New From Weiss Ratings!

The “Rockefeller Recipe”

A Centuries-Old Strategy...

Updated for Today’s Market...

That Can Help Turn Every $10K

You Invest Into $44,508!

Click on the 3-minute video below to discover why RIGHT NOW is one of the single best times in decades to put the Rockefeller Recipe strategy into action!

John Davidson Rockefeller Sr. is widely considered to be the wealthiest American that ever lived.

|

Born in 1839, he began his professional career as an assistant bookkeeper at the age of 16. His daily earnings? Around 50 cents, or $11 in inflation-adjusted dollars.

But over the course of several years, through hard work, savvy negotiations (and if you believe his enemies, ruthless, bloodthirsty business practices), Rockefeller built up an energy empire that remains unrivaled to this day. It grew to dominate the U.S. landscape under the Standard Oil Co. banner – and his wealth ballooned to an estimated $392 billion in today’s money.

For a man with so much wealth, the world truly was his oyster. But for all his billions ... for all his various business endeavors and charitable pursuits ... Rockefeller reportedly zeroed in on a single, solitary event as his greatest source of happiness. In his own words ...

“Do you know the only thing that gives me pleasure?

It’s to see my dividends coming in.”

Surprising, I know. But the greatest U.S. billionaire who ever lived was 100% on to something. Dividends are everything when it comes to building lasting, generational wealth.

His “Rockefeller Recipe” – his dedication to the principal of investing in dividend-paying stocks with relatively high, yet reliable, yields – isn’t just a recipe for happiness. It’s the single-most important recipe for investing success – and literally CENTURIES of data prove it!

|

As a matter of fact, by updating Rockefeller’s centuries-old strategy with the tools and techniques I’ve developed today ... I’m convinced you can turn every $10,000 you invest into at least $44,508!

Before I go any further, allow me to introduce myself. My name is Mike Larson, and I’m a Senior Analyst at Weiss Ratings. I’ve been analyzing and trading my way through the investment markets for two decades now.

Tens of thousands of individual and institutional investors have relied on my research to guide them – in the wake of the Tech Wreck, the Housing Bubble and Bust, the Great Recession, and the recovery that has followed.

Senior Analyst, Weiss Ratings

Senior Analyst, Weiss Ratings

|

Moreover, my on-point forecasts and guidance have led to regular appearances on CNBC, CNN, Fox Business News, and Bloomberg News, as well as interviews by reporters from the Washington Post, Chicago Tribune, Wall Street Journal, Associated Press, Reuters, and more.

I’ve made it my professional life’s work to help investors like you build and protect your wealth. And I can honestly tell you, there is no better way to do so than to follow the “Rockefeller Recipe” – an investment strategy focused on dividend-paying stocks with relatively high, yet reliable, yields!

What’s more, research I’ve just uncovered suggests right now is one of the single BEST times to put that strategy into action!

Since 1802, the “Rockefeller Recipe”

Could’ve Boosted Your Annual Returns by 3.8X!

By the time Rockefeller was born in 1839, our great nation was well on its way to becoming a global powerhouse. But for the sake of this exercise, let’s roll the clock back even further.

The year is 1802. West Point Military Academy was just founded. The city of Washington D.C. was just incorporated. And the first-ever “First Lady,” Martha Washington, just died (two years after her famous husband). No one had even dreamed of the Civil War or World Wars I and II, much less the electric lightbulb, internal combustion engine, or landing on the moon.

Now let’s say you invested $100 that year in a basket of representative U.S. stocks. Then let’s assume you not only held on tight to those shares, but also re-invested every penny worth of dividends you received -- and by some miracle of science, you managed to live until 2002.

When all was said and done ... by following the “Rockefeller Recipe” ... you’d have a lot more than an extended lifetime of historic memories.

Your $100 grubstake would have also grown into an astonishing $402 million mountain of money!

|

Now that doesn’t include the impact of any taxes. Nor does it factor in investment fees and expenses. But while that wouldn’t leave you quite as rich as Rockefeller, somehow I don’t think your heirs would mind.

In case you’re wondering, the math is based on an annualized, average return of 7.9%. Reliable research identifies that as the long-term return for U.S. stocks.

But here’s the thing: Roughly 5 percentage points of that return historically stems from dividends. Another 0.8 percentage points comes from real growth in dividends.

Strip all that out, and you’re left with only the returns generated by inflation and rising valuations – around 2.1%.

Or in other words, the “Rockefeller Recipe” of focusing on dividend-paying stocks with relatively high, yet reliable, yields could’ve boosted your annual returns from by almost 3.8 times.

By the way, if you re-run the numbers based on that middling 2.1% return, guess what? Your mountain of money would look a heck of a lot more like a molehill even after 200 years – about $6,385.

|

Fast-forward a century ... and expand the universe of investments to more corners of the world ... and the same “Rockefeller Recipe” math applies. One study from the London Business School found that dividend yield accounted for around 90% ... NINETY PERCENT ... of the real returns generated in 17 different countries between 1900 and 2005.

Or let’s really stack the deck against you.

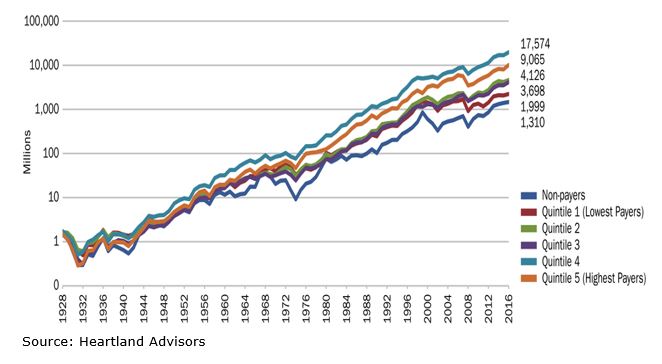

Let’s lop another 28 years of time off your investment timeframe, and start the clock in 1928. In case your history is a bit rusty, that’s just BEFORE the devastating stock market crash of 1929 – the one that had stock brokers jumping out of windows in New York City.

If you invested $1 million in the 20% of stocks paying the highest dividends in that pre-crash year ... and held all the way through year-end 2016 ... you’d have a whopping $9.1 billion to show for it! That’s an average annual return of 10.8%.

(In a “Rockefeller Recipe” quirk I’ll explain in a minute you’d amass even more wealth ... $17.6 billion ... if you bought the next-lower 20% block of dividend payers. Few investors know this, and even fewer take advantage of that knowledge!)

What if you decided Rockefeller was off his rocker? What if you bought stocks that paid no dividends at all? How much would you be left with? Just $1.3 billion.

Sure, that’s a lot of cash. But it’s 92.6% less than you could’ve banked. Look at this graphic here, and you can see that dividend payers in any “quintile” group beat non-dividend-payers hands down!

Source: Heartland Advisors

Source: Heartland Advisors

|

Five Reasons Why Investing the “Rockefeller Recipe” Way is So Richly Rewarding

So just what is it about the “Rockefeller Recipe” that has allowed investors to amass so much wealth?

Why is investing in dividend-paying stocks with relatively high, yet reliable, yields so richly rewarding?

I’ve identified five key reasons ...

First, when a company pays a dividend, it demonstrates a commitment to shareholder-friendly practices. Payouts are like other wealth-building actions such as stock buybacks and earnings-enhancing acquisitions, only better.

That’s because investors interpret dividend declarations as a sign of management confidence in operations, and steer more of their dollars that company’s way. The result is even-greater share-price performance.

|

Consider: Between 1972 and 2011, companies that either raised their dividends or announced new payouts returned 9.6% per year on average. That easily beat the 7.3% return of the S&P 500 ... and it absolutely crushed the pathetic 1.7% return of companies that didn’t pay any dividends at all.

Second, unlike the fixed coupons that bonds pay, dividends tend to grow over time along with the economy, earnings, and inflation. S&P 500 dividends per share rose 6% on average from 1940 onward, according to one study. A separate analysis using data that goes back to 1926 produced a growth rate of 4.4% growth. But either way, you can see why Rockefeller was so enamored with dividend-paying investments.

Third, as one report from Guinness Atkinson Funds puts it: “Profits are a matter of opinion. Dividends are a matter of fact. Dividends are paid from real earnings and in ‘hard’ dollars – they cannot be manipulated by creative accounting. A dollar paid out to the investor is just that.”

Fourth, dividends are much more resilient in downturns than earnings. That’s because companies will do almost anything they can to maintain payouts even when times get tough. And on the off chance they have to reduce dividends, they tend to do so in small increments rather than big chunks.

The evidence: In the five major recessions from 1973 through 2009, S&P 500 earnings per share plunged by an average of 42%. But dividends per share only dipped 8%. In three of those recessions, dividends were reduced by 1% or less ... even as earnings tanked anywhere from 15% to 32%.

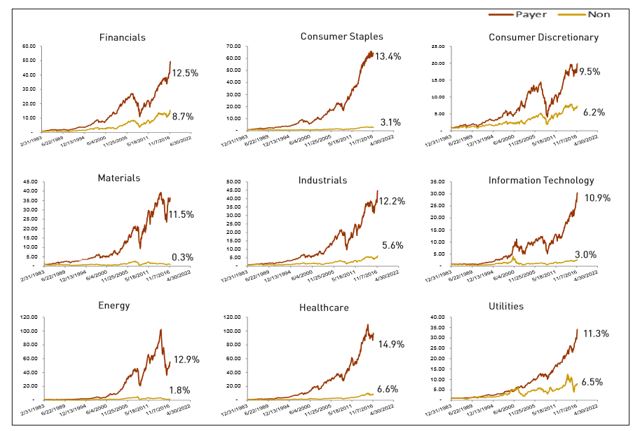

Fifth, it’s not just the major, well-known S&P 500 dividend payers that outperform. The “Rockefeller Recipe” works for mid-caps and small caps, too!

Between 1983 and 2016, dividend-paying small caps returned 13.3% annually -- far above the 7.8% for non-paying ones. Dividend-paying mid- caps returned 13.3% -- well ahead of the 10.4% for non-paying ones.

What’s more, dividend-paying stocks beat non-payers in every single one of the nine major economic sectors. Financials. Industrials. Technology. Healthcare. The results remained the same. As you can see in this graphic, the differences between the lines showing returns for dividend “Payers” and “Non”-Payers are huge

Source: Westcore Funds

Source: Westcore Funds |

Greater Returns AND Less Risk?

The “Rockefeller Recipe” Comes Through Again

Now if you’re like many other investors, you’ve lived through some serious gut-check moments in your investing lifetime. The 1987 stock market crash. The dot-com boom and bust. The housing bubble and bust, and the Great Recession that followed.

That means you know as well as I do that it’s hard to keep your head about you when everyone else is going stark raving mad with panic.

But that’s where the “Rockefeller Recipe” comes through again!

Research shows that this centuries-old strategy ... when updated and paired with modern-day tools and techniques ... can generate much greater returns with much lower risk.

By one measure of risk called “standard deviation,” following this strategy to lasting wealth would’ve slashed your risk and volatility by more than a third.

If you slice and dice the numbers a different way, you find that investing this way delivered better results with less volatility in both the strongest 20-year rolling periods since the late-1920s, and the weakest.

And what about the absolute worst bear markets on record?

The 46 times when stocks dropped at least 10% for two consecutive months? The two highest-paying dividend groups AGAIN outperformed non-payers -- by around 12 percentage points.

Or in plain English: Because you had less risk (and were therefore less likely to panic along with everyone else when times got tough) ... you would’ve made more money ... AND slept better at night ... for 88 long years!

The Hidden Secret of High-Yield Investing

You May Have Never Heard ...

So we’ve established that investing in dividend-paying stocks with relatively high, yet reliable, yields is the greatest, most-consistent way to generate significant wealth.

And we’ve established that none other than the richest man in American history understood that.

But here’s the hidden secret of high-yielding investing you may have never heard about:

You can’t just go out and buy the highest-yielding stocks in the market and hope to beat the pants off everyone else. That’s because they often UNDERPERFORM the next lower-yielding group of stocks.

In fact, three separate studies found that the investing “sweet spot” was in stocks in the 60% to 90% highest-yielding brackets. Or in other words, you don’t want to buy stocks with the absolute highest yields ... but rather the ones just below them.

Why? Because many times, the companies paying the sky-high yields can’t afford them for long!

Some of the stated yields are so high because the underlying share prices have plunged ... a hint that the dividends will soon get cut. Other times, they’re so high because the companies are paying out huge chunks of their earnings ... something they can’t maintain for long.

To avoid those kinds of disappointments, I’ve taken modern-day tools, techniques, and analysis and updated the “Rockefeller Recipe” for today’s market.

My goal: Zero in on stocks that offer both a high dividend yield AND a reasonable payout ratio. The payout ratio is simply a measure of how much of a company’s earnings are being paid out as dividends.

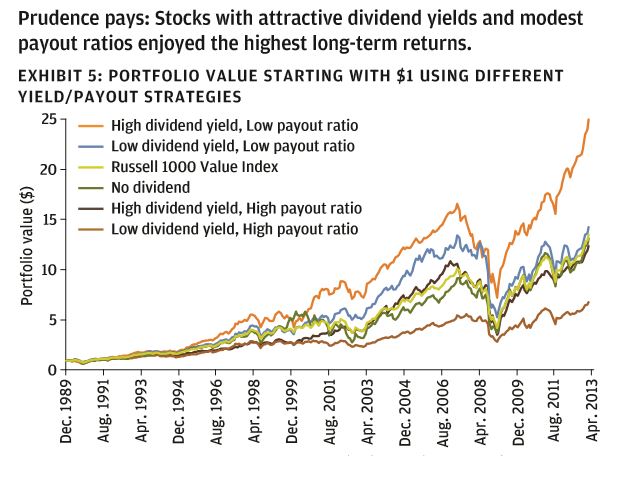

Check out this chart and you’ll see why this makes sense. Between 1990 and 2013, stocks in that group (the orange line identified as “High dividend yield, Low payout ratio”) crushed their less-worthy peers:

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management |

Indeed, by combining the time-tested accuracy and analytical power of our Weiss Ratings ... with rigorous, multi-factor back-testing ... and a five-step, stock-selection process designed to maximize yield and minimize risk ... we’ve brought the “Rockefeller Recipe” into the modern era – turning it into a wealth-building strategy of truly awesome power.

The even BETTER news? My research shows...

This is One of the Single-Best Times in Decades to Put the “Rockefeller Recipe” Plan into Action!

When it comes to investing, success is often a matter of timing. Buying a great stock at the wrong moment can lead to losses. So can implementing the “right” strategy at the wrong time.

But here’s where modern-day tools, techniques, and analysis -- the kind we use at Weiss Ratings -- come in so handy.

They all show that implementing the “Rockefeller Recipe” right here, right now could be the most profitable strategy ever.

Why? We all know the Federal Reserve is in the midst of an interest rate-hiking cycle. Outdated conventional wisdom suggests that higher rates cause significant problems for dividend-paying stocks. But cold, hard data suggests the exact opposite!

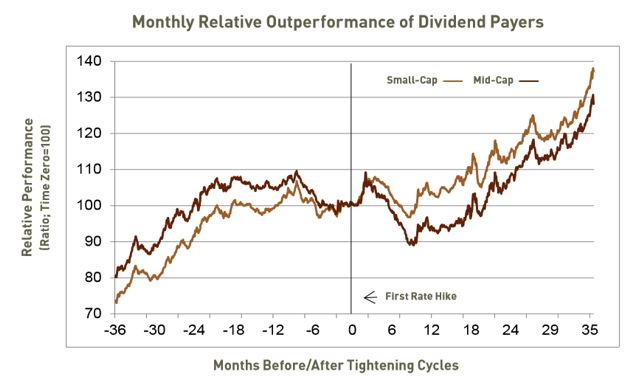

While it’s true dividend payers struggle in the months before the first Fed hike, they tend to turn on the jets about 12-18 months after that move.

Specifically, they begin to outperform ... then keep on going.

One investment firm studied every rate hiking cycle going back to 1987. It found that three years after the first hike, small cap dividend stocks crushed the market by an average of 37 percentage points! Mid cap payers beat the broad averages by 28 points.

This chart illustrates the point. The two lines show how the relative outperformance of small caps and mid caps (versus the broad averages) accelerates higher, starting around a year after the vertical line. That line represents the starting point in past rate-hiking cycles.

Source: Westcore Funds

Source: Westcore Funds |

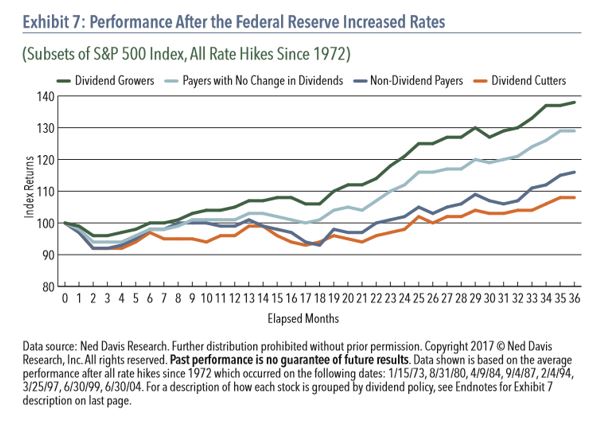

A separate study that covers every rate hike cycle going back to 1972 found the same trend. Dividend payers started outperforming consistently around 18 months after the first hike, and never looked back, as you can see here:

|

Now in case you don’t remember, the Fed’s first hike this time around was in December 2015. That puts the 18-month point right ... around ... NOW!

So not only has the “Rockefeller Recipe” worked financial miracles for the last couple of centuries ... it’s also tailor-made for TODAY’s market!

Or in other words, it’s the right strategy at the right time – a near-perfect way to start building generational wealth.

How to Get Started Turning Every $10,000 You Invest into $44,508 – and Save Up to 40% in the Process!

I hope I’ve convinced you about the power and relevance of the “Rockefeller Recipe.” Now, I want to talk about how I can help you put it to work in your own portfolio – and save up to 40% in the process!

|

I’m launching a brand-new investment newsletter that uses the principals and practices I outlined here every single day.

I call it “High Yield Investing” and it’s designed to turbocharge the yields you’re earning, while also strictly limiting your risk.

The heart and soul of the letter is something I call my “Bedrock Income Portfolio.” It’s a model portfolio of stocks that meet five crucial criteria ...

First, they have to be among the best-rated stocks in our Weiss Ratings universe of more than 13,400 tracked equities. No “Sells,” no junk. They also need to have adequate liquidity and trading volume so you don’t get trapped in thinly traded losers.

Second, they have to pay a dividend that’s at least equal to the S&P 500 ... and as much as 4X greater than it.

Third, they have to have grown that dividend by at least 10% over the past three years. We don’t want companies that are just standing still.

Fourth, they have to meet one of two dividend sustainability tests. We look at the payout ratio I mentioned earlier, as well as a separate measure based on free cash flow. That helps identify companies in that “sweet spot” – those with relatively high, but reliable, payouts.

Fifth, they have to pass two screens designed to weed out stocks with little momentum and/or excessive risk and potential volatility. There’s nothing worse than buying a stock that just sits there like a bump on a log ... or that’s at a high risk of cratering right after you add it to your holdings!

|

Our extensive back-testing ... covering the most recent nine years of market action ... suggests a portfolio of stocks meeting these criteria and rebalanced over time could have generated gains of just over 445%.

That compares to a 133% return for the market as a whole. Or in other words, you could have turned every $10,000 you invested into $44,508 following this system.

High Yield Investing also offers a “kicker” – a “Dynamic Income Portfolio” that’s discretionary. In this portfolio, I pick my favorite stocks and bond ETFs and funds that offer market-crushing yields – with a goal of rounding out your portfolio.

That includes everything from Real Estate Investment Trusts to Business Development Companies to Master Limited Partnerships and more.

With two decades of experience closely tracking the interest rate, bond, and equity markets, I’m confident I can help you boost the yields your investments are spinning off without taking on undue risk.

And don’t forget – I do all the work for you!

As a subscriber to High Yield Investing, you’ll also get ...

* My Monthly Market Overview – A detailed, hard-hitting analysis of what’s driving the stock market overall, which trends are influencing dividend-paying equities in particular, how interest rate moves factor into the equation ... and more.

* My Proprietary Weiss Ratings Market Barometer – This unique tool analyzes 23 different financial, credit, and economic indicators, and produces a simple, easy-to-understand snapshot of market conditions. In other words, you’ll know at a glance whether we’re likely to see further market gains ... or whether a pullback, correction, or even bear market is coming.

* Comprehensive Reviews of Both Portfolios – Did one of your stocks just blow the doors off with earnings? Did another just boost its dividend payout? Is it time to switch from one bond ETF to another, or cut back on your overall equity allocation? You’ll never have to wonder thanks to these monthly updates.

* Complete Weiss Ratings Stock Reports on both new and existing positions – In each issue, I’ll share the complete stock reports we produce on new positions added to either portfolio. Or in months where we have less activity, I’ll publish the reports on some of your existing positions.

* Answers to Any Questions You Might Have – Every issue will feature a Q&A section, where I’ll address the pressing questions on your mind. That way you’ll never be left in the dark about the markets or your investments.

* Flash Alerts as Needed – The markets don’t trade by appointment. They can move fast, opening up new opportunities and generating significant profits at any time. So if I think you need to bag gains, or make other adjustments in between regular issues, I’ll fire off an alert with all the

details.

Try High Yield Investing for Just $99! Or Save Even More With A Two-Year Subscription for Only $149

Normally, an investing service like High Yield Investing costs hundreds of dollars. After all, that’s a small price to pay in order to potentially turn every $10,000 you invest into $44,508 using the “Rockefeller Recipe.”

But you can try High Yield Investing today at a special price of just $99 for one year – for a limited time only.

That’s 12 full monthly issues ... two yield-boosting portfolios ... our proprietary market barometer ... complete Weiss Ratings on your holdings ... and more, all for 33% off the regular price of $149 per year.

Or to save even more, you can get a two-year subscription for just $149. That works out to only $75 per year, resulting in total savings of 40%!

|

High Yield Investing also comes with a 100%, no-questions asked money back guarantee for the first 60-days. So you’ve got nothing to lose.

I don’t want you to miss out on those savings. Nor do I want Rockefeller turning over in his grave because you turned your back on his wealth-building recipe.

Centuries of data ... not to mention modern-day tools, techniques, and analysis ... show it works. All you have to do is take the first step – and put it to work for you.

Yours for investing profits,

Mike Larson

Senior Analyst and Editor,

High Yield Investing