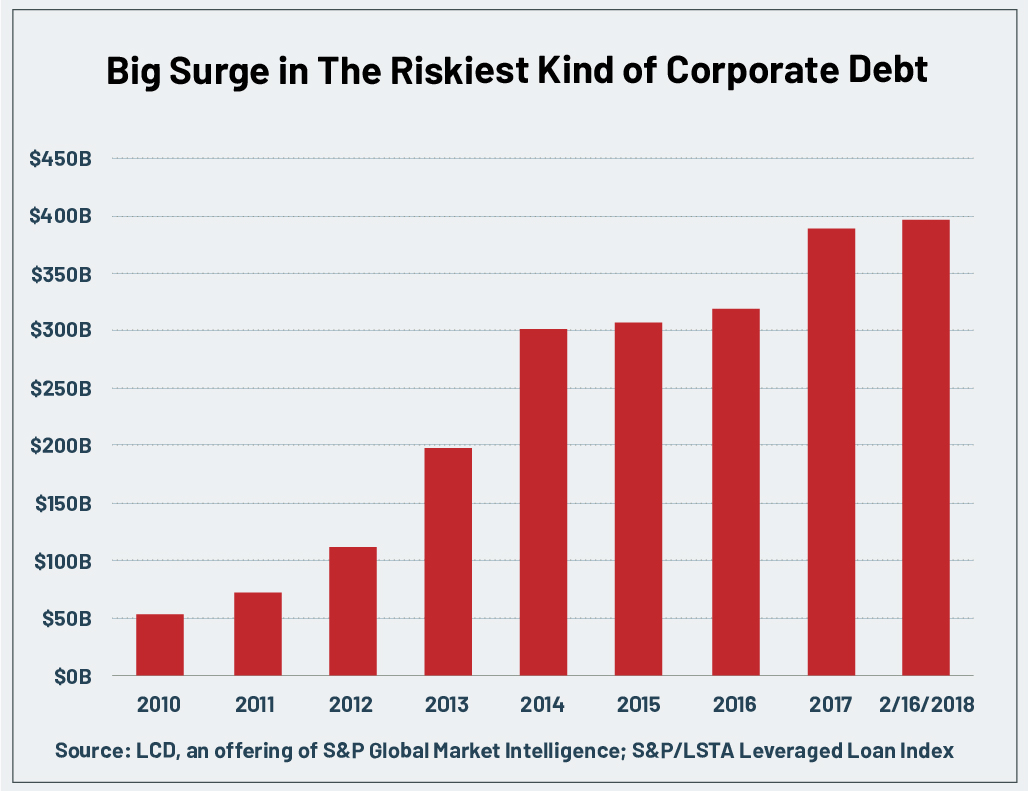

Not only have we seen a surge in corporate debt, we’ve also seen a gigantic surge in the absolute riskiest kind of debt.

In fact, we see more debt going to the highest-risk category of borrowers than at any time in history!

These types of debts are called “Covenant-Lite loans.” They are the riskiest of all because they don’t include strict rules on how much debt borrowers can take on or how much cash they need to keep on hand. They get a rating of single B, which is a low category of “junk.”

I call it “garbage debt.” And it has surged roughly EIGHT TIMES OVER since 2010 to an all-time record of $396 billion. Garbage debt now represents a whopping 75% of all leveraged loans — far and away the highest market share of all time.

This is exactly the same kind of high-risk behavior that preceded nearly every other major economic catastrophe.

It is precisely what we saw just before the Great Depression of the 1930s and The Great Recession of 2008-2009.

Real estate investors are also taking huge risks again.

They’ve piled into single-family homes, condos, apartment buildings and industrial parks. And now, housing affordability is the worst since 2008 when the economy was collapsing!

On Wall Street, deal-making frenzy has risen to levels not seen since just before The Great Recession.

Investment bankers and bond salesmen are celebrating, sipping Cristal champagne, and partying with customer money earned in highly questionable, high-risk deals. Risky lending for mergers and acquisitions has surged to an all-time record pace of $250 billion, up 23% from a year earlier.

Why? Because they’ve been cashing in on the flood of nearly free money that the U.S. Fed has pumped in. Because of nine long years of near-zero interest rates!

And just as in those previous catastrophes, this “devil-may-care” attitude — this appetite for high-risk investments — is setting the stage for an absolute bloodbath on Wall Street.

The trap has been set. Until just recently, the markets are partying like it was the Roaring ‘20s or the 1999 Dot-Com Bubble all over again. And now the clock is ticking.

The Fed lit the fuse in 2018. The bond market was the first to collapse. Then the stock market began to plunge. And very soon, it could lead to one of the greatest economic implosions EVER.

Hidden Time Bomb #2:

The U.S. economy is incredibly

vulnerable to higher rates right now.

Last time around — before the Great Recession in 2008-2009 — the U.S. economy was booming for nearly everyone. It was far better equipped to absorb a shock.

Not so, today!

Sure, the top 1% have made out like bandits, raking in millions, even billions on Wall Street thanks to the Fed’s newly printed money.

But the other 99% are not so lucky.

Workers are earning LESS not more: Disposable income for all income levels has fallen dramatically over the past 15 years.

The inflation-adjusted net worth for the typical household was $142,416 in 2007. Ten years later, it was only $55,876, a whopping 61% decline.

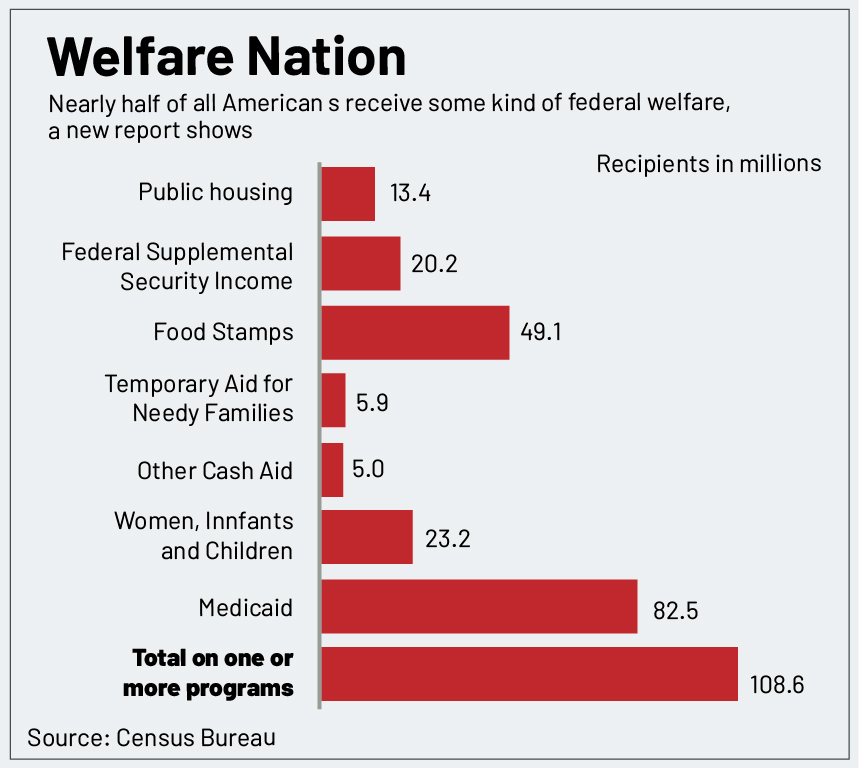

We have become a welfare nation: A record 46.7 million Americans are receiving food stamps. Another 12.8 million are on welfare. And still another 5.6 million are on unemployment insurance.

The price is horrendous: In the last five years the federal government has transferred $3.7 trillion from taxpayers to welfare recipients.

Back in 1960, only 10% of the money Americans received from regular checks came from welfare payments. Today, it’s 35%! That’s right. The portion of income from welfare benefits has more than tripled!

Despite Washington’s claims to the contrary, inflation is raging: You may not see it in the supermarket or at the gas pump. But while middle class income has been stagnant, the cost of tuition, medical care and virtually every other necessity has continued to go up and up.

At the same time, a different kind of inflation – asset inflation – has spiraled out of control. The price of everything from Manhattan condos to baseball cards and vintage whiskey have gone through the roof. To buy or even rent a home is now beyond the reach of middle-class families who could easily afford them ten years ago. High-end homes in Bel Air, California are going for up to $350 million.

Hidden Time Bomb #3:

Washington is paralyzed, helpless to

stop an economic collapse.

Last time around — when the economy collapsed in 2008 — the U.S. government was mostly united and financially strong.

Back then, Treasury Secretary Henry Paulson literally dropped to his knees and begged House Speaker Nancy Pelosi not to “blow it all up” by refusing to bail out the nation’s bankrupt banks. She agreed. So did the Republicans in Congress.

And that memorable scene marked the beginning of the biggest government bailouts of all time. This time, however, there is no safety net. Congress is so deadlocked, even the simplest new laws are stalled for months or even years.

Worse, there’s no money. The national debt has more than doubled since 2008.

That’s why bond prices have already begun to plunge. That’s why interest rates have already started to rise. And that’s why the economy — which was kept alive on cheap money for nine long years — will ultimately fold like a cheap suit.

Remember: That’s what happened the last two times the Fed raised interest rates. Now, the Fed is doing it again. And once they start, more than half a century of rate history tells us they won’t stop for a long, long time.

Indeed, no matter what they say, no matter what you hear, the truth is the Fed absolutely MUST continue raising interest rates. It simply has no choice.

For example, The Fed must raise rates to try to slow down inflation.

Most importantly, the Fed must raise rates because, if it doesn’t, bond investors around the world will promptly dump their bonds, effectively forcing interest rates to go higher — with or without the Fed. In fact, that’s what they’ve ALREADY doing.

Now, with huge bubbles in stocks, bonds, and real estate as Washington drowns in debt,

LOOK OUT BELOW!

If history proves anything, it’s that government price controls always backfire. That backfiring begins when they are forced to let prices rise again. When controls are lifted, prices explode.

Even if it’s just a tiny increase, it sets in motion explosive pent-up forces that drive prices sky high.

That’s precisely what’s about to happen to the most important price of all, the price of money — interest rates.

And it’s happening at the worst time possible: With huge bubbles in stocks, bonds, and real estate … and with Washington drowning in debt.

The only question is: HOW FAR — and

WHEN — will they raise rates next?

The “How” seems clear: It will happen on a Wednesday after a regular meeting of the Federal Open Market Committee (FOMC) The Fed will simply announce that it has raised rates again. And it will go down in history as “Bloody Wednesday.”

When will the Fed act? The smart money is betting on the following two dates: Wednesday, March 20, 2019 and Wednesday, June 20, 2019.

On each of these dates, the Fed's announcement will unleash hell on earth... in the investment markets and then in the economy.

They will crush the U.S. bond market even further ... send interest rates surging higher ... and drive U.S. stock prices into a tailspin.

They will ignite a firestorm of economic catastrophes, one after the other.

And they will go down in history as Bloody Wednesday.

Again — I understand that many readers will not heed this warning.

But make no mistake: Higher interest rates are coming. They’re coming as certainly as tomorrow’s sunrise. And the last two times we saw rising interest rates, the economy collapsed.

What’s more, these rate increases will continue for many months. And this sequence of multiple, over-and-over hikes will be like machine-gun fire for the markets.

How high will interest rates go?

Well, just to reach historical norms, interest rates would have to at least triple.

But because they’ve been held so low for so long, they could easily overshoot to the upside. In other words, quadruple or quintuple from today’s levels.

From there, the sky’s the limit.

Mark my words:

The impact of soaring interest rates

will be devastating!

Bond investors are the first victims. Why? Because the value of all their existing low-yielding bonds AUTOMATICALLY plunges when interest rates rise.

Real estate investors are the next victims. Rising rates will hammer the housing and commercial real estate markets, slashing demand and property values across the board.

Remember: Low rates were THE key reason housing and other property prices surged. Take away low mortgage rates ... and that bubble immediately bursts.

Consumers will get hit hard. They will recoil in horror as rates skyrocket on credit cards and auto loans.

Thousands of indebted companies from coast to coast will sink as their cost of borrowing money explodes higher.

Already, iconic brands, like Sears and Toys R Us have fallen under the weight of crushing debt.

Corporate earnings will be slashed across the boar, and stock prices will fall a lot further.

Blood will run knee-deep on Wall Street as panicky investors rush for the exits.

Millions of workers will be laid off. Unemployment will explode. General Motors, AT&T, Citibank and other big companies have already dismissed thousands of employees.

Even the U.S. government itself will be a victim. According to the Congressional Budget Office, rising interest rates and rising debts will add a staggering $1.6 trillion to the national debt.

The government will have no choice but to make major spending cuts.

Federal workers will suddenly find themselves out on the street. Federal welfare and other programs — upon which millions depend — will be threatened with cancellation.

We’ve never seen anything

like this happen before in America.

We always believed we were somehow insulated from these kinds of catastrophes.

Besides: Things still seem so “normal” for most of us today — so routine.

It’s hard to imagine that such terrible things could happen to us, and that they could come in the blink of an eye.

But isn’t that always the case?

Isn’t there always calm before a storm?

Aren’t people always caught by surprise when historic crises strike?

In my own career as a forecaster and analyst, I’ve seen crisis denial exact a hefty price over and over again.

In the late 1990s, almost nobody believed us when we warned that the Dot-Com Bubble was about to burst.

In the mid-2000s, only a handful of people believed me when I repeatedly warned a great real estate collapse was about to begin.

And of course, very few listened when we warned that Lehman would go belly up and even the mighty Bank of America would come within an inch of oblivion.

So you see, I’m under no delusions here.

I know that the vast majority of Americans will fail to heed this warning and fail to get ready for this crisis.

But I sincerely hope — for your family’s sake — that you are not one of them.

The precautions required to weather the coming tempest are not difficult.

And even if the storm turns out to be less severe than I fear, the worst that’ll happen is you’ll sleep better at night. And potentially make some money in the process.

Because there is some good news ...

First, you still have some time — but not much — to prepare. If you take action right away, you can still use the defensive steps I’m about to recommend to protect yourself and your family.

And second, there are simple things you can buy that will not only protect you ... but also give you the opportunity to build substantial wealth.

Here are four steps I recommend you begin taking immediately to protect yourself and your loved ones from the coming storm ...

Step 1. Prepare your defenses!

If you or anyone in your family has a government job, you may suffer furloughs, pay cuts and benefits cuts. Or worse! The same is true for anyone who works for companies that depend heavily on federal government contracts.

State governments also depend heavily on Washington. So as Washington cuts back, your state could be among those to lose funding.

You’ve probably already seen some cuts in your area. But that is just a small sampling of what will happen when the federal government has trouble selling its bonds and is forced to cut back.

Even Social Security and Medicare could among the programs to get trimmed in some subtle, or not-so-subtle, way. So you’ll need a plan for getting by on your own — without money you from Washington in your retirement years.

Social Security and Medicare could be the next to see the ax. So you’ll need a plan for getting by on your own — without the money you might be expecting from Washington in your retirement years.

It would also be a good idea to take steps to ensure your family’s physical safety — because police, fire and emergency response time could suffer,even in some of the nicer neighborhoods and communities.

If you live in any large city, have a plan and a place to go if living there becomes uncomfortable or unsafe.

Those are the basics. But there’s so much more I need to tell you to help you through this crisis, I couldn’t begin to cover it all in this report.

That’s why we’ve just put the finishing touches on “America’s Day of Reckoning.”

In this indispensable emergency guide, I show you what to do immediately to protect your savings, investments, real estate and everything else you own.

I give you keys to shield your bank account ... safeguard your insurance policies and defend your 401(k) retirement account.

Not to mention a handy tool to insulate your stock portfolio, the value of your home and other real estate assets — no matter how bad things get!

PLUS, you’ll learn how to actually MAKE money with investments that soar when the financial disaster strikes.

I’m not just talking about things that go up DESPITE the economic disaster. I’m talking about specialized investments anyone can buy that are designed to go up BECAUSE of the disaster! Get your free copy of this urgent bulletin today! Click here to learn more.

Step 2. Make sure your bank is the safest one you can find.

Remember, when big banks failed a few years ago, the government’s deficit was a small fraction of what it is today. So, the last time big banks failed, Washington could still borrow money freely.

That’s not the case today. So you need to know if your bank is among the most vulnerable. If so, you need to find a bank that can stand up on its own two feet — without government bailouts.

There is even more I can do to help:

Weiss Ratings is the world’s leading provider of independent ratings on 16,000 banking institutions.

Since 1990, Weiss has issued grades on a total of 1,533 banks that subsequently failed. And for 90% of them, we issued a clear warning to consumers ONE FULL YEAR ahead of time. On nearly all of the rest, Weiss issued a warning or a caution flag at least a few months before the failure.

In recent years, the problems in the global banking industry have gotten a lot worse. So it’s doubly important that you make sure you are NOT using any of the weakest banks on our list.

I recommend you do most of your business only with stronger institutions. Banks with rock-solid balance – and the financial strength to see you through no matter what happens!

And here, too, we can help.

Because Weiss Ratings ALSO has a flawless record of identifying the truly SAFEST banks around the world.

So to help you get your money through this crisis unscathed, I want you to have a complimentary copy of The Weiss Ratings “X” List: The World’s Weakest and Strongest Banks.”

In this guide, I give you the complete list of the weakest banks and credit unions that you should avoid at all costs, and also a full list of the strongest banks well equipped to weather the coming storm.

Step 3. Own mankind’s greatest crisis hedge: GOLD.

Since we first began recommending them in 1999, gold bullion coins and bars have risen by 450%.

An initial investment of $10,000 is worth $55,000 today.

So we strongly recommend that you hold a reasonable portion of your ready money in physical bullion — mostly smaller denomination bullion coins.

Did you know that you can actually get some free gold simply by selecting the right bullion coins to buy? It’s true! And I'll show you in the third report I've prepared for you — “The Weiss Guide to Prudent Gold & Silver Investment” shows you how.

Plus, we give you ...

- Our list of recommended bullion dealers in the United States and around the world ...

- How to hold your gold bullion offshore for greater privacy ...

- How to securely store your precious metals ...

- Why keeping part of your holdings in smaller gold and silver coins could prove to be a godsend for you, and much more!

Get our comprehensive gold and silver strategy here, free.

Step #4. Avoid the weakest stocks and invest only in the very strongest.

One of the services we provide is a powerful free tool you can use to help decide precisely which they are. And at a time like this, a powerful offense is your best defense.

Building up substantial profits you can convert into cash reserves is the best way to ensure your family’s safety and comfort.

In your copy of “America’s Weakest and Strongest Stocks & ETFs” — we introduce you to an entirely NEW way to invest: A way to keep your money growing safely no matter how rocky the stock market becomes.

The data shows that, if you had used this strategy, you could have beaten the S&P 500 by FIVE to since 2007, with an overall return of 809%. And that period includes 2008, when stocks crashed!

That’s enough to turn $25,000 into more than $227,000 or $250,000 into nearly $2.3 million!

You don’t need a lot of money. You don’t need to have a lot of experience as an investor. And you don’t even need to use exotic investment vehicles.

Best of all, this was possible even in the worst of times.

And right now, you can download all of these reports instantly and be reading them just a few minutes from now!

I’ll invite you to do just that in a moment.

First, let me tell you why I am going to such extreme lengths to get this indispensable information to you.

Frankly, I’ve never seen a crisis that even comes close to equaling this one. And I’m deeply concerned that, no matter where you live, you could lose everything.

That’s why I prepared these four emergency survival guides for you. They won’t cost you anything, and you can download them right now.

All I ask is that you also take a risk-free look

at my monthly newsletter, Safe Money Report.

As editor of Safe Money Report, I have three important missions:

The first is to help you shield your wealth against major market declines by warning you of the dangers ahead of time:

In the late 1990s, for instance, Safe Money Report was a voice crying in the wilderness, warning that the Dot-Com Bubble was about to burst and urging investors to take their profits and get to safety.

Anyone who heeded that warning could have done much better than just escape with their profits intact. They could have actually used the crash that followed to pile up profits of 58.7% ... 138.5% ... 171.7% ... up to 240.6% with investment vehicles that soar when stocks sink.

In the mid-2000s, I was among the first lone voices to warn everyone — investors, homeowners and even the U.S. Congress — that a massive crash in real estate would soon crush the U.S. economy.

Once again, if you had heeded that warning, you wouldn’t have had to lose a penny in the crash that followed. And you could have made profits of 82.1% ... 103.4% ... up to 278% in simple investments that rise when stocks fall.

My second mission is to help you avoid losses by identifying stocks that are simply too risky.

I use the Weiss Stock Ratings to warn you away from the riskiest stocks. The Weiss ratings are not based on opinion. They are based exclusively on 100% objective DATA.

As Esquire magazine wrote, the Weiss Ratings are the only ones issued with no conflicts of interest. And as the Wall Street Journal reported, they outperformed all other stock ratings.

My third mission is to introduce you to the small handful of cream-of-the-crop stocks and ETFs that have beat the S&P 500 FIVE to one since 2007, in good times and bad.

I give you the investments most likely to leave other investors in the dust while zealously guarding your principal.

With the Weiss Stock Ratings, I make sure you get ONLY the cream of the crop: The best of the best!

Safe Money Report also has the distinction of accurately warning readers of every major economic crisis and market decline for the past 42 years:

Far in advance, we warned investors about ...

- The S&L crisis of the 80s ...

- The failure of our nation’s major life insurers in the early 90s ...

- The dot-com crash of 2000 ...

- The housing bust and debt crisis of 2007-2008 ...

- And more.

These are the kinds of warnings that could have made you richer even as the average S&P 500 stock tanked between 2007 and 2009.

Even while other investors lost their shirts, those who owned the types of investments I typically like to recommend could have grabbed big profits — including ...

- A 50.7% gain in ProShares UltraShort Consumer Services ...

- A 53.5% gain in ABN Amro Holdings ADR ...

- A 62.2% gain in ProShares UltraShort Technology ...

- A 63.3% gain in SPDR Gold Shares ETF ...

- An 86.9% gain in U.S. Global Investors World Precious Minerals ...

- And more!

This is more than just helping you keep your money safe; it’s also about helping you make money when the going gets tough.

That’s why I’m doing something I’ve NEVER done before ... offering you the absolute lowest price you will ever see, guaranteed ...

FOR THE NEXT 48 HOURS ONLY:

Get Safe Money for just $39

Normally, a full year of Safe Money Report is $228. But for the next 48 hours ONLY — you can join me in Safe Money Report for a full year for $39; just 10 cents per day.

And you don’t even have to make your final decision now.

Just join me and get your four free reports now. Then, take all the time you like — up to a full year — to make your final decision. Even if you decide to cancel on the very last day of your membership, I owe you a full refund.

And I’ll insist that you keep all four free reports plus every issue of Safe Money Report we’ve sent you in the meantime.

Otherwise, call 877-934-7778 ... say “cancel” ... and owe nothing further.

You — and you alone — are in full control!

Then, in future years, when your membership comes up for renewal, we will notify you first and bill your card for $129. You will lock in the 43% discount, forever. That way, you’ll never pay for anything you don’t want, and you’ll never have to miss a single recommendation.

Everything you need to safely grow your wealth today.

In each issue of Safe Money Report, you get ...

- A comprehensive Monthly Market Overview — Full of detailed, hard-hitting analysis about what’s driving the stock market overall, and dividend-paying investments in particular

- My “Bedrock Income Portfolio” — “Best of the Best” Investments that pass a rigorous, five-step culling process. Not only do they offer some of the best yields available, but they also sport the strongest fundamentals among the more than 13,400 stocks Weiss Ratings tracks!

- My “Dynamic Income Portfolio” — Stocks and other investments that yield 4X or more than the S&P 500. These investments can turbocharge the income your portfolio spins off, without adding wildly excessive risk!

And …

- Flash Alerts when fast-breaking events need your immediate attention. I let you know RIGHT AWAY if any of the recommendations I’ve made need your immediate attention. You can rest easy, knowing I’m watching the model portfolio like a hawk, so you don’t have to, and ...

- Q&A webinars as needed where I address current market developments. This is critical information you need to see the emerging trends that could affect your portfolio in the future — and chart out your plan of attack to ensure you come out on top.

Just agree to check out my Safe Money Report for yourself and we’ll give you instant access to all four of the emergency survival guides I just described:

- “America’s Day of Reckoning,” normally sold for $98

- “The Weiss Ratings 'X' LIST: The World’s Weakest and Strongest Banks,” normally $109

- “The Weiss Guide to Prudent Gold & Silver Investment,” normally $98

- “America’s Weakest and Strongest Stocks & ETFs,” normally $109

Plus, as an extra bonus, I will also give you a second subscription to our DAILY online newsletter, our Daily Briefing — to make sure you’re up to date on each day’s new developments, threats and opportunities.

That’s a total of $613 in free gifts and discounts for just $39!

Readers give Safe Money Report a standing ovation!!

I think you’ll agree that Safe Money Report is the ultimate, monthly crisis survival guide.

For 42 years, Safe Money Report has helped everyday investors weather financial crises in great shape.

“Integrity and dedication to his subscribers is outstanding and his accuracy in forecasting economic events and to build your wealth is superior.”

“He calls it right, and early.”— T.A., Petersburg, Virginia

“I started my subscription in 1998. Thanks to the sound financial advice of the Safe Money Report and some fortunate investment choices, my original $352,000 in my 401(k) is now worth $2,171,000.”

— J.D., Medina, Ohio

“My portfolio has continued to increase in both safety and in value.”

“I can’t thank you enough.”

— S.M., Louisville, Kentucky

“We started about eight years ago. Our money is growing and we sleep a lot easier knowing our investments are safer.”

— G.C., Savannah, Georgia

We’re making it remarkably easy for you to grab your free reports and also to check out Safe Money Report for yourself.

This is truly a great value: Safe Money Report at just $39 for one full year.

That’s the lowest price you will ever see, guaranteed, and I’m offering it to you because you urgently need the critical information Safe Money Report provides if you and your loved ones are to survive ... and THRIVE ... in the wake of the next Bloody Wednesday.

But please don't forget: This offer is ONLY valid for the next 48 hours.

After that, it's gone.

So be sure to click this link for details and to grab your $39 subscription while you still can!

All the best,

Mike Larson

Editor, Safe Money Report