Weiss Ratings’ Artificial Intelligence

Town Hall

THE #1 AI STOCK

FOR 2024 TO BUY NOW

Don’t worry. You haven’t missed the AI boom yet. And today, we’ll share the results from our proprietary Weiss ratings:

Over the last 20 years, the average gain of our “Buy” rated tech stocks is 3,316%.

Now, we’ve just handed this precious “Buy” rating to one under-the-radar artificial intelligence stock.

To apply for membership, jump here. Or to read the transcript, scroll down

Martin Weiss: Hello, and welcome to our Artificial Intelligence Town Hall.

Today, I want to address the tremendous opportunity — but also the tremendous hype — around AI.

This long-awaited advance in AI is finally bearing fruit. What was once a low-key buzz among industry insiders has turned into one of the greatest tech booms of our lifetime.

And the advent of the popular app ChatGPT has made artificial intelligence front-page news.

This type of AI, called generative AI, learns from itself. The technology allows ChatGPT to take your prompts and use them to write a fully developed novel, a research paper or a company memo, for example. The potential uses are seemingly endless.

Just months ago, I’d never heard of ChatGPT. Now my team and I use it every day, and my grandkids are jumping into it, too.

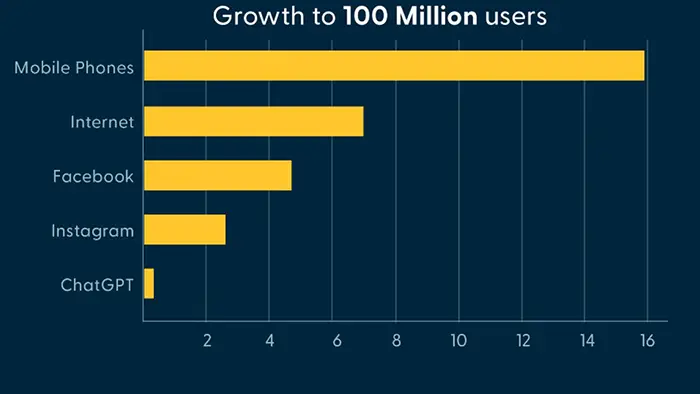

This helps explain why ChatGPT hit 100 million users in just under two months, the fastest-growing app of all time.

That explosive surge in users was 4.5 times faster than TikTok’s and 15 times faster than Instagram’s.

And it’s why Microsoft invested $10 billion into OpenAI, the startup behind ChatGPT.

The craziest part is, ChatGPT is just scratching the surface of what generative AI can do. New ways of using AI and new, improved versions of the AI are hitting the market every day.

Corporations are using artificial intelligence to cut costs from the factory floor to the Executive Suite. AI is taking orders at McDonald’s. The military is studying AI programs that can fly multiple planes at once.

AI has found a way to improve the search for oil, gold and natural resources.

Personalized medicine and precision treatments for cancer are possible because of generative AI.

In fact, ChatGPT just passed the medical exam, for crying out loud.

Bill Gates says artificial intelligence is “as fundamental as the computer chip, the internet and the PC.”

Apple CEO Tim Cook says it will be a part of every product going forward.

And PricewaterhouseCoopers estimates AI could add $15.7 trillion to the global economy by 2030.

That’s more than the current output of China and India, combined.

So, here’s the $64 billion question: Is the AI boom just getting started? Or have investors already missed out?

The tremendous urgency of that one critical question is why I decided to call this Artificial Intelligence Town Hall today.

This megatrend cannot be ignored any longer. And our readers have asked for guidance.

We’ve heard from investors all over the world who have three specific questions about artificial intelligence:

- Is AI just a fad?

- Did I miss out on the AI boom?

- What AI stock should I buy now?

And the main question we get these days:

Within the next hour, we will give you the answers. We will give you what’s probably the most comprehensive overview of the artificial intelligence market you’ve ever seen.

We’ll name 13 AI stocks you should avoid.

We’ll introduce you to our number one AI stock for 2024 to buy now.

And much more!

As our primary guide, we use our proprietary Weiss ratings. Plus, for AI in particular, we dig in even deeper.

Our Weiss stock ratings are based on a tried-and-tested algorithm that factors in thousands of data points to project a stock’s upside potential and stability.

My father created the original Weiss stock formulas in the early 1930s.

And in 1999, during the Dot-Com Bubble, we modernized his system so that we could rate nearly all tech stocks in America.

We developed a rating system that could more accurately pinpoint which tech companies were promising, and equally important, which ones were bombs ready to blow up the portfolios of millions of investors.

That’s always important, and at the time we introduced Weiss Ratings for tech stocks, it was even more important.

Tech stocks had reached bubble-level peaks. Most were all fluff and no substance.

But, while Wall Street firms were unanimously touting them, we issued a landmark report called “Seven Horsemen of the Internet Apocalypse.”

Our ratings showed us what should have been obvious to everyone: Internet stocks (and nearly all tech stocks for that matter) were grossly overvalued. Their share prices were up in the stratosphere, and yet, many had no sales, swimming in a sea of red ink.

Even knowing that, we were shocked with the results of our tech-focused ratings. Not a single stock on the Nasdaq got a “Buy” rating. Almost every single one was a “Sell.”

Needless to say, we received a good deal of blowback from the media and the Wall Street crowd — even some outright mockery.

Then, in early 2000, the Dot-Com Bubble burst, and our model proved to be right on target, despite what all the experts were saying.

By 2003, investors had lost three-quarters of their money — on average. Except, of course, for investors who used our ratings and heeded our warnings.

But after tech stocks hit rock bottom, it was the opposite.

Then, those same Wall Street analysts who had touted tech stocks were in purgatory. And investors wouldn’t touch tech stocks with a ten-foot pole. The Nasdaq itself was a dirty word.

That’s when our rating system saw tremendous value. And that’s when we began upgrading the best among them to a “Buy” for the first time.

Like Microsoft, up 2,151% since our recommendation …

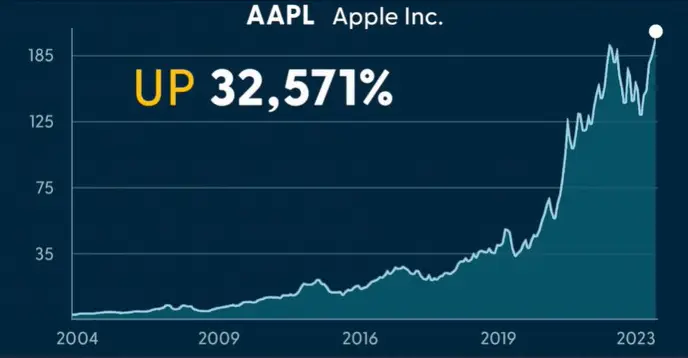

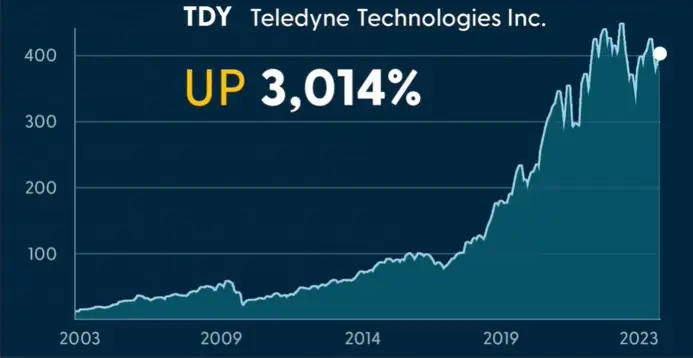

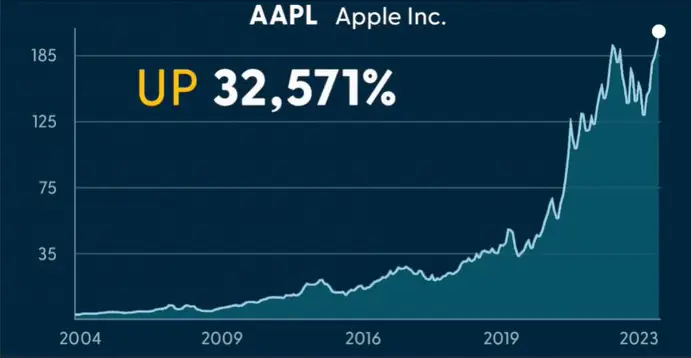

Or Apple, which is up 32,571% since our 2004 recommendation.

Overall, there are 28 tech stocks we upgraded to a “Buy” in 2003-2004 and have never downgraded to a “Sell.” Even including the worst performers among them, their average gain to date is 3,316%.

That’s 34 times your money.

In all my life, I’ve never seen a single technology expert with a better record than our proprietary algorithms for tech stocks.

And it’s exactly what the doctor ordered for the current mania in AI stocks.

You see, most average investors miss out on the truly life-changing gains of a technology boom because they do one of two things:

They buy the wrong stock.

Or they buy the right stock at the wrong time.

Frustratingly, that’s a large reason why average investors drastically underperform the S&P 500.

And it’s especially critical during a stock market mania.

The market is flooded with big-talking companies full of get-rich-quick promises.

But the truth is 70% of all tech startups fail. And in the Dot-Com Bust, the failure rate was even worse.

It’s also what happened in the 5G mania. And we saw the same pattern with so-called “blockchain stocks.”

The buzzier the trend, the more phonies who crowd into the space looking for a quick buck.

That’s why I created Weiss Ratings …

To cut through the hypey headlines and give these stocks a rating based on tried-and-true fundamentals. No emotion. No bias.

All based on the data and nothing but the data.

Our golden rules are simple: We never have a business relationship with the companies we rate. We never take a dime from them for the ratings. No hard dollars. No soft dollars.

So, if a company gets a “Buy” rating from Weiss Ratings, it’s a true “Buy” rating — not a rating that’s bought and paid for by the rated company.

Likewise, we’re not shy about flagging any company that falls below our Weiss Ratings standards.

That’s why The Wall Street Journalreported that investors following our Weiss ratings could have made more money than investors following Merrill Lynch, Goldman Sachs or any of the other Wall Street firms reviewed.

But our strict independence isn’t the only reason we’re so successful. It’s also because we do a lot more than Wall Street does to look under the hood.

We created a set of proprietary formulas that gives a pretty heavy weight to what we call “stabilizing factors.”

Not just earnings, but consistent earnings.

Not just dividends, but a long history of rising dividends.

Not just good upside price momentum, but also limited downside risk.

And right now, this formula tells us artificial intelligence is a true, sustainable, long-term megatrend.

And it’s one we’ve been pounding the table about here at Weiss for a while.

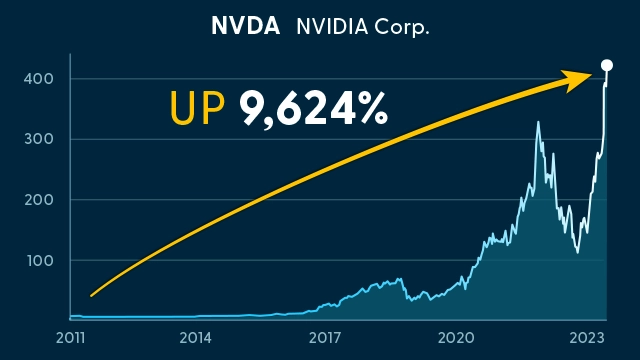

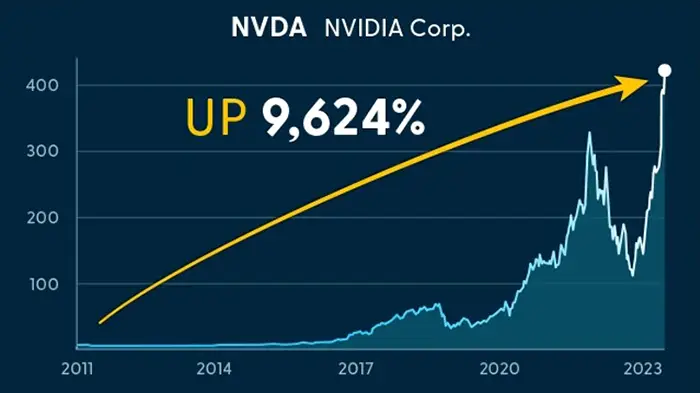

Take Nvidia, for instance.

This semiconductor and chip maker has been the darling of the AI sector — and of the entire stock market.

Nvidia is the overwhelming leader in producing the chips used for generative AI.

In fact, Nvidia recently became the seventh U.S. stock in history to reach a $1-trillion market cap.

It was up 189% in the first few months of 2023 alone.

But we were onto Nvidia much sooner …

In fact, our proprietary Weiss Ratings labeled Nvidia a “Buy” way back in 2011, when it was still mostly in the gaming business.

And when Nvidia pivoted to AI chips, we doubled down on our “Buy” rating.

Care to guess how much the stock is up since we first told investors to buy?

9,624%.

That’s right. Nvidia has surged 9.624% since we first rated it a “Buy.”

And that’s not the only early-stage AI stock our model has nailed.

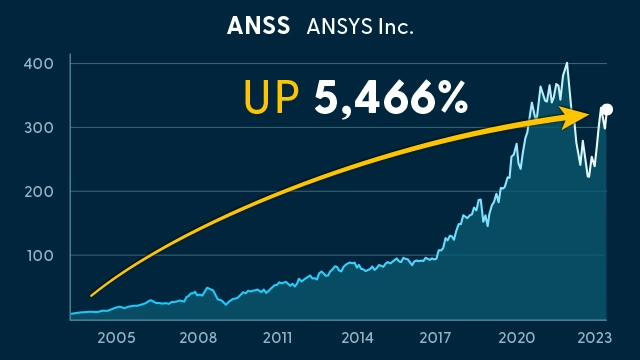

Ansys is another AI name on the list. It’s up 5,466% since we first rated it a “Buy.”

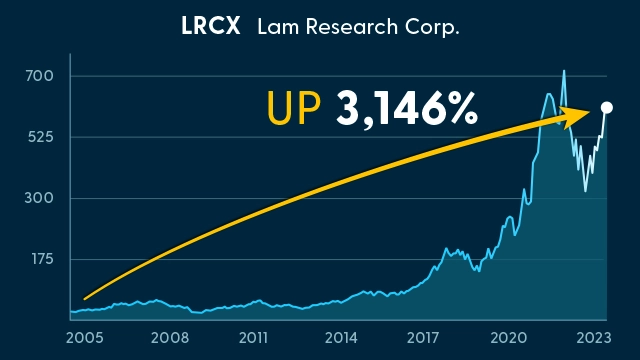

And Lam Research is up 3,146%.

Because of these big gains, you might think the AI boom has passed us by.

But as we explain in today’s AI Town Hall, nothing could be further from the truth.

AI is about to enter a new phase, with a different set of companies leading the way. And many of these companies are still flying under the radar.

Our Weiss ratings have homed in on one AI stock in particular.

We believe this one company will be a leader of the next wave of AI winners because of the specific job it performs.

The company recently inked a deal with Nvidia.

And the revenue from that deal could be far more than what’s been reported.

Weiss Ratings Tech Genius and AI Expert

In a moment, I’m going to turn today’s Town Hall over to our in-house tech genius and AI expert, Jon Markman.

He believes this company could be the Number One AI Stock for 2024 to Buy Now.

Not only has Jon worked extensively with our data scientists and analysts to improve the formulas behind the Weiss stock ratings …

He’s also a Microsoft veteran from the days Bill Gates ran the company. That’s when Jon worked personally and directly with their software geniuses to create a computerized, algorithm-based stock picker, called StockScouter.

It became the heart of Microsoft’s money website, MSN Money, where Jon was the managing editor.

Earlier, when he was at the LA Times, he and his team won two Pulitzer Prizes.

He’s also won the prestigious Gerald Loeb award for Distinguished Business and Financial Journalism, not to mention the Sigma Delta Chi award from the Society of Professional Journalists.

His book, Online Investing, played a critical role in the digital transformation of the brokerage industry.

But that was just the prelude to Jon’s illustrious career at Weiss Ratings.

Soon after he joined us here almost 10 years ago, Jon became one of the first tech analysts in the world to predict four major tech megatrends: mobile computing, big data, autonomous vehicles … and, yes, artificial intelligence.

And today all four have become massive profit engines for investors!

So, you can see why I brought Jon in for today’s Town Hall. To my knowledge …

His experience and expertise in AI — and all the tech that FEEDS AI — is absolutely unmatched by anyone, anywhere.

Today, Jon’s going to detail the rapidly expanding applications of generative AI, like ChatGPT.

He’ll walk us through the stages of the artificial intelligence boom and explain why he believes this could be your last chance to get in on choice AI stocks before they become too pricey.

And the big payoff today: He’ll share more details about his #1 AI Stock for 2024 to Buy Now.

He’ll give you a peek behind the curtain today. And he’ll share what our tech stock ratings are saying about artificial intelligence and investments tied to it.

That way you can make a smarter decision about how to play the AI boom, rather than just throwing your money after hype.

Jon is in Seattle right now, not far from the Microsoft hallways he used to roam while creating the world’s first computerized stock picker.

Jon, how are you today?

JON: Hi Martin, doing great. Very excited to update our readers on AI.

Martin: I am too. We haven’t had this much feedback about one particular sector in a long time. But everyone wants to know: What AI stock should I buy next?

JON: Well, then I’ve got good news, Martin. There’s not just one, but multiple buying opportunities out there for AI. It’s a great time to get in.

And it may be the last time you can buy these stocks at low prices.

Martin: I can’t wait to hear your presentation Jon.

Before I turn it over to you, I want to mention one more thing.

Stick around after Jon’s information-packed AI presentation. Because I’m going to share a one-time-only opportunity with you — something we haven’t done in nearly two years.

We’re going to give you a chance to use Jon’s Disruptors & Dominators letter with no obligation.

I’ll explain all the details after Jon’s AI update.

But for now, Jon, the floor is yours.

JON: Thanks, Martin.

I’m very excited to show you and other investors how to profit from this massive opportunity with artificial intelligence.

AI is rapidly growing into the biggest disruption to modern civilization since the rise of smartphones and even the internet itself.

And for investors, AI presents a new opportunity at least as big as those previous disruptions. In fact, I think it will be even bigger.

We’ve seen many tech trends in recent years. But quite a few of them turned out to be just hype and nonsense.

Consider blockchain tech. Yeah, some people made a lot of money in Bitcoin. But many of the so-called blockchain stocks were losers, or at best, just pure duds.

And what about the so-called “metaverse”? Hah! Other than Facebook changing its name to Meta, nothing much has happened. The Metaverse is still mostly in people’s imagination.

So, what makes AI different?

What makes me so sure that this is a real breakthrough like the Internet or Smartphones, and not just some passing fad?

Here’s the thing: A lot of the trends that failed were sparked by a breakthrough in one specialized technology with a very narrow range of practical applications.

In some cases, it was just one application. The hype for the app was off the charts. The app never took off. And when it collapsed, the thud could be heard around the world.

The whole trend just fizzles out, and investors who fall for the hype are left holding the bag.

But a true tech revolution worth investing in?

That’s what I call a "A Broad-Based Disruption".

I call it that because it’s a tech revolution that has more than one use case. It affects not just one industry, but all industries.

The Internet was a Broad-Based Disruption. It completely transformed modern life and changed how every part of the economy does business.

It also created new business models that were never possible before, like ecommerce and social media.

New companies were born that went on to become giants, like Amazon and Netflix. Meanwhile, once-dominant competitors like Blockbuster and bookseller Borders failed to adapt, and they were crushed.

We saw the same thing with smartphones.

For decades, all you could do with cellular phones was make calls and send text messages.

But after smartphones appeared, suddenly you could take the functionality of the internet with you everywhere you went.

This created entirely new business models, like ride-sharing apps Uber and Lyft.

Food-delivery services, like Grubhub and DoorDash, exploded in popularity.

Newer social media companies specifically optimized for smartphones, like Instagram and Snapchat, grew into multibillion-dollar businesses.

Same for AI. It’s unlocking new possibilities and business models that we’d never dreamed of before.

And it’s happening across almost every industry all at once.

AI is being used to write news articles, screenplays and even music.

Visual AI programs, like DALL-E and Midjourney, are generating animation, images and video that are practically indistinguishable from reality.

AI can now create improved versions of itself and even make new software and programs from scratch.

AI is disrupting medical science. Right now, doctors are using AI systems like Exscientia to offer personalized medicine that no one ever dreamed possible: AI-based treatment tailored to the individual.

For example, MIT published a report about an 82-year-old man in Austria with blood cancer. After six rounds of chemotherapy, the patient was out of options.

But after analyzing the patient’s unique genetic profile, Exscientia recommended a drug that most doctors considered ineffective against cancer.

And it worked! Two years later, this man’s cancer was in complete remission.

The AI-driven program was able to figure out the right medicine even when the world’s best doctors didn’t have a clue.

And that’s just the beginning. Biotech companies are using AI to design new drugs at the molecular level completely from scratch.

Over 150 drug and research companies with a focus on AI raised funding in 2022.

Soon, your doctor could be prescribing you a drug created by AI.

And it could go even further. It’s quite possible that soon AI might perform the diagnosis and recommend the treatment without your doctor.

I know it sounds crazy, but AI is advancing so fast it can now reach levels of human intellect that were never possible for a computer before.

Last year, not one, but TWO different AI programs passed the U.S. Medical Licensing Exam.

Lots of people spend their whole lives preparing for that exam …

But AI did it without any kind of specialized medical training, and without spending years in med school.

The newest version of ChatGPT even correctly diagnosed a rare genetic disorder in seconds.

And it’s not just medicine.

Researchers at Stanford did an experiment to see if GPT-4, the latest version of ChatGPT, could pass the bar exam that law school graduates must pass to become a lawyer.

It not only passed, but this AI program scored higher than 90% of humans hoping to practice law.

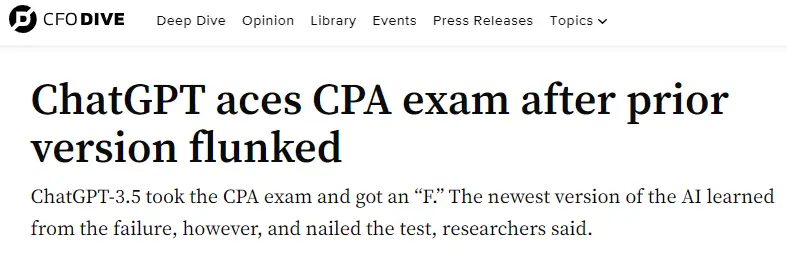

Interestingly the only professional certification that AI struggled with was for accounting of all things.

The first time that researchers had ChatGPT take the exam to become a Certified Public Accountant, it actually failed.

But that’s the kind of event which brings home the truly incredibly high potential that AI has.

Because generative AI learns from its mistakes. It can self-correct and build on its knowledge.

When it took the CPA exam a second time, ChatGPT aced it.

Think about how many industries I’ve already named that will be completely disrupted by generative AI.

Law, medicine, education, entertainment, accounting. On and on the list goes.

So, I have no doubt that companies — and investors — who adapt to this rapidly-moving trend will gain a huge advantage …

While those who don’t master AI could be left behind.

AI implementation is happening quickly, and its practical applications will expand even more quickly.

So, if you’re not getting in on it now, you’re going to be so far behind you’ll never be able to catch up.

Investors already see this because AI stocks are practically carrying the market single-handedly and could continue to do so for the foreseeable future.

So, to catch this wave, you need to consider getting into the right AI stocks immediately. There’s simply no time to waste.

More importantly, you can’t ride the old wave. You need to identify the stocks that will lead the next wave, the wave that’s about to begin.

The companies who succeed will be the ones who are nimble and see the writing on the wall. Nearly all others will fall by the wayside.

A flashback to technologies of the past provides some telltale clues.

Take Xerox, for example. The company’s engineers were so focused on making the best laser printers, they didn’t recognize the incredible tech sitting right before their eyes — like the first PCs, early versions of tablets, the first email systems and so many more.

So, how do you think Steve Jobs created Apple and my old boss, Bill Gates, created Microsoft? Well, a lot of their tech innovations were based on tech that Xerox engineers already had in their own shop.

In fact, Bill Gates had this to say about AI recently:

“The development of AI is as fundamental as the creation of personal computers, the internet and the mobile phone. It will change the way people work, learn, travel, get healthcare, and communicate with each other. Entire industries will reorient around it. Businesses will distinguish themselves by how well they use it.”

− Bill Gates, March 2023

That’s a quote from an essay he published in March 2023, titled “The Age of AI Has Begun.”

This just goes to prove what I said earlier: AI is clearly not a passing fad. It’s a real disruptive force that’s here to stay. It’s the central engine of a massive, Broad-Based Tech Revolution.

In fact, AI is now so advanced that some scientists declared it passed the Turing Test.

The Turing Test is a special test to determine if an AI program can think and reason as well as a human, and even convince the people using it that it is human.

According to some experts, this wasn’t supposed to happen until later in this century, maybe later in this millennium.

But last summer, an AI program developed by Google passed the Turing Test in a demonstration that shocked observers.

And a few months later, another app did it again: ChatGPT.

This means that AI is successfully convincing people it’s human.

AI passed the bar. AI passed the medical licensing exam. AI passed the CPA exam.

It’s writing essays and developing new drugs.

And its growth is accelerating at breakneck speed.

Does this mean it’s too late for investors to benefit? Does this mean the train has left the station?

The local train maybe. But the rapid express is just getting ready to depart.

The Next Wave of the AI Boom

Based on all the data I’ve seen, not to mention the Weiss ratings on many of these stocks … I’m convinced the AI boom has a long way to go.

Right now, we’re still in the early, build-up stage.

And already, the demand for generative AI chips is through the roof.

This was the first phase of the boom, the phase that proved the technology works. And in this phase, the big winners were companies that could build the chips and processors capable of powering the AI explosion.

That’s also what powered the first wave of surging stocks, especially leaders like Nvidia, the same stock we identified as a shining new star many years earlier.

But now, there’s a fundamental shift in the making — a shift that we’ve seen in every tech boom since we began studying tech stocks nearly four decades ago.

Here’s how it unfolds: As soon as the technology is proven, as soon as it becomes accessible to the average person, the market moves on to the next phase.

And in the AI tech boom, we got confirmation that was happening when ChatGPT suddenly burst onto the scene.

ChatGPT gained 100 million users faster than any other app in history.

Suddenly, artificial intelligence wasn’t just insider tech talk by computer geeks in the back offices of Silicon Valley. It was in the hands of anyone with a smartphone and used by tens of millions.

That was the unmistakable signal that the new phase is here.

In this new phase, not only will AI generate reams of data … not only will it create massive demand for data centers … but it will also sweep through the economy and cause a whole new series of disruptions.

In one industry after another, new AI champions will emerge; and in each industry, we will see disruptions that create new rising stars, while leaving the laggards in the dust.

Now, can you see why industry experts foresee AI becoming a $15.7-trillion bonanza by 2030? And now can you also see why the gains we’ve seen so far in stocks like Nvidia could be tiny by comparison?

When will the second phase be under way? It already is under way.

And it’s so new that most investors still don’t know anything about it, or at best, don’t understand its true potential.

But if you’re with me here right now, you do know. You do understand. And that alone already puts you far ahead of the crowd.

We’ve seen this pattern before, over and over again. And I can tell you flatly, with confidence, that the AI boom ahead could make ChatGPT feel like a Ford Model-T.

We’ve barely scratched the surface of what AI is capable of.

That’s why there’s still time for investors to jump in. But you’ll only be successful if you pick the right stocks.

So, beware: Whenever a new tech disruption appears, and whenever the disruption generates trillions of dollars in new revenues …

It also creates a ripe environment for shady, fly-by-night companies — bad actors looking to make a quick buck at the expense of investors who don’t do their homework.

We call them “garbage companies.” And your first step must be to filter out all that junk.

Here’s our current list of some of the most hyped-up tech stocks to avoid. Some are AI companies to avoid. Some are run-of-the-mill tech stocks that Wall Street is trying to disguise as AI stocks.

No matter what, avoid these AI stocks:

- Altair Engineering

- DocuSign

- Elastic NV

- Freshworks

- IBM

- Illumina

- Informatica

- MicroStrategy

- Samsara

- Shutterstock

- Snapchat

- Splunk Technology

- Spotify

Your second step is to take full advantage of the “Buy” ratings we issue. And we’ve used them to help identify a core shortlist of new AI opportunities, including our candidate for the the #1 AI Stock for 2024 to Buy Now.

It’s just been upgraded to a “Buy,” according to our proprietary Weiss ratings formulas.

And similar “Buy”-rated companies have a track record of success going back decades.

Among the 28 tech stocks we rated “Buy” after the Dot-Com Bust (but never downgraded to a “Sell”), the average gain to date is 3,316%.

And on 1,306 possible trades based on the Weiss tech stock ratings, the average gain is a whopping 220%.

That would be more than three times your money.

Per trade.

All without compounding.

We first began using this specific formula to rate tech stocks back in 1999 in the heyday of the Dot-Com Bubble.

At the time, nearly every Wall Street firm was saying “Buy” for any tech stock that landed on their desks. It was a pure, out-of-control mania.

But with our Weiss stock ratings, something interesting happened: We fed the data into our system, and not a single tech stock came back as a “Buy.”

In fact, nearly every Nasdaq stock at the time got a “Sell” rating.

Our model went against the grain, to much ridicule.

But it was a good thing it did because investors who followed our ratings avoided the bloodbath that followed in the Dot-Com Crash.

The real payoff came in 2004. At the time, the sentiment toward tech could not have been worse.

Millions of people got crushed in the crash. And Wall Street was practically ignoring the tech sector, often pretending it didn’t even exist.

Then, something interesting happened: Our model began to turn bullish on tech stocks, and issued “Buy” ratings for one tech stock after another …

The results were astonishing:

2,151% returns with Microsoft …

3,014% returns with Teledyne Technologies …

And 2,519% with Intuit, the company behind TurboTax and QuickBooks.

And those were some of the more modest gains produced by our tech ratings model.

We saw 5,466% — more than 50 times your money — with Ansys, Inc.

Lam Research — 3,146% since we issued a “Buy” rating.

Badger Meter, Inc — 5,005%.

Tyler Technologies — 10,689%.

And now, we get to some of the really big winners.

Martin named Nvidia earlier, but I want to reiterate the point …

Right now, Nvidia is one of the top tech stocks in the world. It just crossed into the trillion-dollar club, something only a few companies in history have done.

And in the first few months of this year alone, the stock was up 189%, largely thanks to Nvidia’s leadership role in the current AI boom.

But our Weiss ratings issued a “Buy” rating for Nvidia years before anyone was paying attention to the stock, and years before the AI excitement you’re seeing today.

And here’s the best part. Throughout that entire period, our ratings system never downgraded Nvidia to sell. Not once!

Remember: Nvidia started as a chip company focused on gaming applications. But ten years ago, its founder, Jensen Huang, made a giant leap into AI software.

His timing was impeccable. And he joined the industry visionaries like Bill Gates and Steve Jobs.

Investors who bought Nvidia when the Weiss Ratings told them to could’ve made 9,624%. So far.

That’s enough to turn a $10,000 investment into nearly $1 million.

But as amazing as that is, it wasn’t even our biggest winner.

We issued a “Buy” rating for another company that would hit a trillion-dollar valuation much sooner …

I’m talking about Apple.

We rated Apple a “Buy” in 2004 when the stock was selling for the equivalent of just 56 cents …

And since then, Apple is up 32,571%.

Investors who put $10,000 into Apple when our model first upgraded it to “Buy” could become a millionaire three times over.

3.25 times a millionaire, to be exact.

Or said a different way … they could have made 325 times their money from the “Buy” rating we issued …

And that’s 135 times better than returns on the S&P 500 over the same period.

This is why I say our Weiss stock ratings are one of the most effective tools for picking the right tech stocks at the right time.

I know of no other analytical model that comes close to these results.

Among the 28 tech stocks we rated “Buy” after the Dot-Com Bust, the average gain to date is 3,316%.

Even more incredible, we’ve never downgraded those stocks to a “Sell,” and most are still climbing, like Apple and Microsoft.

I should add, this is a real-time track record. It’s based on the actual ratings we issued to the public at the time.

This is not some hypothetical, “back-tested” model. We have been using it, refining it and perfecting it for over 20 years. It has stood the test of time, and it works.

It works because it’s not based on hearsay or some particular investment “philosophy.” It’s based on hard data, reams of hard data.

And it works because, unlike other Wall Street research companies and ratings agencies, we never have accepted — and never WILL accept — a dime of compensation of any kind from any company we rate.

We have no conflicts of interest at all.

This transparency, combined with our track record of success, is why I say investors can trust recommendations we make for this ongoing AI revolution.

And it’s the impressive history of this system that makes me so excited about my candidate for the Number One AI Stock for 2024 to Buy Now, which recently received a “Buy” rating, thanks to our ratings model.

Right now, I’ve just prepared a special report with all the details — all the powerful reasons why it’s my candidate for the #1 AI Stock for 2024 to Buy Now, precisely why and how I think this company is about to jump into the lead.

The report includes …

- My trade alert with my recommended “buy” price …

- How high I think it could go …

- And if everything goes as I think it will, when to take profits.

This company just signed a deal with Nvidia that went unnoticed in the media. And yet, it provides an absolutely critical service to the giant chipmaker.

I have strong reason to believe the revenues that flow from the deal could far exceed expectations.

Remember, we’re still in the early stages of the AI boom, but the rate of AI adoption is …

Faster than the internet boom …

Faster than the smartphone boom …

Faster than any other broad-based tech disruption in the history of mankind.

Let me show you exactly what I mean:

It took 16 years for mobile phones to reach 100 million users.

For the internet, it took 7 years.

Facebook took 4½ years to reach 100 million.

Instagram did it in 2½ years.

But …

ChatGPT busted through the 100-million-user mark in just two short months.

That’s …

- 15 times faster than Instagram

- 27 times faster than Facebook and

- 96 times faster than smartphones.

But ChatGPT is just one example. Adoption for AI tech by other industries is also about to happen at breakneck speed.

So, if the adoption of AI is coming so much faster than in previous tech disruptions, it follows logically that the growth and returns investors could reap in the leading AI stocks will also come much faster than in previous tech disruptions.

But this super-accelerated pace of change is a double-edged sword.

Because it also means the time window to jump in also closes a lot faster.

If you want to ride this AI wave, I think you need to consider immediately getting into my candidate for the Number One AI Stock for 2024 to Buy Now.

Once a stock like this gets on the public’s radar, it can shoot up — sometimes to unreasonably high prices that would prompt me to remove my report from circulation.

I’ve just released “The #1 AI Stock for 2024 to Buy Now”. So, the clock is ticking. And in my opinion, the more quickly you take action the better.

Plus, I have three MORE urgent reports, each one with all the info you need to go for potential AI gold mines …

- My pick for the #1 AI Software Stock Today. Their software is powering the Ukrainian defense, city traffic systems worldwide … even wind turbines.

My pick for the #1 AI Stock for Big Data. This is the company that I believe stands to gain the most from the growth explosion we’re seeing in the data. Remember: In its essence, AI is the processing of Big Data at warp speed.

Already, new data is generated at 10 times the speed of just one year ago. This is why the demand for cloud servers and data storage is through the roof. And it’s also why the stock in this second company is on my list of the biggest potential winners.

My pick for the #1 Pharma Stock Powered by AI. I predict this company will be among the first to reap the rewards of AI’s breathtaking impact on disease detection and precision medicine treatments.

It's already at the forefront of major breakthroughs in the field of AI-assisted medicine. Yet, I know of no prominent analyst who has even mentioned its name.

In each of these reports, I’ve included everything you need to know about the companies, and how to invest in them with the best chance of success.

In a moment, we’ll tell you how to make sure you’re among the very first to get it.

But to truly take advantage of the fast-changing world of AI, to truly reap the benefits now and in the months ahead, I also want to help you in another way.

Moreover, as we’ve said here today, the AI revolution is not limited to technology. It’s about to sweep through almost every industry on the planet.

Nor is AI the only tech revolution that’s changing our lives for the better.

The great global shift to electric vehicles has barely begun.

Self-driving cars are already hitting the road, but it’s just the beginning.

And while mobile devices are now everywhere, the explosion of new, more powerful applications is still under way.

So, the best way to profit over the long term is to create a diversified tech portfolio … and then continually trade that portfolio to stay in sync with the fast-paced changes that can only get faster and faster by the day.

A way to pack your portfolio with long-term successful companies who compound your returns.

Martin: Fantastic.

JON: Yes, it’s precisely for this kind of opportunity that I’ve dedicated the last decade to creating a proprietary, tech-stock model portfolio, with a goal of producing the best possible returns, year after year.

Martin: Jon, let me jump in here to say a bit more about it and what folks get.

JON: Sure, go ahead.

Martin: Thanks, Jon. Right off the bat, you can immediately download Jon’s four special reports.

In each and every one …

- The #1 AI Stock for 2024 to Buy Now

- My Pick for the #1 AI Software Stock Today

- My Pick for the #1 AI Stock for Big Data, plus

- My Pick for the #1 Pharma Stock Powered by AI

Jon not only maps out the opportunity for average investors …

He specifically names the investments to buy right now, down to all the critical details: Their ticker symbols, their prospects for the future, how much to pay, how much to expect in returns and much, much more.

But AI is so new … and these amazing applications of AI are evolving so rapidly … there’s not much time to jump in.

Right now, the stocks on Jon’s “urgent buy” list are relatively cheap.

But Jon predicts that, as more investors get wind of the massive changes sweeping through nearly every sector these stocks could surge to such astronomical valuations …

He will have to remove them from his “urgent buy” list and one after another, he will need to take these four special reports out of circulation.

Usually, Jon says, that doesn’t happen with his favorite stocks for months or even years.

But the AI revolution is moving so fast — 100 million users for a -brand-new AI app in just two months …

That these AI tech companies could come off his “buy” list a lot sooner.

This is why he has hurried to release the reports right now.

And this is why we want you to have them right now as a bonus for trying Jon’s monthly letter, Disruptors & Dominators.

All it will cost you is a few cents per day.

And after your instant download of Jon’s four reports …

Even after one full year of profit opportunities with his Disruptors & Dominators …

If you’re not happy for any reason, no problem!

Just give us a call or send us an email, and you can get 100% of your money back.

No delay. No questions asked.

You can even get a full refund on day 365 of your membership, after you’ve taken full advantage of the four reports and after you’ve taken advantage of all the monthly issues and much more.

As the name implies, Disruptors & Dominators gives you both sides of the great innovations we see in the world today.

It covers the new, rapidly emerging technologies or companies that disrupt our world for the better.

And it covers the existing great technologies or well-established companies that already dominate their industry.

That’s what I consider the best of both worlds — the opportunity for faster, often explosive growth, plus the opportunity for safer, longer-term, sustainable growth.

For my money, I need both.

And I trust you do too.

Click here to get all the details about the four bonus reports you can download right now.

Check out the other, equally exciting kinds of opportunities you will get access to month after month.

Consider the fact that you can get access to everything for just a few pennies per day.

Go for the kinds of trades that have produced an average gain of 219% per trade based on our ratings. Even before AI! Use all the information for the opportunity to make as much money as possible …

And do it with my blessings for wealth — and health — for yourself and everyone you care for.

Good luck and God bless!