- Early investors in other private deals made 100x, even 1,000x more than IPO investors.

- You get FIRST and exclusive access before angel investors or any future IPO.

To get in before it closes, click here.

Or read on for the updated transcript …

Hey there, Chris Graebe here, Private Deal Hunter with Weiss Ratings. Take a look at this:

It’s a nickel.

Now, let me ask you: if we both invested in the same company, but for every dollar I made, you made only five cents would you think that’s fair?

If you’re like most people, the answer to that is a definite “HELL NO”!

Well, unfortunately, something very similar to this happens whenever the average person invests in publicly traded stocks.

Because no matter how much the stock may go up in the future… there’s an elite group of folks who got to invest BEFORE the Initial Public Offering, or, as we know it, the “IPO”.

And they make off like bandits compared to everyone else!

Pre-IPO Investors Have Made

About 95% of the Gains

According to research published by Inc. Magazine, retail investors miss out on up to 95% of potential gains by investing in tech stocks AFTER the IPO.

Think about that. 95 percent!

That means, for every 5 cents you make, the rich and well-connected elites who invested before the IPO would be making 95 cents!

But this rigged game ends right now.

See, new legal reforms now make it possible for everyone to invest in red-hot PRIVATE companies with huge growth potential BEFORE they are ever listed on a public stock exchange.

And today, I’m kicking the doors wide open to this elite world of early-stage private deals and showing how investors in a very successful deal could have made nearly 33,000 times greater gains by investing in special private funding rounds that we call the “Alpha Round”.

For investors who get into Alpha Round deals… the gains can be so much bigger, it’s not even in the same universe to be honest.

Let’s just look at Airbnb:

Most investors had the chance to make up to 125% gains by investing in Airbnb’s IPO. Not bad.

But Alpha Round investors? They had the chance to make as much as 4,121,525%.

That’s 32,972 times greater returns!

Now, this is an extreme example and I know how crazy this may sound. Most people have no idea this separate, private market world actually exists, and when they do find out how much bigger the gains can be, they’re furious for missing out.

I know I certainly did when I first learned about this.

And if you’re feeling frustrated for missing out as well, don’t worry

See, for almost 100 years, ordinary people were shut out of these kinds of opportunities.

The markets were completely rigged in favor of the rich and well-connected who were able to get into these deals early, while regular folks had to settle for scraps after the company went public.

There’s no reason why your stockbroker or your financial planner would even have brought it up. It just wasn’t an option.That is, until right now.

See, today, I’m showing how anyone could claim an early stake in the next Facebook, the next Apple, or even the next Tesla, before it ever goes public!

Starting now in this special presentation. We’re calling it the Alpha Round Investing Exposed!

Be sure to stick around till the end to find out how you can claim an early stake in the next great Alpha Round deal.

Now, here’s a quick rundown of what we’re going to be covering over the next few minutes:

- I’m going to show how legal breakthrough changes have opened up private, Alpha Round deals to the public for the first time in almost 100 years.

- I’ll explain why the world’s richest hedge funds, family offices and university endowments are investing up to 50% of their capital in these kinds of deals.

- How shares bought in the Alpha Round phase can be isolated from market turmoil, and how this type of investing can be far less volatile than the regular stock investing.

- I’m also going to show you why investors must act FAST when they see a good Alpha Round deal.

- How anyone can get started in Alpha Round investing, with even as little as $100.

Now, who am I to say any of this?

Well, again, my name is Chris Graebe. I’ve been a private deal investor for the better part of a decade. I specialize in finding undiscovered startups and investing in them before they go public, and before they potentially skyrocket in value.

I was an early investor in companies like ThisWayGlobal, an artificial intelligence firm with breakthrough technology that recently landed them lucrative partnerships with Google and IBM.

I’ve invested alongside Mark Cuban in Beat Box Beverage, a beverage company that is growing like wildfire.

And I also got into an early deal for MC Squares, BEFORE they were featured on Shark Tank and before they received an investment from billionaire Kevin O’Leary.

In total I’ve invested in over a dozen startups with a combined valuation of $400 million and counting…

After years of success doing this on my own, I teamed up with Weiss Ratings to help ordinary people take advantage of these extraordinary opportunities.

My first deal I recommended was a disruptive tech firm in the energy sector, and that deal proved to be so popular, it reached its funding limit in just five days!

Now, I’ve found a lot of success in the private markets myself, and everyone who has followed my research had the opportunity to do something similar.

But this only became possible very recently. You see for nearly 100 years, Depression-era regulations made it illegal for ordinary people to invest in promising companies before they went public.

After the stock market crashed in 1929, the government created regulations that prevented almost everyone from investing in pre-IPO companies…

Everyone except for the special class of people called “accredited investors”.

Basically, this means you had to have certain level of wealth to be allowed to invest in these private deals. These regulations were put into place to protect investors from taking on too much risk after the great crash.

But it backfired− instead of protecting the average Joe, these rules enshrined into law the right of the wealthy and the well-connected to potentially rake in far greater returns than anyone else could ever hope for.

Now, to qualify as an accredited investor today, you must have income of at least $250,000 for two years in a row, or a net worth of at least $1 million − NOT including your house!

Obviously, that meant that most people were locked out of most of the profitable private deals for decades to be honest, and that’s a real shame when you look at how much money private investors made compared to post-IPO investors.

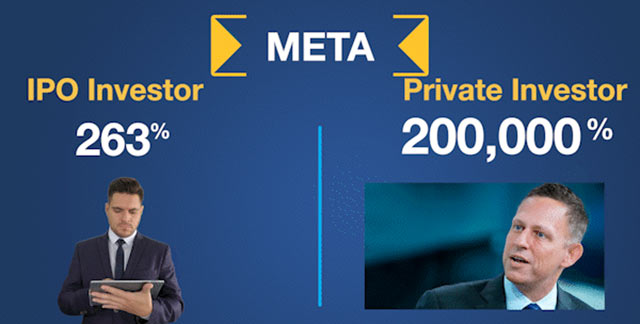

Let’s just take a look at Meta, the parent company of Facebook.

IPO investors could have made 263% since it went public in 2012.

You might think that’s great (and it’s not bad), until you see what Peter Thiel made by getting into a private round of investment in Facebook in 2004:

Instead of 263% gains, Thiel made nearly 200,000% gains. That’s enough to turn his $500,000 starting stake into $1 billion.

In other words, he made over 760 times greater gains than the IPO investors!

And that’s honestly just one example.

Look at Uber. This was one of the most anticipated IPOs of the decade. But last I checked, investors who bought at the IPO were down 25%.

But private deal investors? Even with Uber stock doing poorly, they’re up as much as 17,660% = between 2011 and 2019.

And again, let’s look at Airbnb:

Let’s talk about the IPO investors. And they made a max of 125%. Not bad.

But investors who got into the “Alpha Round” of private investing that we’re covering today?

They could have made as much as, get this, 4,121,525%!

That’s right! And that’s nearly 33,000 times greater returns than IPO investors made between 2010 and 2020!

Now, said a different way…if you invested $1,000 into the Alpha Round deal for Airbnb, you could have seen it grow to $41 million!

Investing that same amount in the IPO would have resulted in just $1,250.

Think about that: $41 million vs $1,250…I think I know which result I prefer!

Though, to be clear, not every private deal works out of course, and these are some pretty big examples that I’m sharing today.

But I share them to demonstrate how bigger private deal gains can be compared to most investors who have just had to settle for the IPO return.

This is why I say if you ever felt like the markets were “rigged” or they were against you, you’re not entirely wrong.

It’s not a question of just “following the news” or spending more time reading technical charts.

It was a structural flaw built into the markets that allowed the rich and well-connected to have an unfair advantage over everyone.

Now, look, I’m a firm believer in capitalism and the free market.

But when I saw how much the whole market was rigged against the little guy, it made my blood boil.

But like I said, that has all changed…

Some important new legal reforms truly flung open the doors to private deals for the very first time.

Including Alpha Round deals with the highest upside potential!

Now, I should be clear…these cases like Airbnb are not typical results.

Investing in early-stage companies is, by definition, it’s risky.

Startups have a failure rate as high as 90%, and that means a lot of deals just won’t work out.

That’s why my team and I have developed a system for carefully screening out all but what we believe are the very best deals. I’ll get into that and how that works here in just a few minutes.

But my point in sharing all these examples is this: when a private deal does work out, it can be truly life changing.

There’s simply no comparison between post-IPO gains, and private market gains.

So, how is it possible for regular people to

invest in private companies right now?

I’m glad you asked.

It started with the JOBS Act. This Obama-era bill allowed private companies to seek early-stage funding from non-accredited investors. Now, this was the first time that these doors opened in nearly 100 years.

This process is called “equity crowdfunding”.

Unlike those other crowdfunding sites like Kickstarter, you’re not just giving away your money. Investing in these deals allows you to get an early piece of equity in a company, just like Peter Thiel got equity in Facebook.

Now, equity crowdfunding got off to a slow start due to legal complexities and low fundraising limits. But, the good news is, in 2021, the Trump administration made some important reforms that got rid of a lot of the red tape, and significantly increased the amount of money that companies can raise within the equity crowdfunding space.

Now it’s growing so fast that Forbes declared that “the upward trend [for equity crowdfunding] is mind boggling.”

To put that into perspective for you, in 2020 $211 million was raised in the equity crowdfunding space. But it is expected to see almost 1,000x growth to nearly $200 billion by 2025.

Now, the huge growth in the private market actually had a lot to do with all the uncertainties in the market over the last 2-3 years.

Because of all the uncertainties in the traditional markets caused by the pandemic, inflation and fears of recession, more and more companies are now turning to the equity crowdfunding space than ever before.

In fact, AT THIS VERY MOMENT, thousands of

private deals are available for virtually

anyone to invest in.

And these Alpha Round deals offer regular people the chance to get in on what could be, who knows, the next Facebook, the next Uber or even the next Airbnb…

Way before hotshot angel investors and the venture capital crowd get involved. And honestly, way before the big banks start poking their noses around.

But you just can’t go for any deal. I really want to stress this.

Any investor who wants to be successful with this, needs a way to separate the wheat from the chaff and find the very best deals.

So how do you do that, if you’re just learning about this now, and don’t even know where to start?

Well, that’s okay. Don’t worry. It’s not nearly as hard as you might think, and I firmly believe anyone can do this with the right strategy.

Why? Because …

I’m living proof that anyone can succeed with

Alpha Round investing.

I wasn’t born into wealth. I didn’t go to an Ivy League school like a lot of these venture capitalist guys. I actually grew up in the cornfields of Indiana.

At home, money was always tight. At school, I was on the lunch plan.

But I always had the dream of being an entrepreneur.

When I was just a young man, and maybe my hair wasn’t quite this color, I started an e-commerce company. Suddenly we had over $2 million in sales. And then, I began networking with other entrepreneurs and became one of the first to take a deep dive into this brand-new space called equity crowdfunding.

When I first jumped into this new funding source, I found it amazing. Finally, a new way for average guys like me to get into private deals that used to be beyond my reach.

I was introduced to dozens, then hundreds, of founders and I built a big rolodex in the equity crowdfunding arena with. I took a deep dive into the research so I could share with my friends and followers the very best deals that I could find.

This market was still in a kind of a what they call wild-west phase, and I loved it. I loved everything about it. I also knew enough about business to realize it pays off to get ahead of major new trends.

I mean, opening up private deals to average people after almost 100 years of shutting them out? I knew this was going to be big, I knew it was going to be a gamechanger.

And I also knew it would unleash massive pent-up potential for private deals, like popping the lid off of a pressure cooker.

So, in the early stage of this trend, before it really exploded — that’s when I decided to start my own firm that specializes in finding the best deals, raising funds and zeroing in on the truly promising companies.

After going through that process over and over again, after nearly a decade, we’ve developed a very strict set of criteria that every deal absolutely has to meet.

These days, I get about a dozen companies calling me every week to help raise capital. Plus, there are many more we look at ─ and, well, I don’t have the exact count, but I’d say we turn away around 99% because they just don’t meet our standards during and throughout our due diligence process.

Honestly, probably less than 1% pass our criteria. But of those companies that did, we’ve had a very high success rate with our Alpha Round investing.

I will get into the details of my criteria in a minute, but first, there’s something we need to clarify if we’re going to be successful at this:

What exactly IS an Alpha Round investment,

and how is it different and better than other

types of private investing?

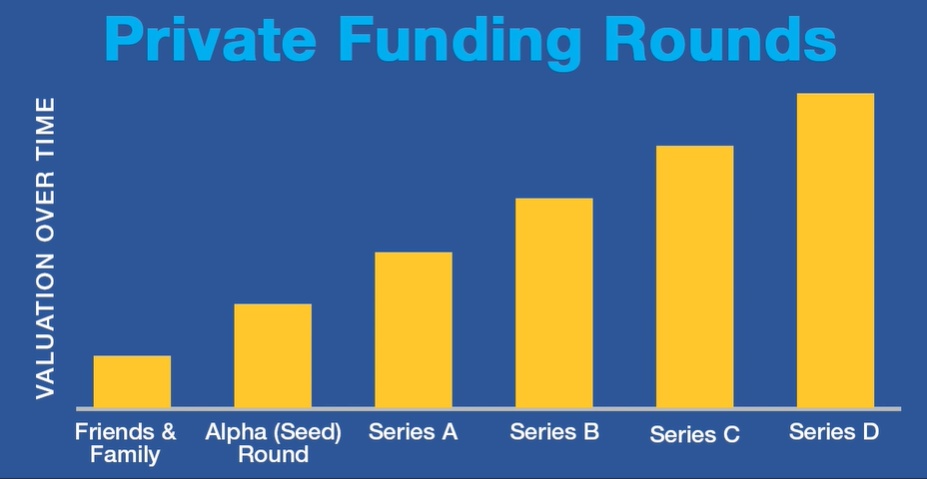

To understand, look at this diagram of each of the funding rounds, leading up to an IPO.

The first time a company seeks outside funding is generally what we call the Seed Round, where the arrow is pointing. With private companies doing an equity crowdfunding deal, we call this an Alpha Round.

The very first round of funding. And historically, that’s often been THE most lucrative round of early-stage investing.

So, after that, we have the Series A round. That’s when venture capital firms typically get involved.

Then comes the Series B round. This is after the company reaches some kind of high-performance milestone, in other words, they’re really catching fire. And that’s when they open new funding rounds. And that’s when other VC firms generally start to jump in, or maybe the venture arms of big companies like Google and so on, they jump in.

Now, let’s talk about the Series C. This could be when major investment banks take a strong interest.

Then, depending on the success of the company, you could see them having a Series D or even a Series E, and so on.

Finally, the company may hold an Initial Public Offering, which we know as the IPO. Then, and only then, does the Average Joe get the chance to invest.

And, by that time, the lion’s share of the gains have already been made.

The early investors kick back and wait for the public to pour money into the stock, driving up the price…

And when their required lock-up period for their pre-IPO shares is over, well, that’s when they sell. And the public is left holding the bag.

The sad truth is that this is all most retail investors will ever be: exit liquidity for early investors who got in before the IPO.

Just look at Coinbase, probably the most well-known crypto exchange out there:

Venture capitalist Fred Wilson was able to invest long before the IPO at just 20 cents per share!

And by the time of the IPO, his investment had swelled from $2.5 million to, get this, $4.6 billion. Over 190,000% returns.

But what about IPO investors? Well, they’re down over 80%!

No offense to Fred, he’s a brilliant investor. But I decided a long time ago that I was DONE being exit liquidity for guys like him.

I mean, wouldn’t you rather be on the other side of this deal? Wouldn’t you rather get in early, and have the opportunity to collect much greater gains now that it’s an option?

I’m sure the answer is a resounding yes.

Now, remember, these are exceptional cases.

90% of startups just, they just don’t make it. And of those that do NOT fail, only a small number will grow into the Coinbases of the world. You have to know that.

And that’s why having a winning criteria on your side is so important.

Now, let me share with you the criteria my

team and I used to build an investment

portfolio that’s grown from just a small

amount to north of $400 million today.

I’ve boiled it down to a formula that I call F, I, V, E, or FIVE.

F stands for Founders.

The founders of any startup are vital to the success of any startup. We want to know everythingthat’s possible about them.. Do they have a track record of success? Have they scaled and exited before? Have they built companies before? If not, then it may be a quick hard pass for us, and that deal goes to the discard pile.

Let’s talk about I in the FIVE methodology: Industry.

Industry is so important; is the trajectory up and to the right?

Are they growing, or is it stagnant?

Is the industry new on the scene, or have they seen growth in the past?

It’s very important to make sure that that company is in the right industry.

Then we go on to V. V stands for Valuation.

To properly value a private company, we spend a lot of time with the people who manage the financials in order to validate the data, and to figure out exactly how they’re putting it all together.

Then we can get a really good handle on the true valuation of a company. If it turns out their valuation estimate is too high or what we call “fuzzy,” that’s just a red flag right there.

And let’s look at the last one, the E. This is important for all investors. It stands for Exit Potential.

Do they have exit potential?

Now, this could take the form of an IPO, but it could also be in the form of a buyout.

Either way, when an exit event occurs, that’s when early investors get paid.

If a company has no plans to IPO soon, or they don’t seem like they could become a prime target for a buyout, that’s an immediate disqualifier for me.

There has to be a lucrative exit potential for me to really even consider bringing it to the table.

Now, there’s a bit more to it than that, of course. What I’ve outlined so far is a decade of experience building a $400 million portfolio summed up in just a few minutes.

But the FIVE model has the most important parts of my criteria I use to spot private deals that I believe have the most potential to be winners.

If you keep the FIVE criteria in mind, you’ll have a major edge when you’re picking a private deal to invest in.

Understanding these principles is how early-stage investors like Sean Aggarwal found hidden gem companies like ridesharing app Lyft.

See, Sean wrote them a check for $30,000. Twelve years later, his stake is estimated to be worth over $120 million by the time of the IPO.

THAT’S the kind of thing that’s been possible for private deal investing for accredited and fat cats for quite some time.

But for decades, regular people were shut out of these deals. And it’s really just crazy when you think about it.

If someone wants to gamble away their life savings in Vegas, it’s perfectly legal. If they want to take out payday loans and bet it all on meme stocks, no one’s going to stop them.

But the small investor who wanted to invest in early, promising companies? Nope. The government didn’t allow it until very recently.

And even now, this IS legal for everyone to invest in, what we’re calling, Alpha Round deals, most people don’t even know where to find them, or how to pick the best ones.

This is big part of why we have such a huge gap between the middle class and the ultra-rich.

Consider the venture capital firm, VenRock, for example, While the law barred most people from private deals, the Rockefeller family established VenRock, which then invested in companies like Intel and Apple before their IPOs.

Most people also don’t know that these ultra-high-net-worth individuals and family offices invest as much as 50% of their money into private deals.

University endowment funds do it too.

Did you know that Yale University endowment fund, which is worth over $40 billion, was an early investor in a lot of the biggest companies in the world today?

They invested in Amazon, Google, Facebook, Airbnb, LinkedIn, Snapchat, Uber! They were early investors in all of them!

I mean, what does that tell you? You don’t make that kind of fortune and keep growing it by being a late-stage investor. You do it by being an EARLY-stage investor.

See, they allocate a large portion of their money into private deals because that’s where the serious money can be made in our modern economy.

But now, thanks to equity crowdfunding and the unique advantages I’ll lay out in couple minutes, it is YOUR turn!

Before we go any further, it’s important to understand why acting with SPEED is so critical

to finding success with Alpha Round investments.

You see, the law only allows equity crowdfunding private deals to stay open until their fundraising goal is reached.

So, if their limit is $5 million, for example, they have to stop accepting new investors after they reach that limit.

A crappy deal will stay open for a long time or may never reach its goal.

But if it’s a hot deal with a great company, one that you actually WANT to invest in, it can fill up pretty fast.

Paladin Power was one private deal I recommended to my readers not long ago. That deal reached its $5 million goal in just about 5 days.

But I’ve seen it happen much faster.

Let’s talk about medical cannabis company Montu. They hit their $1 million goal in 36 hours.

Or Gumroad, the e-commerce platform for average, everyday people, was funded recently, and they reached their $5 million goal in just one day!

Or Thrive, a Fintech company, reached its $1 million goal in, get this, two and a half hours.

And, man, agricultural tech company Areobloom, recently hit their $5 million goal in just 4 hours.

Sometimes, like with Paladin, they stay open a bit longer. But if it’s something you want to participate in, with just a few bucks or maybe even a few thousand, it’s best not to wait.

This is NOT like buying regular stock, and I want to emphasize this, where you can just go back the next day and trade and try again.

When a private deal fills up, THAT’S IT, it’s over. Maybe there will be a waitlist, but you’re not getting in on that deal when you want to.

So, if you see a great private deal that checks all the boxes, and you want to invest, do not sleep on it. You may find yourself missing out entirely.

Plus, there’s one other major advantage Alpha Round investing has over investing in regular public stocks.

You see, it’s not just about the potential for bigger gains. Believe it or not, these deals can be actually less volatile than putting your money in the regular stock market.

Here’s why:

This chart shows the private funding growth for cloud storage company Dropbox.

In this chart, I’m going to walk you through a timeline in which different funding rounds took place, when a series of investors got in before the IPO. There’s the Alpha Round right there at the beginning.

You may be wondering why the valuation actually never goes down? Well, I mean, any other stock would show fluctuations — both up and down. But this one only goes UP. Never down.

No, there’s nothing wrong with this chart. By definition, private company shares are not yet publicly traded on any major stock exchanges. So, they’re not subject to the price fluctuations and are largely insulated from the daily ups and downs and drama of the markets − even during market crashes.

Now, don’t get me wrong. I’m not saying private companies are somehow immune to ups and downs in the economy. Any business is subject to the threats and opportunities of the real world.

But when you see the S&P go down, or there’s a day that the Nasdaq suffers a crash, there’s no point in checking with your private shares and how they did that day.

So that’s why it never goes down. But here’s why Dropbox’s valuation kept going UP:

Each upward step in this valuation chart marks a milestone the company hit before going public. Often the milestone is a specific revenue target. Or, it could also be a new technology the company is developing, for example.

Once that milestone is reached, a new round of funding opens up. And each time that happens, the valuation almost always goes up. If the valuation does not go up, they probably would not go to another round of funding.

And that’s the pattern we see here with Dropbox.

So, for Alpha Round investors in Dropbox, all the later series, Series A and B and C investments from the Googles, Goldman Sachs, Blackrocks, and Bank of Americas of the world, they would have dramatically increased the value of their early shares along the way!

Each situation is different, of course.

But strictly in terms of the dynamics of each funding round, I’d say Dropbox is not atypical.

In private companies, the same kind of dynamic often play out with each new round of funding, whether they’re moderately successful or even wildly successful.

In all of them, the key is to get Alpha Round shares on the right ones, and then let future funding rounds fund and carry up that stake up and up.

How to Get FIRST ACCESS to Alpha Round Deals

Now, if you’re ready to start participating in Alpha Round deals yourself, instead of letting others have all the fun, and settling for scraps in the stock market, I have some really important news.

I’ve teamed up with Weiss Ratings to launch a new initiative focused exclusively on what I believe are the very best Alpha Round deals available to the public.

It’s called Deal Hunters’ Alliance.

This is very different from your typical dime a dozen trading services or investing newsletters.

Unlike other services that toss as many stocks picks at you as possible, the Deal Hunters’ Alliance is more of an exclusive community or group of like-minded individuals.

See, Alliance members do not just buy a service. They join a community of those who want to get the first access to each Alpha Round deal that we select.

That means if you’re a member, you get to be one of the first Alpha Round investors.

And here’s how it works:

Each quarter, my team and I review hundreds of companies. We do all the work, and believe me, it is a lot of work. From those hundreds, we select three private companies. And then, from that small set of three finalists per quarter, we generally narrow it down to ONE. One that we believe truly offers MAXIMUM opportunity for success.

That comes to a minimum of FOUR carefully curated official Alpha Round recommendations.

Why four, you ask?

Well, when venture firms invest in 10 companies over time, they anticipate results along these lines: Among the ten, five are likely to flop, four will break even or produce a single-base hit, maybe a double if they’re lucky.

And only one might really explode in value. And if they’re really lucky and they get that home run like an Airbnb, Dropbox or Facebook, they’re extremely happy.

Now, we’re reviewing more than 10 deals per year, and with our criteria, we’re looking to beat that one in ten ratio for sure.

We’re not promising a win as big as those big companies, of course, but even a fraction of what they did would still be a huge win.

Now, the focus is on QUALITY, not quantity, as it should be.

When we recommend a deal, you’ll receive an alert inside of your inbox about this Alpha Round opportunity, and as an Alliance member, you’ll be able to invest BEFORE anyone else!

Before angel investors, before venture capital firms, even investment banks.

And even before OTHER Alpha Round investors outside of our Alliance who may be interested in this deal.

Now, I want to stop there. That’s a big deal, because remember: Alpha Round deals are time-sensitive opportunities!

You’ve already seen how quickly some of these deals can fill up, like Paladin Power, like I mentioned, it filled up in five days.

Or Gumroad in just one day.

I’ve even personally led a small funding round that once filled up in just 30 minutes!

So, I can tell you from personal experience, getting in first is a HUGE advantage!

And as an Alliance member, you’ll get the chance to be among the very first Alpha Round investors in the four deals that we recommend per year.

Now, if and when more than four exceptional opportunities present themselves, we will send out additional investment alerts if those deals, of course, pass our tests.

But in any case, Alliance members are entitled to be the first investors in the minimum of four thoroughly screened Alpha Round deals per year for as long as they remain a member.

And I want to be crystal clear about something: We’re talking about an Alliance, a community. This is not a publication that throws tons of deals at you week after week without proper vetting. That’s just not what we do.

What’s more, we want to watch the company like a hawk. If you invest in one of the companies we bring to you, we are GOING to hold them accountable for you and for us, and all Alliance investors.

I’m talking about live calls with the founders. I’m talking about opportunities for Alliance members to join us online to ask some questions.

Maybe you have questions about their technology or their patents. Maybe you want to know about what they’re doing — right now — to scale up their business and grow their revenues. Or perhaps you’re thinking about cashing out and you want to get the latest on their IPO schedule.

No matter what, as an investor, you have a right to know.

That’s because of another test I did not mention earlier among the FIVE tests, that model that we talked about.

Every company we select has to pass our test for transparency. The guys and gals running the company, they have to be straight shooters. Otherwise, we don’t even consider recommending them in the first place.

If you want to know something, I’m going to make sure you get the opportunity to ask them, and that they, they give you an answer.

Now, I can’t promise you’re going to get an answer you like. Because, as I said, they’re straight shooters. They’re going to tell it like it is.

And there’s more.

I want members to feel like they can confidently navigate this world of private deals, not just with me by their side, but also, of course, on their own.

$1,000 Private Deal MasterClass Included Free

So, as an extra benefit, I am providing an educational experience. And we’re calling it the Private Deal MasterClass.

It’s 12 video modules that offer a complete tutorial on how these deals work. All the way from A to Z. As well as more detailed breakdowns of the FIVE method and criteria that I shared with you earlier.

It’s a valuable resource for Alliance Members who like that kind of tutorial. It’s NOT mandatory, but it will help give you an edge as you begin your private investing career.

Now, I should be transparent about this: At some point in the future, we plan to offer my tutorials to other investors as a stand-alone product. And we’re probably planning on charging $1,000 or more for it.

Now, I think it’s a crazy bargain when you consider how lucrative these private deals can actually be. But for the folks who join the Alliance today, I am going to include this full MasterClass at no additional cost.

So, how much is this all going to cost?

This service for is for people who are serious about building wealth with Alpha Round investing…

So when they added in the some members of our team initially proposed that a full year of access to Deal Hunters’ Alliance should be priced at $5,000.

To be honest, I think just a single one of the investor dossiers that we provide to Alliance members could be sold for $5,000. Now, investment banks happily fork over that kind of money for intelligence on early-stage opportunities all the time.

And that’s not even considering the 12 MasterClass video lessons, and the section that we talked about, and of course, the invitations to exclusive events and so much more…

But I understand that not everyone who’s interested may have an extra 5 grand laying around.

I want this to be as much of a no-brainer decision as possible for you.

So we’re going to cut my rate even further. My offer is this:

Right here, and only on this page, you can get full access to everything I just listed just $2,497.

Over 50% off the original proposed rate.

Now, we’ve covered a lot of ground here, so let’s quickly recap all the special benefits you get as a Deal Hunters’ Alliance member, plus some other amazing things you’ll get as a benefit as well:

- VIP BENEFIT #1: Minimum 4 Alpha Round Deals per year (+ total 12 Investor Dossiers)

- VIP BENEFIT #2: FIRST ACCESS to these Alpha Round Deals!

- VIP BENEFIT #3: Private Deal Grades Reports

- VIP BENEFIT #4: Private Deal MasterClass (Lifetime Access)

- VIP BENEFIT #5: Members-Only Online Events

- VIP BENEFIT#6: LIVE Alliance Member Retreats

- VIP BENEFIT #7: Save Over 50%

Your price: $5,000 $2,497

VIP BENEFIT #1: A minimum of FOUR carefully curated Alpha Deals selected by me and my team each year. Just ONE successful deal is all it takes to change your life, and you’ll be receiving at least four per year.

Each deal also comes with a special Investor Dossiers that provides Alliance Members clear andeasy-to-follow instructions on where and when and what it looks like to invest in these deals.

Plus, it includes a balanced, professional assessment of the opportunity and, of course, it’s important, the risk, as well as a full rundown of each deal’s unique characteristics and a reasonable timeline estimated before an IPO or even a buyout.

Of course, this doesn’t include the 8 additional runner-up deals per year as well. You’ll receive full dossiers on those as well, so you can pursue those opportunities as you wish and on your timing.

VIP BENEFIT #2: FIRST ACCESS to these Alpha Round deals. You’ve already seen how Alpha Round deals can fill up in as little as one day. It would be tragedy to learn about an amazing deal, only to miss out on that golden window of opportunity to get into the deal.

As an Alliance member, you never have to worry about that. We’re lifting the velvet rope and we’re giving you FIRST access to every deal that we recommend.

There’s simply no better advantage than getting in early, and this is as early as it gets! Truly, it’s an unfair advantage. But hey, you get it as an Alliance member!

VIP BENEFIT #3: Weiss’ Private Deal Grade reports. In addition to your Investor Dossiers, each deal will also come with a ranked investor grade report from the team of analysts over at Weiss Ratings.

They’ve already created one of the world’s top Ratings systems for 56,000 stocks, ETFs, mutual funds, banks and so much more, earning praise from financial publications like Barron’s, Worth Magazine and the New York Times.

Now they’ve put that same expertise to work to develop a special grading system for all private deals. All recommended deals must receive a positive grade before it is sent to you, our members.

So between my criteria, your Investor Dossiers, and the Weiss Private Deal Grades, that’s 3 layers of assurance that Alliance members receive on each and every single deal.

VIP BENEFIT #4: Lifetime Access to the Private Deal Master Class. This is a $1,000 value. In this 12-part video tutorial series, I’ll walk you through all the needed steps to find, select and fund private deals with the greatest possibility of success.

For those who simply want to follow my lead, the tutorial, is really not essential. But for those who want to fully understand the process — and even do it themselves — that’s great. It’s fun, it’s a valuable educational resource, and it’s there for you as well.

VIP BENEFIT #5: Access to special Members-Only Online Events. You’re invited to join me for special, Members-only calls with the founders or the managers of companies we’re investing in. You’ll have the opportunity to ask questions and get answers straight from the source, and that is invaluable.

VIP BENEFIT #6: Access to exclusive Members-Only retreats. I look forward to this. You know, I’m going to invite you to join me for live events in the future, where you can tour company facilities, meet with founders in person and get updates about your investment. Look, this is going to be an amazing time, and I can’t wait to meet some of you in person.

VIP BENEFIT #7: One time savings of over $2,500 Available only here on this page. You’re going to get a full year of access to the Deal Hunters’ Alliance for just $2,497. That’s a savings of over 50% off of the retail price of $5,000! You won’t find this steeply discounted rate anywhere else.

Just click the button below an you’ll be taken to a secure order page where you can review everything again.

Your card will not be charged just for clicking the button. You will be able to review everything before completing your order.

Now, we’re running out of time here but before we leave, I want to leave you with one final thought:

This is a unique, fork-in-the road moment — a time for a decision that I predict will have a profound impact on each investor’s future wealth and their security.

Whatever you decide, we’ll respect your choice. But understand that when this opportunity is gone, it’s gone for good.

Like I said, my goal with the launch of the Deal Hunters Alliance is to help show you how it’s possible to improve your life in a meaningful way.

Remember, I wasn’t born with a silver spoon in my mouth. I grew up in the cornfields of Indiana.

My journey was filled with many ups and many downs, and I was fortunate to discover the world of private deal investing when it was just in its beginning stages.

The road from struggling in odd jobs to entrepreneur, to private deal investor, it was a long one, but it was also fulfilling, and I have no regrets.

Back then, when I was just getting started, if you had told me that there was a shortcut to this more secure lifestyle I have today, you better believe that I would have jumped on it.

Today, we’re offering everyone watching this the chance to profit from my experience and my hard-earned knowledge.

Together with other Alliance members, I predict, with confidence, that you’ll learn to master private deal investing, much like I did.

I’m Chris Graebe with Weiss Ratings, thank you so much for being here, and I just want to say, welcome to the Deal Hunters’ Alliance.

Chris Graebe,

Deal Hunters Alliance