If you’re looking for a safer way to boost your retirement account over the next 3-5 years, then check out our newest research on this group of…

Under-the-Radar Stocks

Over the past year alone, several well-informed investors have enjoyed gains Of 129.3%... 130%... 183.9%... 197.7%... 275.4%... even up to 507% from these little-known stocks that receive virtually ZERO coverage from Wall Street or the media.

In the brief video segment and research report below, you’ll discover:

- The secret of why this ONE particular category of overlooked stocks could provide you with numerous opportunities to bank high double-digit and even triple-digit profits over the next 12 months.

- How the average annual returns of our top “Under-the-Radar Stocks” consistently BEAT the S&P 500 year after year – You’ll see their 213.81% returns in 2013… 84.16% returns in 2014… 52.92% returns in 2015… and 85.11% returns in 2016. As of right now, they’re currently up 99.13% for 2017.

- Three carefully selected “Under-the-Radar Stocks” to invest in by September 30th, 2017 that you’ve likely never heard of before… but could allow you to lock-in triple-digit gains over the next 12 months – turning every $10,000 invested into $20,000 or more…

Dear Investor,

There is a little-known category of stocks that you’ve likely never heard of before.

In fact, practically nobody on Wall Street knows about them either.

They’re not covered in the mainstream media.

And your financial advisor or stockbroker doesn’t know about them… because if he or she did, you could have already been profiting immensely from them.

We call them “Under-the-Radar” stocks, and they could consistently provide you with high double-digit and even triple-digit profits.

And as I mentioned in the video clip above, these select Under-the-Radar Stocks are not risky penny stocks…

…even though they could provide you with penny stock-like gains of 130%... 275%... even up to 500% or more in just one year.

In fact, they’re traded every single day on the New York Stock Exchange and the NASDAQ, and regularly report their quarterly and annual financials.

But chances are… you’ve probably never heard of any of these companies before.

And there’s a good reason why…

You see, most analysts on Wall Street tend to follow stocks with the largest market caps, or those that are the most popular regardless of their size.

Well known stocks like Facebook, Apple, Microsoft, and Wal-Mart have dozens of Wall Street analysts covering every aspect of their businesses including:

Quarterly revenue estimates, number of new customers projected to be acquired, earnings estimates, growth estimates, same store sales, which officers are buying or selling shares, new products coming to the market, and much, much more than the average investor could ever find out on their own.

For these types of companies, there’s not much that these analysts don’t know.

And once you hear news about them in the mainstream media – it’s already too late to act on and profit from the news… or to protect yourself from potential losses if you already own the stock.

However, with the group of select Under-the-Radar Stocks we’ve discovered, we’ve found that having just a few of these little-known stocks could substantially boost your investment portfolio.

Let me show you what I mean…

Betting With Billionaires, Hitting Pay Dirt In Hawaii, And “Cleaning Up” For 507% Gains

Harold Simmons was a very intelligent businessman… and an even smarter investor.

However, you can’t invest alongside Dallas billionaire Harold Simmons anymore. The famous corporate raider, worth an estimated $10 billion, passed away in late 2013.

But two of his wealthy, surviving daughters now control his holding company NL Industries (stock ticker: NL).

The company owns a majority stake in CompX International (CIX) – a security and marine components company. CompX makes mechanical and electronic locks used in postal boxes, office cabinets, safes, and vending machines, as well as exhaust kits, throttles, and gauges used in boats.

NL Industries also owns a 30% stake in Kronos Worldwide (KRO). Kronos provides titanium dioxide pigments used in the manufacture of everything from sinks and toilets to paints and cosmetics.

Now here’s where things get interesting… and highly profitable…

In the first quarter ending on March 31, 2017 – NL Industries sales rose to $29.9 million from $27.1 million. The company also delivered a solid profit of $8.4 million, or 17 cents a share, versus a loss of $2.5 million, or 5 cents a share, in the year-earlier period.

Government demand for security products helped things along, as did surging demand and pricing in the pigment business.

And despite this company only being followed by one Wall Street analyst, NL Industries’ share price spiked more than 197% in 12 months, leaving the S&P 500 in the dust!

Had you invested just $1,000 in this stock, it could have turned into $2,970 and every $10,000 invested could have given you $29,700. That’s almost TRIPLE your original investment.

And this is just the tip of the iceberg when it comes to these Under-the-Radar Stocks that receive little or no coverage on Wall Street…

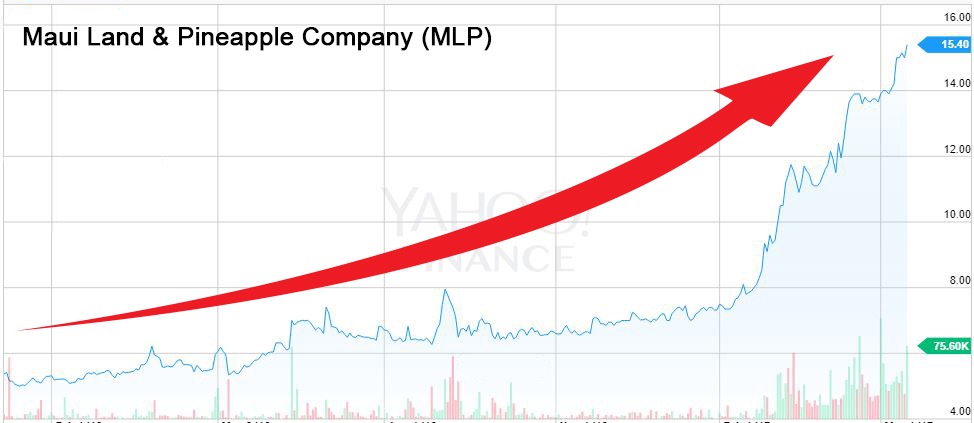

Take, for example, Maui Land & Pineapple Company (MLP).

You’ve probably never heard of MLP before. It’s not your fault – as there isn’t a single Wall Street analyst following it.

But the company has been around for a long time, and it has a rich history on the island of Maui. It owns 23,000 acres of land there, most of which it acquired between 1911 and 1932.

Over time, the company has gradually monetized those assets. It now - manages amenities and properties on the grounds of the Kapalua Resort, provides utility services in the region, and leases and sells resort, commercial, and agricultural property.

In the first quarter of 2017, MLP earned $5.8 million, or 31 cents per share. That was a large swing from the year-ago loss of $1.4 million, or 7 cents per share. The big swing stemmed largely from the sale of a 15-acre, three-hole practice golf course.

As a result, investors who owned shares in this company saw their values surge more than 275% during a 12-month period from July 2016 to July 2017.

Just $1,000 in this company would have turned into $3,750 and every $10,000 invested would have given you $37,500.That’s almost QUADRUPLE your original investment.

And Here’s Another Profitable Example of These Under-the-Radar Stocks in Action…

Take a look at EnviroStar (EVI).

EVI is a distributor of commercial laundry and dry cleaning equipment, industrial boilers, and related parts and services. It also operates Dryclean USA, which has 400 stores in the U.S., Caribbean, and Latin America.

In the fiscal third quarter that ended in March, sales surged 93% to $24.7 million from $12.8 million. Profits jumped 15% to $890,000 from $774,000.

Growing by acquisition has helped out, with the firm recently buying Martin-Ray Laundry Systems for $4 million and Western State Design for $28 million. The two moves are part of EVI’s “buy and build” strategy, and they’ve helped expand the company’s customer list to more than 7,500.

However, you can’t find a single mainstream analyst on Wall Street tracking this company.

But it’s been bouncing back and forth between “B-” (BUY), “B” (BUY), and “C+” (HOLD) in our Weiss Ratings system since September 2016. If you bought (then held) the stock from then through July 2017, you’d have enjoyed a whopping 507% gain in less than a year!

Had you invested just $1,000 in this stock, it could have turned into $6,070 and every $10,000 invested could have given you $60,700.That’s almost six-times your original investment.

These three examples demonstrate that you can find BIG profit opportunities among these rarely publicized stocks… especially when you look where mainstream analysts aren’t paying any attention!

And because these little-known stocks are priced between $5 to $120 per share and are traded every day the New York Stock Exchange is open – you can easily add a few of them to your investment portfolio.

Of course, as I mentioned in the video clip above, you and I can’t go back in time to 2016 to buy (and profit from) these three Under-the-Radar Stocks I just mentioned.

However, our newest research suggests there are dozens of these stocks that could allow you to boost your retirement savings in a relatively short period of time.

In fact, we’ve discovered three carefully selected Under-the-Radar Stocks to invest in today that you’ve likely never heard of before… but could allow you to lock-in triple-digit gains over the next 12 months, turning every $10,000 invested into $20,000 or more…

I’ll tell you more about them in a moment. But before I do, you may be asking yourself:

“Why Isn’t EVERYONE Buying These Under-the-Radar Stocks As Part Of Their Overall Investing Strategy?”

The answer is surprisingly simple.

Hardly anybody knows about them!

You see, many of these companies aren’t reported on for the following three reasons:

1. They may be controlled by a few large shareholders and reluctant to change – Sometimes, majority shareholder positions of these companies are held by families, trusts, or other institutions. And in these cases, they often want to retain control of how the companies are run and are unwilling to change. Plus, many opt to not grow through acquisitions by taking on debt… which leads us to…

2. Little or no NEED for investment banking – In other words, they are already well-capitalized and they don’t require capital markets, equity raises, or debt sales. As a result, there’s no need for investment banking, so those banks don’t cover them and report on their financials.

3. LOW brokerage commission revenues for banks – The trading volume for these Under-the-Radar Stocks is often-times lower than most other stocks because they get so little coverage and attention. Because of this, Wall Street firms rationalize that it’s not financially worthwhile for them to conduct the necessary research to report on these companies.

So, for most people – the disadvantage of investing in these Under-the-Radar Stocks that have just two… one… or even zero Wall Street analysts following them is that you are completely on your own.

And although many of these little-known stocks consistently beat the market year after year… fundamental research, investor information, ratings, and trusted advice are next to impossible to find.

But not anymore…

Weiss Ratings has complete research and data on over 15,000 stocks – including ALL the Under-the-Radar Stocks you won’t hear about anywhere else.

And each of them come with our unbiased and independent Weiss Ratings (A through F) that make it easy for you to decide which ones to buy and sell.

Since this category of stocks is virtually uncovered by Wall Street and unknown to practically all individual investors, we took it upon ourselves throughout 2017 to conduct our own thorough research on these Under-the-Radar Stocks to determine their profitability.

Our team of analysts was led by Mike Larson and Mandeep Rai, whose work includes investigating these companies, poring over their fundamentals, and even traveling to some of their headquarters to oversee operations and conducting interviews of company officials.

And all these months of painstaking research have certainly paid off…

In fact, we discovered that if you can find these stocks that aren’t receiving any coverage on Wall Street or in the mainstream media, and buy shares before the usual herd of investors or Wall Street eventually takes notice – it can have a BIG impact on your investment portfolio.

Let me show you what I mean…

These Are the Kinds of Average Annual Returns

That ANY Investor Would Love

At Weiss Ratings, we know that anybody can “cherry-pick” the best individual stocks within a group and make them look appealing to investors.

So, to test how powerful these Under-the-Radar Stocks can be for your investment portfolio, we tracked the 10 top-performing, Under-the-Radar Stocks with a current rating of A or B, versus the S&P 500 for the past 10 years.

And we were blown away by the results.

When we began our investigation into these investments, we anticipated the average returns of the Under-the-Radar Stocks for some years might be 5 to 10 times greater than the S&P 500.

But we had no idea that the annual average returns of these little-known stocks would be up to 43-times greater than the S&P 500… like it was in 2007 and 2015.

Our Weiss Ratings are such a powerful tool for these critical reasons:

First, unlike other ratings, our Weiss Ratings are NOT bought and paid for by the companies, the brokers or the banks. We have no relationship whatsoever with Wall Street. We are not in the investment banking and brokerage business. We are 100% independent. And we cover stocks big and small strictly for the sake of investors.

Second, to merit a Weiss “buy” rating, stocks must have an historical track record that is not only strong, but is also CONSISTENT. So it comes as no surprise to us that our top-rated stocks have performed well in the past.

Third, and more importantly, to merit our “buy” rating, the stocks must offer investors a very high probability of future potential that’s consistent with that history. Of course, no one can guarantee the future, but we can guarantee the independence, objectivity and power of our ratings.

See for yourself in the chart below…

Year |

*Average Annual Returns Of Top Under-the-Radar Stocks |

S&P 500 Returns |

2007 |

242.52% |

5.57% |

2008 |

34.68% |

-37.00% |

2009 |

414.09% |

26.45% |

2010 |

219.78% |

15.05% |

2011 |

92.75% |

2.11% |

2012 |

114.21% |

15.99% |

2013 |

213.81% |

32.37% |

2014 |

84.60% |

13.67% |

2015 |

52.92% |

1.37% |

2016 |

85.11% |

11.95% |

2017 |

99.13% (thru 7/31) |

10.64% |

* Average returns may include some stocks that may not have qualified for a recommendation precisely at the beginning of each. respective year.

As you can see, our top Under-the-Radar Stocks could provide a significant boost to your overall investment portfolio in as little as one year.

And it gets even better…

We also discovered that buying select Under-the-Radar Stocks could be the best way to stumble upon the next “hot company” that eventually gets noticed by Wall Street and the mainstream media. when that happens, it could provide you with high triple… and even quadruple digit gains.

For example, look at these former Under-the-Radar Stocks which had no coverage just a few years ago, but now have several Wall Street analysts covering them. More importantly, look at their gains…

And these are just a handful of over 80 different Under-the-Radar Stocks that turned into big-time profit producers for investors, each with returns between 106% to 6,944% over the past several years.

So we put our team of analysts to work to find the top three Under-the-Radar Stocks for our readers.

Get in On These 3 Under-the-Radar Stocks

As Soon As You Possibly Can

As you can see, investing in just a few of these little-known stocks could help fast-track your retirement goals. And if you’re already retired, they could help ensure that you will never have to worry about money again…

In fact, we’ve uncovered three opportunities to get into as fast as you can, as each of them could allow you to lock-in triple-digit gains over the next 12 months – turning every $10,000 invested into $20,000 or more…

Under-the-Radar Stock #1:

Enjoy SURGING Profits Year After Year From This “Sin” Stock

Say what you will about investing in “sin” stocks. The simple truth is they can pay off... big time!

For example, this Under-the-Radar company operates a chain of over 40 gentlemen’s clubs and sports bars.

You can only find one analyst who tracks the company on Wall Street. However, it’s up 39% so far in 2017, and a hefty 129% in the past year!

Its sports bar brand is a particularly intriguing growth driver for the future because it’s designed to capitalize on the “social dining” trend. In other words, they don’t want you to dine and dash – they want you to hang out, eat, drink, and watch sports for as long as you want!

Each location runs between 7,500 and 10,000 square feet with an outdoor patio, features more than 75 high-definition televisions, and offers diversified menus and full bars. This Under-the-Radar company hopes to open 80 to 100 units, with around 70% to 80% of them as franchised locations.

In the third quarter, their same-store sales rose 6.8% to $33.4 million. Nightclub sales were particularly strong, and the company added two new locations in St. Louis and Miami. Officials said “management at all levels is excited about the prospects going forward” due to “a broad based recovery around the country both in VIP spend and in customer count.”

With consumer confidence increasing and business booming, this stock could be one you keep in your portfolio for years to come…

Under-the-Radar Stock #2:

LASER-FOCUSED On Generating Huge Gains for Shareholders

Based in New England, this Under-the-Radar company makes a wide range of lasers and laser-based systems for various industries.

These lasers are designed to help mark or drill materials at construction sites, correct patient vision with laser surgery, and analyze various materials to help determine their composition in laboratories.

This company also produces wireless video transmission equipment, and touch panels displays used in healthcare settings.

Additionally, this company has only one analyst tracking it on Wall Street.

But this is no fly-by-night company.

It sports a $1.3 billion market cap, and has been active on the acquisition trail for a long time. Just in the past couple of years, it bought all or part of four other laser or technology companies.

With a whopping 130% gain in the past year ... and a 76% rise in 2017 so far... this company’s financials indicate that it will continue growing at break-neck speed for years to come, making it a healthy addition to any investment portfolio.

Under-the-Radar Stock #3:

The Tech Stock Nobody Knows About That Could DOUBLE Your Money Over The Next 12-Months

There’s no doubt that you’ve heard of the Redmond, Washington-based giant, Microsoft (MSFT).

Everyone has, including the 41 analysts Bloomberg shows following the company.

But within an hour’s drive from there sits another tech stock virtually no one has heard of. In fact, not one single Wall Street analyst follows it... which is a real shame considering the stock has more than doubled so far in 2017, and looks to do so again throughout 2018.

This Under-the-Radar company sells programming systems, equipment, and software used in electronic devices worldwide, including those found in cars and trucks, consumer electronics, and medical devices.

Its customers include a veritable “Who’s Who” of leading tech, industrial, and automotive companies, including LG, Toshiba, HP, Micron, Microsoft, Delphi, and Honeywell.

Additionally, this company delivered a monster first quarter, with sales surging 56% to $7.2 million from $4.6 million in the year-earlier period.

The company’s CEO recently gushed about “strong, across the board growth for equipment and consumable sales from all geographic regions,” citing particular strength in the automotive and “Internet of Things” industries.

What’s more, Q1 bookings hit a 17-year high of $8.4 million. Or in plain English, business hasn’t been this good since the dot-com boom!

This company has already DOUBLED with little to no support on Wall Street. And if it keeps putting up numbers like these, and mainstream analysts finally do take notice, there’s no telling how high it could soar in the months (and years) to come.

In fact, I want to give you all the details I have on it now so you have the opportunity to lock in the greatest gains possible…

To get our research on this company, along with the other two Under-the-Radar Stocks mentioned above – I’m inviting you to try out…

Weiss Ratings' Under-the-Radar Stocks

Investment Advisory Service

As I mentioned in the video above – my name is Nick Moccia, and I’m the Publisher of Weiss Ratings.

Over the past 25 years, our research and investment recommendations have provided our readers with exceptional gains.

And we’re excited about the profit-potential this little-known category of stocks has for our readers.

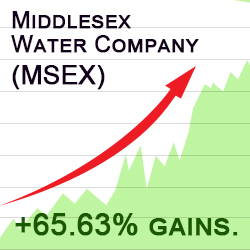

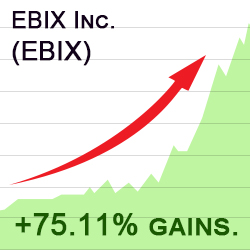

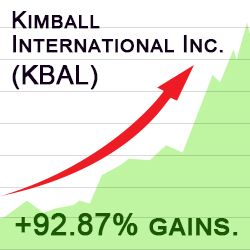

In fact, take a look at some of our top Under-the-Radar Stocks from 2016 along with their gains for that year:

Those are just a handful of the top-performing stocks that you’ve likely never heard of before.

Knowing about these little-known stocks could give you a significant advantage over other investors.

And when our Weiss Ratings team makes investment recommendations, you’re receiving carefully-vetted research and a financial perspective that you simply can’t get anywhere else… especially with these Under-the-Radar Stocks.

I do want to be clear about one thing, though. Not every single Under-the-Radar stock that we pick will be a winner.

That's impossible. But I can guarantee you this: When we make a stock pick that moves downward without prospects of it re-surging in the very near future – we get rid of it fast.

The last thing anyone who has their money tied up in our recommendations wants is to watch it go down.

We don't have an emotional connection to the stocks we recommend.

It's all about performance for us. If a company doesn't meet our team’s performance expectations based on our research (and we have high expectations), we’ll cut it fast.

Even after everything I’ve showed you above about the profit potential of this group of Under-the-Radar Stocks, I know that spending your hard-earned money on investment research and advice isn't exactly at the top of your to-do list.

So Please Allow Me to Remove ALL Doubt From Your Mind About the Profitability Of These Unique Stocks

Given what you’ve seen from our research, I believe we can agree on this...

Companies like Walmart, Microsoft, and Apple - who respectively have 38, 41, and 55 highly-paid (and herd-like) Wall Street analysts -- simply can’t offer any new perspectives on those companies’ stocks… or provide you with profitable insights.

And the same goes for many other companies whose financials are regularly reported on by Wall Street - analysts and the mainstream media.

However, if you really want an edge as an investor, if you want to find the biggest winners and most profitable plays of tomorrow – then you must get off the beaten path, and peer into every corner of the market… just like we do here at Weiss Ratings.

As I demonstrated earlier, we have found a virtual gold mine of these stocks that have virtually zero coverage on Wall Street, or on traditional media outlets.

For example, take these three Under-the-Radar Stocks we’ve been tracking that have soared from the beginning of 2017 through July 31st, 2017:

- Northeast Bancorp (NBN), a Maine-based financial services company generated 90.85% gains

- Simulations Plus Inc. (SLP), a software company that serves the pharmaceutical, cosmetics, and herbicide industries saw its shares rise by 96.05%

- Tropicana Entertainment (TPCA), a gaming company that owns and operates casinos and resorts, posted 133.51% gains

And right now, we’re investigating over a dozen other Under-the-Radar Stocks that promise similar returns. The moment their financials trigger our Weiss Ratings BUY signal, we’ll immediately let you know so you can take action and lock-in the greatest potential gains.

You see, by adding just a few of these little-known stocks to your investment portfolio each year… you could make a substantial difference for your overall annual returns.

In fact, this alone could help you fast-track your retirement goals… or… if you’re already retired, could help ensure that you never run out of money in retirement.

And that's why I'm going to make you this time-sensitive offer.

I’m inviting you to try out our newest investment research service, Under-the-Radar Stocks, for a full two months.

Take the next 60 days to try out everything it has to offer… completely risk-free.

Allow us to remove all doubts from your mind about the profitability of these investments that most investors never heard of… until now.

Here Are All The Benefits

You’ll Receive as A New Charter Member

When you take me up on my risk-free and deeply-discounted offer before the deadline below, here’s everything you’ll receive:

Our Top 3 Under-the-Radar Stocks (Revealed In Our September Launch Issue) – This comprehensive yet easy-to-understand guide will provide you with greater detail about our analysts’ Top 3 Under-the-Radar Stocks to invest in that could provide you with triple-digit gains over the next 12 months. You won’t find this research anywhere else, because as I mentioned earlier – most of these stocks have only one analyst (at most) on Wall Street actively covering them.

Our Top 3 Under-the-Radar Stocks (Revealed In Our September Launch Issue) – This comprehensive yet easy-to-understand guide will provide you with greater detail about our analysts’ Top 3 Under-the-Radar Stocks to invest in that could provide you with triple-digit gains over the next 12 months. You won’t find this research anywhere else, because as I mentioned earlier – most of these stocks have only one analyst (at most) on Wall Street actively covering them.

Monthly Under-the-Radar Stocks Report And Market Commentary – Each month, you’ll receive a report from our team of analysts that cover Under-the-Radar Stocks that have the greatest profit potential. They’ll explain which stocks to buy and which ones to sell. They’ll provide commentary to explain trades in greater detail… along with their insights on the financial markets, and an informative Q&A column that answers our readers’ most pressing questions.

Monthly Under-the-Radar Stocks Report And Market Commentary – Each month, you’ll receive a report from our team of analysts that cover Under-the-Radar Stocks that have the greatest profit potential. They’ll explain which stocks to buy and which ones to sell. They’ll provide commentary to explain trades in greater detail… along with their insights on the financial markets, and an informative Q&A column that answers our readers’ most pressing questions.

It will be like getting a doctorate degree in Finance… only our team simplifies the information in a way that anyone can understand. And before long, don’t be surprised if others start listening in on your commentary on investments at dinner parties and other social events… and start asking you for advice!

Quarterly Members-Only Webinars – At least once a quarter, our team of analysts will also “take you behind the curtain” and answer your questions about investing in our carefully-selected Under-the-Radar Stocks, their profit potential, and other special opportunities that are unknown by the general public – giving you an edge over other investors.

Quarterly Members-Only Webinars – At least once a quarter, our team of analysts will also “take you behind the curtain” and answer your questions about investing in our carefully-selected Under-the-Radar Stocks, their profit potential, and other special opportunities that are unknown by the general public – giving you an edge over other investors.

But you can only access these exclusive webinars if you join before midnight on September 30th, 2017.

When you do, you'll also get Members-Only access to our Under-the-Radar Stocks website, and you’ll also be entitled to:

First-class customer service. If you ever have a problem or a question, our Subscriber Services staff is here to help. Send us a quick email or call us toll-free. No matter which you choose, we'll do everything we can to make you happy.

First-class customer service. If you ever have a problem or a question, our Subscriber Services staff is here to help. Send us a quick email or call us toll-free. No matter which you choose, we'll do everything we can to make you happy.

My zero-risk guarantee. I want you to be 100% satisfied with our Under-the-Radar Stocks research. That's why I'm giving you a full 60 days to try it out and see everything it has to offer. If you aren't happy, let us know and we'll quickly issue you a full refund.

My zero-risk guarantee. I want you to be 100% satisfied with our Under-the-Radar Stocks research. That's why I'm giving you a full 60 days to try it out and see everything it has to offer. If you aren't happy, let us know and we'll quickly issue you a full refund.

My Simple Offer

Later this year… after this Charter Membership launch to the Weiss Ratings family is over, the retail price for our Under-the-Radar Stocks research will be $595 per year.

And even at that price, this one-of-a-kind service will still be worth every penny to those who take advantage of investing in these profit-promising stocks.

In fact, I've seen other analysts charging up to $3,000 per year for far less profitable research than you'll receive from us.

And let’s be serious, most investors aren’t at the level where they need to be spending over $3,000 for investment research.

That’s why I’m inviting you to try out our Under-the-Radar Stocks research advisory service as a new Charter Member at a 50% discount.

So you’ll invest just $297 to join us today.

That comes to less than $25 a month, putting it well within reach of even the most price-conscious investor.

In fact, it costs less than a lunch for two at your favorite local restaurant!

To pay so little in exchange for the opportunity to consistently find stocks that Wall Street ignores that provide double-digit (or even triple-digit) investment returns year after year could be one of the best investments you make toward your retirement.

Plus, depending on your annual income – you may also be able to deduct up to 100% of your membership fee for this tax year, and for years to come.

Please note that this discounted offer will only be valid until midnight on September 30th, 2017.

So here's what I propose…

Try out our Under-the-Radar Stocks service for the next 60 days, check your email for weekly for new research and stock updates from our team of analysts, and make yourself a more profitable (and better educated) investor.

If you're not satisfied with the results we show you – we’ll happily refund your membership fee.

But quite frankly, I believe you’ll love our research on this little-known group of stocks and will look forward to receiving it for years to come.

To get started, simply click on the link below, which will take you to a secure sign-up form.

Your order will be processed immediately, and you'll have access to our newest research in a matter of minutes.

If you prefer to get started over the phone, simply call our Customer Service Team during regular business hours on Monday through Friday from 9AM-5PM (EST) toll-free at 1-800-393-1706.

For callers outside the United States, please dial 1-561-627-3300.

For instant access, click here.

To your wealth,

Nick Moccia

Publisher, Weiss Ratings

P.S. – Keep in mind that this is a special new Charter Member pricing offer for Under The Radar Stocks that only lasts until midnight on September 30th, 2017.

You will never find it for less.

Your risk is zero with this special limited-time offer, and you’ve got absolutely nothing to lose by giving our research a shot.

You'll have the next 60 days to make up your mind. In other words, you are only agreeing to try out our Under The Radar Stocks investment research service to see if you like the results. If you don't, no problem. Simply call our customer service team and we'll issue you a 100% refund.

Click here to take advantage of this special offer before the approaching deadline.